Canadians interested in investing and looking at opportunities in the market besides being a potato. Discussion is geared towards investment opportunities that Canadians have access to, including questions regarding individual companies, ETFs, tax implications, index investing, and more!

$SHOP

A community dedicated to all things web development: both front-end and back-end. For more design-related questions, try /r/web_design.

Doesn't platform like Shopify threaten the job of a web developer?

Is it still worth to learn to make e-commerce websites from scratch? Or by learning to build one using jamstack?

Welcome to Canada’s official subreddit! This is the place to engage on all things Canada. Nous parlons en anglais et en français. Please be respectful of each other when posting, and note that users new to the subreddit might experience posting limitations until they become more active and longer members of the community. Do not hesitate to message the mods if you experience any issues!

A community of like minded individuals that are looking to solve issues, network without spamming, talk about the growth of your business (Ride Along), challenges and high points and collab on projects together. Stay classy, no racism, humble and work hard. Catch Localcasestudy at Rohangilkes.com

Before we get started, let’s get some proof out of the way.

are my lifetime Facebook Ads metrics for the store. are the Shopify metrics, which I can verify live for a mod if needed. I can also privately share the escrow payment for the sale of the store.

I'm not allowed to share the exact profit margin, but it was pretty typical for ecommerce standards.

Pre-Launch

First, some background on where I was before creating this store. Towards the end of 2018, I was in the midst of a plan to do anything I could to escape working a full time job. At the time, I was an Aerospace engineer but had already decided even a year prior that I wanted to leave and work for myself. I was flipping stuff on eBay and making a good amount of money but really wanted to take my experience in online sales to the next level. I had also built a solid foundation in the Esports industry as a journalist, but felt if I could take on the extra challenge.

Having already dabbled in dropshipping as far back as 2015, I wanted to do something similar but separate myself from the crowd. Dropshipping is simply a fulfillment method, so I knew the differentiator would be in the store design and more importantly the product selection. I paid for a premium theme and spent nearly a month fine tuning it.

When choosing the product, I wanted to reduce competition and make the barrier to entry much higher. Therefore, I browsed the internet until I could find product(s) manufactured within the United States but didn’t have a ton of attention. I did this for one main reason: shipping speed. If I could offer quick shipping, that would give me a leg up.

I looked every single day for weeks, searching with U.S. suppliers, on ETSY, and for other niche websites that came up when searching for American made products. Eventually I landed on a group of cool products that had hardly any attention and had a small personal store. I contacted them and asked if they would drop-ship orders for me and/or provide items at a bulk discount. To my surprise, they agreed to both!

One additional reason I was optimistic about the product line I had found was that the suppliers social media presence was small and they weren’t running ads. For those who aren’t aware, you can go to any Facebook page and look at the Page Transparency section. If the page is running ads, it will show them to you.

This effort and correspondence is what separated me from the crowd and is absolutely the route I would go if I were to create another store. It takes more effort to do this than browse AliExpress.

Launch

Almost immediately, the store was profitable when advertising with Facebook. I had previous experience here, which goes a long way. I got permission to use the suppliers’ photos originally but once I knew it was a hit, I ordered the products for myself to have photographed in a lifestyle setting. I also added Google Ads to the mix, but those only accounted for about ~5% of the sales. Another big part of the business was adding the three most popular products to Amazon FBA. That accounted for about ~7% of the total sales.

To top things off, in April of 2019 I found a perfect complimenting product that would be fantastic for upselling. I had it photographed with the other products and started advertising with it, which caused things to really pop. I fulfilled that item from my own office before I realized I could have just asked the supplier to do it. Lo and behold, they were willing to supply it and it only cost me pennies to have them do it once you factored in the savings in postage on my end. It was going so well and I had hit some personal finance benchmarks that left me feeling comfortable enough to leave my job in July.

Pre-Sale

After a fantastic holiday season, I decided I wanted to move on and sell the store despite its success. This was always an inevitability because while I am passionate about building businesses, I wasn’t passionate about the niche. To me, the payout was worth freeing up time for future projects.

In January, I began the process of having Empire Flippers vet the business to list it for sale. Long story short, it sold in March and I recently received a payout for a majority of the sale price. The rest is contingent on the transition of Amazon FBA listings here soon.

Summary

Overall, I think my success hinged on a few things that I highlighted throughout this but will list again and add a couple.

-

Product Selection

-

Shipping Speed

-

Prompt Customer Service

-

Unique Advertising Photos

-

Email and Text Marketing

-

Clean and Professional Looking Website

-

Working Phone Number Displayed on Website

Don’t let this story fool you into thinking there weren’t challenges and failures with this store in particular or ventures I’ve had in the past. You will fail, but you will also learn.

I’d be happy to answer any questions people have about my journey or about their personal situations.

Info

I have nothing to sell, but would appreciate a . I document my day to day work and share helpful tips there in all areas of online business, Shopify, advertising, ecommerce, and more.

I also have a separate but much larger for Esports and in particular CS:GO, if you care for that.

Thank you for your time.

Canadians interested in investing and looking at opportunities in the market besides being a potato. Discussion is geared towards investment opportunities that Canadians have access to, including questions regarding individual companies, ETFs, tax implications, index investing, and more!

A company that just reported over 400 million in sales for the first quarter is about to be Canada's largest Market Cap on the TSX. Let that sink in. This market is beyond ridiculous. Everyday the same tech companies go up while the rest of the market lags.

I’ve built a successful store targeting Denmark. Here’s why Denmark works: for its small size, it has significant purchasing power. Here’s what I focus on:

-

Home (broad market)

-

Fashion (good margins)

-

Kitchen (problem solvers)

Store Design:

I keep it simple. I use Impact Theme and hire a native Danish freelancer to translate the store. Alternatively, you can use Deepl or Chatgpt to handle translations. It’s not perfect, but it works well enough to start making sales.

Product Research:

I don’t reinvent the wheel. I find early winning products and sell them in Europe. Forget about sketchy beauty products or low-ticket items. I use Spylib to find winning products—it’s super handy because it shows me actual daily spend on Meta ads. Look for products with not too many adsets.

Facebook Ads:

I’m currently testing $50 CBOs daily per product, with no interests and 2-3 creatives per ad set. It’s working well in smaller markets like Denmark, where audiences are more niche, so I’m no longer using interests.

Payment Processors:

Denmark is easy—you only need Stripe and PayPal. Klarna is optional but not essential. If you’re selling in Sweden, Klarna becomes a must.

Apps I Use:

Here are the 4 apps that drive revenue on my store:

-

One Click Upsell (post-purchase)

-

Klaviyo (email flows)

-

VITALS (reviews, sticky add-to-cart)

-

SMS Bump (text message flows)

Bonus Tips:

If you’re considering other countries, Germany, the Netherlands, and Sweden are also profitable markets with popular payment methods like Klarna, PayPal, and iDEAL.

Value investing in all its forms - From Graham & Dodd, to Buffett & Munger, to their philosophical descendants today

Shopify had a crazy stock-price movement in the last 2 years, went from roughly $350 prior to the pandemic, to almost $1,800 (almost 5x) at its peak, and is now down to $364 (80% down).

The goal of this post is to share my fundamental analysis and valuation of this highly volatile company. Feel free to provide your feedback and disagree with me :)

At the peak, the market cap was over $220b, let's keep that number in mind. Today, it's around $46b. Let's get started!

Link to the video for those who prefer to watch:

What is Shopify?

In one sentence, it is an eCommerce website builder that takes care of the infrastructure and provides additional services/solutions (payment processing, marketing, analytics, inventory & fulfillment, etc.). It allows setting up and operating a business online easier.

How does Shopify make money?

The revenue is split into two groups:

-

Subscription revenue - This is self-explanatory, and refers to the monthly recurring revenue that Shopify gets from the individuals/businesses that use their platform. This stream of revenue doesn't depend on the success of the users. Regardless if a company sells 1 product or a million, the subscription revenue is fixed. In my view, this is the less-risky stream as they'd only lose customers if they switch to another platform (not that likely) or a business goes bankrupt. Historically, this stream grew 50% year-over-year, now almost $1.4b for the last twelve months (ending Q1/2022). This is also a high-margin business, with a gross margin of 80%.

