Introduction

As online tools make it easier to connect with global customers, more and more businesses are selling overseas. In fact, a Stripe study found that 70% of online businesses are selling internationally today. While it’s easier than ever to reach a global audience, online businesses are also faced with a new challenge: How do you address the diverse customer preferences of a global audience during the checkout experience? The way customers prefer to pay for goods or services online varies drastically based on where they are located. If you don’t create a relevant, familiar payment experience, you could cut off entire countries from your addressable market.

While the global payments landscape has become increasingly complex and fragmented, Stripe makes it easy for any type of business anywhere in the world to discover and accept popular payment methods with a single integration.

This guide helps you evaluate and identify the payment methods that are well-suited to your business model and customer preferences and offers an in-depth look at the payment methods Stripe supports.

The benefits of payment methods

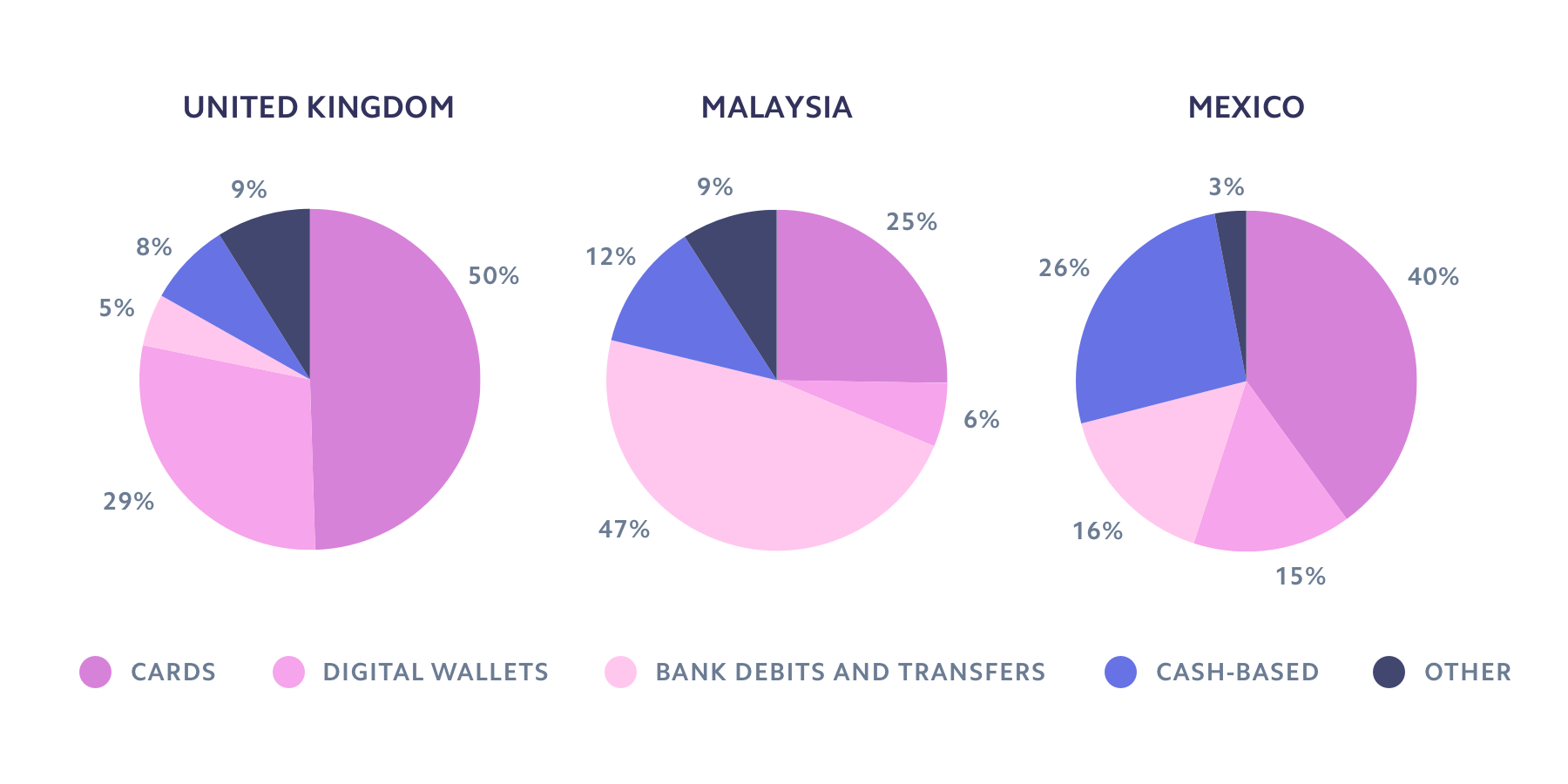

Over the past decade, payment methods have evolved to support different consumer and business needs. Markets with high card penetration, such as the US and the UK, have seen a significant shift towards wallets like Apple Pay and Google Pay, which offer more security and convenience. Some markets, such as France and Japan, even have their own local card networks that help businesses reach more card users. In markets like Germany and Malaysia, where card use is much lower, bank-based methods are strongly preferred and trusted for online purchases. The banking networks in these markets typically offer a faster and more secure checkout experience where users can authorize a payment using their online banking credentials. Meanwhile, in economies with a large unbanked population, such as Mexico and Indonesia, popular payment methods allow customers to pay for online goods with cash using vouchers.

