Introduction

Revenue is a key indicator of the growth trajectory of a business. For investors, bankers, and internal leaders, revenue is indispensable intel that illustrates a company’s current standing and future outlook. If you recognize and record your revenue according to best practices, your business will be more likely to compete and succeed in the market.

This guide is for business leaders who need to understand how to comply with global accounting principles and regulations as they scale their companies. These revenue recognition practices are often required for businesses that intend to fundraise or have set their sights on getting a loan. They’re also essential for every business looking to make strategic business decisions with accurate revenue insights.

You’ll learn the difference between cash and accrual accounting, the regulations and guidelines for revenue recognition, and how to approach the process based on your unique business model. We’ll also explain how Stripe’s built-in revenue recognition tool can help you streamline and automate your accounting practices.

Common revenue recognition terms

-

Accounting practices:

Small business: According to the US Internal Revenue Service (IRS), a small business is any company that has average annual gross receipts of below $25 million for the three-year period before the current tax year.

Cash accounting: An accounting approach that records revenue and expenses when cash is exchanged. It’s often used by small businesses with no inventory.

Accrual accounting: An accounting approach that counts revenue and expenses when they are earned or billed, rather than when payment is received.

Matching principle: The practice of recording expenses during the same period when the related revenues are earned. This accounting concept yields a more accurate picture of a company’s performance and is a defining characteristic of accrual accounting (see above).

Revenue recognition: A generally accepted accounting principle (GAAP) that dictates when and how businesses “recognize” or record revenue in their books.

-

International compliance:

International Accounting Standards Board (IASB): A board of independent experts who set the accounting standards for publicly listed companies in 144 countries. It recommends procedures used in nearly every major market, though some countries such as the US, India, and China don’t necessarily follow them.

International Financial Reporting Standards (IFRS): A set of standards and principles developed by the IASB to create consistency across markets, economies, industries, and businesses. They are less specific than the US equivalent (GAAP).

IFRS 15: The shared international guidelines developed by the IASB to create a cohesive revenue recognition process to strengthen comparability across markets, industries, and business models.

-

US compliance:

Financial Accounting Standards Board (FASB): The non-profit organization that sets and maintains shared accounting rules (GAAP) in the US for both for-profit companies and non-profit organizations.

Generally accepted accounting principles (GAAP): A group of standard accounting rules required by the Financial Accounting Standards Board (FASB) for businesses that do not meet the IRS definition of a small business within the US.

ASC 606: The US guidelines developed by the FASB to create a cohesive revenue recognition process to strengthen comparability across markets, industries and business models.

-

Revenue recognition:

5-Step Revenue Recognition Model: The formal, five-step process for recognizing revenue as outlined in ASC 606 and IFRS 15.

Performance obligation: A “distinct” product or service that the seller has agreed to deliver as part of its commercial contract.

Transaction price: The amount of a performance obligation, including discounts and the rights of the consumer, particularly for returns and refunds.