2. Merchant solutions - This is the segment that takes all of the other revenue and is highly dependent on the success of the individuals and businesses that use the platform. Payment processing fees, currency conversion, referrals, advertising, etc, all of that is included here. If there's a slowdown in the economy and the eCommerce business decreases, this stream of Shopify would be harmed. In the last years, it grew roughly 75% year-over-year to almost $3.5b in the last twelve months. The gross margin in this segment is lower (43%).

The overall gross margin has been decreasing and if we only look at that in isolation, the conclusion would be that something bad is going on and Shopify cannot keep its margins at the same level. This is not correct. The reason for the margin decline is only due to the fact that the lower-margin revenue stream (Merchant solutions) is growing faster than the higher-margin revenue stream (Subscription-based). Hence, the gross margin naturally moves closer to the stream that contributes more.

So, the total revenue is close to $5b. If we put this next to the market cap at its peak of $220b, it seems quite unreasonable for anyone to pay such a huge premium. Yes, the company has been growing at high rates, but the growth cannot continue at that pace forever. The moment the growth declines, that's where the problems start and a correction comes in, so it's always wise to incorporate this growth decline in the model and not assume growth of 50-60% for a very long period of time.

The overall gross margin is at 53% for the last 12 months and it is expected to drop even further. Let's keep it simple and assume that it will decrease to 50%.

Operating expenses

With the remaining 50%, Shopify needs to cover 3 main expenses to get to the operating result.

-

Sales & marketing - Decreased from 34% of revenue (2017) to 21% in LTM.

-

R&D - Remains stable at around 20% of revenue in the last 5 years

-

G&A - Remains stable at around 10% of revenue in the last 5 years

By subtracting these 3 costs, we get to an operating profit of 1%. So, a company with revenue below $5b and no operating profit, was selling for $220b. That sound quite irrational. Of course, there are a couple of other factors to consider.

Every growth company puts as much effort as possible into growing quickly. For Shopify, that's mainly in Sales & Marketing and R&D. The more potential customers they can reach, the faster they can grow. The more they can innovate, the more services they can provide. However, as the growth slows down, these costs as % of revenue decrease. The marketing won't yield the same returns as before, simply because the # of potential customers decreases. All of this will lead to margin expansion.

Balance sheet

There are a couple of main points to mention:

-

Shopify is a capital-light business that doesn't need to invest in tangible assets in significant amounts.

-

They have a strong cash position ($7.2b in cash & short term investments + $2.9b in long-term investments)

-

The debt is at a very low level, roughly $1.2b (insignificant compared to their $10b cash/investments). It could be argued that they didn't use the low-interest rates to increase their financial leverage.

Recently, Shopify announced the acquisition of Deliverr for $2.1b, a company that will add value in their process of inventory inbounding and distribution. The aim is to offer delivery to the customer within 2 days of ordering (Competitive with Amazon Prime). This is not yet paid, so needs to be deducted when valuing Shopify as a company)

DCF model

Key assumptions:

-

Revenue growth: 25% for the next 5 years, then slowly decrease to the risk-free rate of almost 3%.

-

Operating profit: Slowly improve to 25% (Basically, the 3 types of expenses mentioned above, combined, should decrease to 25% of revenue over the next 10 years)

-

Discount rate - 11.7% (Based on WACC)

Outcome: Value per share - $276/share (current market price - $364)

My assumptions are based on what I think Shopify can deliver with high probability. Could be I be wrong? Absolutely!

What if I'm wrong?

Based on my assumptions, the revenue will grow by 426% in 10 years and the operating margin is estimated at 25%. However, I could be significantly wrong. Therefore, the table below provides a valuation of the company based on assumptions different than mine related to the revenue 10 years from now and the operating margin.

| Revenue / Op. margin | 20% | 25% | 30% |

|---|---|---|---|

| 300% ($19.0b) | $190.1 | $229.3 | $269.1 |

| 426% ($24.4b) | $226.8 | $275.8 | $326.4 |

| 1000% ($51.0b) | $400.3 | $500.5 | $601.0 |

| 3350% (159.9b) | $1,089.9 | $1,388.4 | $1,687.0 |

Based on your assumptions about the revenue growth and margin expansion of Shopify, you can decide whether the company is expensive or not at this price.

The last row is only for illustration of how irrational the market was in the last year when the price went up to almost $1800. Basically, to justify that valuation, the company would need to grow the revenue by around 50% every year for the next decade and at the same time improve its operating margin to 30%. So, starting with the gross profit being around 50%, the Sales & Marketing, R&D, and G&A together, should be 20% of sales.

Feel free to add your insights into Shopify and add value to the analysis. Feedback (both positive and negative) is always welcomed :)

Canadians interested in investing and looking at opportunities in the market besides being a potato. Discussion is geared towards investment opportunities that Canadians have access to, including questions regarding individual companies, ETFs, tax implications, index investing, and more!

Shopify valuation can not be justified any way I see it. Can someone explain their valuation?

I mean, how can it possibly be worth 90billion at the moment? They have quarterly sale of 470M, with a net loss of 31 million on that 470M. Their last quarter was 505million, with a mere 0.77million in net profit.

The only possible path to its justification is their growth story. Let's take a look at it,

If we extrapolate the 470m of their most recent quarter into annualized revenue of 1.88Billion, even if we assume 45% annualized compounded revenue growth no matter what for the next 9 years (which is virtually impossible even in the rosiest of projection given the generation defining iPhone/smartphone era could not maintain that kind of growth for that long), that would come out to 53billion in annualized sales, currently net margins are NEGATIVE, but they are in growth mode so I'll forgive that but let's assign a very generous 10% net profit (minus all expenses) for this feebased type of service, that's still only 5.3billion in profit, the CURRENT market cap is 90Billion - 17P/E at today's price

So to conclude, IF shopify can somehow maintain 45% annualized compounded growth no matter what for 9 straight years, which will 28x their current sale volume & be more incredible than the iPhone growth era AND still somehow manage a 10% net profit margin at the end, it'll be valued at 17 P/E of today's market capitalization, in exchange for 9 years of waiting even if perfection is being executed. I mean that's just messed up, all that low probability risk and the reward of it paying off if such low probability events align is 17P/E if you buy at today's price. WTF?

If you have the money, will you pay 90billion in cash today for a business that's less than 2 billion in sales(not profit), still losing money, but growing?

Are you looking for the best Website Builders in 2024? You have come to the right place. Here we discuss the best website builders Reddit recommends. Make sure to join the community and read the pinned post.

I'm looking into Shopify for a few possible online business concepts. I understand that all of the Shopify Apps cost money every month. So, even though Shopify's basic prices are very low, I'm worried about the extra monthly app fees. I want to know how much Shopify really costs for an e-commerce site with average features. Thank you for any help you can give.

Canadians interested in investing and looking at opportunities in the market besides being a potato. Discussion is geared towards investment opportunities that Canadians have access to, including questions regarding individual companies, ETFs, tax implications, index investing, and more!

WeCommerce - "We start, buy, and invest in the world’s top Shopify businesses."

Ticker: WE.V

WeCommerce acquires and operates companies that sell digital products/services for Shopify stores, mainly premium Themes, apps, and web design agency services.

Bill Ackman is an investor in the company, as well as the family office of Howard Marks.

The themes and web design services are normally a one-time fee, apps are usually like small SaaS services with recurring monthly revenue.

They had 9,475,338 M in revenue in the 6 month period ending June 2020, 20% increase from the same period in 2019.

Around 26% recurring revenue, 48% digital goods revenue, 26% agency service revenue.

Financial statements are on page 105 of IPO filing.

The companies that they own/operate.

-

I started a small position in WeCommerce Dec 14.

A place for theoretical discussions about GameStop stock ($GME). Opinions and memes welcome. Suspected crypto coin scams such as the "Superstonk" coin and "DumbMoney" crypto coin (with the symbol "$GME") have nothing to do with GameStop stock. None of this is financial advice.

