Monitor your obligations

Stripe Tax provides insights about your potential tax registration obligations (called economic nexus in the US). We help you understand where you might have to register, collect, and remit tax based on your sales into a state or country, even if you don’t have physical presence there.

Note

Tax provides threshold monitoring primarily for payments processed by Stripe.The only out of band payments we currently include are invoices processed off of Stripe.

How it works

Tax uses your default tax category and location attribution for each Stripe-processed sale minus refunds to see how your total sales within a given time window compare to tax thresholds in different jurisdictions. Tax uses time windows defined by local tax rules and assumes all sales are B2C unless you have included a VAT ID for your customer. Your obligations might differ if you only sell nontaxable items or make B2B sales. For more details on taxable revenue and timeframes, read about tax registration rules by location.

Exceptions

- We provide insight into the places where you don’t have a physical presence so obligations aren’t monitored for your home US state or country.

- Obligations are only monitored in live mode.

- We only monitor obligations for your payments on Stripe.

Location attribution

Location attribution is an important part of monitoring tax thresholds. To correctly determine your tax obligations, Stripe Tax attributes a location to each processed transaction once per day, adding new resulting transactions to your monitoring threshold in a 24-hour cycle. Location attribution happens even if tax isn’t calculated for the transactions, and it’s a different process from the address validation that we perform to calculate tax. You might not need specific tax rates and precise address information for threshold monitoring purposes, unlike when Stripe calculates and collects tax for transactions.

To attribute a location, Stripe Tax uses available information for that transaction and prefers some information sources to others—some examples are the current customer address, country of the card issuer, and the customer’s IP address.

Stripe Tax uses information in the following order:

- Stripe Tax validated address: if we calculated tax for the transaction, Stripe Tax already validated the address. We use the same address when calculating the tax threshold.

- Customer address: property in the Customer object responsible for the transaction. Stripe Tax uses the country, state, and postal code fields to determine a jurisdiction.

- Address Verification (AVS) postal code: AVS is a service that verifies the authenticity of a transaction by checking if the provided address matches the cardholder’s billing address. If the transaction is successful, Stripe Tax converts a US or Canadian postal code into a state and determines the jurisdiction.

- Country of the card issuer: Stripe Tax uses the credit card issuer’s bank country to determine a jurisdiction for the transaction. For transactions in the US and Canada, we might also need state information.

- Payment method: Stripe Tax uses country-specific payment methods to determine the location of a payment. We assume that a transaction through iDeal is from the Netherlands and that a transaction through Giropay is from Germany, for example.

- Customer’s IP address: as a last resort, we use the customers IP address to determine a jurisdiction.

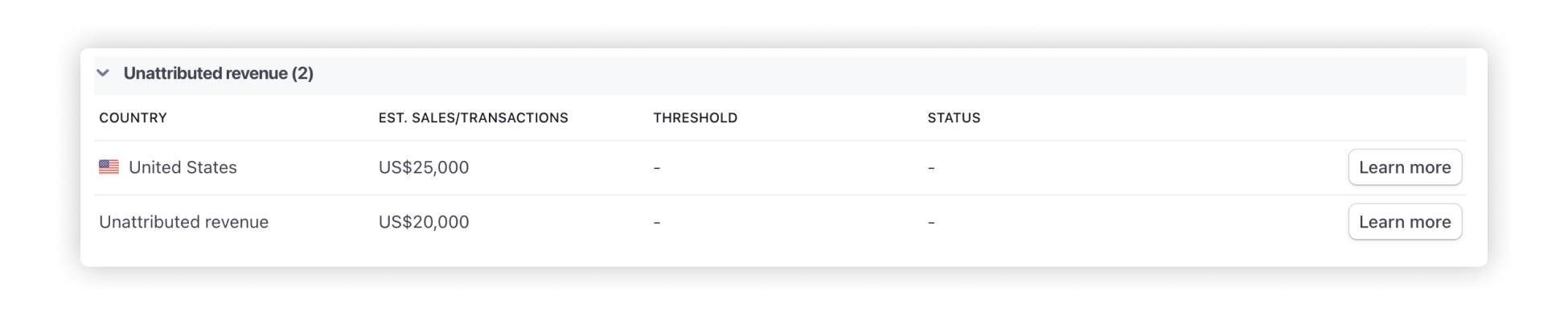

When Stripe Tax can’t determine the location for a transaction, we group its information under Unattributed revenue. Where possible, we break out globally unattributed revenue and US unattributed revenue. For example, if we’re able to determine the customer is in the US (perhaps by using an IP address) but don’t have enough information to make a granular determination, we categorize that as US unattributed revenue.

Handling unattributed revenue

The table below explains what information is needed for different countries.

Using the Dashboard

On the Monitoring tab, you can see insights about your potential tax registration obligations.

You can monitor tax obligations in the following categories:

- Threshold exceeded: Where your estimated sales or transactions are over the location’s threshold and your business likely needs to register for tax.

- To monitor: Where you haven’t exceeded a threshold yet, but you do have buyers located in that market. We’ll provide a percent-to-threshold to help you determine when you might need to register.

- Unattributed revenue: When Stripe Tax isn’t able to determine the location for a transaction, we group its information under this category. Where possible, we break out globally unattributed revenue and US unattributed revenue.

To learn more about an individual state or country comparison, click Review, which contains information about the threshold itself and your latest sales.

Time windows

As noted above, each jurisdiction might have a different time window for calculating nexus obligations. For example, some only look at the past calendar month or quarter whereas others use a rolling basis. You can see how each individual jurisdiction calculates economic nexus as part of the Review flow, but in general, Stripe Tax supports the following calculation windows and methodology:

- Previous or current year: Stripe Tax uses the previous or current calendar year to calculate the count and amount of transactions.

- Previous year: Stripe Tax uses the previous calendar year to calculate the count and amount of transactions.

- Rolling year by quarter: Stripe Tax uses the last four full quarters to calculate the count and amount of transactions.

- Rolling 12 months: Stripe Tax uses the last 12 months to calculate the count and amount of transactions.

Tax threshold notifications

Stripe Tax notifies you about potential tax obligations (known as economic nexus in the US). We send notifications after you hit a threshold in any location. Stripe sends tax threshold notifications by email, and displays them in the Dashboard to the account owner.

Email notification

We send email notifications from support+updates@stripe.com to the account owner’s email. The email notification includes your account name and links to the monitoring tool and other resources that provide additional information.

Dashboard notification

If you log into the Dashboard as the account owner, you can see notifications. Click the bell icon in the navigation bar to show all of your Dashboard notifications.

Note

Click Review tax thresholds inside of the notification to go to the tax monitoring tool.

Tax threshold notification preconditions

Stripe only notifies you when you have exceeded a tax threshold based on Stripe’s calculations. To receive tax threshold notifications, you must meet the following requirements:

- You must have opted into Stripe Tax.

- You must not have disabled Stripe Tax notifications.

- You must not have an active live mode tax registration for the location.

- You must not have received any tax threshold notification within the past 7 days.

Tax threshold notification frequency

After you cross a threshold, Stripe sends you a notification within 1 or 2 days. If Stripe sent you a notification in the past 7 days, you receive batched notifications for new threshold status changes a week after the last notification.

Disable tax threshold notifications

If you’re the account owner, you can disable tax threshold notifications by going to your profile settings.