That's all today - thanks for reading this blog and posting your comments.

We'll be back on Friday, from 9am.

Happy Australia Day!

New records on Wall Street and soaring metals prices pushed the local sharemarket higher, led by a rally in BHP Billiton.

Sentiment also got a boost as US President Donald Trump shifted his focus away from trade protectionism, which had spooked markets, and back to growth initiatives including promising corporate tax breaks and cutting regulation to fuel US investment.

For investors, Trump's actions mean "we face a different set of policy risks, likely to be more sector and stock specific as existing advantages are withdrawn and new ones introduced via fiscal policy, whereas over the last few years we have seen monetary policy dominate, making it much more about the cost of capital than the return on capital", said Mark Tinker, Axa Framlington's head of Aisan equities.

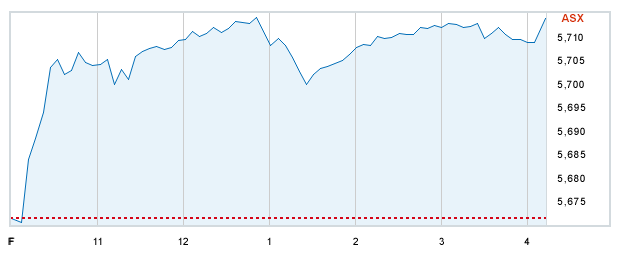

The bullish tone on Wall Street combined with rises in key commodities such as copper and iron ore to push local shares higher from the start. The benchmark S&P/ASX index ended 0.4 per cent higher at 5671.5 points, propped up by a 2 per cent surge in the materials sub-index.

BHP Billiton delivered the biggest boost to the index, jumping 3.3 per cent to a 19-month high of $27.89, after it confirmed its annual iron ore production guidance in a solid quarterly update.

Investors also cheered Rio Tinto's decision to sell its thermal coal assets, lifting the shares 3.8 per cent.

And further in the materials sector, Alumina soared 10.6 per cent, the biggest rise among the top 200 stocks, to hit a two-year high of $2.04, boosted by aluminium prices surging to 20-month highs and by quarterly earnings posted by its joint venture partner Alcoa.

"There are signs that investors are making way for materials stocks in their portfolio by reducing exposure to high growth stocks like CSL and Domino's Pizza," said CMC chief market analyst Ric Spooner.

Market darling Domino's fell 3.1 per cent, one of the day's biggest losers, while CSL ended 0.2 per cent lower.

CPI data showed falling prices within the telecommunications segment, which sparked falls in telcos, sending Telstra down 0.8 per cent, while higher childcare costs led to an outperformance for the likes of G8 Education, up 2 per cent.

Banks were backed by a jump in bond yields, which is healthy for the financial sector, as well as rises in their US peers. ANZ was the top gainer among the big four, rising 1.1 per cent, while NAB rose 0.7 per cent, CBA added 0.6 per cent and Westpac inched up 0.4 per cent.

In other company news, Primary Health Care shares surged 5.1 per cent on reports that China's Jangho Group is seeking a $1 billion loan to expand its stake in the company.

Chinese steel and iron ore futures are building on yesterday's gains, supported by hopes that demand for both commodities will strengthen after the Lunar New Year holiday.

Trading activity in the physical iron ore market has been slow ahead of the week-long break that starts on Friday, but spot prices have edged higher.

"I think some traders may be trying to push up the market, hoping to sustain that sentiment after the holiday when mills should be rebuilding stocks," said a Shanghai-based iron ore trader.

"We haven't seen much activity from our customers and many mills have been in holiday mode since the beginning of this week."

The most-active iron ore on the Dalian Commodity Exchange is up 1.3 per cent at 641.50 yuan ($US93) a tonne, while on the Shanghai Futures Exchange, the most-traded rebar also rose 1.3 per cent, to 3,304 yuan per tonne.

Both commodities have gained more than 10 per cent this month to build on last year's rally, largely spurred by China's efforts to tackle a chronic glut in its steel sector.

Much of January's gains came after China said it would shut all producers of low-quality steel products by the end of June as Beijing also fights heavy pollution.

Spot iron ore climbed 1.9 per cent to $US82.69 a tonne overnight.

Will the US Federal Reserve be jolted out of its torpor amid signs that the US economy is roaring back to life?