Welcome fellow tinfoil enthusiasts.

I have an extra crunchy could be shiny interesting idea. As we all know GME is planning a stock dividend at some point here were all just waiting patiently well some more patient then others.

In case our crayon snorting gme loving may have missed this but shopify is having a 10 for 1 split tomorrow. I know what you are thinking...big deal it isn't my favorite stock.

Although it is true it isn't a very good stock and I don't really like shopify but I like GME and GME is having a stock dividend and shopify is having a split which is kinda similar. I desperately needed to connect shopify to GME just because of tinfoil and stock dividend and gme.

We also know that GME has a few favorite short sellers. Two that come to mind are Susquehanna international and Citadel Advisors. Do you know who the two largest put and call holders of Shopify are? If you guessed Citadel and Susquehanna you are correct. This is a screenshot from FINRA.

What kind of reported holdings do these two short sellers have for GME?

Kinda similar. They got puts and they got calls. That's all I got here. The public information is kinda similar. I don't really trust what the numbers are other than they both have some sort of interest in both stocks.

Just for reference GME short interest reported on yahoo is like 20% and Shopify is 8%

Another weird thing about shopify is its called a meme stock. For the life of me I don't really get what is a meme stock but I haven't seen anyone make a meme about shopify. It's also in the MEME ETF as one of the top holdings at around 4%. Once again why? Where are the shopify memes? How do the memes relate to the stocks? that's another tinfoil adventure for another day.

You know who is also in MEME ETF? GME. GME is in the MEME etf at a reported 3.43%.

Now for some chart foil and string ties GME's last over $200 peak was Nov 22nd 2021.

Shopify's peak was around Nov 19th 2021 so it was on the Friday before GME. GME occurred on a Monday. Let us all take a moment take off our hats and acknowledge the bag holders of Shopify...

Shopify's had a little rally begin on March 14th 2022. From 512.55 to 780. a 52% gain

GME's bottom was March 14th 2022, which began a two week rally from 78.11 to 189.59 a 142% gain. Ahh so the two of them had the same bottom and a similar top date.

This just made me have a thought. When did the MEME etf get created?

Also around a similar time, very tinfoily. I wonder if it took them some time to put the ETF together like November 2021 before it went on sale to the public in December?

What about the float. Shopify is 114.02 Million. GME is 63.37M on yahoo. So it's roughly double.

Well this is where my smooth brain ends I could draw a few strings between the two that could put a tinfoil crayon sniffing connection. Maybe this could be a good lead for the apes with wrinkles

TLDR:

-

Shopify is doing a stock split tomorrow GME is doing one soon

-

They are both shorted by similar parties with these huge amounts of both reported short and long positions.

-

They both began there decline one week from each other

-

They are both considered or labeled "Meme" stocks.

-

They both trade in the MEME ETF.

-

They both bottomed on the same day Mar 14th 2022

I know its probably nothing but what if we see something happen tomorrow or a week from now? My tits would be jacked.

Not financial advice, I just like the stock.

Enjoy the night apes, for tomorrow is another day of GME tickers and charts!

Hello! I wanted to share some of my research and analysis on Shopify after its Q4 2020 earnings report. I've also used Shopify myself for 2 years so sharing some insight on that. TLDR on the bottom.

Q4 2020 Financial Results

-

Shopify beat EPS estimates by $0.35 by generating GAAP EPS of $0.99 and beat revenue estimates by $64 million by generating $977 million in revenue

-

Shopify had a monster 2020 with annual revenue growing by an incredible 86% which in large part is due to the COVID pandemic as stores moved digital and new entrepreneurs came to the scene

-

The company’s platform showed incredible resilience and stickiness as the company continued to grow its monthly recurring revenue at an annual 49% over the past 5 years

-

Customers spent $119.6 billion dollars on Shopify platforms which is up an astonishing 96% year over year

-

Perhaps even more impressive is that the company is maintaining all this growth while improving their margins, reporting operating leverage of 39% in 2020 vs. 53% in 2019

-

This was due to the huge uptick in 2020 revenue and further proves that the company has great product-market fit + has established itself as the go-to eCommerce platform for self-starters

-

Why the Stock is Down

-

Since these numbers are so great, you may be wondering why Shopify stock fell today by ~3% (but as much as 7% intraday)

-

First, as you can see from the , Shopify had a really strong build-up towards earnings because investors were expecting a monster quarter + the stock market was just on fire

-

This is further represented by the 48.3x next twelve months sales multiple Shopify was trading at as of last Friday (- highly recommend to anyone interested in Cloud to sign up for this guy's newsletter)

-

-

The second reason Shopify stock is down is conservative guidance. The company acknowledged that its 2020 growth rate is unsustainable and stated that it expects a more “normalized pace of growth” for 2021

-

Investors probably weren’t surprised by this but since the company didn’t provide aggressive guidance, it seems many investors took profits off the table and sold shares

-

-

Third, just yesterday, Amazon completed its purchase of Australian-based Shopify competitor Selz

-

The acquisition was announced a month ago, so I don’t think this was a primary reason but I do think it is a notable factor for two reasons:

-

First, Australia is an extremely important market for Shopify, with management expressing it as a core market in the latest earnings call

-

Second, of course is just that Amazon is a terrifying competitor and may be encroaching onto Shopify’s territory

-

-

Earnings Call Highlights

-

Throughout the call, most of the discussion was about how the company’s financial metrics are all pointing upwards and how eCommerce is growing like crazy but we already covered that stuff, so I’m going to focus on two main takeaways from the call

-

The first takeaway are the four key trends management believes will shape the new Shopify era

-

The first is that consumers are voting with their wallets, meaning that people are buying products that represent their identities rather than focusing on utility

-

To take advantage of this trend, Shopify launched its mobile app SHOP last April, which is a shopping app where you can purchase from brands on the Shopify platform

-

Personally, I like the idea but I think there’s an incredible amount of competition in the shopping app space so I’m not super bullish on the app yet

-

Also, when asked for more tangible figures on the app’s performance, Tobi Lutke, Shopify’s CEO pretty much dodged the question probably because the numbers are great enough to publicize yet (which is fair since it's a pretty new product)

-

-

The second trend is that retailers are prioritizing retention and in response, Shopify is continuing to build out services that make the customer experience easier, such as Shop Pay which provides accelerated checkout and Shop Pay Installments which lets customers pay in portions instead of all at once

-

The third trend is the growing popularity of modern financial solutions

-

The company highlighted its Shopify Capital offering, which provide merchants with short term loans which they can pay back with their sales, Shopify Pay Installments, and Shopify Balance which lets merchants open business accounts

-

To me, its clear that Shopify is trying to be a one-stop shop for everything a merchant needs, which I think will help grow the company’s total addressable market

-

-

The fourth trend is the power of omnichannel, which is the ability for businesses to be on multiple platforms

-

Shopify has established partnerships with some of the best marketing channels and I believe this trend will only continue

-

-

-

The second key takeaway from the earnings call is the 3 areas the company will be investing into in 2021 and will be sources of future growth

-

The first is the Shopify Fulfillment Network which the company launched 18 months ago and is currently under beta testing

-

If you’re not familiar with fulfillment, basically it allows merchants to not have to physically manage inventory themselves and instead Shopify would have huge warehouses that store your products and ship them out when orders are received for a small fee per item

-

I think this is a great complement to Shopify’s services and think this will be a great area for future growth

-

-

The second main investment will be on the Shop App, which I mentioned a bit earlier already and am cautiously optimistic of

-

The third investment will be on international expansion, and management stated that international GMV grew at a faster pace than overall GMV

-

GMV = Gross Merchandise Volume and is basically the total $ amount spent on Shopify platforms

-

This is obviously a great sign and Shopify has such a great product that I think there is a lot of room for growth in other countries

-

-

The fourth bonus one that management tacked on was Shopify POS (point-of-sale), which competes with Square as an offline retail transaction system

-

My Personal Experience With Shopify

-

I used Shopify for ~2 years as a merchant selling clothes and have nothing but great things to say about the platform. Shopify is so much more than just a company that lets you create an eCommerce site. The services I personally also used are:

-

Shopify shipping - The company gives competitive discounted shipping rates that made it cheaper for me to fulfill myself vs. fulfillment centers (which we also used and are able to offer discounted shipping rates since they ship so many items)

-

Shopify apps - There's an app for everything and a really strong ecosystem of developers who are motivated to make good apps since they earn $$

-

Shopify POS - Before COVID, I held 2 physical pop-up shops and used Shopify's POS system. The only competitor I was considering was Square but Shopify's POS connects so well to everything I already set up on my store (i.e. inventory, pricing, etc.) that there Shopify POS was a no-brainer

-

Shopify Customer Service - This may be the best part as a budding entrepreneur. Shopify service is AMAZING and I was able to call a representative pretty much anywhere at any time for help with my site

-

Buy, Hold, or Sell?

