- published: 25 Apr 2015

- views: 174181

-

remove the playlistOtc

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistOtc

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 21 May 2015

- views: 222268

- published: 12 Jul 2015

- views: 39930

- published: 01 Aug 2015

- views: 27603

- published: 25 Oct 2012

- views: 11782

- published: 16 Apr 2014

- views: 53613

- published: 29 Dec 2010

- views: 1222291

- published: 07 Jun 2015

- views: 988

- published: 21 Apr 2013

- views: 17178

OTC may refer to:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

4:23

4:23OTC - Up All Night (Original)

OTC - Up All Night (Original) -

4:01

4:01OTC - The Next Episode (Original)

OTC - The Next Episode (Original)OTC - The Next Episode (Original)

OTC - The Next Episode OTC - The Next Episode OTC - The Next Episode -

4:32

4:32OTC - Don t Stop (original mix)

OTC - Don t Stop (original mix) -

3:18

3:18The World - OTC

The World - OTCThe World - OTC

Bueno este video lo subio nuclear copy para mi para que no haya confusiones yo se lo pedi Pero el creador del video fue Nuclear Snail el subio el video a nuclear copy pero como yo ya lo dije yo se lo pedí la cuenta de Nuclear Copy es de Nuclear Snail (solo para que no haya confusiones y espero y me haya explicado) Espero y les guste! -

89:49

89:49PharmaSchool Family - Dr.Ahmed Elgewaily - OTC highlights - 21/10/2012

PharmaSchool Family - Dr.Ahmed Elgewaily - OTC highlights - 21/10/2012PharmaSchool Family - Dr.Ahmed Elgewaily - OTC highlights - 21/10/2012

تشرفت اسرة فارماسكول باستقبال د.احمد الجويلى فى كلية الصيدلة جامعة المنصورة فى يوم الأحد الموافق 21/10/2012 لالقاء ندوة عن مبادئ الـ OTC ولاقت المحاضرة اقبالا كبيرا من الحاضرين لمشاهدة صور خاصة بالندوة https://www.facebook.com/groups/pharmaschoolfamily/ للتواصل معنا يرجى ارسال رسالة الى صفحتنا على الفيس بوك https://www.facebook.com/pharmaschool.net او الى الاكونت الخاص بالاسرة https://www.facebook.com/pharmaschool.mans كما يمكنكم متابعة كل جديد على موقعنا http://www.pharmaschool.net/ Pharmaschool - Be Professional Pharmacist نقدم المعلومة فى ابسط صورها لتصبح صيدلى متميز -

26:44

26:44OTC Encore Tool Review -EricTheCarGuy

OTC Encore Tool Review -EricTheCarGuyOTC Encore Tool Review -EricTheCarGuy

The Encore has been discontinued as of 6/15. Sorry :( However I've been informed that the tool now falls under the 'Diagnostics for Live' provision. April 24, 2015 "OTC announced today its ‘Diagnostics for Life’ program and new Bravo 2.0 software in North America for the Encore diagnostic tool. Providing a lifetime warranty on hardware, expanded technical service hours and a software overhaul, efforts were based on direct Encore owner feedback. This critical update, Bravo 2.0, is provided for every Encore owner with or without an active diagnostics subscription. Technicians will see a faster, more stable tool with additional vehicle coverage and a reduction in screen-to-screen waiting times." More info on Diagnostics for Life here: https://www.otctools.com/diagnostics-for-life I had the chance to use this tool for a while before I did the review. I even took it to Pittsburgh and showed it to ScannerDanner. We agree that it's a capable tool but perhaps a bit slow. I'm no expert, but I think it has something to do with the processor used. That said, it still has a lot of great features and at this price point, I think it's a great value. The Encore really shines when you add features like Identifix. With just a few clicks, you're well on your way to a diagnosis. The Android operating system also makes it easy to learn and use. All around, I think the OTC Encore is a great tool and represents a transition into the next generation of scan tools. Camera: Brian Kast Related videos. Choosing an Automotive Scan Tool: https://www.youtube.com/watch?v=yCxsdCtxvtE Useful Links. OTC Encore product page: http://www.otctools.com/products/otc-encore Identifix: https://www.identifix.com/Default.aspx Mitchell1: http://www.mitchellrepair.com/main/ Alldata: http://www.alldata.com iATN: http://www.iatn.net For other tools and deals check out the Tools page at EricTheCarGuy.com: http://www.ericthecarguy.com/tools Discussion about this video: http://www.ericthecarguy.com/kunena/18-The-EricTheCarGuy-Video-Forum/50666-otc-encore-tool-review#94542 The best place for answers to your automotive questions: http://www.ericthecarguy.com EricTheCarGuy code lookup: http://www.ericthecarguy.com/obd-code-lookup Facebook: https://www.facebook.com/EricTheCarGuy?fref=ts Twitter: https://twitter.com/EricTheCarGuy Google+: https://plus.google.com/100195180196698058780/posts Information on Premium Membership: https://www.ericthecarguy.com/premium-content-streaming-etcg-content Stay Dirty ETCG Due to factors beyond the control of EricTheCarGuy, it cannot guarantee against unauthorized modifications of this information, or improper use of this information. EricTheCarGuy assumes no liability for property damage or injury incurred as a result of any of the information contained in this video. EricTheCarGuy recommends safe practices when working with power tools, automotive lifts, lifting tools, jack stands, electrical equipment, blunt instruments, chemicals, lubricants, or any other tools or equipment seen or implied in this video. Due to factors beyond the control of EricTheCarGuy, no information contained in this video shall create any express or implied warranty or guarantee of any particular result. Any injury, damage or loss that may result from improper use of these tools, equipment, or the information contained in this video is the sole responsibility of the user and not EricTheCarGuy. -