These graphs show how payment method preferences vary across countries

By accepting payment methods that are both preferred by your customers and relevant for your business model, you can:

-

Reach more customers globally: As you expand into new regions, accepting local payment methods may be necessary to capture the total market opportunity. For example, 54% of online transactions in China involve wallets such as Alipay or WeChat Pay, and 20% with the local card network China Union Pay. Without supporting these payment methods, you may risk missing out on the substantial and growing buying power of Chinese consumers.

-

Increase conversion: Up to 16% of shoppers abandon their cart if their preferred payment option isn’t available. Surfacing the right mix of payment options to customers can meaningfully increase the chances that they’ll successfully complete a purchase.

-

Reduce fraud and disputes: Anticipate and manage the risks associated with accepting online payments by choosing payment methods that match your risk preferences. As a general rule, the better the level of customer authentication, the lower the likelihood of fraudulent and disputed payments.

-

Optimize your transaction costs: Payment methods have inherently different cost structures. Depending on your business model and where your customers are located, certain payment methods may or may not be relevant.

Choosing the right payment methods for your business

Whether you want to improve conversion in your domestic market or expand globally, surfacing relevant payment methods to your customers is key. But, depending on the nature of your transactions and where your customers are located, certain payment methods may or may not be relevant.

This section covers the seven major payment method families and specific considerations based on your business model: e-commerce and marketplaces, on-demand services, SaaS and subscription businesses, or professional services. If you are a B2B platform that enables your users to accept payments, your relevant payment methods depend on the business model of your users (for example, if your users have a SaaS business model, refer to the SaaS and subscription businesses section).

| Description | Supports recurring payments | Supports refunds | Supports disputes | Payment confirmation | |

|---|---|---|---|---|---|

| Cards | Cards are linked to a debit or credit account at a bank. To complete a payment online, customers enter their card information at checkout. | Yes | Yes | Yes, highest dispute rate | Immediate |

| Wallets | Wallets are linked to a card or bank account, but can also store monetary value. Wallets typically require customer verification (e.g., biometrics, SMS, passcode) to complete a payment. | Yes | Yes | Yes, lower dispute rate than cards | Immediate |

| Bank debits | Bank debits pull funds directly from your customer’s bank account. Customers provide their bank account information and typically agree to a mandate for you to debit their account. | Yes | Yes | Yes, lowest dispute rate | Delayed |

| Bank redirects | Bank redirects add a layer of verification to complete a bank debit payment. Instead of entering their bank account information, customers are redirected to provide their online banking credentials to authorize the payment. | No, but Stripe supports recurring for some methods by converting to direct debit | Yes | No | Immediate |

| Bank transfers | Credit transfers allow customers to push funds from their bank account to yours. You provide customers with the bank account information they should send funds to. | No | Yes | No | Delayed |

| Buy now, pay later | Buy now, pay later is a growing category of payment methods that offers customers immediate financing for online payments, typically repaid in fixed installments over time. | No | Yes | Yes, most methods will take on fraud risk | Delayed |

| Cash-based vouchers | With cash-based vouchers, customers receive a scannable voucher with a transaction reference number that they can then bring to an ATM, bank, convenience store, or supermarket to complete the payment in cash. | No | No | No | Delayed |

For e-commerce and marketplaces

Recommended: Cards, wallets, bank redirects, “buy now, pay later”

While frictionless checkout experiences are vital for any business model, its importance is magnified for e-commerce and marketplaces. Customers expect streamlined payment experiences—ones that give them what they want, when they want it. The right set of payment methods not only offers payment flexibility and convenience to maximize conversion, but also reduces fraud and increases transaction speed.

Cards are the most commonly used payment method and it’s important that you support all relevant card brands to optimize conversion and costs. Wallets and bank redirects can also help increase conversion by allowing customers to use stored payment information (the added verification also lowers the possibility of disputes). Wallets, like cards, are a reusable payment method—customers provide their payment details once and if that information is stored, they don’t need to share any additional information for future payments. This enables you to offer one-click checkout experiences. If you sell high-value goods, consider “buy now, pay later” payment options, which allow your customers to customize their payment terms and break up purchases into smaller installments.

In many large markets with low card use, such as Brazil, Mexico, and Indonesia, customers prefer to pay with cash-based vouchers and bank credit transfers, which don’t support immediate payment confirmation or native refunds. This can create challenges for e-commerce businesses that typically rely on real-time payment notifications to manage their shipping flows or refunds to promote customer loyalty. Stripe can help global businesses cater to these customers by enabling automated refund experiences and faster notifications for payment types that don’t typically support these features.

For on-demand services

Recommended: Cards, wallets

With instant fulfillment at the heart of the customer experience, on-demand services need to encourage conversion—often on mobile—while managing fraud risk. Consider focusing on payment methods that offer immediate confirmation that the transaction was successful, such as cards and wallets. These payment options also allow you to store customer payment details on file and enable one-tap confirmations, shortening the checkout experience. While wallets typically have the same transaction cost as cards, they are more secure since authentication is required to complete payment, lowering fraud and dispute rates.

It’s still important to consider the local context as payment methods with more friction may be trusted and preferred to pay for on-demand services or add top-ups to customers’ app balance.

