Cutting UI early hurt job growth

Employers, right-wing politicians, and the pundits who speak for them have been claiming that the expansion of unemployment insurance (UI) benefits to counter covid woes was hurting job growth. By making it possible to refuse crappy jobs, or maybe even not to work at all, that sort of public sector generosity was making the working class too picky. They’re a lazy lot, you know, and need a good kick in the ass to get them to perform their class duty of laboring for the boss.

Problem is there’s just no evidence that expanded UI benefits hurt job growth. They ended nationwide on September 6, and job growth last month was the weakest of the year—just 194,000, almost half a million below the average of the previous six months.

Comparing job growth in states that cut benefits before the federal deadline with those that didn’t underscores the point. State employment data isn’t released until two weeks after the national data, so we won’t have September data until October 22. But the data through August is revealing.

Graphed below are rates of job growth in August and for the previous three months for cutters (states who cut expanded benefits before the federal termination) vs. non-cutters (those that didn’t). Cutters are divided into those who cut early, before June 26, and those that cut later. The roster is at the bottom of this page.

As the graph shows, non-cutters saw faster job growth than cutters for both August and the three months preceding. In August, national employment grew 0.20%. Among cutters, it grew 0.12%; among non-cutters, 0.25% (These are based on totals of each of the categories, no simple averages of state growth rates.) Within the cutters, the early birds actually saw a small loss of jobs, 0.04%. The April–July figures tell a similar story, with cutters (0.45%) lagging non-cutters (0.61%), and the early cutters (0.29%) doing worse than those later to the cruel game (0.49%).

A look at the roster of cutters below shows that many of the states were covid hotspots over the summer. And there’s a big disparity in vaccination rates: cutters have an average vaccination rate of 50% (early: 48%, late: 51%) compared with 60% among non-cutters. Maybe covid is more of a problem than generous income supports.

Also, there’s no good reason for the feds to have ended expanded benefits. They’ve helped millions cope with a still-broken job market. But it was an additional stroke of cruelty to cut them before the Washington did. I was going to call it pointless cruelty, but cruelty was the point.

Early cutters Alabama, Alaska, Idaho, Indiana, Iowa, Mississippi, Missouri, Nebraska, New Hampshire, North Dakota, West Virginia, Wyoming.

Late cutters Arizona, Arkansas, Florida, Georgia, Louisiana, Maryland, Montana, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Utah.

Fresh audio product

Just added to my radio archive (click on date for link):

October 7, 2021 Nancy MacLean, author of this paper, on how Milton Friedman’s war on public education fit nicely with Southern massive resistance to desegregation • Klaus Jacob, a geophysicist, on how we can live with rising seas and heavier rains

Fresh audio product

Just added to my radio archive (click on date for link):

September 23, 2021 Algernon Austin on the plight of black men in the job market (with an excerpt from a 2005 BtN interview with Devah Pager on discrimination) • Susie Bright on pegging the patriarchy

Corporate tax deadbeats

Biden and Congressional Democrats are talking about raising the corporate tax rate. The latest proposal looks to be boosting it from 21.0% to 26.5%, marked down from the 28.0% level that the administration circulated in April. While that would be a step in the right direction, it only begins to address the seven-decade erosion in what business pays.