2:54

2:54Rahim ft Minix - OTC (official video) prod. DiNO

Rahim ft Minix - OTC (official video) prod. DiNORahim ft Minix - OTC (official video) prod. DiNO

SUBSKRYBUJ: http://goo.gl/iZwDbk FACEBOOK: http://www.fb.com/maxflorec --- MaxFloRec prezentuje klip do utworu "OTC" promującego limitowaną edycję wydawnictwa "Amplifikacja" Rahima. --- KONCERTY: Aneta Błażejczyk, tel: 513-359-609, e-mail: aneta.blazejczyk@gmail.com --- Oficjalna strona artysty: www.rahim.pl FB: https://www.fb.com/rahuene/?fref=ts --- Muzyka: Dawid Kałuża Słowa: Sebastian Salbert Produkcja: Stahu Beats --- Wydawca: MaxFloRec (www.maxflorec.pl) Premiera płyty: 6.12.2010 --- Reżyseria i montaż: Przedmarańcza http://przedmarancza.pl Wystąpili: Rahim, Minix oraz tancerze tyskiej szkoły Tito Dance Studio. -

8:59

8:59Don't Trade the OTC

Don't Trade the OTCDon't Trade the OTC

djellala.net for training levels by videos Contact email istockmoney@yahoo.com Don't Trade the OTC OTC are the over the counter stocks which are not listed in the 3 major exchanges. so stay away from this markets because these companies dont file their financials to the Security Exchange Commission. So when you trade the OTC you are facing big risks and you can lose a lot of money. So it is safer to avoid these kind of stocks. And if you want to trade penny stocks, try to choose stocks that are listed in Nazdaq, Nyse or Amex. At least you can verify the information about the company that you want to invest or trade. thanks Djellala Trading Training offers : A. Djellala Training Course: One to one by Skype. 2 sessions. Each session is 3 hours. Price $1500. B. One part of Djellala training course one to one by skype. One session of 2 hours. Price $500. C. Djellala Strategy. Ebook Price $1000. D. Djellala Training Membership by videos. Price $75 / monthly subscription. E. Djellala Stock Picks Newsletter Price $25. Once a week. 4 times a month at 3 pm sent by email. F. Ebook. Price $75 How to Calculate the Stop Loss? the Most Effective Ways and Strategies to Protect your Trades For any inquiry or questions please write back directly to Djellala email istockmoney@yahoo.com www.djellala.net Swing Trading Training and Education www.makemoneytradingstocks.net -