-

I think if you're already a buyer, then there's for sure no reason to sell and I would hold for the next 5+ years.

-

But for me, I haven't yet initiated a position and while the company's valuation is high (~48X forward sales), the company's growth rate, sticky platform + recurring revenue, and dominance in a growing eCommerce market provide plenty of upside

-

Personally with interest rates having gone up and a potential shift out of tech growth stocks (just my personal opinion), Shopify is one of the stocks I'm keeping a close eye on and hoping to buy during any corrections

-

I'd love to get some opinions from you all on what you plan to do since I'm pretty torn myself on what to do

Sources

TLDR: Shopify crushed earnings growing revenue at an insane 86% from 2019-2020. But shares slightly dipped by 3% due to high investor expectations + conservative guidance for 2021. From personally using Shopify myself for 2 years + knowing the eCommerce market will only continue to grow, I think the company has a really bright future ahead. But, I'm torn given the recent stock price run-up and am trying to be patient and wait for a dip (unless convinced otherwise).

Welcome to /r/StockMarket! Our objective is to provide short and mid term trade ideas, market analysis & commentary for active traders and investors. Posts about equities, options, forex, futures, analyst upgrades & downgrades, technical and fundamental analysis, and the stock market in general are all welcome.

Industry Overview

Shopify competes in the broad e-commerce industry. Competitors include Amazon, eBay, Etsy, BigCommerce, and many other companies. Competitors are either platforms like Amazon that connects buyers and sellers or software companies that offer the same or similar services to Shopify. The e-commerce market is broad and is always expanding. It has seen tremendous growth during COVID-19 and it will likely continue growing long afterward.

E-commerce has been one of the largest trends over the past two decades as more and more consumers turn to Amazon or other online stores to buy products. This trend has only accelerated as COVID-19 has forced buyers online to buy many of their purchases.

Business Overview

Shopify was founded in 2004 by Tobias Lütke, Daniel Weinand, and Scott Lake after Lütke struggled to find competent e-commerce software to enable merchants to sell products online. Lütke, originally a computer programmer by trade, made his own software. This was the start of Shopify. The original founders eventually rebranded to Shopify after originally starting as “Snowdevil” in 2004.

Shopify provides tools for merchants (entrepreneurs, small businesses, medium businesses, and large customers) to manage storefronts. Although the traditional focus of Shopify has been to allow merchants to sell physical products online, Shopify has expanded into offering point-of-sale hardware as well as additional tools such as the Shopify Fulfillment Network, Shopify Capital, and 6 River Systems' collaborative warehouse fulfillment solutions. All these tools have been created in order to help entrepreneurs run and scale their businesses. Shopify has long term goals in place to continue to innovate and build out more services and offerings for its merchant base.

This is the primary goal of Shopify. The running slogan is that Shopify wants to “arm the rebels” and help them compete against large players like Amazon.

Shopify serves as the central nervous system for over 1 million merchants as of the end of 2019. This number has likely only increased due to the COVID-19 pandemic and the rush to buy and sell products online. Some of the tools that merchants have access to via their store dashboard are analytics, data, inventory, orders, payments, and many other tools you can think of.

Many entrepreneurs and small businesses sell courses, digital products, or other offerings through Shopify. Although Shopify might be thought of as a company that benefits strictly from selling physical goods, this is not the case. This is another interesting point about Shopify and my personal investment thesis. Shopify is benefitting from many tailwinds such as the rise of the creator economy, direct-to-consumer brands, and entrepreneurship.

Total Addressable Market

Shopify's total addressable is defined as around $78bn in their financial filings, but of course, this is only growing over time. Shopify is empowering more and more people to become entrepreneurs and make it easier for anyone to sell a product or service online. Shopify is actively expanding its total addressable market.

One of the interesting ideas about innovative companies like Shopify is that these companies expand their own market. I briefly touch on this below.

For example, previously most people were deterred from starting a business because it’s too difficult, expensive, or time-consuming. Shopify changed this. Starting an online store can be as easy as spending 1 hour and $29. Previously, starting an online business required some heavy coding expertise or lots of software to piece together all the parts of an internet business. More and more people are confident to start an online store because of the ease of using Shopify and all the tools and integrations it offers.

Shopify has the potential to expand into other adjacent markets related to online commerce. This doesn’t necessarily need to be physical products or even virtual products. Any financial transaction that occurs could one day be powered by Shopify to some extent. If it’s a business trying to build a brand or a solo entrepreneur building a paid community of like-minded people then Shopify may play a role in enabling this. To some extent, Shopify already offers some of these services mainly through the partner ecosystem and all the apps that are available.

Competitive Advantages

From a shallow dive perspective, Shopify has a good set of competitive advantages.

-

Scale

Because of its size, Shopify is able to pump more money into R&D to enable new offerings to its merchant base. Smaller competitors don’t stand a chance competing against Shopify. Shopify offers more tools through its dashboard and partner ecosystem than smaller competitors will ever have time or money to build. Merchants utilize multiple services to build a complete and functioning online store. Small startups don’t stand a chance trying to build out a shipping network, offering the equivalent of Shopify Capital, or all the integrations and apps offered through the partner ecosystem. -

Partner Ecosystem

This is one of the most interesting aspects of Shopify and it’s similar to many other platforms. This is a mini-network effect buried in Shopify. As more designers, developers, and other partners join Shopify’s partner ecosystem, more and more merchants will be attracted to the breadth of offerings of themes, apps, integrations, and more. This will in turn attract more partners, and more merchants, and so on.

This is a small network effect and isn’t terribly important in the grand scheme of things on Shopify, but it sure does keep competitors out and it attracts more merchants to use Shopify. Another benefit for Shopify is that this provides a look into the future. Shopify can see which apps are most popular among merchants and Shopify can develop tools, offerings, or simply buyout these apps from developers. Shopify did this with in 2017.

As more apps are developed on the platform and more competitors offer software tools for entrepreneurs, Shopify can jump ahead of the competition and buyout these tools or build something to compete with them. For example, if you believe that gated content will be popular in the future, there are already apps that exist on the Shopify platform to enable gated content for paid communities. Shopify can buyout these tools or build a similar offering from the inside to benefit from this trend. -

Switching Costs

Merchants don’t want to waste time switching stores, remaking whole websites, managing inventory just to save a few bucks a month. The headache involved with switching websites and storefronts is not worth the small potential cost savings of switching from Shopify to another competitor.

Merchants want to focus on their business rather than working on smaller details that will not vastly improve their business. Customers also become familiar with Shopify’s dashboard and the rest of the layout of the backend software leading to familiarity and increased productivity. The headache of switching and becoming familiar with the Shopify platform are some of the switching costs that give Shopify a sustainable competitive advantage.

Financials

Shopify has some pretty incredible financial results through the end of 2019, and the COVID-19 pandemic has only accelerated their results. These numbers are from the end of 2019, so the results during 2020 are different and may lead to a different result if you’re thinking about investing in them.

