That's all for today - thanks everyone for reading this blog and posting your comments.

We will be back Monday from 9am.

Have a good weekend!

A rough day for miners following steep drops in Chinese metals futures led local shares into the red today.

The ASX lost 0.4 per cent to 5621.6 on Friday and 1.6 per cent over the week, as growing worries about US President Donald Trump's aggressive trade and immigration policies hurt confidence.

"Trump jitters dominated markets over the last week with his 90 day travel ban and reports of belligerent phone conversations with various country leaders (including Australia's) and attacks on allies like Germany adding to concerns about inexperience and political and trade risk," said AMP's head of investment strategy and chief economist Shane Oliver. "So despite pretty good global economic and profit news, this saw most sharemarkets dip and bond yields fall."

"A still gradual Fed also weighed on the $US which combined with news of a record trade surplus saw the Australian dollar rise," he said.

The Aussie broke through the US76c resistance level on Thursday, boosted by strong local trade numbers and shortly after Trump lauded the benefits of currency devaluation and a key administration adviser accused Germany of manipulating the value of the Euro. It traded above 76c all of Friday.

Iron ore futures fell as much as 6.3 per cent in China after trade resumed today following the week-long New Year celebrations. It didn't help local sentiment that China's central bank surprised with a rate rise.

Iron ore pureplay Fortescue was one of the hardest hit miners, with shares tumbling 4.6 per cent, but BHP, down 3.1 per cent, Rio, off 4 per cent and South32, down 2.9 per cent all closed deep in the red too.

Banks fared a bit better, slipping between 0.03 per cent (NAB) and 1 per cent (ANZ), while Telstra was among the few blue chips posting a gain, up 1 per cent.

Here's one we missed yesterday but as it's a sign of the times, we reckon it's still worth a mention:

A key lawmaker wants US banking regulators to halt talks over international agreements until President Donald Trump has a chance to review their work and replace top negotiators.

"The Federal Reserve must cease all attempts to negotiate binding standards burdening American business until President Trump has had an opportunity to nominate and appoint officials that prioritize America's best interests," House Financial Services Committee vice chairman Patrick McHenry wrote in a letter to Fed chair Janet Yellen dated Tuesday.

The letter that has every central banker quaking in his and her boots.... pic.twitter.com/QlXqG6yCj1

— Lionel Barber (@lionelbarber) February 2, 2017

McHenry and other congressional Republicans have regularly railed against the international negotiations designed to guide bank regulators, saying the process is opaque and allows foreign nations to impose their views on US rulemakers. The North Carolina lawmaker said the Fed's continued talks with "global bureaucrats in foreign lands" is unacceptable and that it doesn't have the authority to participate.

Just like the RBA, Fed officials often participate as US representatives in international groups including the Financial Stability Board and Basel Committee on Banking Supervision. The central bank is an independent agency, meaning its largely insulated from White House control, and Fed chair Janet Yellen has said she intends to finish her term, which doesn't expire until February 2018.

Eric Kollig, a Fed spokesman, said the central bank has received the letter and is planning to respond.

McHenry said the international process is too secretive and the agreements are "killing American jobs." Existing accords will likely need "comprehensive review," he said.

Though the lawmaker's letter was critical of "binding standards" being negotiated, adoption of most of the international accords isn't mandatory for participating countries

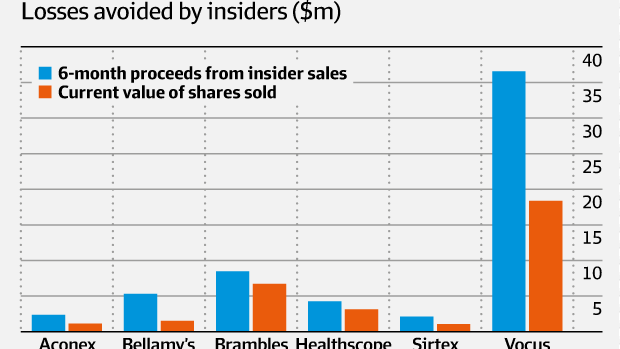

As six of Australia's worst-performing listed companies lost $11 billion in value in just six months, well-timed sales by "insiders" helped them avoid the sharp falls that followed profit warnings, downgrades and other corporate disasters.