For SaaS and subscription businesses

Recommended: Cards, wallets, bank debits

If you manage recurring revenue and want to optimize your checkout experience for ongoing transactions, it’s important to consider whether or not payment details can be stored on file and reused. The ability to reuse a customer’s payment credentials allows you to initiate payments on a custom schedule, without requiring any action by your customers. Cards, wallet, and bank debit payments are all reusable—customers only need to provide their card number or bank account details once. And, for customers who prefer to use bank redirects such as iDEAL, Sofort, or Bancontact, Stripe makes it possible to use these methods for recurring payments by converting them into direct debits.

In addition, many SaaS and subscription companies face involuntary churn issues, where customers intend to pay for a product but their payment attempt fails due to expired cards, insufficient funds, or outdated card details. In fact, 9% of subscription invoices fail on the first charge attempt due to involuntary churn. Stripe Billing can help manage recurring declines for cards, in addition to supporting many of the most relevant payment methods for increasing recurring payment conversion (for example, because bank account information doesn’t expire, accepting bank debits can increase retention).

While accepting reusable payment methods is beneficial to the business, it’s also important to consider local expectations regarding recurring billing. For example, in markets like Brazil and Indonesia, it’s common to send recurring invoices or reminders for customers to initiate each payment. (Stripe Billing makes it easy to accommodate both recurring charges and invoicing.)

For professional services

Recommended: Cards, bank debits, bank transfers

If you offer professional services or wholesale products, even a single payment failure or dispute could result in significant revenue loss. The ability to securely and successfully accept large payments can protect your business and can be solved, in part, by invoicing your customers so they have more flexibility to initiate payment when funds are available. Historically this has often meant asking customers to send checks. You can also send a hosted invoice with built-in support for cards and bank methods to minimize payment failure and automate payment tracking and reconciliation.

In addition, bank transfers are a secure, non-disputable payment option that is often preferred for very large payments. Bank transfer funds are deposited directly into your account once the payment has been confirmed. Bank transfers also require your customers to initiate the payment, adding an extra level of authentication and security. And, because contracts are typically in place before payment, it’s less important that your business initiates the payment and more important that payments don’t fail and can’t be disputed. While tracking and reconciliation for bank transfers can be difficult, Stripe generates virtual bank account numbers to keep your company’s banking details private and automatically reconcile incoming payments with outstanding invoices.

This table summarizes relevant payment methods supported on Stripe by business model

How Stripe can help

Companies of all sizes and from around the world use Stripe to accept multiple payment methods and simplify global operations. Stripe is actively adding new payment methods with the goal of enabling businesses to accept any payment method in the world with a single integration. Stripe offers:

Seamless integration options for all business models: The entire Stripe product suite comes with built-in global payment support, so you can create localized payment experiences regardless of your business model. Stripe’s Payments API makes it easy to support multiple payment methods through a single integration. This leaves you with a unified and elegant integration that involves minimal development time and remains easy to maintain, regardless of which payment methods you choose to implement.

Supporting a localized and compliant payments experience for global customers is even easier with Stripe Checkout and Payment Element. With either option, you can add payment methods right from the Stripe Dashboard without any additional integration work and rely on Stripe to dynamically display the right payment methods and language based on IP, browser locale, cookies, and other signals. Checkout is also able to trigger 3D Secure and can handle European SCA requirements by dynamically applying card authentication when required by the cardholder’s bank.

Recurring revenue businesses can use Stripe Billing to manage subscription logic and invoices, and give customers the ability to pay their invoices with bank debits or other preferred payment methods. Platforms and marketplaces can use Stripe Connect to accept money and pay out to third parties. Your sellers or service providers benefit from the same streamlined Stripe onboarding and get instant access to select payment methods.

Simple payment method setup: Stripe allows you to quickly add and scale global payment method support without filling out multiple forms with the same information or following one-off onboarding processes. You can also enable certain international payment methods without having to set up a local entity, bank account, or Stripe account.

Expanded payment method capabilities: Stripe can fill in certain gaps in payment method capabilities and expand their supported use cases. For example, bank redirects such as iDEAL, Sofort, or Bancontact don’t normally support recurring payments. However, Stripe converts these payment methods into direct debits so customers can use them to pay for subscription services.

Unified monitoring and reporting: Payments made with any payment method appear in the Stripe Dashboard, reducing operational complexity and allowing for lightweight financial reconciliation. This enables you to develop standardized processes for typical operations such as fulfillment, customer support, and refunds. And, because Stripe abstracts away the complexity of dealing with each payment method provider, you also benefit from one single point of escalation and accountability on disputes or other exceptions that may arise when dealing with diverse payment methods.

For more information on supporting payment methods with Stripe, read our docs or contact our sales team. To start accepting payments right away, sign up for an account.

Payment methods fact sheets

Based on your customer’s geography and your business model, identify relevant payment methods to integrate by reviewing the profiles of Stripe-supported payment options below. You can also see which payment methods are available for your account by visiting the Dashboard.

ACH credit transfers

Credit transfers on the Automated Clearing House (ACH) network enable customers to send funds from their bank account to a US-domiciled bank account. In 2019, the ACH network moved 24.7 billion electronic payments, making it one of the largest, safest, and most reliable payment systems.

To collect a payment via ACH credit transfer, you must provide a routing and account number to your customers, who then initiate the payment from their bank account. Funds can take a few days to arrive, however some financial institutions process same-day ACH credit transfers, allowing for accelerated movement of funds.