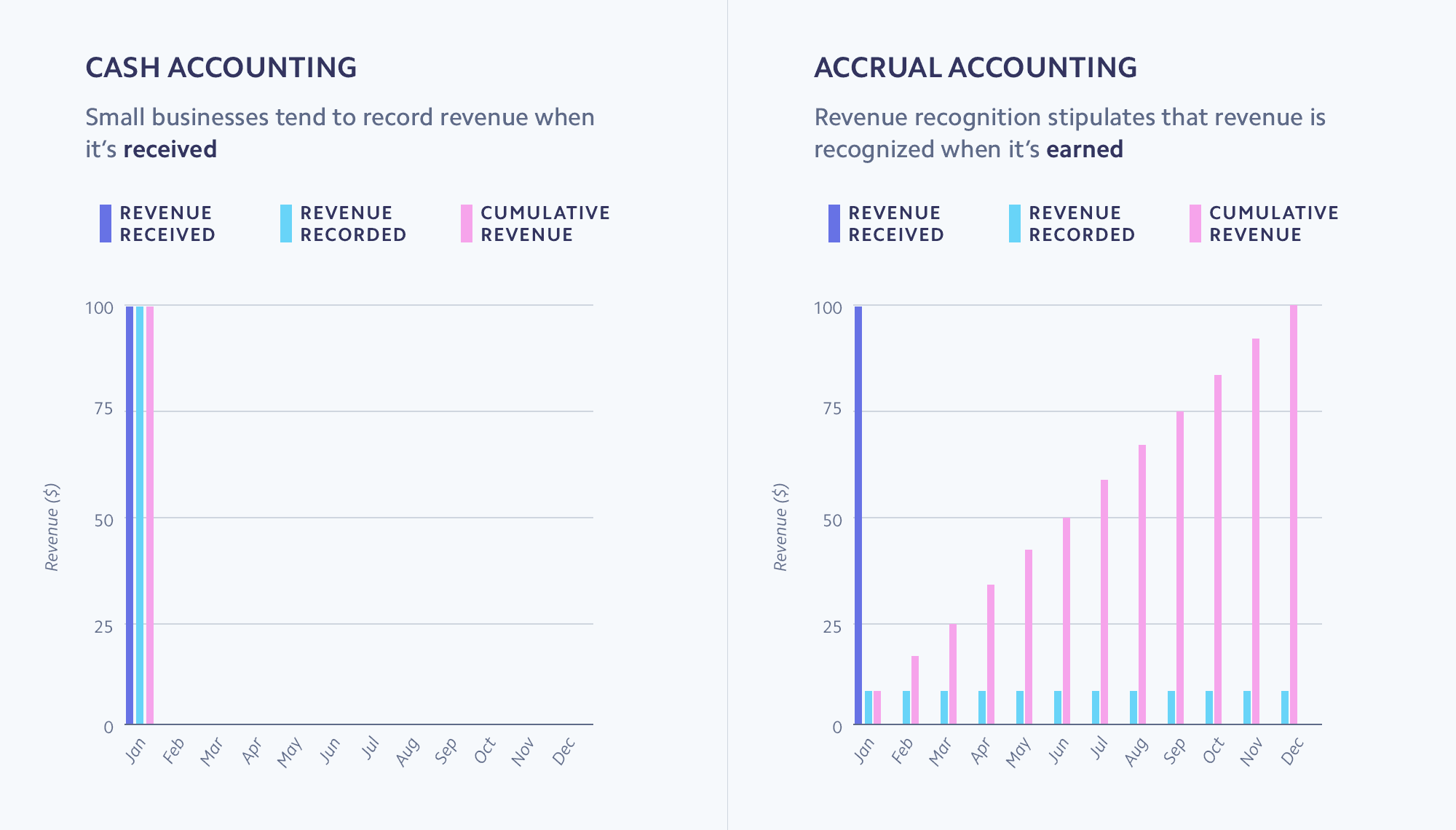

The difference between cash and accrual accounting

There are two primary ways to manage finances and estimate tax liability: cash accounting and accrual accounting. Depending on the kind of business you manage and the size of your operations, one method may work better than the other.

In the US, the IRS requires that businesses with more than $25 million in revenue¹ and publicly traded companies work on an accrual accounting basis. This method also adheres to the International Financial Reporting Standards (IFRS), which outline accounting standards around the globe. Investors also want to see earning statements that comply with accrual accounting to ensure an accurate view into performance. This approach ensures consistency over time and the ability to compare different businesses.

Although cash accounting is popular among sole proprietors and small businesses without inventory, accrual accounting is the standard for the vast majority of companies, particularly those with recurring revenue, large inventories, or multiple fulfillments.

Cash accounting

Small businesses often opt for cash accounting because it’s intuitive and simple. Cash accounting records revenue the moment it hits the company’s bank account and records expenses the moment that they’re paid out. In other words, exchanging payment marks the transaction in a company’s books.

That means if you’re an ecommerce retail store, and you bought $10,000 in clothing from a designer in December 2021, you count the expense on that date. If you sell the clothing at a markup for $20,000 to customers—and their payments hit your bank account on January 1, 2022—you count that revenue for the following year. You enter the revenue into your books on January 1, even if the clothing hasn’t been delivered to the customers yet. When delivery occurs, you don’t record any additional revenue because it’s already been accounted for. Although cash accounting is the most straightforward way to manage your books, there also aren’t clear, consistent guidelines that businesses can follow. It also means that expenses and their corresponding revenue don’t often match up within the same time period.

With cash accounting, it’s also easy to see a snapshot of your company’s cash flow at any moment. There’s no complicated math, and you sometimes benefit from a slight deferral of taxes given that you record expenses when you pay them but don’t register revenue until it’s received from the client or customer. Overall, cash accounting is most relevant for small businesses with no inventory or recurring revenue.

Accrual accounting

Accrual accounting differs from cash accounting because it counts revenue and expenses when they are earned or billed, rather than when the money hits a bank account. For example, you’ll record a sale when your performance obligation to a customer is complete, instead of when the customer pays.