That's the big question for investors after the US factory sector enjoyed a 'bumper start' in 2017, as a flood of new orders spurred a sharp rise in production.

Markit's flash US purchasing managers' index (PMI) jumped to 55.1 in January, from 54.3 in December as US factories ramped up activity and hiring as new orders jumped to the highest level in 28 months.

At the same time, however, companies reported that higher raw material costs had forced them to raise selling prices for the fourth month in a row.

Markit's chief business economist Chris Williamson predicted that "with such strong growth being signalled and price pressures rising, speculation around the next Fed rate hike will intensify".

The surprisingly strong rise in US factory output in January gives some support to the argument that Donald Trump's surprise electoral victory last November has helped to revive US 'animal spirits', boosting US business and consumer confidence, and encouraging US companies to boost their investment and hiring.

But it's not only US manufacturing that's upbeat, yesterday Japan's flash manufacturing PMI showed the fastest expansion in almost three years, and while the eurozone index slipped slightly, it remains firmly in expansionary territory

All three indicate that global growth is starting the year on a firm footing.

The "Global flash PMI" extended its upturn in January: https://t.co/XWqkVJhSkt $MACRO $BONDS pic.twitter.com/PQp3nf00DN

— Topdown Charts (@topdowncharts) January 24, 2017

Alumina shares have soared nearly 8 per cent to hit a two-year high of $1.99 as aluminium prices surge

London aluminium futures are holding close to 20-month highs hit overnight in Asian trade today, buoyed by reports of possible capacity cuts in China, after the contract hit its highest since May 2015 in the previous session

Further boosting the shares, Alumina's US partner Alcoa said it expected 4 per cent growth in global aluminium demand in 2017 and reported higher-than-expected quarterly revenue, helped partly by a rise in alumina prices.

Alumina runs a joint venture with Alcoa called Alcoa World Alumina and Chemicals and while AWAC's quarterly production of alumina was down slightly from the previous quarter at 3.1 mln tonnes, bauxite production from wholly owned mines and equity interests was 11.8 mln bone dry tonnes, up 6 per cent, Alumina said.

Back to top

Should investors follow Donald Trump's incessant tweeting?

The US President has famously embraced Twitter as his bully pulpit, a 140-character instantaneous broadcast of his pronouncements and denouncements, including about companies that he thinks deserve his praise or ire.

Some big banks and hedge funds are apparently using computer programs to trade instantly on his tweets, but their actions are shrouded in secrecy. Few people know who these traders are, what programs they use or how successful they are at exploiting Trump's rants.

What is clear, however, is that retail investors are getting in the game. A conventional wisdom is taking root that Trump's tweets move stock prices in predictable ways, and a growing number of outlets will alert investors when Trump tweets about a company. The Bloomberg terminal is one, and so are apps from Trigger Finance and IFTTT.

There's just one problem: It's not at all clear that Trump's tweets have any predictable effect on stock prices.

For example, Trump praised Ford Motor on November 17 for keeping a plant in Kentucky rather than moving it to Mexico. Ford's stock is up about 3 per cent since then (until early this week). Several weeks later, however, Trump criticised General Motors on January 3 for selling Mexican-made cars in the US. GM's stock is up, too - about 6 per cent.

Nor is there any apparent relationship between Trump's tweets and subsequent declines in stock prices. Trump criticised Toyota Motor on January 5 for plans to build a plant in Mexico. Toyota's US-listed ADRs are down about 2 per cent. Four days later, Trump praised Fiat Chrysler Automobiles for its plans to add 2000 US jobs. But Fiat Chrysler's US-listed stock was also down, about 4 per cent until yesterday.

It's not even clear that markets are paying attention to Trump. Yes, sometimes volume surges after a Trump stock tweet, but other times it declines. For example, on the day that Trump tweeted about Ford, the stock's average volume surged 53 per cent from the previous day. Volume was also higher when Trump tweeted about Boeing, Lockheed Martin, GM and Toyota.

On the day that Trump tweeted about United Technologies, however, the stock's average volume dropped 58 per cent from the previous day. Volume was also lower when Trump tweeted about Rexnord and Fiat Chrysler.