Start accepting ACH credit transfers- Payment method type

- Bank credit transfer

- Relevant payer geography

- US

- Relevant business model

- Professional services

- Presentment currency

- USD

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- 2-3 business days

ACH debits

Direct debit payments on the Automated Clearing House (ACH) network, or ACH debits, allow you to collect funds from your customers’ US bank accounts. The ACH network processed more than 14 billion debit transactions in 2019.

Your customers must provide their bank account details and give you permission to debit their account. Confirmation for ACH debit payments can take up to five business days.

ACH debits can fail or can be disputed by customers after the payment is initially completed. These risks can be mitigated by verifying account ownership through login credentials or micro-deposits.

Start accepting ACH debits- Payment method type

- Bank debit

- Relevant payer geography

- US

- Relevant business model

- SaaS and subscription businesses, professional services

- Presentment currency

- USD

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 5 business days

Affirm

Affirm has a network of more than six million shoppers in the US. Customers can choose from one of two options for payment: Split Pay and Installments. Businesses offering Affirm receive the full payment upfront and are protected against fraud and customer payment risk.

Affirm Split Pay allows customers to make an online purchase and spread the cost over four interest-free installments.

Affirm Installments offers customers up to 36 months of credit. To receive financing, they complete a one-time application. If approved, customers make their monthly payments to Affirm online or in the mobile app.

Contact us about adding Affirm to your Stripe integration- Payment method type

- Buy now, pay later

- Relevant payer geography

- United States

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- USD

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Afterpay / Clearpay

Afterpay (also known as Clearpay in the UK) offers customers more payment flexibility with no credit checks, no upfront fees, and no interest for on-time payments. Afterpay has more than 13M global customers and works with 75,000 brands and retailers.

Afterpay allows customers to get what they want today and pay for purchases over time. During checkout, customers choose Afterpay as their payment method and spread the cost across 4 interest-free payments over the next 6 weeks, with the first payment due at time of purchase. Afterpay is free for customers who pay on time.

Businesses offering Afterpay receive the full payment upfront and are protected against fraud and customer payment risk.

Start accepting Afterpay- Payment method type

- Buy now, pay later

- Relevant payer geography

- Australia, Canada, France, Italy, New Zealand, Spain, United Kingdom, United States

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- AUD, CAD, EUR, GBP, NZD, USD

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Alipay

Alipay is a popular wallet in China, operated by Ant Financial Services Group, a financial services provider affiliated with Alibaba. Launched in 2004, Alipay currently has more than one billion active users worldwide.

Alipay wallet holders can pay on the web or on mobile using their login credentials or their Alipay app. Funds are drawn from the customer’s bank, card, or prepaid Alipay account and because payments are authenticated with the customer’s login credentials, dispute rates are very low.

Start accepting Alipay- Payment method type

- Wallet

- Relevant payer geography

- All geographies with Chinese consumers

- Relevant business model

- E-commerce and marketplaces, on-demand services

- Presentment currency

- AUD, CAD, CNY, EUR, GBP, HKD, JPY, MYR, NZD, USD

- Recurring payments

- Supported through Stripe if approved

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Apple Pay

Apple Pay is a wallet that allows customers to pay using payment details stored on their iPhone, iPad, or Apple Watch.

To make a payment online, customers select Apple Pay as the payment method and authorize the transaction via Face ID, Touch ID, or a passcode. This two-factor authentication makes transactions more secure and often results in fewer disputes compared to other payment methods.

In addition to payment information, customers can also store their billing and shipping address, email, and phone number.

Start accepting Apple Pay- Payment method type

- Wallet

- Relevant customer geography

- Where Apple Pay is supported

- Relevant business model

- E-commerce and marketplaces, on-demand services

- Presentment currency

- 135+

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- Immediate

Bacs Direct Debit

Bacs Direct Debits is a bank transfer payment method that accounts for 14% of the market share in the United Kingdom. It is also the most popular method for sending and receiving recurring payments.

You are required to get explicit approval from customers in order to debit their account. Customers may cancel this approval at any time with their bank and can reclaim payments indefinitely via Bacs’ evergreen dispute policy.

Payments via Bacs’ Direct Debit take three working days to clear and are always presented in GBP. Funds can only be taken from UK domiciled GBP bank accounts.

Start accepting Bacs Direct Debit- Payment method type

- Bank debit

- Relevant payer geography

- UK

- Relevant business model

- SaaS and subscription services, professional services

- Presentment currency

- GBP

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 3 business days

Customer-facing flow

Selects Bacs Direct Debit at checkout

Provides bank details and authorizes mandate

Receives notification of upcoming payment

Bancontact

Bancontact, founded in 1979 and formerly known as Bancontact/Mister Cash, is a bank redirect payment method offered by more than 80% of online businesses in Belgium.

Bancontact payments are authenticated by customers and immediately confirmed to your business. Using their mobile app, customers can identify by scanning a QR code presented at the time of payment. Each transaction is then confirmed with a PIN. Bancontact payment details are single-use, however each transaction allows you to retrieve customers’ bank account details, enabling subsequent payments to be completed via SEPA Direct Debit with the appropriate mandate authorization.