Let’s say that you work in publishing and offer monthly magazine subscriptions. The customer paid an invoice upfront in December 2021 for the entire year of magazines. With accrual accounting, you would recognize the revenue in installments as each of the twelve magazines is delivered.

Accrual accounting helps businesses gain a clearer understanding of their overall performance. The matching principle is a key concept of accrual accounting and stipulates that it’s more accurate to report related expenses and revenues within the same time period. The matching principle is particularly important for inventory-heavy businesses that require significant expenses to generate revenue and for businesses with a subscription revenue model.

In the case of the latter, SaaS companies that use cash accounting are mismatching their revenue and expenses. Let’s say you’re a SaaS company that charges customers monthly. Typically, billing occurs the month before the services are provided. By leveraging accrual accounting, you ensure that you’re matching the revenue earned in December 2021 with the services provided for that month. Your financial statements will more accurately reflect profit and loss.

At scale, the accounting method you choose can have a tremendous effect on the future of your company. Although cash accounting gives you a sense of cash flow, it doesn’t give you the insights you need to make big-picture business decisions the way that accrual accounting does.

Businesses that use accrual accounting will also want to keep their eyes on bank accounts to ensure that their business has more than enough liquid assets to cover costs. Sometimes, companies can look profitable in the long run with accrual accounting even though they face short-term cash shortages.

| Cash Accounting | Accrual Accounting |

| Who it’s for | Appropriate for small, service-based businesses and sole proprietors |

Best for businesses with recurring revenue, large inventories, or multiple fulfillments

Required in the US for companies with more than $25 million in revenue |

| How it works | Records revenue and expenses at the moment cash is exchanged | Records revenue and expenses when the performance obligation is complete |

| Tax implications | Taxes are only paid on cash the business has received | Taxes are paid on all sales, including cash not yet received |

| Business benefits | Simple practices and transparency into day-to-day cash flow | More accurate profit and loss statements, clearer view into performance, and compliance with regulations |

Everything you need to know about revenue recognition

Revenue recognition is an aspect of accrual accounting that stipulates when and how businesses “recognize” or record their revenue. The principle requires that businesses recognize revenue when it’s earned (accrual accounting) rather than when payment is received (cash accounting). Businesses adhere to this shared accounting practice because it provides transparency and predictability into accounting practices, enabling them to fairly assess revenue and report on it to stakeholders, shareholders, and governing bodies.

Regulating bodies have significant oversight into how businesses manage their accounting to ensure that everyone adheres to the same guidelines in reporting their profits and losses. Revenue recognition is a generally accepted accounting principle (GAAP) or standard practice required by the Financial Accounting Standards Board (FASB) within the US. In 2014, the FASB partnered with the International Accounting Standards Board (IASB), which sets the accounting standards for publicly listed companies in 144 countries, to develop shared regulation. (Through the IFRS, the IASB mandates procedures in every major capital market with the exception of the United States, India, and China. India has their own separate standard, which overlaps with but doesn’t adhere to every aspect of the IFRS.)

In the past, global accounting policies were industry specific, which created disjointed and fragmented revenue recognition standards that were challenging to implement. It made it difficult to fairly compare the performance and standing of companies across industries. Together, the FASB and IASB created joint regulations called ASC 606 (in the US) and IFRS 15 (internationally), which set a new, shared framework for recognizing revenue across industries and business models. It’s relevant for private, public, and non-profit organizations that enter into contracts with customers to exchange goods and services. Even non-profits that need to account for grants, government contracts or recurring donations benefit from following accrual accounting.

