I’ve moved this blog to ianhogarth.com

Shout out to my Tumblr/RSS reader peoples.

New blog is here: https://www.ianhogarth.com/blog/

New post on the geopolitics of AI just up: https://www.ianhogarth.com/blog/2018/6/13/ai-nationalism

Shout out to my Tumblr/RSS reader peoples.

New blog is here: https://www.ianhogarth.com/blog/

New post on the geopolitics of AI just up: https://www.ianhogarth.com/blog/2018/6/13/ai-nationalism

For the 5th year running I give you some arbitrary rankings of some media products from 2016.

New non-media categories added this year!

Books

1. JR

2. Gilead

3. All the Presidents Men

4. 1984

5. Under the Volcano

6. The Adventures of Augie Marsh

7. The Recognitions

8. Submission

9. When Breath Becomes Air

10. Jerry Moffatt Revelations

Films (released in UK in 2016)

1. 45 years

2. Dheepan

3. A Bigger Splash

4. Kajacki

5. Wiener

6. Magic Mike XXL

7. Heart of a Dog

8. Leviathan

9. Carol

10. Eye in the Sky

Music (for albums released in 2016 and standout track)

1. Anohni (Watch Me)

2. Skepta (Konnichiwa)

3. Kanye (Real Friends)

4. Ariana Grande (Be Alright)

5. dvsn (With Me)

6. Beyoncé (All Night)

7. Rich Chigga (Dat $tick)

8. YG (Still Brazy)

9. ATCQ (We the People)

10. Lil Yachty & Dram (Broccoli)

Meals

1. Mugaritz in San Sebastián w stag ladz

2. Delhi food walk in Old Delhi w M

3. Bar Nestor in San Sebastián w stag ladz

4. channa masala at Amma’s Ashram w Laura & M

5. Roscioli in Roma w Jeff & Alex

6. mirchi bada at Shahi Samosa in Jodhpur w M

7. golgappa at Kashi Chat Bhandar in Varanasi w M

8. spicy fish bhaji & mixed samosa at roadside coffee shop in Oman w M

9. slow cooked pork carnitas w orange Chez Hog

10. Paolo’s Italian BBQ veg in Somerset w P&K crew

Top 10 active outdoor lyfe:

1. sending Lucky Luka in Kalymnos

2. climbing at Hadash

3. night surfing in Ekas

4. hiking round Telendos

5. walking over the Jean Claude & Christo golden piers installation at Lake Iseo

6. sending Marie Rose in Fontainebleau

7. climbing in Yangshuo

8. running London 10k

9. deer hunting in N Florida

10. Napali coast hike

As we start the New Year, I want to share some personal and professional news. I will be moving to a Chairman role and Matt Jones will be CEO. We’ve always known the co-CEO structure was temporary and best suited to the the first stage of our merger - but why make this change now? There are a number of reasons.

The co-CEO approach has been a helpful structure for Matt and me to combine our visions, strategies, products, organisations and cultures - everything that we have had to marry to make this merger a success. We’re now 7 months into the merger, and have created some great momentum, so can revert to a more orthodox leadership structure.

I have also been working towards this transition for very personal reasons. I’ve always tried to use this blog as a place to be real about some of the challenges of building a start-up and should share the other reason why this is the right time. A few years ago my younger sister was diagnosed with a brain tumour. The prognosis was not great, but there was room to hope. At the start of 2015 my sister’s prognosis abruptly shifted to terminal and she died weeks later. I’m a very private person when it comes to my family, so this isn’t easy to share in public, but reading essays by Paul Bucheit on the death of his brother really helped me this year, so I’m trying to be more open. This transition is also about me taking time to properly grieve after spending the last year head down and focused on making a success of our merger.