13:25

13:25OTC Highlights New Edition 01

OTC Highlights New Edition 01 -

4:12

4:12"O.T.C." - Nobody Wetter w/ Killa Kyleon, Fireball & Big Remy

"O.T.C." - Nobody Wetter w/ Killa Kyleon, Fireball & Big Remy -

2:40

2:40Empire-OTC Paradise

Empire-OTC Paradise -

30:20

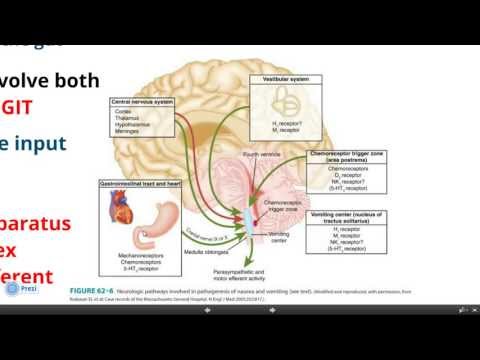

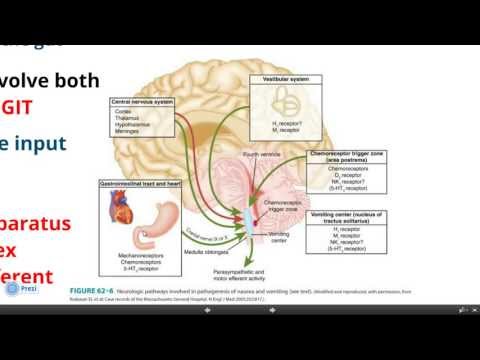

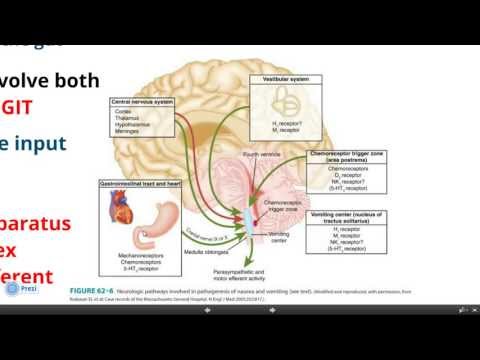

30:20OTC of the GIT - 1 امراض الجهاز الهضمي الحلقة

OTC of the GIT - 1 امراض الجهاز الهضمي الحلقةOTC of the GIT - 1 امراض الجهاز الهضمي الحلقة

الحلقة 1 من سلسلة علاج امراض الجهاز الهضمي بالادوية اللا وصفية episode 1 of OTC of the GIT series in this episodes we will discuss treatment of Nausea and Vomiting with OTC drugs ----------------------------------------------------------------------------------------------------------- -PDF file containing important notes http://www.mediafire.com/view/?9yzrv6puoufxtfm -peer reviewed study on treatment of NVP http://www.uptodate.com/contents/treatment-and-outcome-of-nausea-and-vomiting-of-pregnancy -NCCAM link on ginger http://nccam.nih.gov/health/ginger -Dose of ginger during pregnancy according to a controlled trial http://www.ncbi.nlm.nih.gov/pubmed/11275030 ----------------------------------------------------------------------------------------------------------- presented by pharmacist : Ahmed Ibrahim Fahmy bachelor degree of pharmaceutical sciences Alexandria university - Egypt

OTC

ALBUMS

- Dance July 2007 released: 2007

Dance July 2007

Released 2007- add to main playlist Play in Full Screen The Creeps (Get on the Dancefloor) (Vandalism vocal mix)

- add to main playlist Play in Full Screen A Neverending Dream (Buzz Junkies mix)

- add to main playlist Play in Full Screen The Year of the Cat (Alex Gaudino & Paul Sander mix)

- add to main playlist Play in Full Screen Sign Your Name (Soul Corporation club mix)

- add to main playlist Play in Full Screen Gimme Your Love (Bob Roberts remix)

- add to main playlist Play in Full Screen Come Tomorrow (Soul Seekerz club mix)

- add to main playlist Play in Full Screen I Don't Wanna See You Again (Starchaser remix)

- add to main playlist Play in Full Screen Sunstaring (Digital Dog mix)

- add to main playlist Play in Full Screen So Good (Shaolin Master remix)

- add to main playlist Play in Full Screen Estrella (original mix)

- add to main playlist Play in Full Screen Get the Party Started (North vs. N West remix)

O.T.C

ALBUMS

- Phase 2 released: 2004

- The Late EP released: 1999

Phase 2

Released 2004- add to main playlist Play in Full Screen 0800

- add to main playlist Play in Full Screen Suspecies

- add to main playlist Play in Full Screen Blasterizer

- add to main playlist Play in Full Screen Alcyone (Species remix)

- add to main playlist Play in Full Screen Shamaniac

- add to main playlist Play in Full Screen Rings of Saturn

- add to main playlist Play in Full Screen Our Perception

- add to main playlist Play in Full Screen Bust Mix

- add to main playlist Play in Full Screen New Era

-

-

OTC - The Next Episode (Original)

OTC - The Next Episode OTC - The Next Episode OTC - The Next Episode -

-

The World - OTC

Bueno este video lo subio nuclear copy para mi para que no haya confusiones yo se lo pedi Pero el creador del video fue Nuclear Snail el subio el video a nuclear copy pero como yo ya lo dije yo se lo pedí la cuenta de Nuclear Copy es de Nuclear Snail (solo para que no haya confusiones y espero y me haya explicado) Espero y les guste! -