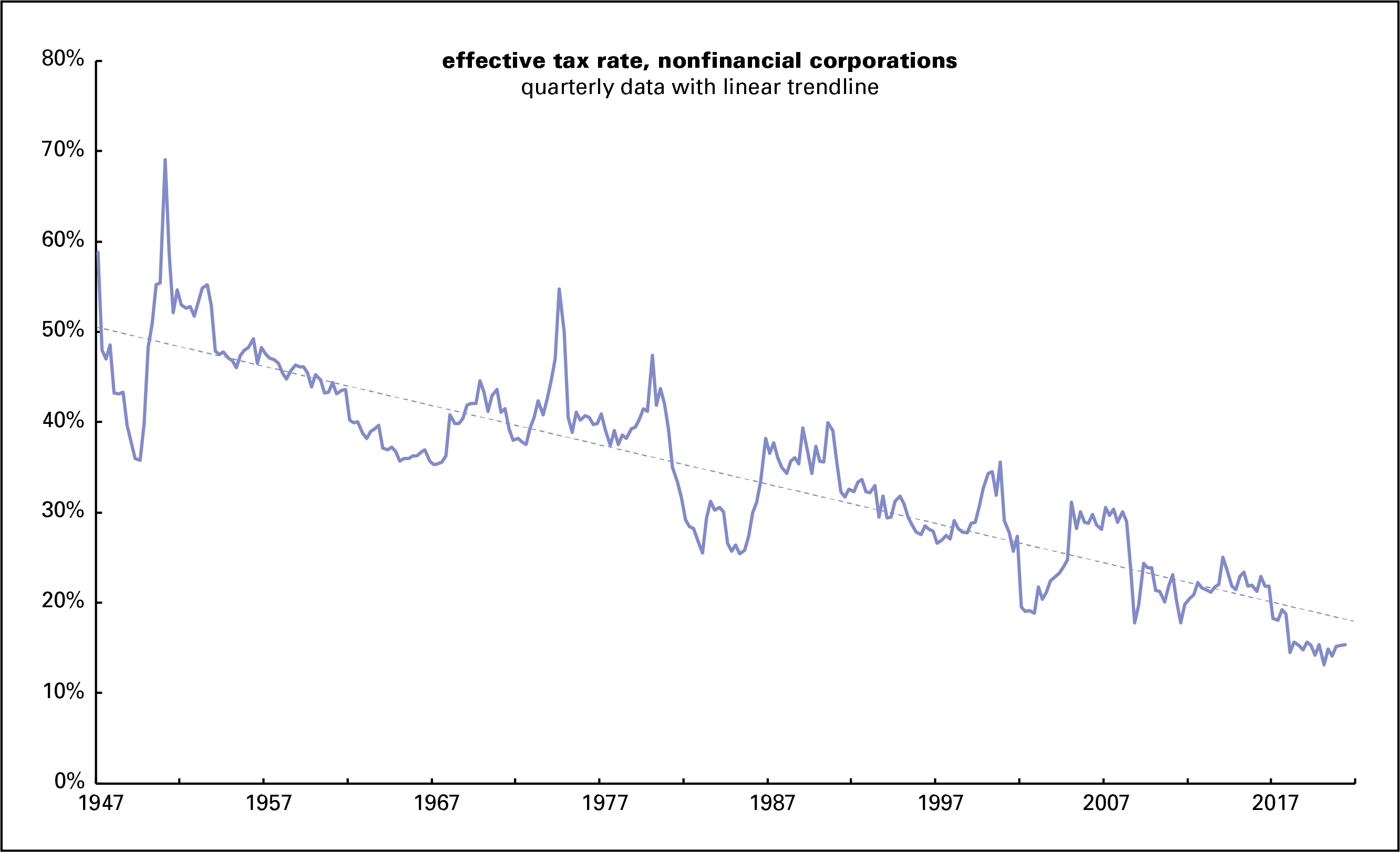

Graphed below is the effective tax rate for nonfinancial corporations, drawn from the national income accounts. “Effective” means the rate actually paid—taxes paid divided by profits—not the rate on the books before clever lawyers and accountants do their evasive magic.

In the 1950s, firms turned over about 50% of their profits to federal, state, and local tax authorities. That fell to 40% in the 1960s and 1970s. The Reagan revolution took the rate down to near-25% in the mid-1980s. It rose a bit off those lows, but began declining again, hitting a post-World War II low of 15% following the Trump tax cuts of 2017. Yet Corporate America is whining about the possibility of taking the rate back to where it was roughly ten years ago, when capital was hardly suffering from confiscatory taxation.

Lobbyists and publicists claim that cutting corporate taxes spurs investment, and with it innovation and employment. In fact, investment has been declining at a rate similar to the tax rate. Graphed below is net private fixed investment—net, that is, of depreciation, an estimate of the effects of wear and obsolescence on the existing capital stock. If new investment is only keeping up with the rot of the old, net investment would be 0. We’ve been doing somewhat better than that, but not much.

The two lines of the graph show total investment in buildings, machinery, and intellectual property (IP) as a percent of GDP, and that with IP taken out. A lot of IP consists of pointless patents designed to maximize economically pointless things like brand value and to limit competition from new entrants, so it’s not obvious how much of an economic good IP investment really is. Note that both lines have traced a steady downtrend. There were strong bursts of investment in the 1960s and late 1970s, and a less dramatic rise in the late 1990s—but it’s been mostly downhill since. Recent peaks around 2015 and 2018 are in the same neighborhood as the recession-induced lows of the mid-1970s and early 2000s. So far this year, net business investment is 1.5% of GDP, up from the pandemic-induced low of 1.2% last year, but still one of the lowest on record. It means that corporations are barely keeping ahead of decay.