2019:

-

Total revenue = ~$1.58bn

-

Subscription solutions revenue = ~$640mn

-

Merchant solutions revenue = ~$940mn

-

GMV = ~$61.1bn

-

Gross profit = ~$870mn

2018:

-

Total revenue = ~$1.07bn

-

Subscription solutions revenue = ~$460mn

-

Merchant solutions revenue = ~$610mn

-

GMV = ~$41.1bn

-

Gross profit = ~$600mn

2017:

-

Total revenue = ~$670mn

-

Subscription solutions revenue = ~$310mn

-

Merchant solutions revenue = ~$360mn

-

GMV = ~$26.3bn

-

Gross profit = ~$380mn

There are many other aspects of Shopify’s financial information to dig into such as the differences in the cost of revenues between the software-related revenue and the merchant solutions revenue. This is just a shallow dive and if you’re interested in doing a full deep dive on Shopify, do your own due diligence and valuation work.

What’s Interesting

Shopify is one of the few companies that has been able to compete against Amazon and be successful thus far. Amazon is a behemoth of a company and typically companies don’t survive if Amazon tries to enter their industry. Shopify is an outlier.

Shopify also benefits from some interesting tailwinds such as the move for companies to sell direct-to-consumer (DTC), e-commerce, and the creator economy that I’ll now dig into more below.

DTC

Many companies are skipping the traditional method of selling by going through Amazon, Walmart, or other “middlemen” and instead relying on Facebook, Google, and other advertising in order to get out in front of customers. Selling directly to consumers has multiple benefits. First, products sold directly to consumers typically have a higher gross margin. Second, companies are able to establish a brand and a direct relationship with customers when going directly to them instead of going through a middleman.

Companies like Nike, Lululemon, and many other companies (not just clothing companies) are investing in this new revenue line in order to grow profit margins. Shopify “arms the rebels” by enabling companies to establish their own brand instead of simply selling a product on Amazon where consumers might just be comparing the cheapest option.

E-Commerce

Everyone knows e-commerce is growing and it’s not even a majority of the total GMV sold in the world. COVID-19 has accelerated e-commerce by a decade.

Creator Economy

As more entrepreneurs look to create physical products, digital products, or facilitate transactions online, Shopify will serve as the foundation for many of these people. Whether it’s YouTube personalities creating merchandise or people on Twitter creating courses, communities, or gated content, Shopify will help to power many of these transactions. Shopify has the ability to empower these creators and collect a small portion of revenue based on their success.

Future Questions

-

Valuation?

Shopify has seen tremendous growth during the COVID-19 pandemic and its stock price has risen above $1,000. More work is needed to understand the long-term potential of Shopify and whether the current price gives investors a fair rate of return over the next 3-5 years. I think Shopify has many potential tailwinds but valuation may be a concern to some investors. -

10x potential?

Shopify has a market cap of ~$144bn which makes it one of the largest tech companies. If you’re looking for 10x potential like I am, Shopify may not be the best company for you, but I do think it has the potential to grow. Shopify is still growing revenue at a fast rate and there seems to be a long runway of growth ahead of it.

There are only 4 companies that are above $1tn in market cap (Microsoft, Google, Apple, and Amazon). These are the largest companies in the world and it’s difficult to say that any company will be above $1tn, but I do think Shopify has this potential if they continue to empower entrepreneurs, small businesses, and all other businesses in the world.

Conclusion

Shopify is an innovative and interesting company that I believe has a long runway of growth and lots of future potential. Shopify has room to expand into other areas to help empower entrepreneurs and small businesses.

Fun Facts

Shopify refers to its people and partners as Shopifolk.

If you're reading this, I hope you've enjoyed it!

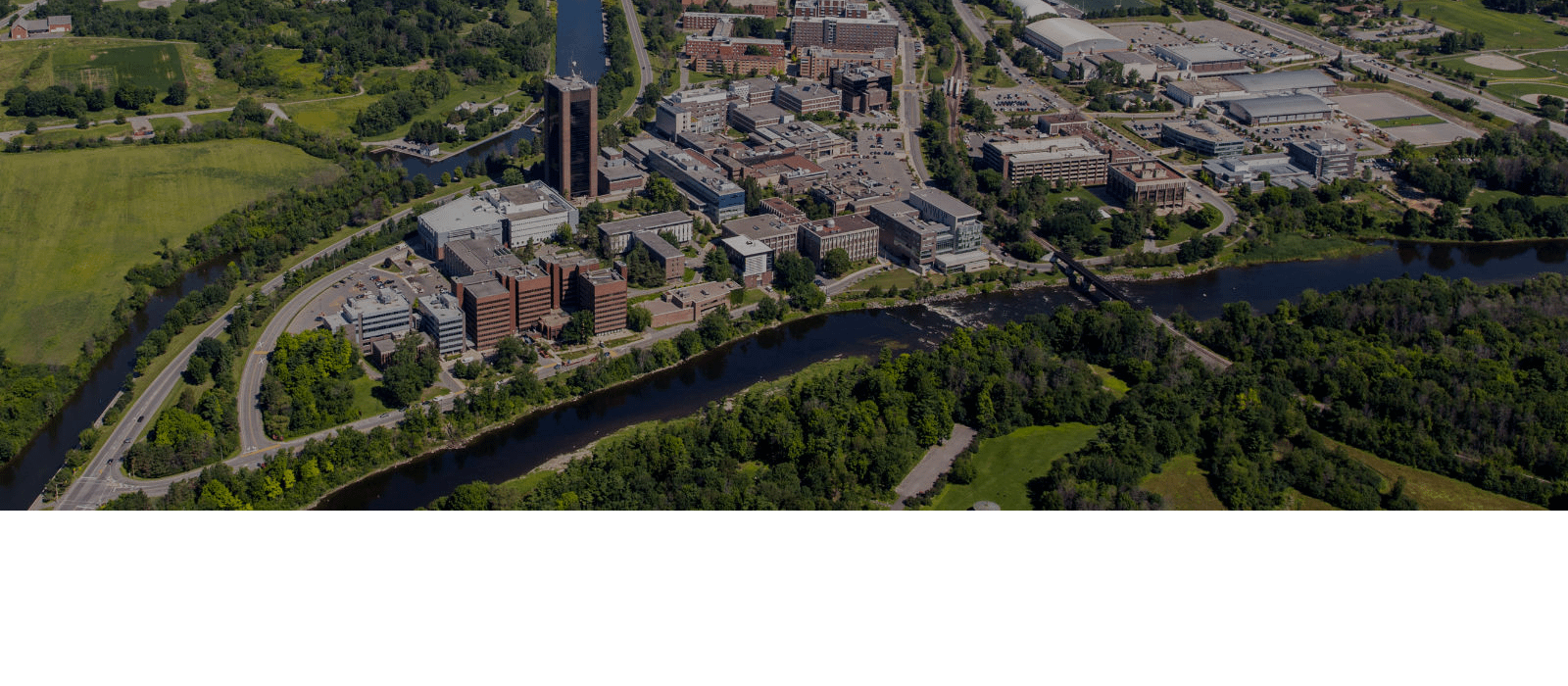

Carleton University. Canada's Capital University. The best University in Ottawa, Ontario.

Hey all,

Recently I have been working remotely and thinking more and more about the atmosphere at Shopify, where I currently work as a software developer. I started here as an intern, not long ago, and went on to gain a full time offer after multiple internships. However, I wanted to shed some light on what may otherwise go unnoticed here.