PharmaSchool Family - Dr.Ahmed Elgewaily - OTC highlights - 21/10/2012

تشرفت اسرة فارماسكول باستقبال د.احمد الجويلى فى كلية الصيدلة جامعة المنصورة فى يوم الأحد الموافق 21/10/2012 لالقاء ندوة عن مبادئ الـ OTC ولاقت المحاضرة اقبالا كبيرا من الحاضرين لمشاهدة صور خاصة بالندوة https://www.facebook.com/groups/pharmaschoolfamily/ للتواصل معنا يرجى ارسال رسالة الى صفحتنا على الفيس بوك https://www.facebook.com/pharmaschool.net او الى الاكونت الخاص بالاسرة https://www.facebook.com/pharmaschool.mans كما يمكنكم متابعة كل جديد على موقعنا http://www.pharmaschool.net/ Pharmaschool - Be Professional Pharmacist نقدم المعلومة فى ابسط صورها لتصبح صيدلى متميز -

OTC Encore Tool Review -EricTheCarGuy

The Encore has been discontinued as of 6/15. Sorry :( However I've been informed that the tool now falls under the 'Diagnostics for Live' provision. April 24, 2015 "OTC announced today its ‘Diagnostics for Life’ program and new Bravo 2.0 software in North America for the Encore diagnostic tool. Providing a lifetime warranty on hardware, expanded technical service hours and a software overhaul, efforts were based on direct Encore owner feedback. This critical update, Bravo 2.0, is provided for every Encore owner with or without an active diagnostics subscription. Technicians will see a faster, more stable tool with additional vehicle coverage and a reduction in screen-to-screen waiting times." More info on Diagnostics for Life here: https://www.otctools.com/diagnostics-for-life I had t... -

Rahim ft Minix - OTC (official video) prod. DiNO

SUBSKRYBUJ: http://goo.gl/iZwDbk FACEBOOK: http://www.fb.com/maxflorec --- MaxFloRec prezentuje klip do utworu "OTC" promującego limitowaną edycję wydawnictwa "Amplifikacja" Rahima. --- KONCERTY: Aneta Błażejczyk, tel: 513-359-609, e-mail: aneta.blazejczyk@gmail.com --- Oficjalna strona artysty: www.rahim.pl FB: https://www.fb.com/rahuene/?fref=ts --- Muzyka: Dawid Kałuża Słowa: Sebastian Salbert Produkcja: Stahu Beats --- Wydawca: MaxFloRec (www.maxflorec.pl) Premiera płyty: 6.12.2010 --- Reżyseria i montaż: Przedmarańcza http://przedmarancza.pl Wystąpili: Rahim, Minix oraz tancerze tyskiej szkoły Tito Dance Studio. -

Don't Trade the OTC

djellala.net for training levels by videos Contact email istockmoney@yahoo.com Don't Trade the OTC OTC are the over the counter stocks which are not listed in the 3 major exchanges. so stay away from this markets because these companies dont file their financials to the Security Exchange Commission. So when you trade the OTC you are facing big risks and you can lose a lot of money. So it is safer to avoid these kind of stocks. And if you want to trade penny stocks, try to choose stocks that are listed in Nazdaq, Nyse or Amex. At least you can verify the information about the company that you want to invest or trade. thanks Djellala Trading Training offers : A. Djellala Training Course: One to one by Skype. 2 sessions. Each session is 3 hours. Price $1500. B. One part of Djellala... -

-

-

-

OTC of the GIT - 1 امراض الجهاز الهضمي الحلقة

الحلقة 1 من سلسلة علاج امراض الجهاز الهضمي بالادوية اللا وصفية episode 1 of OTC of the GIT series in this episodes we will discuss treatment of Nausea and Vomiting with OTC drugs ----------------------------------------------------------------------------------------------------------- -PDF file containing important notes http://www.mediafire.com/view/?9yzrv6puoufxtfm -peer reviewed study on treatment of NVP http://www.uptodate.com/contents/treatment-and-outcome-of-nausea-and-vomiting-of-pregnancy -NCCAM link on ginger http://nccam.nih.gov/health/ginger -Dose of ginger during pregnancy according to a controlled trial http://www.ncbi.nlm.nih.gov/pubmed/11275030 ----------------------------------------------------------------------------------------------------------- presented b...

