File your 1099 tax forms

Before you can file your 1099 tax forms, you must ensure they’re complete and accurate.

If you work for a platform that pays you via Stripe and want to learn about your 1099 forms and how to get them, see 1099 tax forms on the Stripe Support site.

Obtain “Ready” status

Stripe categorizes your tax forms as follows:

Obtain a Ready status before filing your tax forms.

Forms in Needs attention status may be missing the name, taxpayer identification number (TIN), or part of the address. You can provide missing information by updating the connected accounts or updating the tax form.

Forms in Will not file status are below either the IRS or State thresholds the IRS threshold and won’t be filed. You can file tax forms that are below the threshold or are incomplete by specifying filing requirements in a CSV import. You can also use filing requirements to omit a tax form from filing.

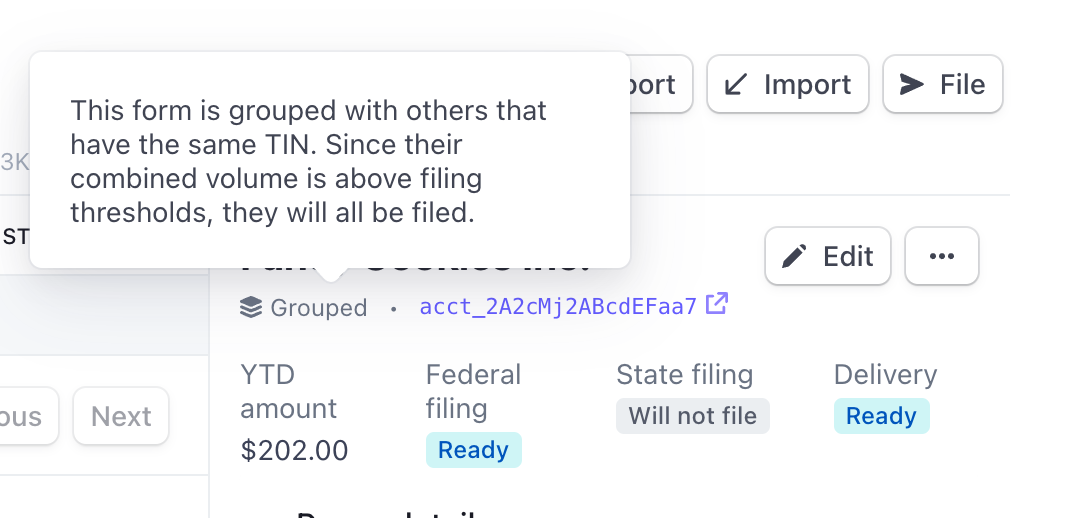

Aggregating totals for forms that use the same TIN

Some forms with totals that might seem below the federal threshold can also show up as Ready or Needs Attention because totals for forms that have the same TIN get aggregated together when it comes to determining filing eligibility, and each of the forms (even the ones in the group that are individually lower than the threshold) get filed separately.

If an account is grouped, you will see this in the Dashboard:

To determine which forms share the same TIN, export your forms as CSV. Include the full TIN in the export and then sort by the CSV file by TIN.

Confirm tax form settings

Confirm the accuracy of your payer information and tax form settings before filing. You’ll reconfirm some tax form settings in the filing process, but you should also confirm the tax form settings before filing.

File your tax forms

When you’re ready to file, perform one final check of the forms that are in Ready status. All forms marked Ready (or Ready! if you applied filing requirements) are automatically filed when you complete the filing process.