It’s not like firms are short of cash; there’s no evidence of a declining rate of profit in the national income accounts. It’s just that corporate managers would rather stuff their shareholders’ pockets with cash rather than investing in buildings and machines. They’ve spent $8.6 trillion on buying their own stock to boost its price since 2000, well over half of it since 2012. Add to that $6.0 trillion in traditional dividends and we’re talking some serious money—almost $15 trillion since 2000. That’s over twice what the entire corporate sector has paid in taxes over the same period. How nice for their shareholders and their top execs, who are largely paid in stock now. It’s not so nice for the rest of us though.

Fresh audio product

Just added to my radio archive (click on date for link):

September 16, 2021 Dave Zirin, author of The Kaepernick Effect, on how taking a knee spread across the country (and why leftists shouldn’t hate sports) • Dwayne Monroe, cloud data architect and author of this piece, disassembles the hype around artificial intelligence

Fresh audio product

Just added to my radio archive (click on date for link):

September 9, 2021 Clyde Barrow on how Texas, a diverse, urbanized, sophisticated state, is run by a bunch of reactionary white would-be cowboys • Anatol Lieven, author of this article, on the US–China rivalry and the meaning of the US withdrawal from Afghanistan

Work from home: mostly for the high end

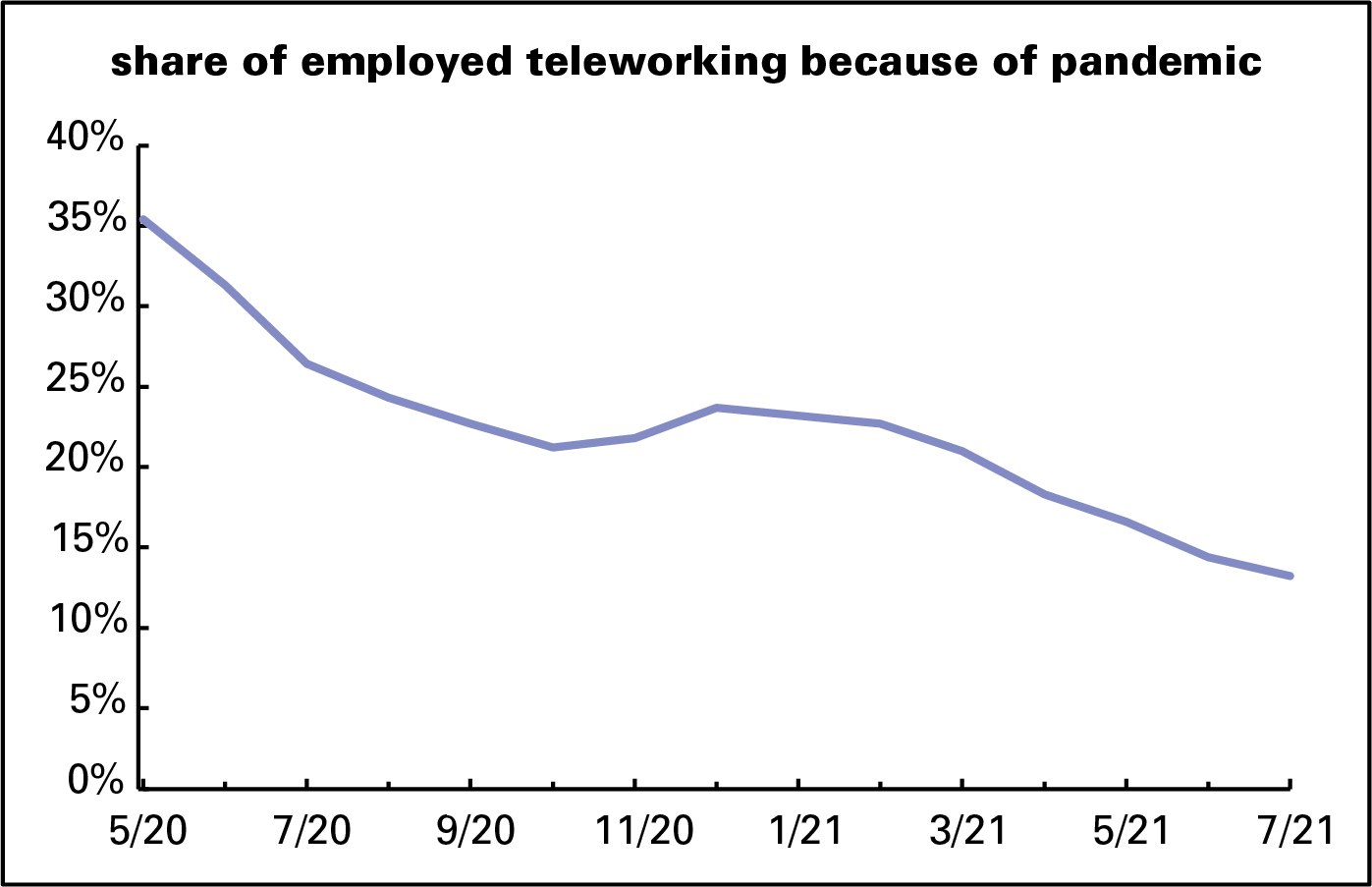

Judging from the media coverage of the work from home (WFH) phenomenon, you’d think it’s become near universal. It’s not. In July, only about one in eight workers were teleworking—the Bureau of Labor Statistics’ (BLS) preferred term—and those are heavily concentrated in a few sectors and occupations, and among the highly credentialed.

According to BLS stats, in July 2021, just 13% of workers are doing so remotely because of the pandemic, down from 35% in May 2020, the first month the numbers were collected. (See graph below.) And that initial 35% number was inflated by the fact that so many workers who couldn’t work from home, like those in retail and hospitality, had been laid off. Since that peak, the share has declined in twelve of the subsequent fourteen months.