OTC - Up All Night (Original)

- Order: Reorder

- Duration: 4:23

- Updated: 25 Apr 2015

- views: 174181

OTC - The Next Episode (Original)

- Order: Reorder

- Duration: 4:01

- Updated: 21 May 2015

- views: 222268

- published: 21 May 2015

- views: 222268

OTC - Don t Stop (original mix)

- Order: Reorder

- Duration: 4:32

- Updated: 12 Jul 2015

- views: 39930

- published: 12 Jul 2015

- views: 39930

The World - OTC

- Order: Reorder

- Duration: 3:18

- Updated: 01 Aug 2015

- views: 27603

- published: 01 Aug 2015

- views: 27603

PharmaSchool Family - Dr.Ahmed Elgewaily - OTC highlights - 21/10/2012

- Order: Reorder

- Duration: 89:49

- Updated: 25 Oct 2012

- views: 11782

- published: 25 Oct 2012

- views: 11782

OTC Encore Tool Review -EricTheCarGuy

- Order: Reorder

- Duration: 26:44

- Updated: 16 Apr 2014

- views: 53613

- published: 16 Apr 2014

- views: 53613

Rahim ft Minix - OTC (official video) prod. DiNO

- Order: Reorder

- Duration: 2:54

- Updated: 29 Dec 2010

- views: 1222291

- published: 29 Dec 2010

- views: 1222291

Don't Trade the OTC

- Order: Reorder

- Duration: 8:59

- Updated: 07 Jun 2015

- views: 988

- published: 07 Jun 2015

- views: 988

OTC Highlights New Edition 01

- Order: Reorder

- Duration: 13:25

- Updated: 11 Jul 2014

- views: 19750

"O.T.C." - Nobody Wetter w/ Killa Kyleon, Fireball & Big Remy

- Order: Reorder

- Duration: 4:12

- Updated: 09 Jan 2014

- views: 23873

Empire-OTC Paradise

- Order: Reorder

- Duration: 2:40

- Updated: 13 Jul 2015

- views: 18416

OTC of the GIT - 1 امراض الجهاز الهضمي الحلقة

- Order: Reorder

- Duration: 30:20

- Updated: 21 Apr 2013

- views: 17178

- published: 21 Apr 2013

- views: 17178

-

OTC Podcast May 8

-

-

2016 OTC Banquet Slideshow

-

Emergency telephone communication OTC fair in USA

Kntech sales marketing Manager on the fair of OTC in USA in May 2016, If you need any support or request for the emergency telephone/industrial telephone/intercom/open access control/ VoIP solution/PSTN/Metro/Airport/subway/busstation project,Pls come to fine me in here: sales1@koontech.com./+86 182 1881 6979/ www.koontech.com/ www.hksosphone.com, Welcome yours!!!! -

2016/05/06 John 00 Fleming OTC @ Toika: 23. 00.db aka J00F & The Digital Blonde - Oxygene

23. IMG_6272 00.db aka John 00 Fleming & The Digital Blonde - Oxygene -

2016/05/06 John 00 Fleming OTC @ Toika: 22. Binary Finary - 1998 (Protoculture remix)

22. IMG_6270 Binary Finary - 1998 (Protoculture remix) -

-

-

-

2016/05/06 John 00 Fleming OTC @ Toika: 18. Astrix & Ace Ventura - Valley of Stevie

18. IMG_6265 Astrix & Ace Ventura - Valley of Stevie -

2016/05/06 John 00 Fleming OTC @ Toika: 17. ID#5

17. IMG_6264 ID#5 -

2016/05/06 John 00 Fleming OTC @ Toika: 16. Electric Universe - Rain (Astral Projection remix)

16. IMG_6263 Electric Universe - Rain (Astral Projection remix)

OTC Podcast May 8

- Order: Reorder

- Duration: 93:29

- Updated: 09 May 2016

- views: 5

- published: 09 May 2016

- views: 5

SZUKAMY JEDZENIA OTC 1

- Order: Reorder

- Duration: 7:05

- Updated: 09 May 2016

- views: 0

2016 OTC Banquet Slideshow

- Order: Reorder

- Duration: 26:12

- Updated: 09 May 2016

- views: 6

- published: 09 May 2016

- views: 6

Emergency telephone communication OTC fair in USA

- Order: Reorder

- Duration: 0:21

- Updated: 09 May 2016

- views: 1

- published: 09 May 2016

- views: 1

2016/05/06 John 00 Fleming OTC @ Toika: 23. 00.db aka J00F & The Digital Blonde - Oxygene

- Order: Reorder

- Duration: 5:47

- Updated: 08 May 2016

- views: 3

- published: 08 May 2016

- views: 3

2016/05/06 John 00 Fleming OTC @ Toika: 22. Binary Finary - 1998 (Protoculture remix)