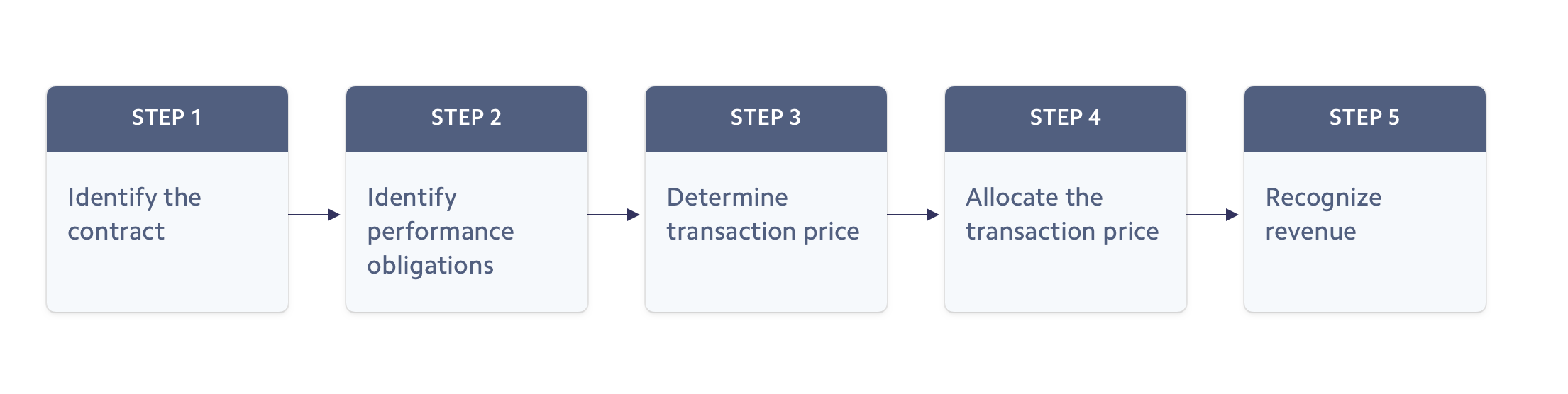

5-step revenue recognition model

1. Identify the contract or contracts with the customer

To recognize revenue, you must begin by identifying the contract or contracts with the customer. Not all contracts need to be formal and signed to complete this step in the revenue recognition process. Verbal agreements and stated terms and conditions of your service or product can be considered a contract.

There are some key requirements for every contract. It has to be a commercial agreement between two parties where the payment terms, rights, and obligations are clearly stated. A contract can be a formal written agreement, as is often the case with service-based businesses, or a receipt for a point-of-sale purchase at a retail store. With online purchases, terms of service are often embedded within invoices or subscription details, forming a contract.

2. Identify the contract’s specific performance obligations

Before you record revenue, you need to make sure that there’s clarity on your obligations to the customer. The term “performance obligation” refers to a “distinct” product or service that the seller has agreed to deliver.

A “distinct” product or service is usually its own line item on a receipt or an invoice. In the example of a bakery, a specific performance obligation could be the verbal agreement to hand over one pastry in exchange for a set price, rather than the entire order. For an insurance broker, a distinct performance obligation could be one insurance policy for a single house.

It’s not always that simple, though. A customer must be able to benefit from the product or service separately from the other products or services in the contract. Let’s say that you’re selling a vacuum to a customer. You also sell them an additional warranty for the vacuum, which is its own line item on the receipt. If the warranty can’t be purchased without the vacuum, it isn’t its own “performance obligation.”

3. Determine the transaction price

In addition to the money you’re exchanging with a customer for a good or service, there are also other considerations included in the “transaction price.” It can include the right to return or potential discounts. These terms should always be transparent, especially if there’s been a change from past precedent.

If you offer a discount on ecommerce purchases for your semi-annual sale, that discount is included in the transaction price, as is the right to return or to cancel the contract. For example, if a department store has a clearance sale, the transaction price might cover the following: The customer buys a dress that’s normally $100, but it’s 75% off at a cost of $25 with no returns or refunds.

Typically, people think of refunds in association with physical goods, but defining those terms are just as important in any service or SaaS company. What if people aren’t satisfied with the service? They will want to know what their rights are.

4. Allocate the transaction price to distinct performance obligations

Every business needs to determine the specific selling price connected to each individual performance obligation. Allocating the transaction price is straightforward when there’s a stand-alone selling price for each product or service. When there are variable considerations, including discounts, incentives, and rebates, estimate the price based on the expected value.

5. Recognize revenue when you’ve fulfilled each performance obligation

Until your performance obligation is complete, no revenue should be recognized. If your customer has paid you up-front for services not yet completed or goods still in your care, consider the amount “deferred revenue.” Once you’ve transferred control of the good or service to your customer, then you can record the amount as revenue.

For subscription businesses, the performance obligation may be satisfied over a period of time. In that case, you can recognize the revenue evenly throughout the service period. Similarly, there are business models when a service is completed over time but can be measured in other ways: external milestones met, percentage of production completed, costs, or labor hours.

Common types of revenue recognition

Depending on your business model, there are different methods and timing for fulfilling a performance obligation and accounting for revenue.

SaaS and digital subscriptions

For SaaS businesses like Netflix or digital subscription businesses like Slack, a customer signs up for a service or product for a specific period of time and derives value from it throughout the service period. In these simple subscription models, businesses recognize revenue linearly across the service period.