But here's the real kicker. If investors had faithfully followed Trump's tweets and bet equal amounts on each company that Trump praised - Ford, United Technologies and Fiat Chrysler - and against each company that he criticised - Rexnord, Boeing, Lockheed Martin, GM and Toyota - their reward would have been a loss of 1.6 per cent through late last week. On the other hand, if investors had invested those same amounts in the S&P 500 on those same dates, their return would have been 2 per cent (excluding dividends in each case).

Investors would do well to remember that they're not high-frequency traders. It doesn't matter what happens in the milliseconds that follow Trump's tweets. What matters is what happens in the days and weeks that follow. And contrary to the budding conventional wisdom, Trump's tweets are no crystal ball.

A snippet of good data: the economic outlook rebounded strongly in December indicating a solid pick up in activity in the first half of the current year.

The Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity nine months into the future, rose to 1.28 per cent in December, from 0.00 per cent in November.

Westpac chief economist Bill Evans said the run of five consecutive above or at trend readings was signalling a better outlook for the first half of 2017.

BlackRock CEO Larry Fink has sent out his latest letter to the chief executives of S&P500 companies, providing another indication of a huge shift in US business psychology.

In his annual letter, Fink warned US company bosses that BlackRock - the world's biggest fund manager and one of the most important shareholders in most US companies - will look carefully at how they use the cash they bring back from overseas under Trump's proposed tax reforms.

Trump during his election campaign suggested a one-off tax cut to encourage big US companies to bring back hold more than $2.6 trillion in profits they hold offshore to avoid a 35 per cent US corporate tax rate.

Fink urged US companies not to simply use this cash bonanza to fund share buybacks. "While we certainly support returning excess capital to shareholders, we believe companies must balance those practices with investment in future growth."

In his letter, which was made public overnight, Fink also urged US company bosses to adapt their corporate strategies to take account of the backlash against globalisation, that triggered the Brexit vote and Trump's election win.

Charles Elson, a University of Delaware finance professor who follows corporate governance issues, said the language shows how Trump's rise has caused business leaders like Fink to pay attention to matters such as inequality.

"CEOs are responsive to the public," Elson said. "His customers are the public and a healthy portion of the public has concerns about globalisation."

Harvey Norman's December-half profits will be boosted by at least $70 million in revaluations on its $2.4 billion property portfolio, a move likely to trigger further debate about whether the gains should be included as income.

Harvey Norman said the preliminary pre-tax net property revaluation increment for investment properties in Australia would be more than $70 million for the six months ending December, compared with $20.6 million in the same period a year ago, and would be recognised as income.

The first-half revaluation reflects Australia's strong property market and is the highest since the GFC. It suggests that the net revaluation booked to profit for the full year could be more than $100 million, based on the pattern in past years.

Harvey Norman booked net property revaluations of $48.4 million in 2016 and $8.7 million in 2015 after booking a decline in net property valuations in the previous three years.

The size of the gain in 2017 is likely to add to debate over whether Harvey Norman should book the property revaluations as income.

Most analysts and investors exclude the property revaluations from Harvey Norman's earnings because of the volatility year to year and the lack of transparency.

The latest revaluation may also add to calls from governance experts for Harvey Norman to consolidate its franchisee and group accounts.

Shares are up 0.4 per cent at $4.89.

And here some early economist reactions:

Michael Blythe, CBA:

The low inflation story remains in place (from) the end of 2016, with these numbers being a bit below expectations. Although some of the gloss has been taken off with an upward revision to the third quarter underlying numbers, we've kind of ended up at the 1.5 per cent mark that we expected to see, which is around about where the RBA expected it to be as well. I don't think there's any immediate implications for monetary policy there.

Su-Lin Ong, RBC Capital Markets

It is broadly in line with the RBA's own forecast and they are unlikely to change their near or medium-term inflation forecast in the next quarterly statement mid-February. Mid-point inflation is barely 2 per cent all the way through to 2018. This is still consistent with a very mild easing bias, though there is no trigger to exercise that bias soon. The print today is no trigger either. We still have a (rate) cut in the second quarter. The inflation picture suggests there is scope to do so if activity disappoints. There is a likelihood of a weaker housing market as the year unfolds.