- Order: Reorder

- Duration: 6:17

- Updated: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 21. Relativ - Back to Infinity

- Order: Reorder

- Duration: 3:47

- Updated: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 20. Quench - Dreams

- Order: Reorder

- Duration: 4:43

- Updated: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 19. Christoper Lawrence - Banshee (Lostly remix)

- Order: Reorder

- Duration: 0:20

- Updated: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 18. Astrix & Ace Ventura - Valley of Stevie

- Order: Reorder

- Duration: 3:53

- Updated: 08 May 2016

- views: 3

2016/05/06 John 00 Fleming OTC @ Toika: 17. ID#5

- Order: Reorder

- Duration: 2:31

- Updated: 08 May 2016

- views: 3

- published: 08 May 2016

- views: 3

2016/05/06 John 00 Fleming OTC @ Toika: 16. Electric Universe - Rain (Astral Projection remix)

- Order: Reorder

- Duration: 2:58

- Updated: 08 May 2016

- views: 3

-

المحاضرة الأولى لدكتور تامر شاهين - أدوية الأطفال otc

المحاضرة الأولى لدكتور تامر شاهين فى شرح أدوية الأطفال otc وهى المحاضرة الخامسة فى كورس الكلينيكال المجانى التابع لفريق التعليم الإلكترونى . لينك جروب الفريق على الفيس بوك https://www.facebook.com/groups/team.e.learning.for.pharmacists/ -

Торговля бинарными опционами OTC в выходные дни у IQ option

В этом видео мы даём объяснение что такое торговля OTC. Фактически, данный видео ролик является практическим руководством в торговле бинарными опционами в выходные дни у брокера бинарных опционов iq option Обучающий курс по бинарным опционам http://investorzzz.ru/novosti/nashi-novosti/kurs-torgovli-binarnymi-opcionami/ Надежные брокеры http://investorzzz.ru/binarnye-opciony-brokery/ -

OSCILOSCOPIO AUTOMOTRIZ OTC 3840F DIAGNOSTICANDO AUTO CHINO FOTON

Demostración del Uso del Osciloscopio Automotriz OTC 3840F diagnosticando sistemas en un vehiculo de fabricación china. Este equipo pueden encontrarlo en nuestro Showroom: Av. Separadora Industrial 750 - Salamanca - Ate - Lima Telfs: 01-4357498 | 992720470 | 981414558 Email: ventas@obd2soluciones.com Web: www.obd2soluciones.com -

Tax Sale Investing "Over the Counter" OTC Tutorial Training Tax Liens Deeds Foreclosures

Members Weekly Webinar Training – Over the Counter (OTC) – Learn about what types of properties can be found and purchased after the auction. And how to get started investing in OTC tax liens and tax deeds. Download your Free 2-Part eBook Series “Tax Lien Investing Secrets” at http://secretsoftaxlieninvesting.com In this week’s Members Webinar Training we discuss “Over the Counter Investing” OTC. Also, if time permits we review “Live” upcoming auctions, properties and county records. Take advantage of the Tax Sale Market, and get started making Money Today. Tax Sale Investing is one of Real Estates least understood investment strategies. Many people have heard of tax sales, but few investors know how they work. Tax Liens are one of the best investment strategies available to investo... -

Discipline in OTC's Trading

Me ranting about having discipline in penny stock trading. www.thestockgarage.com -

OTC Highlights : Anemia ..

المحاضرة الكاملة بنقابة صيادلة البحيرة .. احصل على الدورة بالكامل عند اتصالك على 01008916220 -

Ralph Ring Flying the OTC-X1 Spacecraft

In a dramatic experiment, Ring co-piloted a 45 foot disk a distance of ten miles, arriving at their destination instantaneously. -

Over-the-Counter Financial Derivatives Regulation Explained: Market, Example (2009)

Over-the-counter (OTC) or off-exchange trading is done directly between two parties, without any supervision of an exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, mitigates all credit risk concerning the default of one party in the transaction, provides transparency, and maintains the current market price. In an OTC trade, the price is not necessarily published for the public. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivatives of such. Products traded on the exchange must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and iden... -

OTC Genisys Touch Scan Tool

"G" Jerry Truglia, Pierre Respaut, and John "Bear" Stahlberger use the OTC Genisys Touch Scan Tool.