Significant insider selling was evident at the four worst-performing companies in the S&P/ASX 200 over six months and four out of the 10 worst-performing stocks in the S&P/ASX 100 Index over that period, as directors and management were spared losses by the good timing of their sales.

In total nine executives and directors sold shares in Aconex, Sirtex Medical, Bellamy's Australia, Vocus Group, Healthscope and Brambles worth $60 million since late August. These shares would now be worth just $32 million as of this week.

Hugh Dive of funds management firm Atlas Funds Management described 2016 as "a banner year for the informational value of insider trades".

"We see that a consistently under-appreciated source of intelligence as to the future prospects for an individual company is trading in that company by insiders," he says.

The leaders of former market darlings Bellamy's, Aconex and Sirtex sold shares ahead of these companies more than halving in value as a string of downgrades rattled investor confidence and sent prices tumbling.

Meanwhile, top 100 companies Vocus, Brambles and Healthscope all surprised investors with earnings downgrades months after senior executives and directors had sold shares.

Shares in construction software company Aconex fell 45 per cent this week after it downgraded its earnings. But co-founders Rob Phillpot and Leigh Jasper sold 375,000 shares at a price that was $1.2 million higher than their current value since they last reported earnings last August.

One of the largest insider sales was executed by James Spenceley, the founder of telco Vocus, who sold 3.2 million shares for $26.6 million in August as he moved on to set up his funds management firm. Those shares would now be worth $13.2 million, meaning Spenceley avoided a potential loss of more than $12 million.

Tony Grist, the founder of Amcom, which was acquired by Vocus in 2015, sold 1.185 million shares, which has since halved in value, at about the same time.

The pair left the board in October after their attempt to replace the chief executive failed. Vocus is the worst performer in the S&P/ASX 100 over six months, declining by 54 per cent.

Crown Resorts should have known its focus on drawing Chinese high rollers to its casinos was a hugely risky strategy, according to a law firm seeking to launch a shareholder class action against James Packer's gaming giant.

Solicitors Maurice Blackburn today invited Crown shareholders to join in a potential class action to seek compensation for the share price drop that followed the detention in China of 18 Crown employees amid a clampdown on the illegal promotion of gambling and the illicit outflow of money from the country.

Crown shares fell 14 per cent in one day, wiping more than $1.3 billion off Crown's market value. Shares are down 1.1 per cent at $11.14 today.

Maurice Blackburn class actions principal Julian Schimmel said Crown should have notified shareholders of the risks associated with its strategy well before the detentions, which included the arrest of three Australians.

"We have reason to believe that: one, Crown knew the risks of its activities in China; two, it knew of the importance of VIP revenue to its business; and three, it therefore knew or should have known that if the real nature of its marketing activities were revealed, there would be a revenue problem that would be material to Crown's share price," Schimmel said.

'This is information that the company's shareholders should have been told so that they could factor it into the share price and buy their shares on a fully informed basis."

Miners are having a poor end to the week as investors react to a awful return to Chinese trading in commodity futures...

Selloff in Chinese commodity futures getting a tad nasty now..https://t.co/XFuv4ycKXQ pic.twitter.com/88Ey6PAq0m

— David Scutt (@David_Scutt) February 3, 2017

Bulks getting hit pretty hard here.. PBOC raising the cost of 7,14 & 28-day reverse repo's by 10bp.. fairly clear message to the market

— Chris Weston (@ChrisWeston_IG) February 3, 2017

Here's what can happen to a housing market if restrictions on foreign buyers are imposed: Vancouver house prices have dropped nearly one-fifth in just one year, while sales plummeted 39.5 per cent in January from a year ago, five months after the government slapped a tax on foreign buyers.

January marked the sixth consecutive month of falling sales in Canada's hottest real estate market, where an influx of mainly Chinese offshore buyers has helped push the price of a typical home to more than 12 times the median resident's household income.

