Increase revenue with lower decline rates on Stripe

Increase revenues and improve your network acceptance rates with a platform that offers direct integrations to industry infrastructure, issuer-level insight, and powerful machine learning that optimizes every payment and reduces declines.

Performance-driven infrastructure

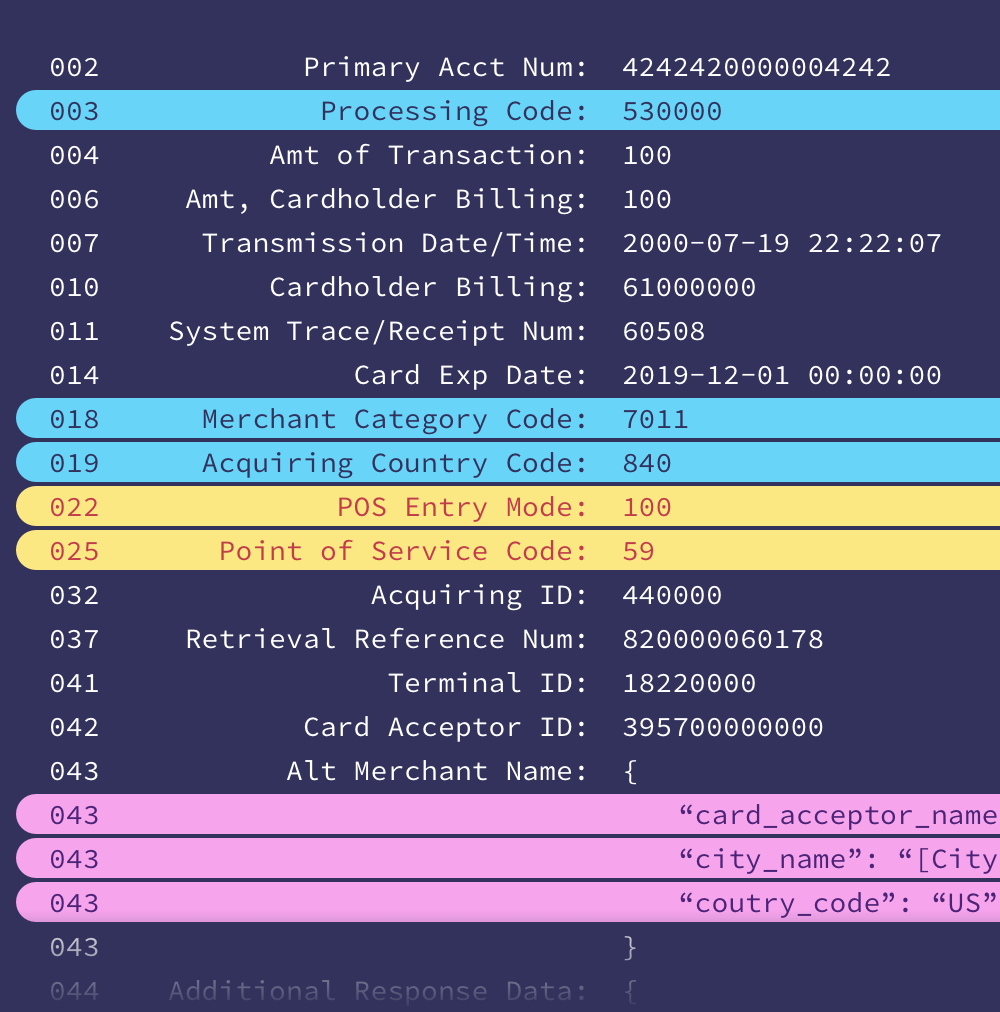

Stripe’s direct integrations with the card networks reduce latency, improve reliability, and give you access to the latest features and enhanced data fields—like raw response codes—that help optimize payments.

Higher revenues, built in

Maximize total revenue with tools designed to avoid friction at checkout, protect your business from fraud, and minimize declines. Our acceptance tools automatically adapt to your business to drive higher conversion.

Put machine learning to work

Legacy payments systems can rely on outdated infrastructure. Stripe’s modern acquiring platform is built to learn from billions of data points to optimize routing and messaging on each transaction.

Improve acceptance rates with intelligent acquiring

Stripe delivers powerful, issuer-level insight and access to the latest network features using our direct network integrations and industry partnerships. Our unified API integration offers:

-

Issuer-optimized authorizations powered by ML

-

Dynamic validations to confirm card details

-

Real-time and batch card account updater

-

Enhanced authorizations for American Express

-

Tokenization service

-

Stored credential optimizations

Recover declined payments with machine learning

Stripe’s pre-processing layer uses optimized network messaging and synchronous card updates to help prevent declines before they happen. If a payment is declined, Stripe's Adaptive Acceptance uses ML to identify the best retry messaging and routing combinations to save lost revenue for all card payments. In addition, Stripe Billing can reduce declines for recurring charges by up to 45% using smart dunning to retry charges at a later time.

Since moving over to Stripe, our payment processing approval rates have picked up by 6% in a very, very short period of time, which is a huge win on improving our conversion rates with customers and our reputation with issuers.

Matthew Neff

Global Head of Product, SkipTheDishes

When Remitly added Stripe as a payments partner, we saw an immediate and significant increase in authorization rates. That's great for Remitly's business and—most importantly—for our customers, who come to us for fast, secure, low-friction transactions.

Nate Spanier

VP, Global Payments and Risk, Remitly