Start accepting Bancontact- Payment method type

- Bank redirect

- Relevant payer geography

- Belgium

- Relevant business model

- E-commerce and marketplaces, SaaS and subscription businesses

- Presentment currency

- EUR

- Recurring payments

- Supported through Stripe via SEPA Direct Debit

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing web flow

Selects Bancontact at checkout

Gets redirected to Bancontact and enters credentials

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

Customer-facing mobile flow

Selects Bancontact at checkout

Gets redirected to Bancontact and scans QR code

Enters pincode

Gets notification that payment is complete

(Optional) Returns back to business’s site

BECS Direct Debit

Bulk Electronic Clearing System (BECS) is an Australia-based payment method administered by the Australian Payments Network for electronic debit and credit payment instructions. It accounted for 19% of non-cash transaction value in Australia in 2018.

During the payment flow, you must collect a mandate: Customers need to provide their bank account details—consisting of the account holder’s name, the Bank-State-Branch (BSB) number, and the bank account number—and accept the service agreement.

It can take up to four business days to receive notification of the success or failure of a payment after you initiate a debit from the customer’s account.

Start accepting BECS Direct Debit- Payment method type

- Bank debit

- Relevant payer geography

- AU

- Relevant business model

- SaaS and subscription services, professional services

- Presentment currency

- AUD

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 3-4 business days

Customer-facing flow

Selects BECS Direct Debit at checkout

Completes the Direct Debit Request

Receives notification of upcoming payment

Boleto

Boleto is a popular Brazilian voucher-based payment method and represents more than 20% of transactions in Brazil. Boleto allows customers to pay for online purchases or services with cash or from their bank.

To complete a transaction, customers receive a voucher stating the amount to pay for services or goods. Customers then complete the payment before its expiration date using one of several different methods, including at authorized agencies or banks, ATMs, or online bank portals. You will receive payment confirmation after 1 business day, while funds will be available for payout 2 business days after payment confirmation.

Boleto doesn’t offer any cancellations and disputes are typically managed directly between you and the customer.

Start accepting Boleto- Payment method type

- Cash-based voucher

- Relevant payer geography

- Brazil

- Relevant business model

- E-commerce and marketplaces

- Professional services

- Presentment currency

- BRL

- Recurring payments

- No

- Refunds

- No

- Disputes

- No

- Payment completion

- 1-2 business days from when customer pays

Cards

Credit and debit cards (Visa, Mastercard, American Express, Discover and Diners, China UnionPay, JCB, Cartes Bancaires, Interac) are a dominant payment method globally, accounting for 41% of online payments.

Credit cards are issued by banks and allow customers to borrow money with a promise to pay it back within a grace period to avoid extra fees. Consumers can accrue a continuing balance of debt, subject to being charged interest on the amount.

Debit cards offer the convenience of card payments but are linked to a bank account, where funds are drawn directly from the linked account at the time of payment.

Visa and Mastercard, the largest card networks in the world, function exclusively as payment processing systems that do not issue cards to consumers directly. Instead, they allow banks and financial institutions to brand and distribute their cards. American Express is also a payment processing system that—unlike Visa and Mastercard—issues its own cards directly to consumers.

Start accepting cards- Payment method type

- Card

- Relevant customer geography

- Global

- Relevant business model

- E-commerce and marketplaces, SaaS and subscription businesses, on-demand services, professional services

- Presentment currency

- 135+

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment confirmation

- Immediate

Customer-facing flow

Selects credit card at checkout

Enters credentials

Gets notification that payment is complete

Click to Pay

Click to Pay, based on the Secure Remote Commerce (SRC) specifications, provides a unified checkout process supporting all participating network brands, including Visa, Mastercard, American Express, and Discover. Customers can add cards from participating networks and enable click-to-pay simply and securely.

To complete a transaction, customers select the Click to Pay checkout option. In some instances, they may be required to confirm their identity. Once they are authenticated, the payment cards enrolled in Click to Pay appear as payment method options. Customers select which card they wish to use and confirm payment and shipping information.

Start accepting Click to Pay- Payment method type

- Wallet

- Relevant payer geography

- Global

- Relevant business model

- E-commerce and marketplaces, on-demand services, SaaS and subscription businesses

- Presentment currency

- 135+

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- Immediate

Customer-facing flow

Selects Click to Pay at checkout

Enters credentials and selects stored card information

Receives notification that payment is complete

EPS

EPS is an Austrian online transfer payment method with approximately 18% market share. It’s accepted by 80% of all online businesses in Austria and was developed jointly by the Austrian banks and government.

At checkout, customers choose EPS, select the name of their bank, and log into their online banking environment. They review the pre-populated payment details and authorize the funds to be credited directly to your business account.

Start accepting EPS- Payment method type

- Bank redirect

- Relevant payer geography

- Austria

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- EUR

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects EPS at checkout

Gets redirected to EPS and chooses bank

Enters account credentials

Completes authorization process (with scanner or SMS)

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

EUR bank transfers

Bank transfers on the Single Euro Payments Area (SEPA) network are payer-initiated payment methods that enable customers to send funds from their bank account to another European-domiciled account. With lower transaction fees, bank transfers are one of the preferred methods for high-value payments, accounting for $4 trillion in B2B transactions in Europe every year.

When accepting SEPA bank transfers with Stripe, businesses provide customers with a virtual bank account number that they can push money to from their own online bank interface. The virtual bank account allows for automated reconciliation and seamless refunds.