المحاضرة الأولى لدكتور تامر شاهين - أدوية الأطفال otc

- Order: Reorder

- Duration: 48:06

- Updated: 08 Jul 2014

- views: 13313

- published: 08 Jul 2014

- views: 13313

Торговля бинарными опционами OTC в выходные дни у IQ option

- Order: Reorder

- Duration: 20:52

- Updated: 06 Sep 2015

- views: 3868

- published: 06 Sep 2015

- views: 3868

OSCILOSCOPIO AUTOMOTRIZ OTC 3840F DIAGNOSTICANDO AUTO CHINO FOTON

- Order: Reorder

- Duration: 23:09

- Updated: 23 Oct 2014

- views: 5750

- published: 23 Oct 2014

- views: 5750

Tax Sale Investing "Over the Counter" OTC Tutorial Training Tax Liens Deeds Foreclosures

- Order: Reorder

- Duration: 75:12

- Updated: 15 Oct 2015

- views: 533

- published: 15 Oct 2015

- views: 533

Discipline in OTC's Trading

- Order: Reorder

- Duration: 22:10

- Updated: 17 Jan 2014

- views: 5624

- published: 17 Jan 2014

- views: 5624

OTC Highlights : Anemia ..

- Order: Reorder

- Duration: 87:44

- Updated: 09 Oct 2011

- views: 21057

- published: 09 Oct 2011

- views: 21057

Ralph Ring Flying the OTC-X1 Spacecraft

- Order: Reorder

- Duration: 105:03

- Updated: 13 Dec 2012

- views: 47077

- published: 13 Dec 2012

- views: 47077

Over-the-Counter Financial Derivatives Regulation Explained: Market, Example (2009)

- Order: Reorder

- Duration: 138:35

- Updated: 07 Aug 2015

- views: 514

- published: 07 Aug 2015

- views: 514

OTC Genisys Touch Scan Tool

- Order: Reorder

- Duration: 92:57

- Updated: 16 Jul 2013

- views: 10288

- published: 16 Jul 2013

- views: 10288

- Playlist

- Chat

- Playlist

- Chat

OTC - Up All Night (Original)

- Report rights infringement

- published: 25 Apr 2015

- views: 174181

OTC - The Next Episode (Original)

- Report rights infringement

- published: 21 May 2015

- views: 222268

OTC - Don t Stop (original mix)

- Report rights infringement

- published: 12 Jul 2015

- views: 39930

The World - OTC

- Report rights infringement

- published: 01 Aug 2015

- views: 27603

PharmaSchool Family - Dr.Ahmed Elgewaily - OTC highlights - 21/10/2012

- Report rights infringement

- published: 25 Oct 2012

- views: 11782

OTC Encore Tool Review -EricTheCarGuy

- Report rights infringement

- published: 16 Apr 2014

- views: 53613

Rahim ft Minix - OTC (official video) prod. DiNO

- Report rights infringement

- published: 29 Dec 2010

- views: 1222291

Don't Trade the OTC

- Report rights infringement

- published: 07 Jun 2015

- views: 988

OTC Highlights New Edition 01

- Report rights infringement

- published: 11 Jul 2014

- views: 19750

"O.T.C." - Nobody Wetter w/ Killa Kyleon, Fireball & Big Remy

- Report rights infringement

- published: 09 Jan 2014

- views: 23873

Empire-OTC Paradise

- Report rights infringement

- published: 13 Jul 2015

- views: 18416

OTC of the GIT - 1 امراض الجهاز الهضمي الحلقة

- Report rights infringement

- published: 21 Apr 2013

- views: 17178

- Playlist

- Chat

OTC Podcast May 8

- Report rights infringement

- published: 09 May 2016

- views: 5

SZUKAMY JEDZENIA OTC 1

- Report rights infringement

- published: 09 May 2016

- views: 0

2016 OTC Banquet Slideshow

- Report rights infringement

- published: 09 May 2016

- views: 6

Emergency telephone communication OTC fair in USA

- Report rights infringement

- published: 09 May 2016

- views: 1

2016/05/06 John 00 Fleming OTC @ Toika: 23. 00.db aka J00F & The Digital Blonde - Oxygene

- Report rights infringement

- published: 08 May 2016

- views: 3

2016/05/06 John 00 Fleming OTC @ Toika: 22. Binary Finary - 1998 (Protoculture remix)

- Report rights infringement

- published: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 21. Relativ - Back to Infinity

- Report rights infringement

- published: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 20. Quench - Dreams

- Report rights infringement

- published: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 19. Christoper Lawrence - Banshee (Lostly remix)

- Report rights infringement

- published: 08 May 2016

- views: 2

2016/05/06 John 00 Fleming OTC @ Toika: 18. Astrix & Ace Ventura - Valley of Stevie

