A technology-first solution for payment facilitation

Stripe’s payfac solution powers some of the world’s fastest-growing platforms. Unlock SaaS revenue, turn payments into a profit center, and offer new financial services through your software platform.

Own the customer experience

Use Stripe’s whitelabeled payfac solution to bring payments in house and fully control the customer experience—from payments pricing to payout timing.

Maximize revenue

Stripe’s unified tech stack lets you generate revenue from payments globally, while other payfac solutions limit you to one market. Plus with Stripe you can take advantage of low ongoing costs and interchange+ pricing.

Monetize more than just payments

Other payfac solutions are limited to online card payments. Stripe’s integrated platform lets you offer new services to your customers like point-of-sale payments, invoicing, business loans, and more.

A modern payments stack for payfacs

Traditional payfac solutions require investment in dozens of systems that can take years to build and significant resources to maintain. Stripe’s global platform unifies these systems—from acquirer sponsorship to merchant onboarding, compliance, money transmission licenses, and more. We can help you launch faster without hidden costs or complexity.

-

Instant merchant onboarding

-

Smart routing and payout engine

-

Dashboard to easily track and reconcile payments

-

Metadata for robust reporting

Add new lines of business and revenue

Stripe lets you offer more features and services to your customers. Differentiate your customer experience and increase retention by offering tools like invoicing, subscription billing, in-person payments, or business lending—all from one unified integration.

Improve onboarding while minimizing risk

Avoid the slow, manual sub-merchant onboarding with other payfac solutions, and shift your payments compliance obligations to Stripe. Optimized across years of experience onboarding and verifying millions of individuals and businesses, our payfac solution includes real-time KYC checks, sanctions screening, secure card data tokenization and vaulting, and IRS tax threshold tracking and 1099 support.

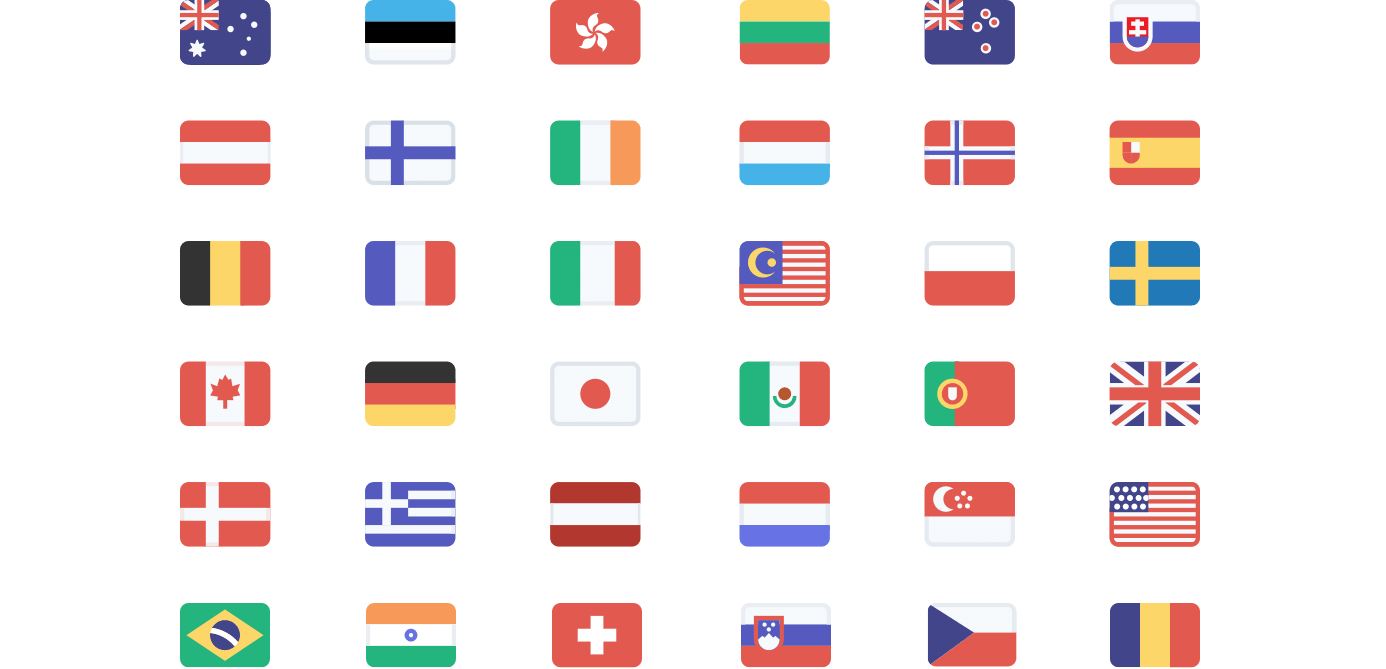

Global coverage, local expertise

Supporting customers around the world requires partnerships with local acquirers, gateways, verification partners, and other service providers to adapt to local requirements in multiple regions. With Stripe, you can quickly expand anywhere we operate without establishing separate local subsidiaries. Launch and scale your payments service to new markets in weeks, not years.

-

Accept 135+ currencies and dozens of local payments all over the world

-

Expand to offer your software in 35+ countries

-

Pay out in 15+ currencies

Stripe offers enterprise-grade infrastructure that puts our customers on the cutting edge of modern payments technology. The combination of Terminal and Connect is a powerful integrated solution in the market for ambitious platforms to facilitate payments for their merchants.

Dax Dasilva

Founder and CEO, Lightspeed

The partnership between Stripe and Shopify is very, very deep. We could go and build a payment gateway, but there would be a massive opportunity cost in this and I think the best you could do is build something like Stripe.

Tobias Lutke

CEO, Shopify