Vancouver topped a list of cities around the world that UBS has identified as most at risk of a housing bubble. Sydney placed fourth after London and Stockholm.

The Real Estate Board of Greater Vancouver said the monthly sales - 1523 homes sold in January - marked a 10.3pc drop on the 10-year average for the month.

"While we saw near record-breaking sales at this time last year, home buyers and sellers are more reluctant to engage so far in 2017," said Dan Morrison, the board's president.

The government of British Columbia - Vancouver is the province's biggest city - acted last year to cool the market, slapping a new 15 per cent tax on offshore buyers in August.

The average benchmark price for detached properties in the Pacific port has fallen 17.8 per cent to $C1,474,800 ($1,475,000) from a record high of $C1.83 million in January 2016. The average price has fallen 6.6 per cent in the past six months and edged 0.6 per cent lower from December.

The Aussie dollar has slipped about half a cent from its three-month high of US76.96¢ it hit overnight - but that puts it pretty much smack bang at its long-term average, Westpac's Sean Callow notes:

AUD/USD rebuffed at 0.77, now drifting back to very familiar territory: average daily close since 1983 float is 0.7630 #ausbiz pic.twitter.com/6o3SfYTs2i

— Sean Callow (@seandcallow) February 3, 2017

The Aussie is up about 1.5 per cent this week, and 6.3 per cent in 2017, the best performing major currency against the greenback.

It's also doing well against other currencies, hitting a 19-month high of 71.28 cents against the euro.

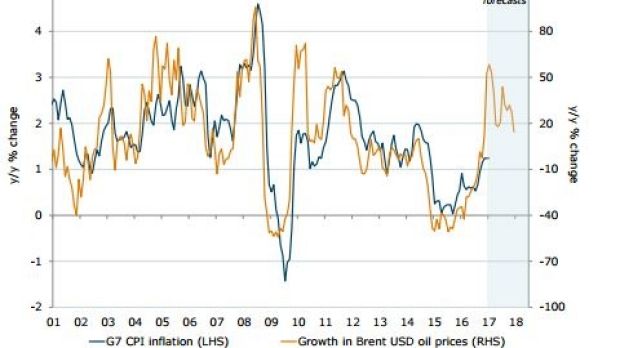

Aussie inflation is set to stay low despite the global reflationary trend, UBS economists reckon.

Core inflation in annual terms looks to have bottomed at around the 1.5 per cent it reached a year ago, the UBS team led by Scott Haslem say.

Haslem & Co point out that rising oil prices have seen headline CPIs rising strongly across US and Europe, and headline inflation has also drifted higher in Australia. There has also been a recent sharp pick-up in producer prices across China, US and Europe.

So wil those global trends spill over on to the local scene? The UBS team argue no. In early 2016 they identified four structural drivers for subdued inflation in Australia:

- Heightened competitive pressure from new entrants;

- New regulatory resistance to above CPI price rises in many "public" services sectors;

- Sharply higher housing supply that would slow rents; and

- Record low wages growth.

They estimated these competitive and regulatory pressures, including increased housing supply, were weighing on almost 50 per cent of the CPI basket.

"Our analysis suggests that while pass-through from higher world prices is an emerging risk, we argue Australia's structural disinflationary forces not only remain in play, but have intensified," they write.

"Wage growth has trended lower, competition & regulatory pressures have broadened, while housing rent (& construction) costs have further to slow. Our analysis again raises the risk inflation may stay below the RBA's target band for longer."

The economists believe Aussie core inflation will underperform the rest of the world and stay below the RBA's 2-3 per cent target until the first half of 2018.

"Against forecasts by some for near-term rate cuts and by others for multiple hikes from early-18, we retain an on-hold rates outlook until at least mid-18, targeting a late-18 start to RBA normalisation," they write.

"For equities, the mix of improving domestic growth, a relatively stable Aussie dollar and ongoing low interest rates, should generally be positive."