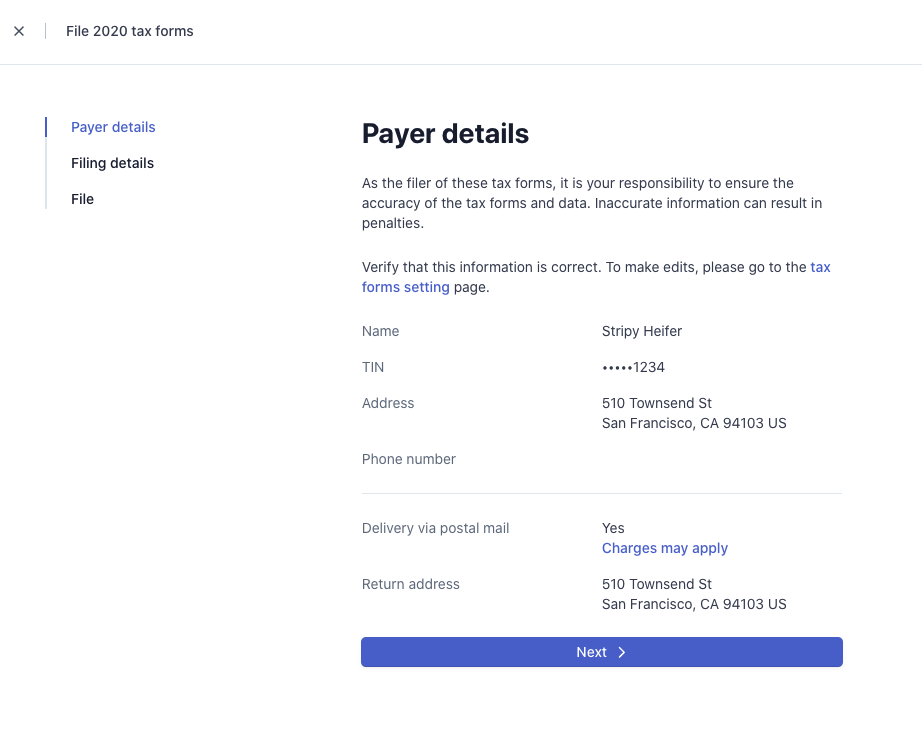

From the Tax forms view in the Dashboard, click the File button, then File with IRS to begin the filing process.

You first confirm your payer information. To change any payer information, close the filing process and go to your tax form settings. If you file forms with incorrect payer information, the IRS requires you to mail a letter with the corrections.

Next, confirm the settings for specific tax form types. To change the settings, close the filing process and go to your tax form settings.

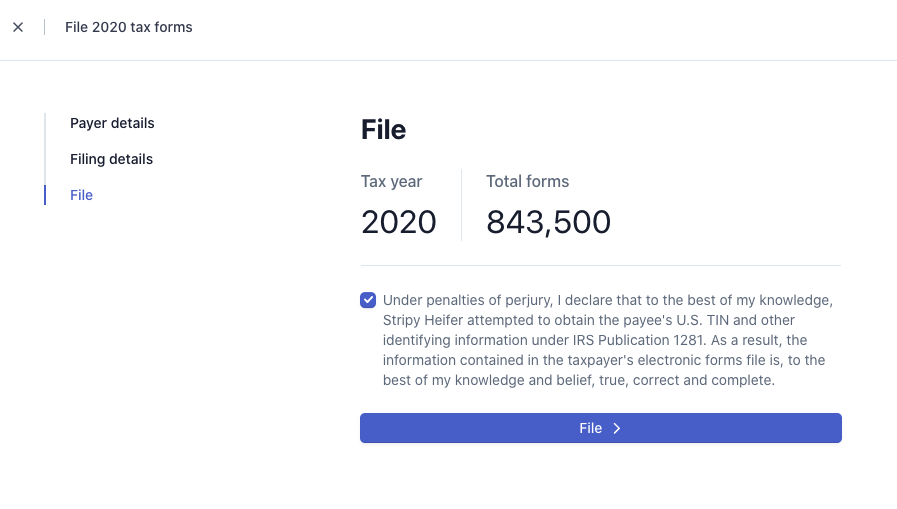

Finally, accept a standard IRS penalty of perjury statement. Click the File button to queue your tax forms for automatic filing with the IRS.

Deliver your tax forms

If you chose the postal delivery option for your tax forms, they’ll be mailed automatically as part of the filing process. For information, see Deliver tax forms.