Today

The Aussie funds that beat bitcoin and big tech

It was often savvy bets at the smaller end of the market that shot the top-performing fund managers to the top of the leader table in the last financial year.

- Updated

- Joshua Peach

Tech sector plunges; traders lift bets on interest rate increase

Jobless rate edges higher in line with expectations, job gains beat forecasts. Domino’s cuts guidance. Telix lifts sales forecasts. Nasdaq posts worst day since 2022. Follow here.

- Timothy Moore, Tom Richardson, Sarah Jones, Joshua Peach and Joanne Tran

Geopolitics tops inflation as key market risk: global fund managers

The “perception” of geopolitical risk is a net 88 per cent above normal, and at its highest since November 2022, according to a Bank of America metric.

- Timothy Moore

Yesterday

Investors size up ASX small caps as Wall Street pops

With the US central bank looking like it will begin cutting rates, smaller stocks there have been on a tear. The same could happen in local equities.

- Sarah Jones and Joshua Peach

Why Ark’s Cathie Wood is betting big on Tesla

The fund manager is banking on Elon Musk’s move into robotaxi’s will be a catalyst for a roughly 10-fold increase in Tesla’s share price

- Bei Hu

- Opinion

- Private equity

Private equity has become hazardous terrain for investors

The days of easy windfalls from freakishly loose monetary policy are gone. Now, private capital is much more hazardous terrain for investors.

- John Plender

Resurgent Zip raises cash and pays big break fee to eliminate its debt

Zip has indicated it will push the accelerator on growth in the United States despite regulators investigating whether it has violated consumer protection laws.

- James Eyers

ASX resets record as property, tech rally; gold stocks climb

Shares extend advance above 8000 points; BHP breaks iron ore export record, promises copper lift; Cettire flags revenue, customers ahead of FY24 report; gold climbs to record; New Zealand Q2 inflation slows, keeps rate cuts on the table. Follow updates here.

- Timothy Moore, Joanne Tran, Joshua Peach and Sarah Jones

- Opinion

- Superannuation

Spending a few hours on this now will make you richer later

Work through these 11 steps to grow your superannuation faster.

- Colin Lewis

This Month

Investors to pull money from banks as property, miners rebound

Equity strategists are expecting the ASX 200 to stay around 8000 points until the end of the year. But it won’t be the banks leading the year-end rally.

- Joanne Tran

ASX slips back below 8000 as BHP, Rio Tinto weigh; DroneShield sinks

Australian shares end lower. The Dow closes at a record high. Bitcoin bounces. Rio Tinto’s iron ore production slips. Follow updates here.

- Timothy Moore, Joshua Peach, Sarah Jones and Joanne Tran

The ’10-bagger’ stocks that helped push the ASX above 8000

Two blockbuster biotech winners and beneficiaries of investment in the energy transition helped create wealth for savvy investors as shares topped 8000 points.

- Tom Richardson

Inside AirTrunk’s pitch to the world’s heaviest hitting investors

Also around the boardroom table: the same Blackstone team who ruled off a $US10 billion ($14.8 billion) takeover of QTS in 2021

- Sarah Thompson, Kanika Sood and Emma Rapaport

- Opinion

- Chanticleer

CBA at $132? No one says ‘buy’, yet there are buyers

Commonwealth Bank is a tussle between active and passive investors, mums and dads and fund managers, and traditional valuation frameworks versus reality.

- Updated

- Anthony Macdonald

Bell Potter’s Hugh Robertson jumps ship to Morgans

Robertson is understood to have resigned from Bell Potter on Friday and started work at Morgans on Monday.

- Sarah Thompson, Kanika Sood and Emma Rapaport

ASX crosses 8000 as tech stocks rally

Shares rise amid broad rally; iron ore advances; China growth weakens more than expected as outlook darkens; haven rush on investor minds after the assassination attempt on former US president. Follow here for more.

- Timothy Moore, Joanne Tran, Joshua Peach and Sarah Jones

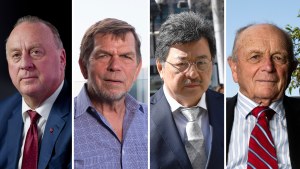

Three little-known stocks driving this veteran’s mega returns

Pengana’s James McDonald discusses his blockbuster year and the ASX-listed stocks he is backing into the new financial year.

- Joshua Peach

ASX to hit 8000 as markets bank on Federal Reserve to cut rates

It’s taken the local bourse just over three years to climb another 1000 points after breaching the 7000 level in April 2021, fuelled by pandemic-era stimulus.

- Sarah Jones

- Opinion

- Interest rates

Why the US Fed needs to start cutting rates now

Key inflation and employment data that central bankers use to guide monetary policy lag far behind economic turning points, which results in hugely suboptimal rate decisions, writes Vimal Gore.

- Vimal Gor

The surprising asset class the rich are using to build wealth

An increasing number of seasoned and wealthy investors are increasing their exposure to ETFs, an asset class that has been typically associated with the young.

- Michelle Bowes