During 2015 we achieved some great things. We raised two rounds of financing, hired some great new people, launched new products, and saw growth we are all excited by. I’m also really proud of the progress we’ve made against one of the less tangible goals of the merger - to combine the DNA of CrowdSurge - a deep understanding of the needs of artists surrounding ticketing - with the DNA of Songkick - building scalable consumer products for fans. We didn’t expect to see the results of that within the first year, but when Adele’s team approached us to help them counteract what they expected to be unprecedented levels of scalping around their upcoming tour, we launched a new product that drew on all the strengths of the merged company. In the words of one industry commentator “Songkick has done more in one campaign to address the issue of touting than has been achieved to date by any other party in any other sector…the prospects are tantalising and, for once, both the artist and the fan seem to have won”. I’m really looking forward to us scaling this product up with more artists in 2016.

We also, like all start-ups, have challenges ahead and felt that the next phase of execution would benefit from a more orthodox and battle-hardened leadership structure.

Without a doubt, Matt Jones is the best CEO for the next chapter. Matt’s been a long-time friend and collaborator of mine, and our shared vision and mutual respect were big factors in wanting to merge our companies. He’s one of the most impressive people I’ve ever met, with a combination of insane levels of energy, infectious ambition, and downright relentlessness. If you spend a few minutes in his company you’ll see that he cares at the deepest possible level about the future of the concert industry, and has a single-minded determination to use technology to make it better.

His leadership is a huge asset to Songkick, and it’s been a big factor in our ability to continue to hire exceptional team members, raise funding from world class investors and earn the trust of artists like Adele, Metallica and Mumford & Sons. Matt’s vision has always been that an artist should be able to sell tickets wherever their fans are engaged, and that vision of distributed commerce is central to our plans for 2016. But as well as being a visionary, Matt’s also deeply pragmatic - a rare combination in our industry - and a leader dedicated to getting shit done.

I’m grateful to our board and executive team in supporting Matt and me with this transition, and in particular to my co-founder Michelle and my new co-founders Adam and Matt for their support throughout this year.

2016’s a huge year for Songkick, and now the merger’s fully complete we have the right team, technology and structure to make it a success. I’m more convinced than ever that we can have a transformative impact on artists, fans and the wider industry, and I’m excited to continue building towards this in the year ahead as Chairman.

Same format as last year, and the years before.

Books (most published before 2015):

1. The Grapes of Wrath (Steinbeck)

2. Moby Dick (Melville)

3. A History of Western Philosophy (Russell)

4. East of Eden (Steinbeck)

5. Any Human Heart (Boyd)

6. Between the World and Me (Coates)

7. H is for Hawk (Macdonald)

8. Stoner (Williams)

9. Barbarian Days: a Surfing Life (Finnegan)

10. The Entrepreneurial State (Mazzucato)

Other good things I read: Strangers Drowning (MacFarquhar), Speak, Memory (Nabakov), USA Trilogy (Dos Passos), Purity (Franzen), Antifragile (Taleb), Post Capitalism (Mason)

Films (released in the UK in 2015)

1. Starred Up

2. Whiplash

3. Still Alice

4. Birdman

5. Margin Call

6. Mommy

7. The Duke of Burgundy

8. Citizenfour

9. Girlhood

10. Creed

Artists (for music released in 2015 and standout track)

1. Kendrick Lamar (Alright)

2. Skepta (Shutdown)

3. Kanye (Only One)

4. Vince Staples (Jump off the Roof)

5. Hot Chip (Huarache Nights)

6. Dej Loaf (Back Up)

7. Nicki Minaj (Feeling Myself)

8. Rae Sremmurd (Throw Sum Mo)

9. D’Angelo (The Charade)

10. Grimes (California)

(repost of guest blog post I wrote for TechCrunch)

At present, there are three distinct music industries: radio, on-demand music, and concert ticketing. However, we are starting to enter a new phase, where these industries will converge and produce one integrated experience for artists and fans. I’ve taken to calling this full stack music, because at heart it speaks to a holistic experience that integrates these industries through data.