Shane Oliver, AMP Capital Investors:

It keeps the prospect of another rate cut well and truly alive. I don't think the RBA will cut in February. We are thinking more likely in May. These numbers highlight the downside risks to inflation in Australia and the risk that it will take longer to get back to the 2-3 percent target for inflation. Since the last RBA meeting in December where they left rates on hold, we have seen a negative GDP number and we have now seen a lower inflation number. All of that suggest that the Reserve Bank will probably have to revise down its growth and inflation forecasts. That is ultimately consistent with another rate cut to come.

David de Garis, NAB:

The headline is a little bit softer than expected, including our own expectation, but underlying inflation is tracking right in line with the RBA's forecast. For the moment there are some factors that are holding back inflation, wages particularly and one or two components like rent which will keep inflation low. We expect inflation to remain pretty subdued through 2017. I don't think the Reserve Bank will be rushing ....they certainly wouldn't be thinking of increasing rates for this year. Our expectation is that more likely to cut rates.

The following graphic by ANZ's Martin Whetton shows that markets remain fairly relaxed about the soft inflation numbers, still betting in the second half of the year a rate hike is more likely than a cut.

#RBA meeting date #OIS pricing post #CPI around 2bp rally in mid to long part of OIS curve, pic.twitter.com/IaHqZ1gNd7

— Martin Whetton (@martin_whetton) January 25, 2017

For reference, before the CPI numbers, interest rate swaps were for October were at 1.54 per cent, suggesting a 16 per cent chance of a rate hike, while they're now around 1.52 per cent, so no big move.

And markets are still seeing just an extremely slim chance of a cut at the RBA's next board meeting in February, moving up to an about 10 per cent chance in May.

That could obviously change a bit once the numbers are digested, but given the uptick in regional inflation as well as the surge in commodity prices, traders are still likely to look through the softish local CPI, for now.

Some reactions on Twitter to the soft inflation data. Bottom line: disappointing but unlikely to force the RBA's hand next week:

Vegetable prices rose 12.5% in 2016 . #smashedavocado.

— Kit Lowe (@kit_lowe) January 25, 2017

Oz inflation remains 'dead'. #ausecon pic.twitter.com/OSDDxsaBqO

— Justin Fabo (@justinfabo) January 25, 2017

AUD/USD drops about 50 pips on CPI downside surprise, details hint at retail discount war continuing. Aldi-flation? #ausbiz

— Sean Callow (@seandcallow) January 25, 2017

Dec qtr CPI show underlying inflation still stuck around 1.5% YoY..RBA counting on it rising to 2% in next 2 reports.. doubful IMO

— David Bassanese (@DavidBassanese) January 25, 2017

But if commodity prices begin to decline, as many expect, and the CPI figure for March is weak then cuts come back into focus.

— Callam Pickering (@CallamPickering) January 25, 2017

Q4 CPI +0.5%qoq/1.5%yoy, underlying +0.4%/1.5%. Higher prices for cigs, fuel & dom travel offset by lower clothing,furnishing, global travel

— Shane Oliver (@ShaneOliverAMP) January 25, 2017

Ouch! Consumer price data has come in well below expectations, defying hopes that inflation is slowly picking up again in Australia.

Consumer prices rose just 0.5 per cent over the fourth quarter and 1.5 per cent over the year, below predictions of a 0.7 per cent / 1.6 per cent rise.

The all-important core inflation numbers closely watched by the RBA also came in lower at 0.4 per cent over the quarter and 1.55 per cent for the year. Analysts had been hoping for a quarterly rise of 0.5 per cent.

Headline inflation up 0.5% in Dec quarter and 1.5% over the year. Core CPI up 0.4% in the quarter and 1.6% over the year #ausbiz #auspol pic.twitter.com/0EhChc3VYw

— Callam Pickering (@CallamPickering) January 25, 2017

In the third quarter headline CPI came in at 0.7 per cent for the quarter and 1.3 per cent for the year, while core CPI was 0.35 per cent and 1.5 per cent.

The Reserve Bank targets annual core inflation of between 2 and 3 per cent but has already signalled it's willing to accept it coming in below that level for an extended period.

However, after surprisingly soft Q1 inflation data last year the RBA promptly reacted by cutting rates in May, and again in September.

The Aussie immediately dropped about one-third of a cent to US75.60¢ as traders adjusted their RBA outlook.

Moody's has confirmed Australia's triple-A rating, no surprise there, but the credit ratings agency highlights two main risks.