Start accepting bank transfers- Payment method type

- Bank transfers

- Relevant payer geography

- Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

- Relevant business model

- B2B SaaS and subscription businesses; high-value and high-volume B2C retailers

- Presentment currency

- EUR

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 3 business days

FPX

Financial Process Exchange (FPX) is a Malaysia-based payment method that allows customers to complete transactions online using their bank credentials. Bank Negara Malaysia (BNM), the Central Bank of Malaysia, and eleven other major Malaysian financial institutions are members of the PayNet Group, which owns and operates FPX. It is one of the most popular online payment methods in Malaysia, with nearly 90 million transactions in 2018.

In order to pay with FPX, customers are redirected to their online banking environment where they have to perform two-step authorization, like entering a one-time passcode sent via SMS. The exact customer experience will vary depending on the bank.

Start accepting FPX- Payment method type

- Bank redirect

- Relevant payer geography

- Malaysia

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- MYR

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects FPX at checkout

Chooses bank and gets redirected

Enters account credentials

Completes authorization process

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

GBP bank transfers

GBP transfers on Bacs Payment Schemes Limited (BACS), Faster Payment System (FPS), or Clearing House Automated Payment System (CHAPS) networks are payer-initiated payment methods that enable customers to send funds from their bank account to another UK-domiciled account. With lower transaction fees, it is one of the preferred methods for high-value payments—98.5% of UK businesses use bank transfers for business-to-business (B2B) payments.

When accepting bank transfers with Stripe, businesses provide customers with a virtual bank account number that they can push money to from their own online bank interface. The virtual bank account allows for automated reconciliation and seamless refunds.

Start accepting bank transfers- Payment method type

- Bank transfers

- Relevant payer geography

- UK

- Relevant business model

- B2B software as a service (SaaS) and subscription businesses; high-value and high-volume business-to-consumer (B2C) retailers

- Presentment currency

- GBP

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 3 business days

giropay

giropay is an online bank transfer payment method offered by more than 1,500 banks in Germany.

Customers are able to complete transactions using their online bank credentials, with funds being debited from their bank account. Depending on their bank, customers confirm payments using a second-factor authentication or a PIN. Payments are immediately confirmed to your business and irrevocable.

Because giropay uses real-time bank transfers, payments are 100% guaranteed.

Start accepting giropay- Payment method type

- Bank redirect

- Relevant payer geography

- Germany

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- EUR

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects giropay at checkout

Gets redirected to giropay and enters bank details

Receives SMS on mobile and enters into redirect page

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

GrabPay

GrabPay is a digital wallet developed by Grab—a popular super-app in Southeast Asia. Customers maintain a balance in local currency in their wallets that they can then use to pay for purchases with Grab and other merchants.

In order to pay with GrabPay, customers are redirected to GrabPay’s website, where they have to authenticate the transaction using a one-time password. After authenticating, customers will be redirected back to your website or app.

Start accepting GrabPay- Payment method type

- Digital wallet

- Relevant payer geography

- Singapore, Malaysia

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- SGD, MYR

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects GrabPay at checkout

Gets redirected to GrabPay and enters phone number

Receives one-time password on mobile and enters into redirect page

Confirms payment

(Optional) Returns back to business’s site for payment confirmation

Google Pay

Google Pay allows customers to pay with any payment method saved to their Google account.

Google Pay works in Android native apps and across the web. To make a payment online, customers select Google Pay as the payment method and select which payment credential they would like to use. These include credit and debit cards the customer may have used on any Google property, such as Chrome, YouTube, or the Play Store. Google Pay does not allow users to hold a balance.

In addition to payment information, you can request the customer’s billing and shipping address, and contact information.

Start accepting Google Pay- Payment method type

- Wallet

- Relevant payer geography

- Where Google Pay is supported

- Relevant business model

- E-commerce and marketplaces, on-demand services

- Presentment currency

- 135+

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- Immediate

Customer-facing flow

Selects Google Pay at checkout

Enters Google Pay credentials

Gets notification that payment is complete

iDEAL

iDEAL is a Netherlands-based payment method that allows customers to complete transactions online using their bank credentials. All major Dutch banks are members of Currence, the scheme that operates iDEAL, making it the most popular online payment method in the Netherlands with a share of online payments close to 55%.

In order to pay with iDEAL, customers are redirected to their online banking environment where they can authenticate the payment using a second factor of authentication. The exact customer experience depends on the bank. Payments are irrevocable and immediately confirmed.

While iDEAL payments are single-use, subsequent recurring payments can be completed via SEPA Direct Debit transactions.

Start accepting iDEAL- Payment method type

- Bank redirect

- Relevant payer geography

- The Netherlands

- Relevant business model

- E-commerce and marketplaces, SaaS and subscription services

- Presentment currency

- EUR

- Recurring payments

- Supported through Stripe via SEPA Direct Debit

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects iDEAL at checkout

Gets redirected to iDEAL and chooses bank or gets redirected to bank straight away

Enters account credentials

Completes authorization process (with scanner or SMS)

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

Klarna

Klarna offers flexible payment options that give customers more freedom to choose when and how to pay for a purchase. Klarna provides payment solutions for 90 million consumers and over 200,000 businesses across 19 markets.

There are four different ways for customers to pay for a transaction with Klarna: Pay in Installments, Pay Later, Pay Now, and Financing. You can choose to offer one, two or multiple options. You are paid upfront and are protected against fraud and customer payment risk.

Klarna Pay in Installments allows customers to make an online purchase and spread the cost over three or four interest-free payments*.

Klarna Pay Later in 14 or 30 days lets customers immediately complete a transaction and pay the full amount later, at no additional cost.