The integration of these three, previously distinct industries will produce a richer experience for artists and fans, unlock a ton of additional subscription, ticketing and advertising revenue for artists and create a better experience for fans. It will resolve the central tension between fans, artists and technology companies that so much ink has been spilled about.

There are three main businesses of music:

Radio

Radio is where music discovery happens, and where the majority of casual music fans engage with music. Ninety-two percent of the U.S. population listens to radio at least once per week; on average, they listen for 15 hours. It is critical to artists because a radio station decides which track a fan listens to next, and so radio has an incredible ability to drive new artist discovery. Radio is primarily monetized via advertising, generating $45 billion/year. It also is the primary channel for marketing concerts.

On-Demand Music

This is when the listener decides exactly which song comes next (unlike radio). It started with vinyl, migrated to CDs, migrated to iTunes and finally has migrated to on-demand streaming services like Apple Music, SoundCloud, Spotify and YouTube. Monetization used to be in the form of direct spend (buying a CD); it is now a mix of advertising and subscription.

Concert Ticketing

Paying to see your favorite artist live. This used to be a side business for the music industry. However, over the past 10 years this has expanded to become the main event, growing from $10 billion in 1999 to $30 billion in 2015 in gross ticket sales. It is where artists make the majority of their income — typically 70-80 percent. Most of the growth has come from increasing ticket prices — 50 percent of concert tickets go unsold and attendance has not increased anything like as fast as prices.

These industries have been loosely coupled in the past. Going back to 1999, the record company would use radio as a way to get fans to discover a new act, then monetize that investment, primarily via selling “on-demand” access in the form of CDs and, finally, drive additional discovery by subsidizing touring (known as “tour support;” a label would underwrite some of the cost of touring to help build an audience to whom to sell CDs). Touring represented a small percentage of artist income.

The industries were also coupled at a corporate level at one point, with ClearChannel. Over the course of many years, a massive roll-up of local U.S. radio stations resulted in ClearChannel. That rolled-up business exists today as iHeartRadio, with 850 local stations and 245 million monthly unique listeners. In parallel, a roll-up of local concert promoters produced a new touring behemoth, SFX Entertainment, and the two businesses — radio and concert promotion — were merged in 2000 to form a new conglomerate. The goal was to combine the No. 1 channel for concert discovery (radio) with the No. 1 promoter of concerts (SFX).

Eventually, these businesses were separated into Clear Channel Communications (iHeartRadio) and Clear Channel Entertainment (LiveNation). Subsequent to that, LiveNation embarked on a huge project of vertical and horizontal integration and, at this point, is the world’s largest artist manager (Maverick/ArtistNation), the world’s largest primary ticketing company (TicketMaster), the world’s second-largest secondary ticketing company (TicketMaster+) and the world’s largest festival owner, venue owner and concert promoter.

We have seen a massive transformation of the recorded music landscape — with the growth of iTunes/Apple Music, Deezer, Pandora, SoundCloud, Spotify and YouTube — to the point where more than 1 TRILLION tracks are now streamed online across these services each year. The line between radio and on-demand is rapidly blurring across each of these services:

At the same time, discovery of local concerts has started to transform — rather than generic emails about all the tickets on sale in Los Angeles, new services like Bandsintown and Songkick (which I co-founded) will send you personalized alerts whenever the artists you listen to on these music streaming services announce a local show. These concert discovery apps now reach more than 20 million fans each month, and are more personalized and convenient way to find out about concerts.

Leading artists have started to articulate the extent to which streaming music and ticketing are becoming joined at the hip. For example, Ed Sheeran:

“I’m playing three Wembley Stadium (shows) on album two. I’m playing sold-out arena gigs in South America, Korea, south-east Asia and Australia. I don’t think I’d be able to do that without Spotify or if people hadn’t streamed my music. My music has been streamed 860million times, which means that it’s getting out to people. I get a percentage of my record sales, but it’s not a large percentage, (whereas) I get all my ticket sales, so I’d much rather tour. That’s why I got into the business — I love playing gigs. Recording albums, to me, is a means to an end. I put out records so I can tour. For me, Spotify is not even a necessary evil. It helps me do what I want to do.”