In general, Shopify does have a lot of noticeable employee firings. In the last few years, many senior employees and executives have been fired, but also many junior employees. As well, many employees, both senior and junior, have left because of this atmosphere or related circumstances. 2018 was an intense year as there was a hiring freeze, and recruiters were told to slow down and at times halt hiring. During this time, many were also fired. The SVP of Data and Analytics at the time, who came to us from Netflix was not around long, and was quickly terminated from their position. Soon after the General Manager of Money, the department that handled Shopify Payments, Capital, and more, was let go. A senior accountant who assisted in the company reaching its IPO efforts was also let go. Soon after that, the Director of Engineering (or internally known as Director of Getting Shit Done), and someone who was directly asked to join Shopify by our now CTO, Jean-Michel Lemieux (JML), and worked directly with JML in a previous job, was let go, by JML. This was a challenge as people disagreed with the director's management efforts, but have since greatly disagreed with JML becoming CTO, as he has gradually lost control of his teams, and gradually gained a larger ego through his position. Also at this time the new/recent lead of the Dev Degree Program was terminated. Shopify held a town hall meeting, our weekly meeting in which executives address the company, or new announcements are made that are relevant to the company as a whole, soon after. In this meeting, many employees asked about job security, and why there were so many firings happening. Of course, not much information was provided, though the company's motto is "default to open". The students in Dev Degree were also in a bit of a tough spot at this point too, though the original first cohort was very used to the chaos at this point. They were also brought into a meeting of their own, which apparently was of similar amounts of help to them.

So, as many now know, Shopify started the about 4 years ago as an experiential learning program with the schtick that they pay you and pay your tuition during school. Super cool right? Well, I knew many of the first students in this program, and even acted as a mentor for this program. It kind of went up in flames quickly and the fire has not yet been put out. The unfortunate part is the , without letting them know the complete health of the program. During the first little while of this program, 11 students were brought in. One of them was more or less directly asked to join by the CEO of Shopify, Tobi Lutke, at least based on what they said. This was believable considering they had also been brought into Shopify in high school after cold emailing Tobi. In the first little while of the program, I heard the stresses from the students were mainly oriented around management. The original managers of the program consecutively went on parental leave, as they should, but temporary management was low priority. A temporary manager was brought in, who for the most part, was constantly at odds with the students. From my mentee, and her colleagues, this manager acted opposite to Shopify's culture. At one point, a student had asked for leave to visit her parent for health reasons, which the manager responded with by asking for double the time worked. This all the while normal Shopify employees were entitled to unlimited vacation, provided a discussion with managers. The original team lead of the program had been provided feedback by the Director of Getting Shit Done, based on much of the current uproar at the time by students to colleagues. Her response (or reaction), was not provided to the students, but was written on her blog, which the students individually discovered and shared. The blog post was titled "". Soon after this was when the original team lead left on parental leave. Understandably, students expressed their worries regarding this reaction, as well as the change in management without proper explanation. I was hearing much of this second-hand, while also seeing much of it myself in what were the "Dev Degree Mentor" meetings. Originally, this program was slated to begin a year after its actual launch, but was rush-launched in an effort to just get it out there. The discovery of unpreparedness was clear immediately, yet the team, and new manager quickly worked to bring more cohorts of students in without the success of a first cohort. In this time, many issues arose.

The aforementioned student asked to join Shopify by the CEO, was one of the many original students who began understandably challenging the route of the program they had signed up for, which would change without their knowledge. The new manager had quickly changed the style of learning, and provided students with only 4 months of training out of high school, expecting this to serve them fully on professional software development teams. One student, a friend of my mentee's, had reported their first software development team lead saying "the Dev Degree students should go back to high school if they need more hand holding". The student asked to join Shopify by Tobi, was the first of many let go, without a contingency plan in place to bridge them into the university's normal computer science program, essentially leaving them with no place to go, a sudden loss of income, loss of tuition payments, and loss of community among many other things. Students continuously brought up struggles in keeping up with the little amount of training provided, and still do. The first cohort was left to continue forward, while the new manager worked on creating a team to bring in new cohorts and "fix forward", only with real people as the product. New cohorts are provided with at least one academic year's worth of training. The thing is, they lost what was easily one of the brightest minds in the company, if not the world. That student now runs an app and company he co-founded with a friend, used by the masses and endorsed by celebrities. Students signed offers for 25 hours of work, but were generally only recognized by teams and the program manager if at work full time, while managing a full course load at school. One instance in particular stood out when an original cohort member was denied a raise while he was putting in some of the best work seen in a student, while a new cohort member, who had never worked on a software development team nor was, was provided a raise. Additionally, the new program manager began developing an effort to remove reading weeks from students, citing the fact that they were provided with 10 days vacation and should not need reading weeks as additional paid vacation. However, to stay in this program, students must hit a specific high GPA, which was at many times, only possible with the reading weeks used to catch up after putting in more hours than required-on-paper at work by many of them. This in combination with their colleagues getting any amount of vacation.

During the entry of new cohorts of students, the program manager raised the need for students to come up with projects to work on web development skills in an effort to prepare and continue training them for development teams. It was mentioned that the program was in need of a website, with some students suggesting this be built as a group project, splitting work up and working in a similar style to Shopify development teams. To me, this seemed completely logical! Why not do this in preparation for team work? The program manager did not respond and later outsourced the development of a... website... at a... highly skilled web development company... to . The first iteration of the website, which was only recently changed to the current one previously linked, failed Web Content Accessibility Guidelines (WCAG) standards, outrageously falling out of line with our own web development guidelines, as well as other usability issues. We continuously work towards improving our accessibility while always ensuring Shopify's own content is produced in an accessible manner for both hiring and customers. The issues surrounding the Dev Degree website were raised numerous times with no changes.

The contracts for the first cohort of students underwent renewal in the summer of 2018, where students had raised a number of issues and questions. One student, also a mother, was told to sign it or leave, in basic terms. I'm told she quit, after considering what would leave her happier and more stable. Two months or so later, another student was let go from the program after raising issues regarding the present and future plans for the program. It was said to be without cause, but to refer back to conversations with the program manager, as was the termination of the student brought in by the CEO. About a week after this, the new program manager was terminated from her role. Weeks later, two more students were terminated from their roles.

After all of this, one of the students told me Shopify had mistakingly sent upwards of at least 25k dollars to their accounts as payments for tuition. Of course, many students thought this was part of a severance. However, the issue was raised on worry of the amount coming back to bite the students, causing money to be unexpectedly owed. Without explanation on the appearance of the money in accounts, the money disappeared from student accounts days later.

Originally, students were only able to join the Dev Degree program at the start of an academic year. After losing many students, a new student was hired mid-semester, in what may have been an effort to increase success vs. failure rates.

This program does not guarantee you a position on a software development team. The cohort that just graduated contains students that have not been offered jobs at Shopify, while the Dev Degree team did not offer them mentorship in what may help them gain one recently. Some students abandoning those frustrations sought out completely independent internships at Shopify without the Dev Degree team and succeeded, only representing the weak connection the Dev Degree team has to Shopify as a company, though they work as a team within it.

Shopify has grown to an enormous size, and has shown it both through its monetary value and internal treatment of employees. Additional employees have since left, quit, or have been suggested to quit after disagreeing with management practices. Some have been let go through disagreeing with managers . In the past, it has been explained that one big reason we are provided lunch is because generally, employees at companies that do not provide lunch, spend 1 - 1.5 hours on lunch, whereas those at Shopify spend around 45 mins at lunch providing them with that much more time to focus on work. This could be viewed as good or bad really. One of the first hires at the Toronto office was extremely frustrated with the work environment, as well as their manager, leading to them quitting around the time of their stock options vesting. They were denied the options, which were likely going towards their child, as they were a single parent. Shopify acquired a company called Kit years ago. The founder, and now directory of Kit once posted on social media that they would provide anyone who refers a friend to a Shopify job that is successfully hired, with a sum of money. That sum of money was equal to the amount Shopify provides to all employees for referring anyone to Shopify. Of course, the affiliate link was also posted. In this attempt to look generous, it is worth considering the same director purchased a white gold Rolex GMT Master II for his infant son, valued over tens of thousands of dollars. Additionally, a highly known and respected director of engineering for the Core team at Shopify (the most important team), quit due to disagreeing with the management practices of the now CTO, JML.

The point of this post is to provide you with an internal view of Shopify's management, in an "open by default" effort as we say here. Please use this when deciding on internship and job opportunities, and hopefully things will get better.

I do enjoy my role as a software developer, but can 100% say I am considering joining the others in quitting.

Reddit community for TheFinanceNewsletter.com and its 70,000 readers to debate finance, investing, financial news, personal finance, real estate, stocks and crypto. Upvotes & Downvotes control this community!

