Across Perth it's either feast or famine when it comes to options for eating and drinking according to a new wide-ranging survey of the city's office hubs.

But the same research has also identified $5.1 billion dollars worth of new shopping developments in the pipeline for Perth; so maybe hungry white-collar workers won't have to trek far and wide for a feed too much longer.

Y Research's June 2017 West Australian Suburban Office Market report uses a ratio called 'The Cappuccino Co-Efficient,' to compare the amount of office space in 50 suburban office markets with more than 5,000 square metres against the number of food and beverage options available nearby.

On average across Perth, for each food and beverage option (ranging from cafes, restaurants and takeaway food) in a suburb there was 1,469 square metres of office space and 79 suburban office workers.

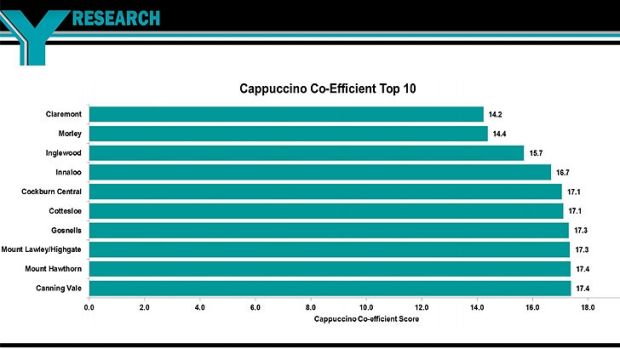

Drilling down, the scale shows that suburbs with major shopping centres, such as Claremont, Morley, Innaloo and Cockburn Central, rated the highest with a food or beverage option for every 15.6 office workers.

But suburbs with fast-growing office sectors like Herdsman, Subiaco, Perth Airport, West Leederville, Rivervale and Stirling have 325.1 office workers for every food and beverage option – a poor score on the Cappuccino Co-Efficient.

Cappucino Co-Efficient top 10

Y Research's Principal Damian Stone said the new research reflects a deeper trend for Perth in the migration of office space outward from the CBD.

"Perth's office markets have changed significantly over the last decade - over 44 per cent of metropolitan office supply is now located outside the Perth CBD and West Perth," he said.

"The movement of office workers has largely been unmatched by the development of accompanying retail offerings. Less than 10 per cent of suburban office developments contain their own in-house café."

Looking a bit wider, amenity is shaping to be a key battleground for Perth's office markets as CBD buildings look to win business back from the 'burbs.

"Ten years on from the decentralisation of tenants to the suburbs, the amount of vacant office space in the CBD has increased to the equivalent of 10 vacant Woodside Plazas," Mr Stone said.

"Providing more choice and convenience to suburban office workers will be key to retaining existing suburban tenants, ensuring balanced office vacancies in these key suburban employment hubs."

But the influx of office workers to new areas across Perth could also trigger more development for cafes and restaurants. So if you work in a quiet end of town like East Perth, there could be some new places to eat and drink coming soon.

Big retail investment on the way for Perth

Continuing on with the growth theme, Y Research has also identified an estimated $5.1 billion dollars of investment for Perth's shopping centres coming over the next decade.

This capital injection will see around 49 projects get underway, comprising a mix of expansion to existing centres and new neighbourhood centres

This work is estimated to bring around 50,000 new jobs to WA and have the potential to add approximately 25.8 per cent to Perth's shopping centre supply.

Upon completion, these centres will be home to new supermarkets, department stores, discount department stores, international retailers and an estimated 1,480 additional specialty retailers.

"There are two key drivers to the Perth shopping centre development pipeline – continued delivery of neighbourhood shopping centres on Perth's fringes in the Byford, Peel and North West corridor, Mr Stone said.

"The bulk of the development will come from the once in to decade expansion of Perth's major shopping centres."

And the new shopping centres won't just be bigger – according to Mr Stone they will also be of a higher quality, with changes in local development laws allowing a more mixed-use facility to be created.

"The 2010 introduction of the Activity Centres Policy has facilitated changing major regional centres from big retail boxes to community focal points encompassing a broader range of uses.

"The wave of development will create entertainment hubs across Perth's suburbs – no longer just food courts, centres will establish dining precincts with top line restaurants and taverns.

"In limited examples, there is space planned for concerts. Refurbished and expanded cinemas are a key feature despite the rise of streaming services. New service based retailers will become mainstays of larger regional centres."

To fill the expanded centres, Mr Stone predicts WA will see new wave of retailers to come west, such as Marks and Spencer, TK Maxx, Uniqlo, GAP, Sephora, Miniso, Decathlon and Under Armour open up stores.

"Importantly, these developments will create much needed jobs and growth over the next 5 years in their construction and operation.

"By the end of the decade, shopping centres will have achieved their outlined role as a focal point not only for the community but for the development industry as well."

0 comments

New User? Sign up