ANZ economists have also chipped in, saying they believe the recent rise in global headline inflation "appears to be close to maxing out" as "commodity prices have peaked". They wonder whether investors' "embrace of reflation" has been "premature".

"An analysis of core inflation suggest that there is not much else out there that will add to inflation pressures in the near term," they add.

Trump just doesn't get it, writes BusinessDay columnist Michael Pascoe:

"America first" (Donald Trump), "Australia first" (Scott Morrison), "winning in Asia on our terms" (Bill Shorten) – populist nationalism is all the rage on the political trade stage.

And the one thing you can be sure about populism is that its goals are short-term and short-sighted, that it is disastrously myopic when faced with the big picture, that it champions the simple and simplistic because it's not capable of anything more.

That's on display with President Trump abandoning the Trans-Pacific Partnership (TPP) and attacking NAFTA (the North American Free Trade Agreement) – he repeatedly called it "the worst deal ever", at least until he told Malcolm Turnbull what he thought of the Nauru/Manus refugee deal.

It's also on display in Labor's hedging on the TPP's worth and in the comments of the many local TPP critics who are glad to be rid of it, assuming it has no future without the US.

The common refrain by Australian TPP knockers is that there was "nothing in it for us" while we bowed to US demands on copyright and patents. Trump also claimed there was nothing in for the US, that it would cost more American jobs, just as NAFTA helped Mexico "steal" American jobs.

The critics like to selectively quote a World Bank study that did indeed model that Australia and the US would achieve the smallest GDP lift from the TPP by 2030. The graph tells the story – on a very simple level.

That smudge on the line above Australia is 0.7 per cent. That sort of GDP gain for the US and Australia over a dozen years is, to use a technical term, pretty much stuff-all.

Local TPP critics claim the small gain would come at a high cost in acceding to US demands on copyright, intellectual property and investor-state dispute settlement.

But that's "Australia first" talking. It fails to credit the benefits that come from other countries doing well.

To keep it simple for those focused on the simple, you're generally better off if your neighbours are better off. Trade is not the zero-sum game mercantilists like Trump think. The other team winning doesn't mean your team must lose. Vietnam gaining 10 per cent is a good thing. In the longer term, Vietnam doing well is good for Australia and everyone else.

Back to top

The surprise rates hike has spoiled the party for Chinese equity investors coming back from the Lunar New Year holidays.

The Shanghai Composite has dropped 0.6 per cent on its first day of trade in more than a week, while Hong Kong's Hang Seng index is down 0.75 per cent..

Donald Trump's barrage of controversial executive orders aren't helping sentiment, fuelling concern he will follow through with a campaign promise to raise tariffs on Chinese imports.

"Trump has implemented some of his campaign promises very quickly, and he's said he will raise tariffs on Chinese imports to 45 per cent," said Daniel So, a strategist at CMB International Securities. "Now it looks like it might not just be empty talk. But the market may not be scared so soon."

China's central bank has surprised financial markets by raising short-term interest rates on the first day back from a long holiday, in a further sign that it is slowly moving to a tighter policy bias as the economy shows signs of steadying.

The People's Bank of China said it raised the interest rate on open market operation reverse repurchase agreements (repos) by 10 basis points. Two banking sources also told Reuters it had raised the lending rates on its standing lending facility (SLF) short-term loans.

While the moves were modest, they reinforced views that Chinese authorities are intent on containing risks to the financial system this year by forcing highly debt-laden companies to deleverage and cracking down on the use of short-term money for speculative activities.

Today's action is significant as it suggests the PBoC will adopt a flexible interest rate regime in 2017, ANZ economist Raymond Yeung said.

"Since the PBoC has been keeping the reverse repo rate at 2.25 per cent since October 2015, the change today is ground-breaking. This suggests that the central bank will change the onshore rates more frequently," he said.

Daiwa Institute of Research chief economic researcher Naoto Saito said the intent appears to be to to control a real estate bubble.

"It could also be aimed at arresting the yuan's depreciation, although it is on the reverse repo they touched upon and the impact remains to be seen," said Saito. "All in all, it comes across as a move to tweak interest rate levels to accompany a broader monetary policy shift."