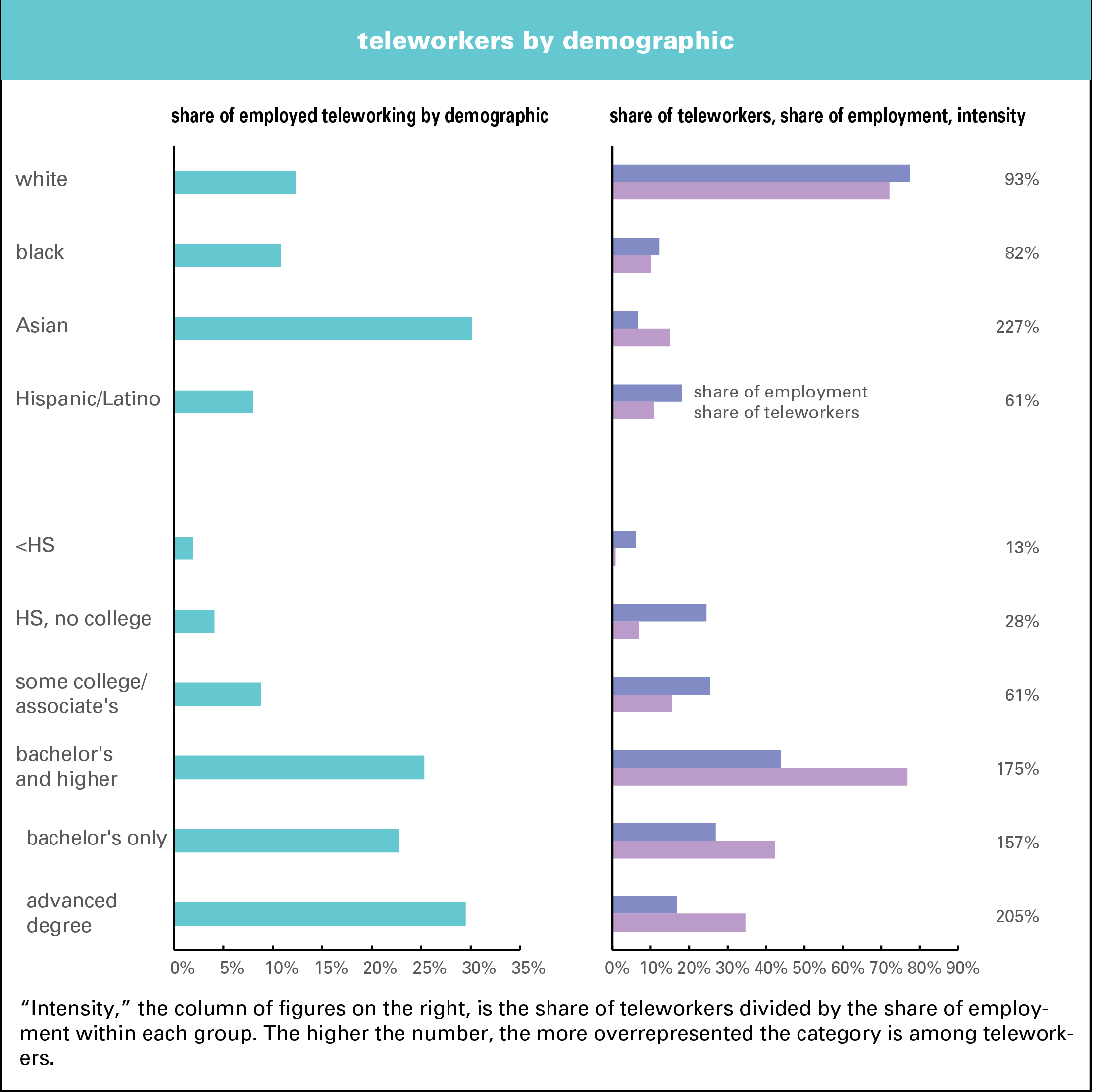

And, as the paired bar graphs below show, WFH is heavily concentrated in a few demographics. Asians account for 15% of teleworkers, well over twice their share of the employed, no doubt reflecting their strong presence in tech; Hispanics/Latinos, just 11%, well under their share of employment. By education, workers with less high school diplomas or less barely register—but those with advanced degrees are heavily over-represented.

If we define the heavily teleworking segments as those with an intensity (share of teleworkers divided by share of employment) of over 150%, just eight occupations out of twenty-two (computer and mathematical, business and financial operations; legal; life, physical, and social science; architecture and engineering; arts, design, entertainment, sports, and media; management; and community and social services) accounted for 69% of teleworkers in July, over twice their share of employment (30%). The concentration by industry is even sharper: just five sectors out of twenty-three (finance and insurance, professional and technical services, information, public administration, and utilities), pass the 150% intensity test. Together, they account for 70% of teleworkers, but just 21% of employment. (These aren’t graphed because they’d be too big for a little blog post.)

Telework was somewhat more democratic in the early days of the pandemic. In May 2020, 46% of those working from home had less than a bachelor’s degree, somewhat less than their 55% share of total employment. In July, that share was down to 15%. In May 2020, 57% of those in managerial and professional occupations were working from home; in July 25% were. Over the same period, the share of those teleworking outside the professional and managerial occupations went from 17% to 5%.

On the left, you often hear its said that we should just pay people to stay home. Of course, if people can’t find work, they need generous support. It’s cruel to cut off expanded unemployment insurance benefits.