Pay Now is offered in many European countries and lets a customer pay for a transaction immediately using stored payment credentials. Supported payment methods include bank transfers or direct debit.

Klarna Financing offers customers up to 36 months of credit. To receive financing, they complete a one-time application. If approved, customers make their monthly payments to Klarna online or in the mobile app.

*In the UK, customers Pay in three Installments.

Start accepting Klarna- Payment method type

- Buy now, pay later

- Relevant payer geography

- Austria, Belgium, Denmark, Finland, Germany, Italy, Norway, Spain, Sweden, The Netherlands, UK, US

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- EUR, GBP, USD

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- Yes, for non-fraud disputes. For fraud-related disputes, Klarna takes on the risk and any associated costs.

- Payment completion

- Immediate for Pay Now. In most countries, Pay Later is also immediate. In the US and UK, a temporary credit confirmation is issued and confirmed within five business days.

Pay later: customer facing flow for hosted payment page

Selects Pay Later, Installments, or Financing at checkout

Gets redirected to the Klarna hosted page and enters additional detail if needed

Klarna uses customer details to confirm approval

Returns to business’s site to complete checkout

Pay now: customer facing flow for hosted payment page

Selects Pay Now at checkout

Gets redirected to the Klarna hosted page and chooses payment method

(For new customers) Enters account credentials

Klarna uses customer details to confirm approval

Returns to business’s site to complete checkout

Meses Sin Intereses

Installments is a feature of consumer credit cards in some markets that allows customers to split purchases over multiple billing statements. You receive the full amount (minus a fee) as if it were a normal charge, and the customer’s bank handles collecting the money over time.

In Mexico, installments are known as “meses sin intereses”. Stripe supports payments with meses sin intereses for Stripe Mexico accounts using the Payment Intents API and Payment Methods API, Checkout, Invoicing, and Payment Links.

Start accepting meses sin intereses- Payment method type

- Installments

- Relevant payer geography

- Mexico

- Relevant business model

- E-commerce and marketplaces, SaaS businesses, on-demand services, professional services

- Presentment currency

- MXN

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- Immediate

Mexico bank transfers

Bank transfers in Mexico are payer-initiated payment methods that enable customers to send funds from their bank account to another Mexican-domiciled account. Due to lower decline rates, fraud, and transaction costs, bank transfers are widely used for both B2B and B2C transactions—2 billion transactions were made in 2021, an increase of 60% from 2020.

When accepting bank transfers with Stripe, businesses provide customers with a virtual bank account number that they can push money to from their own online bank interface. The virtual bank account allows for automated reconciliation and seamless refunds.

Start accepting bank transfers- Payment method type

- Bank transfers

- Relevant payer geography

- Mexico

- Relevant business model

- B2B SaaS and subscription businesses; B2C retail and direct marketplaces with high volume; B2C retailers with high average order value (AOV) and low-frequency order; and fintech businesses

- Presentment currency

- MXN

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- No

- Payment completion

- 3 business days

Microsoft Pay

Microsoft Pay is a wallet that allows customers to store their payment and shipping information so their details are auto-populated when paying from Windows devices.

Customers are prompted to sign in with their Microsoft account and authorize the payment by confirming the card’s security code.

Start accepting Microsoft Pay- Payment method type

- Wallet

- Relevant payer geography

- Where Microsoft Pay is supported

- Relevant business model

- E-commerce and marketplaces, on-demand services, SaaS and subscription businesses

- Presentment currency

- 135+

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- Immediate

Customer-facing flow

Selects Microsoft Pay at checkout

Signs in with Microsoft account and enters card security code

Gets notification that payment is complete

Multibanco

Multibanco is an interbank network that links the ATMs of all major banks in Portugal, allowing customers to pay through either their ATM or online banking environment. Multibanco has a 30% share of the payments market in Portugal.

At checkout, customers select the Multibanco payment method and then log into the Multibanco page, which displays a reference number and other transaction details. Customers use these details to initiate a payment via online banking or from an ATM.

Payments processed with Multibanco should succeed immediately, however Multibanco sources will be pending until your bank receives the funds (which can take up to a few days depending on how and when the customer chooses to complete the transaction).

Start accepting Multibanco- Payment method type

- Bank credit transfer

- Relevant payer geography

- Portugal

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- EUR

- Recurring payments

- No

- Refunds

- Supported through Stripe

- Disputes

- No

- Payment completion

- Immediate

Online banking flow

Selects Multibanco at checkout

Receives payment details (incl. entity, reference, amount, and expiry date)

Logs into online banking

Initiates and confirms transfer using payment details

Receives confirmation of funds sent

ATM flow

Selects Multibanco at checkout

Receives payment details (incl. entity, reference, amount, and expiry date)

Uses payment details to complete payment at ATM

Receives confirmation of funds sent

OXXO

OXXO is a Mexican chain of convenience stores with thousands of locations across Latin America and represents more than 30% of transactions in Mexico. OXXO allows customers to pay bills and online purchases in-store with cash.

To complete a transaction, customers receive a voucher that includes a reference number for the transaction. Customers then bring their voucher to an OXXO store to make a cash payment. You will receive payment confirmation by the next business day along with the settled funds.

OXXO doesn’t offer any cancellations and disputes are typically managed directly between you and the customer.