In late January, the PBoC raised rates on its medium-term loan facility (MLF) for the first time since it debuted the liquidity tool in 2014. It was the first time it has raised one of its policy interest rates since July 2011.

Analysts expect any further steps to be gradual as policymakers weigh their impact on economic growth, and believe the PBoC will be in no hurry to raise the policy lending rate for now.

The seven-day open market operations rate was raised to 2.35 per cent from 2.25 per cent, the rate for 14-day tenor to 2.50 per cent from 2.40 per cent, and the rate for 28-day tenor to 2.65 per cent compared with the previous 2.55 per cent, the PBoC said in a statement.

Property prices are likely to keep rising this year before slowly losing momentum and going backwards.

That's the consensus view of the 27 leading economists, academics, consultants and money managers polled for the BusinessDay Scope economic survey.

Another consensus view is that the slowdown in price growth doesn't equate to a housing crash or "property bubble" bust. All except for one, that is. Economist Steve Keen, now based in Kingston University London, says "they will burst."

What drives house price growth is mortgage credit growth, Professor Keen says.

"Mortgage debt in Australia has gone from 80 per cent of GDP at the time of the GFC to 95 per cent today - one of the 3 highest levels in the OECD."

The panel's average forecasts are for an increase in Sydney prices of 4.9 per cent (after 15.5 per cent in 2016) and an increase in Melbourne prices of 4.3 per cent (after 13.7 per cent).

Saul Eslake says in the absence of any obvious "trigger" like unexpected rate increases or an exodus of foreign investment there will be further "very small" city-wide gains in both cities.

Interest rates will stay low for long enough to support demand.

"We are expecting further growth in house prices this year .. but at a modest pace," Bank of Melbourne's Besa Deda says.

It's been a tough few weeks for the greenback, which has been on the way down ever since Donald Trump's first press conference in mid-January, but Goldman Sachs sees some upside for the currency.

The US dollar, which began climbing after Trump's election victory in November on expectation that his stimulus policies would stoke growth and inflation, has hit the skids since the new president has been putting more emphasis on trade protectionism and immigration.

Overnight the US dollar index - which measures the greenback against a basket of currencies - fell as low as 99.23, its lowest since mid-November. At the same time, the Aussie hit a two-month high of US76.96¢.

But Goldies reckons that trend will soon reverse.

For one, the investment bank reckons markets are underpricing the amount of Fed rate hikes this year, as its US chief economist Jan Hatzius reiterated yesterday in Sydney.

The widely followed economist said he was forecasting three interest rate hikes from the US Federal Reserve in 2017, compared to the market's forecast of two increases. He is also expecting the US economy to achieve above-trend annual growth of 2.5 per cent.

On top of that, the bank's analysts reckon the currency is now undervalued:

GS: This is NOT the end of the dollar bull run. Says the dollar is 3% cheap on its models$USD pic.twitter.com/FAFIGjpb0M

— Yogesh Chandarana (@Yogi_Chan) February 2, 2017

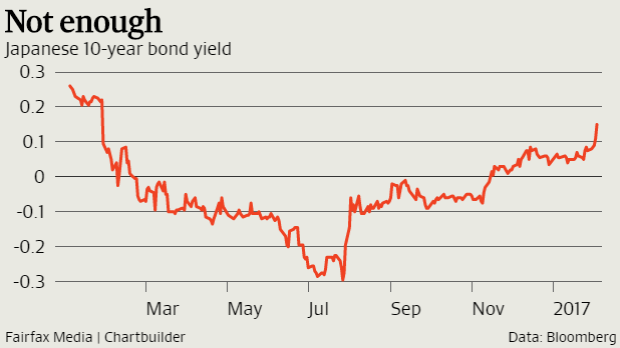

Japan's 10-year yield has surged as traders judged the central bank's expanded bond purchases Friday to be insufficient to cap borrowing costs as global rates advance.