Mooody's says the triple-A is based on Australia's credit strengths, which include economic resilience, a very robust institutional framework and stronger fiscal metrics than many similarly rate countries.

"Despite an increase from low levels in recent years, Australia's debt burden remains moderate, which supports our assessment of fiscal strength at 'very high'," the analysts write in a note.

Moody's forecasts government debt to rise to around 40 per cent of GDP by fiscal 2017 and above that level by the end of the decade, mainly because fiscal consolidation will remain challenging due to a splintered Senate.

"However, Australia's debt burden will remain consistent with an Aaa rating. For instance, general government debt will be lower than in Canada or the Netherlands, and not significantly higher than Denmark or Sweden's (all Aaa stable)," the analysts say.

Despite the strong overall marks, the analysts cite two key areas of worry:

- The rapid rises in house prices and a build-up in household debt in recent years leave the economy and financial system vulnerable to negative shocks. According to the Bank for International Settlements, Australia's household debt amounted to 123.0% of GDP in the second quarter of 2016, much higher than other Aaa-rated commodity export sovereigns.

- The Australian government and private sector's dependence on external funding is another source of vulnerability, since it exposes the domestic financial sector to global developments. Foreign investors can at times shift their investments to different markets more suddenly than domestic investors would.

"Nonetheless, stable sources of financing and the Australian dollar's emerging status as a reserve currency point to somewhat lower external vulnerability risks than the scorecard metrics imply," they say.

If you wanted to see what a speculative commodity bubble looks like, then coking coal's huge rally in the second half of last year and subsequent retreat provides a good example, Reuters columnist Clyde Russell writes:

Like most bubbles, coking coal's surge had a solid foundation in supply and demand fundamentals, with top buyer China's appetite for the fuel used to make steel rising sharply in 2016, and suppliers unable to respond rapidly.

Coking coal futures on the Singapore Commodity Exchange leapt from $US86.92 a tonne on June 1 last year to a high of $US299.87 on November 30, a gain of 245 per cent. They have since dropped by almost 40 per cent to Monday's close of $US184.17 a tonne, still more than double what they were in the middle of last year, but also probably a level more reflective of market dynamics.

There is little doubt that the huge rally in coking coal was off the back of Chinese demand, with customs data showing that the country imported 59.23 million tonnes in 2016, a jump of 23.8 per cent from the prior year.

This was partly because steel output was higher than expected because domestic coking coal production was crimped by government policies that lowered the number of working days at mines.

But delve deeper into the Chinese customs data and it seems that the rise in coking coal imports by itself doesn't really justify the sharp rally in prices in the second half of the year.

The SGX futures contract is based on the Steel Index free-on-board Australia coking coal price, and is thus reflective of the cost of the fuel at ports in Australia, the largest exporter of the fuel.

The almost fourfold increase in prices in the five months from June to November last year wasn't accompanied by a huge surge in China's imports from Australia.

China's total coking coal imports from Australia in 2016 were 26.77 million tonnes, an increase of just 4.8 per cent.

The tightness in the coking coal market appears to have been wildly exaggerated by the huge rally, with the relatively modest increase in demand for Australian cargoes standing in sharp contrast to the jump in prices.

So where was China actually getting its extra coking coal from? The answer is neighbouring Mongolia.

Chinese imports from Mongolia jumped 85.2 per cent in 2016 to 23.56 million tonnes, putting it just behind Australia among suppliers to China.

It's not surprising that Mongolian coking coal is gaining on Australian supplies, given it is massively cheaper, with customs data showing it cost China $US62.93 a tonne in December, while cargoes from Australia were $US233.72.

Another factor to consider is Chinese imports of North Korean coal.

This is classified as anthracite by customs, but North Korean supplies are largely used as coking coal in steel-making or as a high-quality fuel in other manufacturing, such as ceramics.

China imported 22.42 million tonnes of anthracite from North Korea in 2016, an increase of 14.6 per cent from the prior year.

This was achieved despite Beijing saying it would place sanctions on imports from its neighbour in line with UN resolutions against Pyongyang's nuclear weapons program.

With the froth having come out of coking coal prices, the question becomes what will happen in 2017?

