8:02

Office Hours: Reviewing Tax Revenue, Incidence, and Deadweight Loss

Explanation of tax revenue, deadweight loss, and incidence. See more videos and economics ...

published: 09 Aug 2011

Author: dmateer

Office Hours: Reviewing Tax Revenue, Incidence, and Deadweight Loss

Explanation of tax revenue, deadweight loss, and incidence. See more videos and economics learning resources at www.dirkmateer.com!

2:47

Safaricom, EABL lead in tax returns

www.ntv.co.ke Telecommunication firm Safaricom has been named the top taxpayer for the fin...

published: 22 Oct 2012

Author: NTVKenya

Safaricom, EABL lead in tax returns

www.ntv.co.ke Telecommunication firm Safaricom has been named the top taxpayer for the financial year 2011 East African Breweries came second and third is the Teachers' Service Commission, TSC. At a ceremony that was the culmination of the Kenya Revenue Authority Taxpayers' Week, President Mwai Kibaki applauded 40 firms that were recognized for their tax compliance and high remittance adding KRA's collections have risen from 200 billion shillings in 2003 to 700 billion in the financial year 2011/2012.

1:35

Kenya Revenue Authority Tax Clubs

The Kenya revenue authority has launched a program to educate secondary school students on...

published: 18 Oct 2012

Author: K24TV

Kenya Revenue Authority Tax Clubs

The Kenya revenue authority has launched a program to educate secondary school students on the importance of paying taxes. The schools' tax clubs program is part of KRA'S wider outreach to Kenyans to develop a tax-paying culture.

20:03

REALIST NEWS - California's tax revenue "unexpectedly" collapses by 33.5 percent

www.realistnews.net...

published: 17 Aug 2012

Author: jsnip4

REALIST NEWS - California's tax revenue "unexpectedly" collapses by 33.5 percent

www.realistnews.net

2:13

Israel withholds Palestinian tax revenues

Palestinians say they are outraged by the Israeli government's decision to withhold mi...

published: 02 Nov 2011

Author: AlJazeeraEnglish

Israel withholds Palestinian tax revenues

Palestinians say they are outraged by the Israeli government's decision to withhold millions of dollars of tax revenues from them while accelerating settlement construction. The decision follows Palestine being recognised as a state by UNESCO - the United Nations Education, Scientific and Cultural Organisation. There are now 150000 Palestinian Authority employees across the West Bank and Gaza who do not know whether they will receive their full salaries next week. Al Jazeera's Nicole Johnston reports from Jerusalem, Occupied West Bank.

8:13

16x9 - Tax Man: Epic fight against Canada Revenue Agency

[May 17, 2009] It was a million-dollar mistake that turned in to a 13-year battle. A Briti...

published: 30 Jul 2012

Author: 16x9onglobal

16x9 - Tax Man: Epic fight against Canada Revenue Agency

[May 17, 2009] It was a million-dollar mistake that turned in to a 13-year battle. A British Columbia man lost almost everything in a tax tiff with the Canada Revenue Agency. The CRA admits they were wrong, but now refuses to repay his money. 16:9 brings you the incredible story of how Irvin Leroux took on the taxman.

4:27

Yaron Answers: How Would A Government Gain Revenue Without Taxes?

Yaron Brook answers a question from Justin: "How would a government gain revenue with...

published: 11 Sep 2012

Author: AynRandInstitute

Yaron Answers: How Would A Government Gain Revenue Without Taxes?

Yaron Brook answers a question from Justin: "How would a government gain revenue without taxes?" www.laissezfaireblog.com

2:48

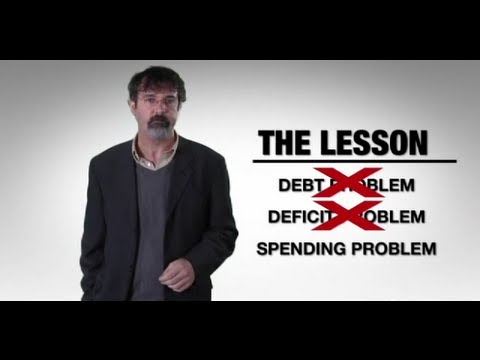

Does Government Have a Revenue or Spending Problem?