The yield rose as much as 4 basis points to 0.15 per cent,the highest since the Bank of Japan implemented its negative rate policy last January. The BOJ increased purchases for bonds due in five-to-10 years to 450 billion yen ($5.2 billion), from 410 billion yen planned for the first operation this month, according to a statement from the central bank.

"It's not enough," said Simon Pianfetti, a senior managerin the market solutions department at SMBC Trust Bank inTokyo. "The market will test the BOJ further."

The Japanese currency moves were contained. The yen at first weakened to 113.1 yen per US dollar, before strengthening 0.2 per cent to 112.6.

BOJ governor Haruhiko Kuroda faces the challenge of seeking to hold down borrowing costs just as accelerating inflation and an improving outlook for some of the world's biggest economies push up bond yields globally.

Kuroda on Tuesday recommitted to his yield-curve control strategy, while pledging to cap bond purchases at 80 trillion yen per year.

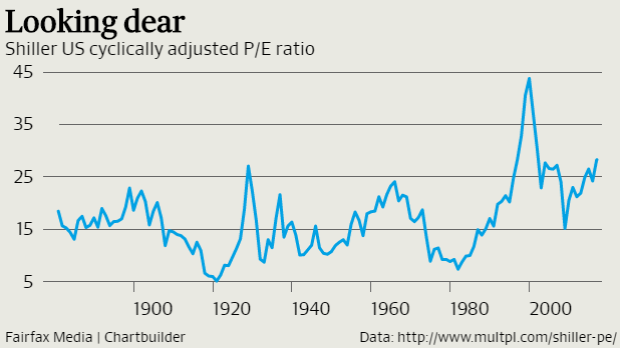

Here's an extract from a nice "Short view" column in the FT on the high hopes priced into US stocks:

While the US is obviously one of the world's wealthiest and most developed countries, the early experience with Trump suggests there should be an 'uncertainty discount' embedded in valuations — as there is in emerging markets.

Yet there is little sign of one. Take the S&P 500. It is currently trading at more than 21 times its trailing earnings, compared to 19 times for global stocks as a whole, and 14 times for emerging market equities. There's clearly a lot of optimism baked into the cake. Even if economic growth accelerates, that should lift bond yields and undercut valuation calculations as well.

The frothiness of US equities looks even more extreme using Robert Shiller's cyclically-adjusted price-to-earnings ratio. After the post-election rally, that now stands at 28.25 times, the highest since the dotcom bubble and not far from the "Black Tuesday" peak on 1929.

The price-to-book value ratio is at a 10-year high of nearly 3 times, and the price-to-revenues ratio is at its highest since the dotcom boom. Even a modest EM-style uncertainty discount factoring in the unquantifiable risks of trade wars, growth-stunting populist measures, and erosion of the rule of law would have a big impact when valuations are this lofty.

Bridgewater's Ray Dalio recently noted the rising risks of "nationalism, protectionism and militarism". These are familiar dangers in parts of the developing world but they fit poorly with idea of US equity prices at record levels.

Gold stocks are on track for a sixth weekly gain out of the last seven, after the precious metal's price hit an 11-week high overnight.

The All Ords gold index is up 1.4 per cent today, set for a near-6 per cent weekly rise and extending a rally that has seen the sector add more than a third in value, or roughly $11 billion in market cap, since mid-December.

The gold price rose as far as $US1225 an ounce overnight after the US Federal Reserve gave no clear signal on the likelihood of a March interest rate increase in its latest statement, prompting another drop in the US dollar. But gold pared gains as the US dollar turned positive later in the session; it's currently fetching $US1213 an ounce.

"Gold... successfully traded through its resistance at $US1220," Heraeus trader Alexander Zumpfe said. "If it closes above there, the short-term uptrend is back and a test of $US1235 might be on the cards."

The weakening US dollar was the main factor driving gold higher, along with concerns about political risk, said Afshin Nabavi, head of trading at MKS.

"Gold has benefited on the back of yesterday's FOMC meeting and recent US policy statements," said RBC Capital Markets. "Overall, this provides further support to our view that gold is likely best bought as a risk overlay this year. We are not necessarily a buyer at current levels and prefer buying on likely dips."