Over the next few years we will see this connection between streaming and ticket sales become completely explicit. Streaming services will increasingly make it seamless for fans using their services to see when the artist has a local show; Songkick’s existing API partnerships with Deezer, SoundCloud, Spotify and YouTube are hints at what this could look like. It’s not impossible to imagine a time when you could possibly buy tickets directly from your favorite artist right inside your streaming service.

When that happens, artists will finally be able to see a connected picture of how their music is distributed and monetized. An act who gets 100 million streams will see that 10 million of those were monetized via paying subscribers, 90 million by ads and another 5 million fans via ticket purchases. The outcome will be a more seamless experience that results in casualmusic fans attending more concerts.

This is a big deal — only 20 percent of Americans attended a concert in the last year, and the biggest reason for not going is that they didn’t know when shows for their favorite act were happening. This will finally create firm alignment between artists and music streaming services — to the point where all acts will see the explicit and causal relationship between an ad-supported online radio stream and a paid ticket purchase, as Ed Sheeran does.

This is just the start, though. Along with joined up analytics for artists, fans will be offered new propositions that tie together live and recorded music experiences. For example, imagine if all streaming music subscribers were offered lower booking fees on ticket purchases — creating another reason for fans to subscribe rather than use an ad-supported service, and driving faster growth in subscription income for artists.

After the show, the set list will immediately be available on your streaming service of choice, further helping to reinforce the connection you have built to that artist and increasing the likelihood of buying merchandise from the gig. Finally, tour routing will be impacted by the data from streaming services similar to Spotify’s recent experiment with Hunter Hayes:

“Hayes turned to Spotify to help him route the tour. The online music streamer crunched its numbers and determined the college markets where the country star is the strongest. Hayes’ biggest fans in the target markets will receive pre-sale access. His top 21 fans in each market will receive such prizes as early entry, meet-and-greets, signed memorabilia and other goodies. The fan who streams Hayes’ music the most in each market will be awarded a one-year sub to Spotify Premium.”

The key point across all of this is that the central, most valuable asset of streaming musicservices will be the listener data they generate. As we shift from offline radio to online streaming, artists will know how those 1 trillion tracks of music were streamed — which fan listened to them, where they were based, which concert tickets they purchased in the past — and be able to tailor personalized and richer experiences to their fans.

That is an incredible shift compared to the data-poor ecosystem of 1999. The trend will only continue, as more and more offline listening (in particular, terrestrial radio) migrates to online streaming. Once that is fully complete, we will hit 5-10 trillion streams, and these shifts will be even more critical. Zoe Keating, one of the most visionary artists I have the pleasure of knowing, has been saying this for a few years now:

“I want my data and in 2012 I see absolutely no reason why I shouldn’t own it. It seems like everyone has it, and exploits it…everyone but the creators providing the content that services are built on. I wish I could make this demand: stream my music, but in exchange give me my listener data. But the law doesn’t give me that power. The law only demands I be paid in money, which at this point in my career is not as valuable as information. I’d rather be paid in data….The new model says that in the future I’m not supposed to sell music: I’m supposed to sell concert tickets and t-shirts. Ok fine, so put me in touch with the people who will buy concert tickets and t-shirts.”

There are signs that this integration is coming — Pandora appointed the former CEO of AEG Live, the world’s second-largest promoter, to their board, and have started to experiment with concert marketing — for example, campaigns to promote tours for the Rolling Stones and Odesza. Global Radio, the largest terrestrial radio company in the U.K., has expanded into artist management and concert promotion, again hiring key execs from AEG Live. AppleMusic is broadcasting on Beats 1 all the shows from their upcoming festival, and is encouraging the artists they book to share information about their performances on Connect.