People say the government has a debt problem. Debt is caused by deficits, which is the dif...

published: 25 Apr 2012

Author: LearnLiberty

Does Government Have a Revenue or Spending Problem?

People say the government has a debt problem. Debt is caused by deficits, which is the difference between what the government collects in tax revenue and the amount of government spending. Every time the government runs a deficit, the government debt increases. So what's to blame: too much spending, or too little tax revenue? Economics professor Antony Davies examines the data and concludes that the root cause of the debt is too much government spending.

5:53

Prager University: Do High Taxes Raise More Money?

If you raise taxes does it automatically follow that you'll raise more revenue? Is the...

published: 10 Sep 2012

Author: PragerUniversity

Prager University: Do High Taxes Raise More Money?

If you raise taxes does it automatically follow that you'll raise more revenue? Is there a point at which tax rates become counterproductive? UCLA Economics professor, Tim Groseclose, answers these questions and poses some fascinating new ones.

3:16

Will Higher Tax Rates Balance the Budget?

As the US debt and deficit grows, some politicians and economist have called for higher ta...

published: 11 Apr 2012

Author: LearnLiberty

Will Higher Tax Rates Balance the Budget?

As the US debt and deficit grows, some politicians and economist have called for higher tax rates in order to balance the budget. The question becomes: when the government raises taxes, does it actually collect a larger portion of the US economy? Professor Antony Davies examines 50 years of economic data and finds that regardless of tax rates, the percentage of GDP that the government collects has remained relatively constant. In other words, no matter how high government sets tax rates, the government gets about the same portion. According to Davies, if we're concerned about balancing the budget, we should worry less about raising tax revenue and more about growing the economy. The recipe for growth? Lower tax rates and a simplified tax code.

5:34

The Truth About Tax Rates

Cenk Uygur breaks down a series of graphs discussing tax rates including: who did the Bush...

published: 19 Apr 2012

Author: TheYoungTurks

The Truth About Tax Rates

Cenk Uygur breaks down a series of graphs discussing tax rates including: who did the Bush tax cuts benefit, average income of top 400 highest incomes, average tax rate for top 400 incomes, average effective income tax rates, and sources of federal tax revenue. Do we really have a progressive tax structure watch to find out. Subscribe to The Young Turks: bit.ly Find out how to watch The Young Turks on Current by clicking here: www.current.com The Largest Online New Show in the World. Google+: www.gplus.to Facebook: www.facebook.com Twitter: twitter.com

21:54

Should Tax Be More Taxing?

Richard Murphy, Philip Booth and Mike Lewis ask: Do we need to fundamentally change our at...

published: 23 May 2012

Author: theRSAorg

Should Tax Be More Taxing?

Richard Murphy, Philip Booth and Mike Lewis ask: Do we need to fundamentally change our attitude toward tax? To view it as a fair and just contribution toward shared public services, and not as an egregious state-run money pinching scheme? Listen to the podcast of the full event including audience Q&A: www.thersa.org Our events are made possible with the support of our Fellowship. Support us by donating or applying to become a Fellow. Donate: www.thersa.org Become a Fellow: www.thersa.org Find out more about HMRC: www.hmrc.gov.uk Tax Avoidance: en.wikipedia.org Tax Noncompliance: en.wikipedia.org

7:21

Harborside Health Center Press Conference 07/12/12

Henry Wykowski introduces the happenings at Harborside Health Center and explains the layo...

