This is Vitaliy Katsenelson’s Book Translated into Russian

Vitaliy is a pretty sharp market guy. Really sharp.

He took this Friday, though, to write a pretty great story not about stock analysis or international equities, but instead about his dad who painted the cover (above) especially for the Russian translation of Vitaliy’s book.

Go ahead, click through & have a great little read: My Russian Book

Chart of The Day: Comparing Apple Now to Oil Five Years Ago.

The chart above was sent to us by Eric Swarts. It compares the present price behavior of Apple to that of oil in 2009. Both sold off similarly and there is much we might glean about Apple by the way oil resolved after its own incident.

Eric writes,

Foresight 20/20 - value. Although one could debate the granularities of if it’s the chicken-or-the-egg between technical and fundamental motivations, once the momentum drain was completed for both assets - the underlying rationale for trend was reliant on value and the perception for growth. Both oil and Apple had/have it - Microsoft did not. Icahn noticed it this past August and Apple is confirming as much today with disclosure of $12 billion of stock over the last two weeks in its accelerated repurchase program.

Perhaps, this is a bit heavy for a Friday afternoon, yet, whenever one is able to integrate fundamental & technical analyses as elegantly as Eric does here, we pay attention…

Head on over to Eric’s amazing blog and take a look at the full post.

duedil:

So a few of you might be wondering how doge made it into your nespaper this morning. Well… we admit it, it was us. But why, you may ask. Did we want to kill the meme by making it mainstream? Do we hate the internet? No. We actually thought we’d do something nice.

We’ll be honest. We were…

So this is pretty awesome.

DueDil, the largest source of private company information in the UK and England, used its free advertisement in the Guardian, a prize it won in a Small Business Networks competition, to place the ad below in the Guardian this morning.

Dogecoin, as you might not be aware, is a part whimsical part very serious cryptocurrency created by Jackson Palmer and Billy Markus only months ago (read more on the brief history of Dogecoin here).

DueDil goes on to offer a drawing to use more of its free ad space in the Guardian. Come up with some genius small biz owners and contact DueDil:

So that’s what we’re going to do. Enter your company in the draw by sending an email to wow@duedil.com with a brief explanation of what you would do with an advert in the Guardian, and the winner will get an ad running for 2 days in the business section (right in place of doge).

And here we were thinking that this whole Guardian Dogecoin ad thing was the next Cicada 3301.

:)

Photo Source: Buzzfeed

dennys:

Would you eat this #BYOPancakes combo?

If Denny’s ever actually put this on the menu, we’d be buying the stock.

:)

…And while we are focusing on Microsoft today, we loved this 20 year old photo of people getting very excited to get their hands on a spanking new Windows 95 Operating System.

It reminded us of, you know, a more recent and more fruity mania…

.

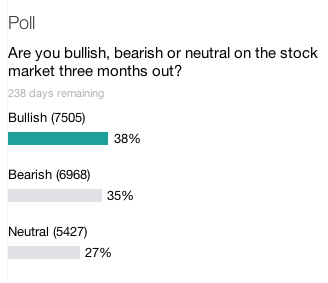

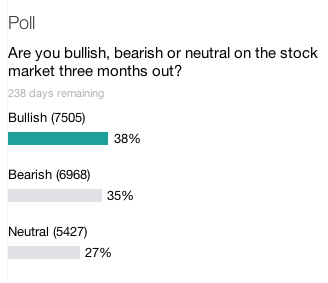

The Yahoo Finance Poll above shows that 60% of the 13,000 respondents do not like Microsoft stock here.

That’s a pretty clear-cut bearish majority.

However, if you take a look at the Microsoft price chart below, you will notice that despite some very recent weakness, Mr. Softie still trades above its rising 200 day simple moving average denoting a longer term uptrend.

One might expect that while a stock is in an uptrend, sentiment would also be bullish, but this morning’s poll shows that despite the longer term rising trend, the majority remains bearish.

This suggests a bullish sentiment to price divergence for the kids from Redmond.

Today’s Yahoo Finance Sentiment Poll results might be concerning to bulls.

The data for these polls are collected from the 4PM close on Fridays to the Monday open - essentially over the weekend.

Last week’s data, registered before market’s opened last week, showed bulls at 37%, bears at 36% and Neutral at 26%.

The markets then dropped for the week with the S&P 500 falling around .5%, the Dow Jones Industrial Average falling around 1% and the NASDAQ Composite falling a bit more than .5%.

In this morning’s poll, we get a reading of 38% bulls, 35% bears and 27% Neutral.

So we got a slight uptick in bullishness and downtick in bearishness even as the markets continued to fall.

No extreme reading and no extreme increase in bearishness on top of last week’s large move.

A modest concern for bulls.

It should be noted that, while the Yahoo Finance Sentiment Poll has a huge sample set, we have only been collecting data for a few months. As such, there is little historical data to base interpretive analysis.

Checking back in with Schaefer’s Ryan Detrick who calculated the Dow Jones Industrial Average performance on years when the Broncos or the Seahawks have been involved.

When the Broncos win (2x), the Dow has averaged 21% gains and when they lose (4x) the Dow has averaged only 2.5% gains.

When the Broncos win or the Seahawks lose, the Dow has averaged 19%.

So, if you’re betting on a strong market, then you’re rooting for the Broncos.

Of course correlation does not suggest causation but what the heck, pour yourself an ice cold beer and enjoy the big ball game…

:)

High-res

High-res