Shopify had a crazy stock-price movement in the last 2 years, went from roughly $350 prior to the pandemic, to almost $1,800 (almost 5x) at its peak, and is now down to $364 (80% down).

The goal of this post is to share my fundamental analysis and valuation of this highly volatile company. Feel free to provide your feedback and disagree with me :)

At the peak, the market cap was over $220b, let's keep that number in mind. Today, it's around $46b. Let's get started!

What is Shopify?

In one sentence, it is an eCommerce website builder that takes care of the infrastructure and provides additional services/solutions (payment processing, marketing, analytics, inventory & fulfillment, etc.). It allows setting up and operating a business online easier.

How does Shopify make money?

The revenue is split into two groups:

-

Subscription revenue - This is self-explanatory, and refers to the monthly recurring revenue that Shopify gets from the individuals/businesses that use their platform. This stream of revenue doesn't depend on the success of the users. Regardless if a company sells 1 product or a million, the subscription revenue is fixed. In my view, this is the less-risky stream as they'd only lose customers if they switch to another platform (not that likely) or a business goes bankrupt. Historically, this stream grew 50% year-over-year, now almost $1.4b for the last twelve months (ending Q1/2022). This is also a high-margin business, with a gross margin of 80%.

2. Merchant solutions - This is the segment that takes all of the other revenue and is highly dependent on the success of the individuals and businesses that use the platform. Payment processing fees, currency conversion, referrals, advertising, etc, all of that is included here. If there's a slowdown in the economy and the eCommerce business decreases, this stream of Shopify would be harmed. In the last years, it grew roughly 75% year-over-year to almost $3.5b in the last twelve months. The gross margin in this segment is lower (43%).

The overall gross margin has been decreasing and if we only look at that in isolation, the conclusion would be that something bad is going on and Shopify cannot keep its margins at the same level. This is not correct. The reason for the margin decline is only due to the fact that the lower-margin revenue stream (Merchant solutions) is growing faster than the higher-margin revenue stream (Subscription-based). Hence, the gross margin naturally moves closer to the stream that contributes more.

So, the total revenue is close to $5b. If we put this next to the market cap at its peak of $220b, it seems quite unreasonable for anyone to pay such a huge premium. Yes, the company has been growing at high rates, but the growth cannot continue at that pace forever. The moment the growth declines, that's where the problems start and a correction comes in, so it's always wise to incorporate this growth decline in the model and not assume growth of 50-60% for a very long period of time.

The overall gross margin is at 53% for the last 12 months and it is expected to drop even further. Let's keep it simple and assume that it will decrease to 50%.

Operating expenses

With the remaining 50%, Shopify needs to cover 3 main expenses to get to the operating result.

-

Sales & marketing - Decreased from 34% of revenue (2017) to 21% in LTM.

-

R&D - Remains stable at around 20% of revenue in the last 5 years

-

G&A - Remains stable at around 10% of revenue in the last 5 years

By subtracting these 3 costs, we get to an operating profit of 1%. So, a company with revenue below $5b and no operating profit, was selling for $220b. That sound quite irrational. Of course, there are a couple of other factors to consider.

Every growth company puts as much effort as possible into growing quickly. For Shopify, that's mainly in Sales & Marketing and R&D. The more potential customers they can reach, the faster they can grow. The more they can innovate, the more services they can provide. However, as the growth slows down, these costs as % of revenue decrease. The marketing won't yield the same returns as before, simply because the # of potential customers decreases. All of this will lead to margin expansion.

Balance sheet

There are a couple of main points to mention:

-

Shopify is a capital-light business that doesn't need to invest in tangible assets in significant amounts.

-

They have a strong cash position ($7.2b in cash & short term investments + $2.9b in long-term investments)

-

The debt is at a very low level, roughly $1.2b (insignificant compared to their $10b cash/investments). It could be argued that they didn't use the low-interest rates to increase their financial leverage.

Recently, Shopify announced the acquisition of Deliverr for $2.1b, a company that will add value in their process of inventory inbounding and distribution. The aim is to offer delivery to the customer within 2 days of ordering (Competitive with Amazon Prime). This is not yet paid, so needs to be deducted when valuing Shopify as a company)

DCF model

Key assumptions:

-

Revenue growth: 25% for the next 5 years, then slowly decrease to the risk-free rate of almost 3%.

-

Operating profit: Slowly improve to 25% (Basically, the 3 types of expenses mentioned above, combined, should decrease to 25% of revenue over the next 10 years)

-

Discount rate - 11.7% (Based on WACC)

Outcome: Value per share - $276/share (current market price - $364)

My assumptions are based on what I think Shopify can deliver with high probability. Could be I be wrong? Absolutely!

What if I'm wrong?

Based on my assumptions, the revenue will grow by 426% in 10 years and the operating margin is estimated at 25%. However, I could be significantly wrong. Therefore, the table below provides a valuation of the company based on assumptions different than mine related to the revenue 10 years from now and the operating margin.

| Revenue / Op. margin | 20% | 25% | 30% |

|---|---|---|---|

| 300% ($19.0b) | $190.1 | $229.3 | $269.1 |

| 426% ($24.4b) | $226.8 | $275.8 | $326.4 |

| 1000% ($51.0b) | $400.3 | $500.5 | $601.0 |

| 3350% (159.9b) | $1,089.9 | $1,388.4 | $1,687.0 |

Based on your assumptions about the revenue growth and margin expansion of Shopify, you can decide whether the company is expensive or not at this price.

The last row is only for illustration of how irrational the market was in the last year when the price went up to almost $1800. Basically, to justify that valuation, the company would need to grow the revenue by around 50% every year for the next decade and at the same time improve its operating margin to 30%. So, starting with the gross profit being around 50%, the Sales & Marketing, R&D, and G&A together, should be 20% of sales.

Feel free to add your insights into Shopify and add value to the analysis. Feedback (both positive and negative) is always welcomed :)

This sub is not for advertisements! Questions and answers about starting, owning, and growing a small business only.

I want to make my dream a reality, after living 20 years and going into the medical field thinking I'd be happy didn't really work. I want to own a buisness where I make shirts, custom shoes, canvases, jewerly, etc and I already have a few pieces and collections in mind but where do I start. What would be the things I need to start or wholesale websites I could use for clothing and shoes?

Value investing in all its forms - From Graham & Dodd, to Buffett & Munger, to their philosophical descendants today

I have seen Shopify come up a few times, but to me Shopify is not a value stock, underpriced nor does it have a margin of safety, and even with the recent drop they have doubled since pre covid.

Not sure why it is being mentioned here at all? Their earning definitely don't justify a $100billion+ market cap and I don't really see what their moat is (if they have one) when there are other companies like Wix and Weebly for example.

Just because something has large price drop doesn't make it good value.

A community about affiliate marketing, search engine optimization and related topics. Learn what works, what doesn’t and what’s new through real experiences from both beginners and experts. We welcome and encourage posts from anyone, but please review our rules before posting.

Disclaimer: My site is very small and I don't purport this to be a gamechanger for, well, anyone. I just wanted to share something that is seeming to work well for me.

I started my niche site in 2018 -- it is focused around a particular type of vehicle that has a hobbyist following. Initially the site was monetized through a combination of Google Adsense and the Amazon Associates program. At some point, I started trying to diversify the income as much as possible. For me, this meant adding the eBay Partner Network for some items and applying for Ezoic as soon as I met the requirements.

I also experimented with some small affiliate programs but didn't have much success -- I had to get very creative to find them as most of the stores I really wanted to refer sales for did not offer an affiliate program. I reached out to them multiple times seeing if there was something we could arrange. I even offered to just sell display ads to them, but no dice. The result was signing up for a couple small affiliate programs with low commissions and low sales volume proructs. This frustration was the start of my desire to curate my own store of products I genuinely want to sell.

Shopify and subdomaining

I use Shopify to host my online store. I am a software engineer by profession so I generally don't consider ease-of-use and setup to be the most important factors when choosing software -- I just want whatever is the most effective. There are other options like WooCommerce that I have heard great things about.