Accounting for upgrades, downgrades, prorations, and cancellations is a critical part of revenue recognition for subscription businesses. If a customer upgrades plans midway through a month, the revenue recognized in that particular month should reflect the different subscription plans used. Let’s say the basic plan costs $30 a month and the premium plan costs $45 a month. If the customer used the basic plan for 20 days (representing $20 in value) and then upgraded to the premium plan for 10 days (representing $15 in value), the business would recognize $35 in revenue for that month.

Subscriptions with fulfillment obligations

As subscription businesses grow, more and more are building hybrid business models.

For example, a snack box subscription company may charge a monthly subscription fee to ship a snack box each week. Instead of linearly recognizing revenue over the month, the subscription revenue would be proportionately recognized depending on when the performance obligation is fulfilled–in this case, when the snack boxes are shipped or delivered.

A similar approach would be used by software companies that charge a one-time setup fee or a consulting fee in addition to a monthly recurring subscription fee. These businesses have to assess whether the setup or consulting fees should be considered separate from or part of the overall performance obligation.

Ecommerce with future fulfillments

For ecommerce businesses, payment is often received before the goods are delivered, but revenue isn’t recognized until control transfers. Depending on its contractual arrangement with customers, a company may determine that control transfers at shipment or delivery, at which point the cash already received would be recognized. While ASC 606 and IFRS 15 recommend using the moment the product is shipped as the trigger for recognizing revenue, the prior rule ASC 605 recommends recognizing revenue upon delivery.

Installments

Many companies accept payment in installments to attract customers who might not want to pay the full price upfront. According to ASC 606, although payment might not be collected until later, revenue is earned when the service or product is provided. Businesses offering installment payment options may recognize revenue before all of the cash is received.

As “buy now, pay later” options become more popular in ecommerce, it’s even more common for businesses to record revenue before it hits their bank accounts. In accordance with accrual accounting, installment businesses add the revenue to their books when they ship or deliver products rather than when customers have paid.

Metered billing

Rather than charging a flat fee, some businesses bill on a metered basis, tying the price customers pay to the amount customers use.

In the case of pre-paid metered billing businesses, customers pay before the service or good is provided. For example, a business might allow customers to purchase credits to be used for different exercise classes. In this case, the business would record revenue as the customer uses each credit.

Post-paid metered billing is similar to pre-paid metered billing except that companies bill in arrears. For example, an enterprise cloud provider might charge its customers at the end of each month. As the customer uses gigabytes of storage over the course of a given month, the business proportionally recognizes revenue according to the customer’s usage. When an invoice is sent at the end of the month, the cloud storage has already been provided, and all revenue should have been recognized.

Digital goods

For a few businesses, goods or services are fulfilled immediately. For example, digital goods such as e-books, music, and movies are typically downloadable assets, and the corresponding revenue is recognized as soon as they’re downloaded.

Digital goods businesses differ from software subscription services and streaming services based on some key criteria defined by the Financial Accounting Standards Board (FASB):

- The customer can take possession of the software during the hosting period without extra fees beyond the cost of the product.

- The customer can use the software on their own hardware or through a third-party unrelated to the software company.

How Stripe can help

The more you grow, the more challenging it is to manage revenue recognition with accuracy and efficiency. Scaling manual processes is error-prone and inefficient, wasting time, energy, and resources. Stripe Revenue Recognition takes the hassle out of accrual accounting, freeing your team to close the books quickly, correctly, and compliantly. For a complete picture of your revenue, easily access and assess transactions, fulfillment data, and billing terms from inside and outside of Stripe with one reporting tool.

We can help you:

Assess all your revenue

With Stripe, see all your revenue across every revenue stream or business model. Consolidate all of your native Stripe revenue, including subscriptions, invoices, and payment transactions, as well as non-Stripe revenue, fulfillment schedules, and service terms into the same easy-to-use tool.

Automate reports and dashboards

Skip the tedious engineering integrations with out-of-the-box accounting reports. Your team can automatically create and download reports that set up internal and external auditors for a seamless revenue recognition process.

Customize for your business

Configure custom rules to fit your specific accounting practices. With Revenue Recognition, you can exclude passthrough fees, manage tax line items, and adjust recognition schedules for different types of revenue.

Audit in real time

Simplify internal audits and prepare for external auditors by tracing recognized and deferred revenue numbers to their underlying customers and corresponding transactions. Review detailed monthly breakdowns and get granular views into how revenue was categorized.

For more information about Stripe Revenue Recognition, visit our site.

Back to guides¹ The IRS requires any company that does not meet the definition of a small business to use accrual accounting. According to their definition, a small business has average annual gross receipts of below $25 million for the three-year period before the current tax year.