Despite flat budget expectations, regulatory change and investor activism, your primary mandate as finance leader should be business growth. Yet only a fraction of companies have consistently achieved simultaneous top- and bottom-line business growth. How have the finance leaders at these growth riders succeeded in allocating resources to support current and future business growth potential?

Efficient Growth Strategy

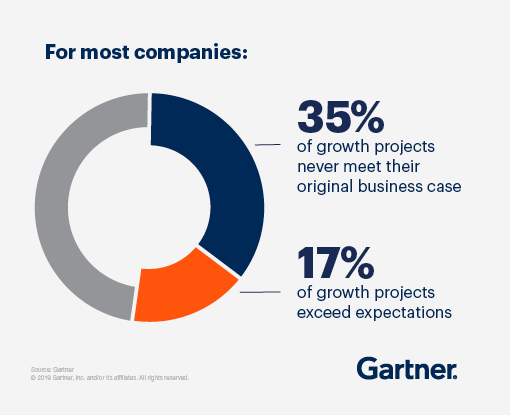

Consistent business growth is elusive

Efficient business growth is not impossible

Efficient business growth leaders focus on making better capital allocation and investment decisions and cutting the right costs. They allocate capital to bigger, riskier growth bets and innovation. They manage businesses for asset efficiency, not just profit and loss. They scrutinize acquisition and partnership opportunities. And they communicate with investors effectively.

Insights you can use

Over the past 20 years, only a few dozen companies across the Fortune 1000 and S&P Euro 350 achieved efficient growth — consistent year-over-year revenue and margin improvement and long-term growth that exceeded their industry peers. Gartner profiled their best practices for business growth.

Capital Allocation Do’s & Don’ts

Developing a growth-oriented capital allocation model is key to putting long-term flexibility above short-term investor returns. Learn how the best CFOs develop capital plans for business growth.

The New Finance Mandate

The world’s efficient growth leaders follow four rules to win over investors and make the right decisions. Take four steps to drive business growth.

Create the Conditions for Efficient Growth

Without realizing it, governance and processes intended to reduce risk can actually stifle business growth. Efficient growth leaders remove harmful business growth anchors and erect business growth ladders by allocating capital to bigger, riskier growth bets and innovation.

Grow Through Every Up and Down

Only a fraction of global companies recorded business growth in every up and down of the last 20 years. Fund innovation like these business growth leaders.

Questions about becoming a Gartner client?

Gartner CFO & Finance Executive Conference

The Premier Destination for CFOs and Their Leadership Teams

Join hundreds of senior finance executives to hear key insights and learn actionable strategies for building the finance function of the future. Finance leaders who attend will:

- Absorb insights based on proven practices

- Capture crowd-sourced implementation ideas

- Leave with prioritized objectives and practical solutions

- Build lasting connections with finance peers

Case Study

How does Gartner help finance leaders create efficient growth strategies?

A new CFO turns to Gartner for support in building board-ready capital allocation and M&A strategies.

Gartner business growth experts

Dig Deeper with Gartner

Gartner’s finance experts are trusted advisors and an objective resource for over 1,750 finance organizations.

Gartner for Finance is a tailor-made solution providing trusted insights, strategic advice and practical tools that help finance leaders make the right decisions to drive business performance.