Among local gold miners, Resolute is boasting the biggest gains since the bull run started in mid-December, soaring 64 per cent. Next is Saracen, up 44 per cent, while Australia's largest gold miners, Newcrest, has added 33 per cent.

Seven West Media has announced the findings of a review into chief executive Tim Worner, saying it has cleared him of wrongdoing.

Earlier this year, the company asked law firm Allens Linklaters to review allegations by former employee Amber Harrison of misconduct by Mr Worner.

In a statement to the ASX, the board said it was satisfied that there were no irregularities in Mr Worner's credit card use and that it could not substantiate allegations of illicit drug use.

It also accepted the "strong and vehement denials" by four other staff members that they had had an inappropriate relationship with Mr Worner, saying their responses "cast doubt on the veracity of other accusations" by Ms Harrison.

The board said that communications between Mr Worner and Ms Harrison - who had an affair from the end of 2012 until mid-2014 - while "totally objectionable", were "consensual, personal and private".

"The board has at all times made clear to Mr Worner that while the relationship, which concluded in July 2014, was personal and consensual, it was inappropriate given his senior position in the company and not behaviour condoned by the company," it said.

"Mr Worner has been disciplined by the chairman and the board and provided an undertaking this behaviour will not be repeated as well as an apology."

Seven West shares are down 0.9 per cent at 82 cents.

Service sector activity has kicked off the year solidly with lifts in sales, employment and new orders.

The Australian Industry Group's Performance of Services Index (PSI) dropped 3.2 points to a level of 54.5 points in January, but remained above the 50-point level signifying expansion.

Ai Group chief executive Innes Willox said decent activity in January followed expansion the previous two months.

"While growth eased back from the very strong pace seen in December, it was relatively broadly spread across the very diverse services sector and included the highest showing from the wholesale sales sub-sector since the global financial crisis and the related rise in transport and storage services, which entered positive territory for the first time since 2011," Mr Willox said.

"Tempering the generally positive tone and a reminder of the fragility of the economy was the continued contraction in both the hospitality and communication services sub-sectors."

Ai Group said four of the five activity sub-indexes expanded in January, with supplier deliveries rising to 61 points - its highest ever level.

Sales and new orders also expanded, but at a slower rate, while stocks declined into contraction.

Six of the nine services sub-sectors expanded in the month, led by personal and recreational, finance and insurance and property and business services.

Meanwhile, the survey showed that the massive health and community services sub- sector was flat in January.

Communication services contracted for a fourth month and the hospitality sub- sector, including accommodation, cafes and shrank for a thirteenth consecutive month.

Input prices rose - albeit at a slower pace - and wage growth accelerated, but selling prices returned to the mainly flat or contractionary pricing conditions seen through most of last year.

Rio Tinto, which agreed last month to sell $US2.45 billion ($3.2 billion) of Australian assets, has received approaches for its remaining coal operations in the country, people with knowledge of the matter said.

The company is considering options for its Hail Creek and Kestrel mines, including a potential sale, according to the people, who asked not to be identified because the details are private. Its controlling stakes in the operations, which are located in Queensland's Bowen Basin and mainly produce coking coal used in steelmaking, could fetch as much $2 billion, the people said.

Rio, the world's second-biggest miner, has been divesting Australian coal assets since dismantling its energy division in 2015. The company is focusing on its most profitable and long-life operations in iron ore, copper and aluminium as China's economy matures and growth cools, chief executive officer Jean-Sebastien Jacques told investors at a London seminar in December.

The assets are Rio's last producing coal mines globally after it agreed to sell its stakes in Australian thermal coal operations to an arm of China's Yanzhou Coal Mining for $US2.45 billion. A formal sale process for Hail Creek and Kestrel may not begin until Anglo American decides whether to sell its Australian coking coal mines, the people said.

Rio declined to comment in an emailed statement. The company said last month it has agreed or completed at least $US7.7 billion of asset sales since 2013.

Search pagination

1 new post(s) available. View post(s) Dismiss