published: 13 Jul 2012

Author: HarborsideHealth

Harborside Health Center Press Conference 07/12/12

Henry Wykowski introduces the happenings at Harborside Health Center and explains the layout of the Harborside Press Conference on July 12, 2012. MEDIA ALERT! For Immediate Release: July 11. 2012 11 AM Thousands of Patients Threatened to Lose Safe Access US Attorney & DEA Threaten Harborside Health Center Landlords Property Forfeiture Filed in District Court of San Francisco *** Invitation to Attend Press Conference Oakland, California - Thursday July 12th at 9 AM - Oakland City Hall With Appearances and Statements by Patients, Oakland Mayor Jean Quan, State Board of Equalization & City Officials, Union Officials, Arturo Sanchez, LEAP Officers, Rebecca Kaplan and Other Statewide Officials July 12, 2012 -- Oakland, California - The federal attack on safe access for medical cannabis patients continues. Yesterday morning, taped to the front doors of the nation's model medical cannabis dispensary, Harborside Health Center in Oakland and San Jose, was an official 'Complaint for Forfeiture of Property.' The complaint is signed by US Attorney Melinda Haag, Assistant US Attorney Arvan Perteet, and DEA Agent David White, filed on July 6, 2012, in the District Court San Francisco Division and received by the court on Sunday, July 9. The complaint seeks forfeiture of real estate and improvements on the grounds that cannabis is being distributed on the premises, in violation of federal law. This latest federal action to seize property flies in the face of promises made by Haag to <b>...</b>

2:55

121004 - Here Come the Death Panels

Source Links and video text for Today's Items are located at hyperreport.org All conte...

published: 04 Oct 2012

Author: HyperReport

121004 - Here Come the Death Panels

Source Links and video text for Today's Items are located at hyperreport.org All content contained on the Hyper Report, and attached video is provided for informational and entertainment purposes only. 'Hyper Report' assumes all information to be truthful and reliable; however, the content in this video is provided without any warranty, express or implied. No material here constitutes "Investment advice" nor is it a recommendation to buy or sell any financial instrument, including but not limited to stocks, commodities, corporation, options, bonds, futures, or intrinsically valueless Federal Reserve Notes. Any actions you, the reader/listener, take as a consequence of any analysis, opinion, or advertisement on this video is your sole responsibility. Thank you.

Youtube results:

6:49

Part one: 13 Investigates IRS tax loophole

Eyewitness News shows a massive tax loophole that provides billions of dollars in tax cred...

published: 27 Apr 2012

Author: 13WTHR

Part one: 13 Investigates IRS tax loophole

Eyewitness News shows a massive tax loophole that provides billions of dollars in tax credits to undocumented workers and, in many cases, people who have never set foot in the United States.

55:55

ILLUMINATI CULT (1of5): Profiting from 9/11

ILLUMINATI CULT part 1 of 5: Profiting from 9/11 (re-edit r2). PLAYLIST (5 parts): www.you...

published: 01 Aug 2012

Author: LightTheDarknessLor3

ILLUMINATI CULT (1of5): Profiting from 9/11

ILLUMINATI CULT part 1 of 5: Profiting from 9/11 (re-edit r2). PLAYLIST (5 parts): www.youtube.com . * DOCUMENTS: Zurich Files - Revelations of a Swiss Banker: www.slideshare.net . Zealot Files - Masons Bravely Speak Out: www.slideshare.net . Zealot Files - Rosenthal Interview on the Zionist Conspiracy: www.slideshare.net . * "This was supposed to go into affect on September 12, 2001. Guess what happened on September 11, 2001? "NESARA implements the following changes: -- 01. Zeros out all credit card, mortgage, and other bank debt due to illegal banking and government activities; -- 02. Abolishes income tax; -- 03. Abolishes IRS, creates 14% flat-rate, non-essential 'new items only' sales tax revenue for government; -- 04. Increases benefits to senior citizens; -- 05. Returns Constitutional Law to all courts and legal matters; -- 06. Establishes new Presidential and Congressional elections within 120 days after NESARA's announcement; -- 07. Monitors elections and prevents illegal election activities of special interest groups; -- 08. Creates new US Treasury currency, 'rainbow currency', backed by Gold, Silver, and Platinum precious metals; -- 09. Initiates new US Treasury Bank System in alignment with Constitutional Law; -- 10. Eliminates the Federal Reserve System; -- 11. Restores financial privacy; -- 12. Retrains all judges and attorneys in Constitutional Law; -- 13. Ceases all aggressive, US government military actions worldwide; -- 14. Establishes peace throughout <b>...</b>