- Report rights infringement

- published: 08 May 2016

- views: 3

2016/05/06 John 00 Fleming OTC @ Toika: 17. ID#5

- Report rights infringement

- published: 08 May 2016

- views: 3

2016/05/06 John 00 Fleming OTC @ Toika: 16. Electric Universe - Rain (Astral Projection remix)

- Report rights infringement

- published: 08 May 2016

- views: 3

- Playlist

- Chat

المحاضرة الأولى لدكتور تامر شاهين - أدوية الأطفال otc

- Report rights infringement

- published: 08 Jul 2014

- views: 13313

Торговля бинарными опционами OTC в выходные дни у IQ option

- Report rights infringement

- published: 06 Sep 2015

- views: 3868

OSCILOSCOPIO AUTOMOTRIZ OTC 3840F DIAGNOSTICANDO AUTO CHINO FOTON

- Report rights infringement

- published: 23 Oct 2014

- views: 5750

Tax Sale Investing "Over the Counter" OTC Tutorial Training Tax Liens Deeds Foreclosures

- Report rights infringement

- published: 15 Oct 2015

- views: 533

Discipline in OTC's Trading

- Report rights infringement

- published: 17 Jan 2014

- views: 5624

OTC Highlights : Anemia ..

- Report rights infringement

- published: 09 Oct 2011

- views: 21057

Ralph Ring Flying the OTC-X1 Spacecraft

- Report rights infringement

- published: 13 Dec 2012

- views: 47077

Over-the-Counter Financial Derivatives Regulation Explained: Market, Example (2009)

- Report rights infringement

- published: 07 Aug 2015

- views: 514

OTC Genisys Touch Scan Tool

- Report rights infringement

- published: 16 Jul 2013

- views: 10288

-

Lyrics list:lyrics

-

Armas blancas

-

Un momento de meditacion

-

Muerta

-

Ya sé

-

Cuál es el precio

-

Cuánta cerveza

-

Como Billy the kid

-

Chicos y perros

-

Angeles caidos

-

America

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Armas blancas

Chicos rudos

de brazos tatuados

peleando se divierten

en las calles otra vez.

Peleas callejeras

Armas Blancas.

Alcohol y desorden

odio y descontrol

chicas borrachas

en un callejón.

Peleas callejeras

Armas Blancas.

Pelean por su vida

pelean por diversión

pelean por mujeres

pelean por su honor.

Peleas callejeras

Armas Blancas

Boy wonder may have discovered lost Mayan city

Edit CBS News 10 May 2016Tensions Grow As US Navy Warship Sails Close To Disputed Chinese Island

Edit WorldNews.com 10 May 2016Australian mum reveals quintuplets in photo shoot

Edit BBC News 10 May 2016Scientists Return To Gulf Crater Site To Study Rocks For Clues About Early Earth Life

Edit WorldNews.com 10 May 2016I don’t want exemption from ‘ignorant’ Trump’s Muslim ban

Edit Raw Story 10 May 2016First Order of Cannabis Strains Placed with Whistler Medical Marijuana Corporation

Edit PR Newswire 11 May 2016Costar Technologies, Inc. Announces Financial Results For the First Quarter Ended March 31, 2016

Edit PR Newswire 11 May 2016Moelis Reiterates Buy Rating for Alexium and Price Target of $1.20

Edit Stockhouse 11 May 2016Revised: First Order of Cannabis Strains Placed with Whistler Medical Marijuana Corporation

Edit Stockhouse 11 May 2016May 10, 2016 - FCB Announces First Quarter 2016 Earnings (Founders Bancorp)

Edit Public Technologies 11 May 2016Alexium CEO Winner of 2016 Management Award

Edit Stockhouse 11 May 201605/10/16 : Advanced Emissions Solutions Reports First Quarter 2016 Results (Advanced Emissions Solutions Inc)

Edit Public Technologies 11 May 2016Advanced Emissions Solutions Reports First Quarter 2016 Results

Edit Stockhouse 11 May 2016OTC Markets Group Welcomes Newly Verified OTCQB Companies – May 10 (OTC Markets Group Inc)

Edit Public Technologies 10 May 2016Largo Resources Ltd. announces OTC Markets Group Listing

Edit Stockhouse 10 May 2016Largo Resources Ltd. announces OTC Markets Group Listing (Largo Resources Ltd)

Edit Public Technologies 10 May 2016Interest in post trade risk mitigation services grows in Asia, according to TriOptima whitepaper (ICAP plc)

Edit Public Technologies 10 May 2016Becoming a substantial holder from CBA (Atlas Iron Limited)

Edit Public Technologies 10 May 2016- 1

- 2

- 3

- 4

- 5

- Next page »