Chinese coal mines are currently maximising output to take advantage of the still healthy price, but may face production restrictions later in the year as Beijing has made it clear it is still determined to cut excess capacity by closing older and less efficient mines.

Supply is likely to increase from Australia and elsewhere as miners bring back idled output or work existing mines harder.

Imports from Mongolia are likely to remain robust, given the massive price advantage, while those from North Korea are less certain, given Beijing's commitment to limit imports to an annual 7.5 million tonnes, about a third of the 2016 level.

If China does stick to this limit, it will certainly provide support for seaborne coking coal exporters, as Chinese buyers will have to seek alternatives, and it will be easier to import via ship than use trucks and rail cars from Mongolia.

China's purchases from North Korea thus remain the main x-factor for seaborne coking coal markets.

Shares in Rio Tinto have surged to a two-year high with sentiment cheered by the sale of a further suite of coal mines which raises the odds of a buy-back or dividend hike.

Last night, Rio announced the sale of its NSW coal mines to an arm of the Chinese government, Yancoal Australia for $US2.45 billion, subject to government approvals.

Since the release of strong production data, analysts have been pencilling in forecasts of a share buy-back or dividend hike to be unveiled when Rio releases its December half earnings February 8, with the sale overnight boosting their optimism that there will be more good news for shareholders over the course of the year ahead.

"The sale marks the end of Rio Tinto's gradual exit from thermal coal, commencing in 2009 with the Cloud Peak spinoff in the (US) Powder River Basin, and subsequent divestments of Clermont, Bengalla, and Mount Pleasant," Deutsche Bank said in a note to clients.

"We estimate that proceeds from the sale could help reduce the company's net debt to $US3.9 billion by the end of 2017, further strengthening the balance sheet position, underpinning capital returns, and lending flexibility to the company's approach with growth projects in the key divisions of iron ore, copper and aluminium - Koodaideri, Oyu Tolgoi and Amrun."

Analysts have been steadily raising their price forecasts for Rio shares on the flow of good news, with Macquarie, for example, now tipping the shares will reach $74 over the year ahead.

Shares are up 2.8 per cent at $66.53, their highest level in around two years. This followed a 4 per cent surge in overnight trading in London.

Shares have opened higher, buoyed by strong gains in the big miners after commodity prices jumped overnight and BHP posted a solid production update.

The ASX is up 0.5 per cent at 5677.9, with a 1 per cent rise in the materials sub-index leading the charge.

Overnight, investors were buoyed by Trump making it good on some of his campaign promises, breathing new life into two key oil pipeline projects as well as meeting with US car company CEOs to push for more cars to be built in America.

"This is Trump's first step down the road of demonstrating that he is going to be onside with business and receptive to economic growth, despite the political protests that are bound to ensue following the decision to go ahead with the pipeline development," said Fat Prophets CEO Angus Geddes.

"Economic growth and creating jobs in the US, are central to Trump's policies, and the initial signs are that he is acting on these promises."

BHP has added 2.3 per cent and Rio is rallying 2.4 per cent, while nickel producer Western Areas is soaring 6.6 per cent and Alumina is up 5.4 per cent.

Among the losers are gold miners after the precious metal's price retreated a bit to below $US1210 an ounce, with Newrest shedding nearly 2 per cent.

SPONSORED POST

The story in Australia is clearly the moves in commodities and the materials sector, IG's Chris Weston says:

The bottom line is that if you are a momentum, trend trader or even a quant guy this space is flashing red hot right now and if you are not exposed to the space then you are missing out on what is arguably the best place to drive outperformance in a portfolio.

In recent reports, I had highlighted that really since the January 10 sellers had pulled the ASX 200 lower from the unwind of the morning auction, but at 10:28am (AEDT) that changed yesterday and investors and traders pushed into materials names. Volume was good, with $6.076 billion turnover through the market and 15.8% above the 30-day average. The bulls will take a market closing at its highs every day, but the big flows are in the mining space, although with 196 million shares traded (through the sector this was strong but not breathtaking.

The good-will should flow through again today with the ASX 200 materials sub-sector likely breaking out to the highest levels since August 2014, with BHP at the heart of this move with an open some 1.7% higher to $27.46. The pure plays will likely rally more aggressively.