4:22

Submitting your ITR12 via SARS eFiling

Learn how to complete and submit your personal Income Tax return hassle-free with eFiling....

published: 30 Jun 2012

Author: SARS TV

Submitting your ITR12 via SARS eFiling

Learn how to complete and submit your personal Income Tax return hassle-free with eFiling. General disclaimer These tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the Commissioner for SARS. They provide general assistance, are simply expressed and may provide step by step guidance that does not cover all possibilities. Generally, they do not address a taxpayer's specific circumstances. For more information you may: • Visit the SARS website www.sars.gov.za • Visit your nearest SARS branch • Contact your own tax advisor/tax practitioner • If calling locally, contact the SARS Contact Centre on 0800 00 SARS (7277) Operating hours (Excluding weekends and public holidays): Mondays, Tuesdays, Thursdays and Fridays: 08:00 -- 17:00, Wednesdays: 09:00 -- 17:00 • If calling from outside South Africa, contact the SARS Contact Centre on +27 11 602 2093 Operating hours: 08:00 - 16:00 South African time (Excluding weekends and public holidays). Protection disclaimer A taxpayer who relies on guidance in this document that is found to be incorrect or misleading will have to pay the tax, including penalties, that would otherwise be payable under the law and will not be protected against penalties based on false or misleading statements by the taxpayer as a result of such incorrect or misleading guidance. Copyright Disclaimer © SARS. Copyright subsist in this publication and no part of this publication may be <b>...</b>

2:17

How to register for SARS eFiling

An easy step-by-step guide to registering for our free, convenient and secure eFiling serv...

published: 30 Jun 2012

Author: SARS TV

How to register for SARS eFiling

An easy step-by-step guide to registering for our free, convenient and secure eFiling service. General disclaimer These tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the Commissioner for SARS. They provide general assistance, are simply expressed and may provide step by step guidance that does not cover all possibilities. Generally, they do not address a taxpayer's specific circumstances. For more information you may: • Visit the SARS website www.sars.gov.za • Visit your nearest SARS branch • Contact your own tax advisor/tax practitioner • If calling locally, contact the SARS Contact Centre on 0800 00 SARS (7277) Operating hours (Excluding weekends and public holidays): Mondays, Tuesdays, Thursdays and Fridays: 08:00 -- 17:00, Wednesdays: 09:00 -- 17:00 • If calling from outside South Africa, contact the SARS Contact Centre on +27 11 602 2093 Operating hours: 08:00 - 16:00 South African time (Excluding weekends and public holidays). Protection disclaimer A taxpayer who relies on guidance in this document that is found to be incorrect or misleading will have to pay the tax, including penalties, that would otherwise be payable under the law and will not be protected against penalties based on false or misleading statements by the taxpayer as a result of such incorrect or misleading guidance. Copyright Disclaimer © SARS. Copyright subsist in this publication and no part of this publication may <b>...</b>

![Aldine Community Health Center. The East Aldine Management District, headquartered at 5202 Aldine Mail Route,[3] generates revenues through a one cent sales tax Aldine Community Health Center. The East Aldine Management District, headquartered at 5202 Aldine Mail Route,[3] generates revenues through a one cent sales tax](http://web.archive.org./web/20121022210253im_/http://cdn2.wn.com/pd/0c/d5/d15356649d0c43a6227b92ab01b1_small.jpg)

![East Aldine street signs. The East Aldine Management District, headquartered at 5202 Aldine Mail Route,[3] generates revenues through a one cent sales tax. East Aldine street signs. The East Aldine Management District, headquartered at 5202 Aldine Mail Route,[3] generates revenues through a one cent sales tax.](http://web.archive.org./web/20121022210253im_/http://cdn3.wn.com/pd/88/f9/9e791eb8f6ad3e28c1301a0ae5cb_small.jpg)