But most jobs just can’t be done remotely. Those who can work remotely have to be served by the majority of lower-status, lower-paid workers who make things and move them around. If they were paid not to work, money would quickly become worthless because there’d be nothing to buy with it—no food, no electricity, no appliances, no medical equipment, nothing.

Telework is common among high-paid, high-visibility fields, but it’s just not the “new normal” for most workers. And it’s hard to see how it could be otherwise.

Fresh audio product

Just added to my radio archive (click on date for link):

September 2, 2021 Paul Passavant, author of Policing Protest, on the change in how cops treat protesters since the 1960s • Marisol Cantú and Shiva Mishek (co-author of this article) on how activists won a shift of public funding from cops to social services in Richmond, California

Fresh audio product

Just added to my radio archive (click on date for link):

August 12, 2021 Mia Jankowicz, author of this article, on anti-vaxxers, notably Sherri Tenpenny • Sanford Jacoby, author of Labor in the Age of Finance, on unions’ weird alliance with Wall Street during the shareholder revolution

Fresh audio product

Just added to my radio archive (click on date for link):

August 5, 2021 Sean Jacobs and William Shoki of Africa Is a Country on riots in South Africa and the long trajectory of the ANC • Max Krahé, author of this report for the Belgian sovereign wealth fund, on the need for central planning to cope with the climate crisis (FT article here)

Fresh audio product

Just added to my radio archive (click on date for link):

July 29, 2021 Rupa Marya and Raj Patel, authors of Inflamed, on the social and ecological causes of disease • Robert Pollin, co-author of this article, on the role of giant bailouts in neoliberalism and the greatness of Hyman Minsky

Fresh audio product

Just added to my radio archive (click on date for link):

July 22, 2021 Robert Fatton, author of The Guise of Exceptionalism, on the assassination of Haiti’s president and the long history that led to this sorry pass