Aluminium looks super strong and trading at the highest levels since May 2015, with talk of producers cutting capacity. Copper has pushed 2.5% higher and eyeing a break of the November highs of $2.75p/lb level, while the bulks have seen modest upside in the overnight session after strong gains yesterday.

By way of a guide, just look at Freeport-McMoran (FCX: US) which has well and truly broken out and now trading at the highest levels since July 2015, gaining 7.3% on the session. Shorting in this space is ill advised, it is long positions all the way, and that is until price action tells us otherwise.

By way of a lead, the S&500 has shown real signs of life and the bulls have pushed the S&P 500 to new all-time highs. A market at all-time highs is bullish and despite the climate of political uncertainty I still can't understand how we can think of this any other way. Earnings are coming in thick and fast and names like DR Horton and Dupont have reported well. Still, if we look at the sectors it's a story of financials, energy and industrials putting in the points, helped by a rise in US treasury yield. Clearly fixed income trader have it tough right now, with the yields all over the place!

These leads and the moves in commodities should push the ASX 200 into 5683 on open and through the January downtrend of 5664. Traders will be focused on moves today in copper, iron ore and steel futures (on the Dalian exchange) through the session to give mining stocks another leg up, while the FX traders have the bigger event risk in the form of Aussie Q4 CPI at 11:30 AEDT.

Sticking with metals, BHP Billiton has been able to cash in on surging iron ore prices, boosting output here to record levels in the December quarter as it continued to restrain oil and gas production in the US.

Iron ore output hit a record 60 million tonnes in the quarter, up 9 per cent from the same period a year earlier as it benefited from the ramp-up in output at the Jimblebar mine which also allowed it to access the rebound in prices recorded in the quarter.

It maintained full-year guidance of between 265 million and 275 million tonnes.

The price of iron ore received by the miner hit $US55 a tonne in the quarter, rising 28 per cent year on year. It was outpaced by surges in the price of coking coal which more than doubled to $US179 a tonne and the price of steaming coal which rose 51 per cent to $US74 a tonne.

Concern among forecasters is rising that millions of tonnes of additional low cost supply from Australia and Brazil will soon send iron ore prices into retreat.

Petroleum division output declined 15 per cent from a year earlier as it waits for prices to improve. The drop here was directly in line with the 15 per cent fall recorded in the September quarter.

With copper, BHP said it has cut its production forecast 2 per cent to 1.62 million tonnes due to an extensive power outage at the Olympic Dam project in South Australia. In the half, copper output declined by 7 per cent to 712,000 tonnes.

This revision coupled with lower grades at the Escondida mine in Chile resulted in copper production declining.

Aluminium climbed to a 20-month peak after reports of potential capacity cuts in China while zinc touched a five-week high as funds remained bullish on the sector and the dollar weakened.

Copper hit its highest in nearly seven weeks, but some analysts were wary of demand weakness and said the market is vulnerable to a correction.

Copper & aluminium having a great run higher. So what is this telling us about global economic pulse? Certainly still looks strong at moment pic.twitter.com/euxxL7reW8

— Robert Rennie (@R0bertRennie) January 24, 2017

Three-month aluminium on the London Metal Exchange closed with a 1 per cent gain at $US1867 a tonne, having earlier touched $US1883, its strongest since May 2015.

Traders cited a Bloomberg story saying that China is drawing up plans that would halt about 3.3 million tonnes of operational aluminium capacity during the winter to combat air pollution.

China's top environment watchdog delivered verbal warnings last month to Chalco, the nation's top aluminium producer, for failing to deal with pollution appropriately, state news agency Xinhua had reported.

Also supporting base metals was a weaker US dollar, making commodities priced in the greenback cheaper for buyers using other currencies. The dollar index slipped after data showed that US home resales declined by more than expected in December to a 17-year low.

LME zinc finished 1.3 per cent higher at $2,827 a tonne, having earlier touched $US2829.50, its highest since December 15.

Copper, meanwhile, climbed 2.6 per cent to end at $5,943, its highest since Dec. 7.

"Copper and zinc prices are artificially higher," said Gianclaudio Torlizzi, partner at consultancy T-Commodity in Milan, citing interest from funds.

"But demand is weak, the physical market is not chasing these gains, they're waiting for lower prices. The market is at serious risk of a correction lower."

Search pagination

1 new post(s) available. View post(s) Dismiss