However, for me, Shopify is almost magically easy to use and offers everything I have needed or wanted so far. Following Warren Buffet's advice to "buy what you like" I actually bought as much stock in the company as I could after using it for a month. Everything just works exactly how I expect it to. I have never struggled to find any answers or documentation about anything. The support is phenomenal.

It's just a great product -- to me I think they could be a bigger company then Amazon in a few years because it allows anyone to create to sell online and maintain a lot of control, something retailers lose with Amazon. I signed up for the Shopify affiliate program because I want to refer people to it, not to refer people to it. I helped my cousin set one up for his beef jerky business and it took 20 minutes before he was online and it has been a gamechanger. The small independent grocery store across the street from me is surviving (probably thriving) through COVID-19 because they allow online orders through Shopify and window pickup. But most importantly, it's great to get the little notification when you make a sale, especially when the margins are so much higher than affiliate, but I'll get to that later.

For me, I used a shop.mydomain.com subdomain for my Shopify site. It's great because there are no conflicts with your Wordpress site and it's a very clean looking link. Shopify has some on this if you would like to try it.

Profit Margins

Selling items yourself is great mainly because you get to choose and experiment with your profit margins. Want to experiment with razor-thin margins because you know your visitors will shop around a lot? Try it. Want to raise the price so any one sale is $80 in profit but you don't have to pack and ship as much? Might work, try it! Between Google Analytics and Shopify's analytics stats, you can measure anything you need to.

Here's a concrete example of one item from my site. I sell a particular type of spark plug that is used on a vehicle that my site is partly focused on. This is an item I have sold/referred in one way or another since the beginning of my site in 2018:

-

Amazon Associates commission: $0.84 (before commission slashing!)

-

Average Amazon Associates sales/month: 3

-

Shopify profit margin: $14.06

-

Average sales/month: 4

This is a small item that is extremely easy to buy in bulk and pack/ship quickly.

I actually averaged more clicks to this item when the destination was Amazon, so my conversion rate actually went up when I moved away from Amazon. I charge a few dollars more than Amazon and many other online retailers for this item. I could probably do some experimenting to find the optimal price/sales ratio, but I think those numbers speak for themselves.

One of my early fears was that the trust people have for Amazon and their affinity towards Prime is hard to challenge, but my opinion is that the trust you gain by writing well-researched, meaningful articles and being an active participant in the niche you serve makes people want to support you.

Dropshipping

Dropshipping has negative connotations because of the bastardized "buy cheap small items from overseas and make 4000% profit while the user doesn't know that the item wont arrive for 2 months" format that is shown by YouTube influencers and the like. However, dropshipping is simply collecting a sale yourself while having an underlying price agreement with a supplier who will pack and ship the item for you. The first item I sold through my Shopify store I actually sold on a dropshipping basis.

This was a line of products within the $200-300 price range, and I also sold these through the Amazon Associates program before. It was nice to make $10-17 for one sale, but I felt like I should be making more. I called the company that produces this item and asked to buy 3 or 4 to sell myself, but he suggested dropshipping instead which I was interested in as these items are rather large. I agreed to buy the items for around $160-200 and now I profit around $60 per sale -- the only effort required on my end is sending an email (gave them a card to have on file) and adding the tracking number to Shopify when it is available. The credit card points are nice too!

One other thing about this that I think is important -- It's really nice to have personal relationships that this kind of business offers. The guy that answered the phone was the owner of the small business and he's the nicest guy, great to deal with and it feels good to get him some sales, especially during a crisis like this. I actually met up with him at an industry event and we talked for a long time. He's an older guy and at some point I want to get him setup with a better online presence especially as he sells a lot of other products over the phone that I can't necessarily refer in my niche, but could definitely benefit from a real online store and web presence. I am building similar relationships with other suppliers and personally I love it.

Item Selection

If you go the route of stocking and shipping items yourself, the scope of products you can monetize through your site broadens drastically. For me, there was always a certain type of item that I wanted to sell, but I could never find a good version of this item on Amazon or anywhere that offered an affiliate program. This was actually one of the retailers I reached out to asking for an affiliate program to no avail. Then I asked for a dropshipping agreement -- the answer was still no. However, it's a lot easier when you ask to buy 50x of one item. They processed my distributor account in a day and had my items to me by the end of the week. It is now my best selling item!

Shipping Logistics and Tools

One of the things that I think could be a dealbreaker for people is something I personally really enjoy -- stocking, packing, and shipping items. My inventory is small enough to fit in a walk-in closet in my apartment. I love the process of getting the Shopfiy "ca-ching" notification, packing the order, and dropping it off at the mailbox. Here are some tools I have used to make this process more efficient:

-

Label printer: I initially bought the cheapest option on Amazon. This was a mistake. That thing was absolute garbage. Then I bought a Brother QL-1100 and I love it. It's nearly $200 but worth every penny. The driver worked immediately, a stark contrast to the earlier printer. Prints quickly in very high quality. You can get away with using a regular printer, cutting out the label, and taping it on your package, but the presentation value is much better with a good label printer.

-

Standard printer: Use for leaving a packing slip, order receipt, etc.

-

Computer: Definitely not important, but I like to have a dedicated laptop for my "ship station" right next to my label printer and regular printer.

Here is part of my dedicated "ship-station" where I manage my store and print labels/packing slips.

I would probably wait to receive the items you're selling before selecting the packaging you're going to use. That way you can take exact measurements and consider alternative sizes/types of packages. One of my items is a collection of smaller items. I throw away the box that my supplier ships it in, and put it in a bag that goes inside my small mailer box. I use a particular size of bubble wrap which was also specifically chosen to protect the item, while also taking up all of the surrounding space. It's much easier to make all of these choices when you have the item in front of you.

Here's the previously mentioned item (spark plugs) in the box I chose (bubble wrap not shown!) There is no wasted space when it is packed.

For me, I use USPS for nearly all of my orders. It's usually the cheapest option and very fast for the size of item I have. I live in an apartment complex and I can just drop my packages in the mailroom and they get picked up daily. Shopify will show you all of the available shipping options with speed and price. For international orders, it's only a few dollars more, and I think it goes from USPS and gets picked up by DHL.

Item Presentation

Another benefit of this approach is that you have infinitely more opportunity to make a good impression on your customers which is huge if your items are the kind that might be reordered, or if the customer may be interested in other items you sell. For me, item presentation is also important because as I said, I am operating out of a spare closet in my apartment, so I want to look as professional as possible.

Here are some ways you can do this:

-

Light box: You definitely don't want to just pick pictures from Google Images. Take your own pictures. I bought a decent sized light box from Amazon for around $70 and it makes a massive difference. I would link it here but it seems like it's no longer available. I have an iPhone SE which is worlds away from most good cameras these days, but with the light box my pictures look extremely professional. This is not an item I sell (it's my beard comb) but I did a of using the light box vs. my initial approach: using printer paper with an overhead lamp.

-

Custom packaging: As discussed before, get your measurements and then choose the package you want to ship in. For me, I wanted to have some custom packaging with my logo on it. I didn't buy in huge bulk so it cost me about $3 per mailer box for the first order of packaging. It's a lot when my margins are mostly $20-40, but to me it is important. For companies to consider, I strongly recommend UPrinting or Packwire.

-

EDIT: I originally noted issues I had with Packwire here but Phil from Packwire spotted it and he is sending me a new shipment free of charge that we expect will solve the issue I had. Thank you Phil! Based on this experience alone I would recommend trying them out if you need custom packages.

-

-

Packing slips/notes: All of my orders contain a thank you note to the customer with my name and email. I thank them for the order and ask them to reach out if they have any questions or concerns. I also ask them to reach out if there's any item they would be interested in that they do not currently see on my store. I haven't had any responses recommending products customers would be interested in, but I did have one customer ask about using the item. I sent him my number and he gave me a call and I explained everything to him. I think my store will be his first stop if he ever needs anything else.

-