Start accepting OXXO- Payment method type

- Cash-based voucher

- Relevant payer geography

- Mexico

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- MXN

- Recurring payments

- No

- Refunds

- No

- Disputes

- No

- Payment completion

- 1-2 business days from when customer pays

Customer-facing flow

Selects OXXO at checkout

Receives voucher with transaction reference

Provides voucher and cash payment at OXXO store

Receives notification that payment is complete

Pre-authorized debits in Canada

Pre-authorized debits (PADs) are used to collect direct debit payments from customers in Canada. In 2019, more than C$876 billion was processed through bank debits.

You are required to get explicit approval, in the form of a pre-authorized debit agreement, from customers in order to debit their accounts. The agreement must outline the debited amount, the frequency of withdrawals, and how customers can cancel the agreement (among other things).

Customers have 90 days from the date of withdrawal to report an incorrect or unauthorized debit.

Start accepting pre-authorized payments- Payment method type

- Bank debit

- Relevant payer geography

- Canada

- Relevant business model

- SaaS and subscription businesses, professional services

- Presentment currency

- CAD

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 2-3 business days

Customer-facing flow

Selects PADs at checkout

Provides bank account information and accepts PAD agreement

Receives notification of upcoming payment

Przelewy24

Przelewy24 (P24) is a Polish payment method that facilitates the transfer of funds between more than 90,000 businesses and all major Polish banks. Przelewy24 allows consumers to pay for internet-based transactions using direct online transfers from their bank account.

In order to pay with Przelewy24, customers are redirected to an online environment where they can authenticate their payment by logging into their bank’s site. For the majority of banks, destination details (Przelewy24’s bank account) are pre-populated, though in some cases the consumer has to enter details manually.

Upon successful authentication, funds are guaranteed. A business-initiated refund is the only way to reverse funds.

Start accepting Przelewy24- Payment method type

- Bank redirect

- Relevant payer geography

- Poland

- Relevant business model

- E-commerce and marketplaces

- Presentment currency

- PLN

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects Przelewy24 at checkout

Gets redirected to Przelewy24 and chooses bank

Enters account credentials

Completes authorization process

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

SEPA Direct Debit

The Single Euro Payments Area (SEPA) is an initiative of the European Union to simplify payments within and across member countries. They established and enforced banking standards to allow for the direct debiting of every Euro-denominated bank account within the SEPA region, facilitating more than 20 billion transactions every year.

In order to debit an account, you must collect your customer’s name and bank account number in IBAN format. As part of the payment confirmation, customers must accept a mandate that authorizes you to debit the account.

Customers are able to dispute a SEPA Direct Debit transaction within eight weeks on a “no questions asked” basis: funds will automatically be returned to them. Beyond that point and over the following eleven months, they are still able to dispute transactions that were not backed by an appropriately authorized mandate. During that period, the arbitration process involves both your bank and the customer’s bank. After 13 months, disputes are no longer possible.

Start accepting SEPA Direct Debit- Payment method type

- Bank debit

- Relevant payer geography

- Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

- Relevant business model

- SaaS and subscription businesses, professional services

- Presentment currency

- EUR

- Recurring payments

- Yes

- Refunds

- Yes

- Disputes

- Yes

- Payment completion

- 6 business days

Customer-facing flow

Selects SEPA Direct Debit at checkout

Provides full name and IBAN and authorizes mandate

Gets notification that payment is complete

Sofort

Sofort is a bank transfer-based payment method that was acquired by Klarna, a Swedish banking company, in 2014. It has 85 million users in 15 countries.

In order to pay with Sofort, customers are redirected to Sofort’s site where they enter their bank login credentials. Upon authentication, Sofort initiates a bank transfer from their bank account.

Although successful authorization indicates a very high likelihood of payment, funds are not guaranteed to your business until they are actually received, which is typically two business days later (but can be up to 14 days later). Once received, payments cannot be reversed except by business-initiated refunds.

Start accepting Sofort- Payment method type

- Bank redirect

- Relevant payer geography

- Austria, Belgium, Germany, Italy, Netherlands, Spain

- Relevant business model

- E-commerce and marketplaces, SaaS and subscription businesses

- Presentment currency

- EUR

- Recurring payments

- Supported through Stripe via SEPA Direct Debit

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate directional confirmation; definitive confirmation delayed by typically 2 but up to 14 business days

Customer-facing flow

Selects Sofort at checkout

Gets redirected to Sofort to choose bank

Enters account credentials

Gets notification that payment is complete

(Optional) Returns back to business’s site for payment confirmation

WeChat Pay

WeChat Pay, the wallet inside the popular Chinese messaging app WeChat, has more than 900 million active monthly users.

Customers must first add their credit card to their WeChat Wallet (WeChat Pay supports Visa, Mastercard, American Express, Discover, JCB, and Chinese bank cards). They can then make a payment directly in the WeChat app or via QR code.

Start accepting WeChat Pay- Payment method type

- Wallet

- Relevant payer geography

- All geographies with Chinese consumers

- Relevant business model

- E-commerce and marketplaces, on-demand services

- Presentment currency

- AUD, CAD, EUR, GBP, HKD, JPY, SGD, USD

- Recurring payments

- No

- Refunds

- Yes

- Disputes

- No

- Payment completion

- Immediate

Customer-facing flow

Selects WeChat Pay at checkout

Scans displayed QR code with WeChat app

Enters PIN into WeChat app

Gets notification that payment is complete