We are in the early stages. Eventually we will know not just how many streams are generated per artist, but how many ticket sales resulted. If this deeper integration of streaming and ticketing results in one ticket sold per 5,000 streams, then we’d know that 1 trillion streamsgenerated 200 million tickets — at an average face value of $50, this would be $10 billion in ticket gross — equivalent to the revenue from 100 million subscribers paying $8/month. It would also have the consequence of making Apple, SoundCloud, Spotify, Pandora or YouTube new power players in ticketing.

Artists will start to focus on promoting the service, which in aggregate generates the most ad, subscription and ticket revenue, which in turn will drive further growth in online listening. We’re about to watch the next big shift in online music play out as we move from three separate music industries to Full Stack Music.

Same format as last year.

Books (most published before 2014):

1. Anna Karenina (Tolstoy)

2. My Struggle books 1 & 2 (Knausgard)

3. Herzog (Bellow)

4. Island (Huxley)

5. Ham on Rye (Bukowski)

6. Post Office (Bukowski)

7. Superintelligence (Bostrom)

8. The Diversity of Life (Wilson)

9. White Girls (Als)

10. Steve Jobs (Isaacson)

Musical artists (new music released in 2014) & standout track:

1. Beyonce (7/11)

2. YG (Bicken Back Bein Bool)

3. Lil Wayne (Rich as Fuck)

4. Makonnen (Tuesday)

5. Future Islands (Seasons)

6. Vince Staples (Limos)

7. Young Thug (Lifestyle)

8. Ariana Grande (Bang Bang)

9. Sleaford Mods (Tiswas)

10. Bobby Schmurda (Hot N***a)

Films (UK release in 2014):

1. All is Lost (Chandor)

2. Le Weekend (Michell)

3. Boyhood (Linklater)

4. Bullhead (Roskam)

5. Under the Skin (Glazer)

6. A Touch of Sin (Zhang Ke)

7. Nightcrawler (Gilroy)

8. Interstellar (Nolan)

9. Blue Ruin (Saulnier)

10. Fury (Ayer)

(haven’t yet seen Ida, ‘71, Leviathan, We are the Best or American Sniper - suspect they will shake the list up)

We just launched a new partnership with Pitchfork to integrate listings from Songkick into Pitchfork’s core review pages. I’m out in California working round the clock as usual but even if only for myself I wanted to take a minute out of the waves of meetings and emails to remind myself what this means to me.

I have been reading Pitchfork since I was a teenager. I have found more music that I have fallen in love with through Pitchfork than through any other online service. They have made my life as a fan an order of magnitude richer. Ever since we started Songkick in 2007 it has been a dream to work with them. We have some amazing API partners - Bandcamp, HypeMachine, SoundCloud, Spotify, YouTube - they are all examples of companies I find inspiring, but still there’s just such a rush from finally getting this partnership live.

After years of being a founder Pitchfork now stands for something different than it did when I was a teenager or when we were getting started. It stands for building something that endures and gets better every year. Pitchfork has been getting better EVERY YEAR SINCE 1995. Outside of VICE it’s hard to think of a brand and team that has shown as much commitment to online media. How many great online music services have died in just the years while Songkick has been active? iLike, Imeem, MySpace, Lala - this shit is hard. Let alone when you consider everything that has happened since Pitchfork was founded. And yet they endure, improve and prosper.

Michelle, the whole team and I are really proud they chose us as a partner and can’t wait to do more together.

On the plane to the US I finished reading Nick Bostrom’s Superintelligence. I jotted down notes as I went and thought a few friends might be interested so posting here.

Bostom’s background spans philosophy (he is a professor at Oxford), computational neuroscience and physics - his breadth of knowledge makes this a broad reaching read. It’s particularly interesting if you have a basic understanding of machine learning and want to understand some of the philosophical and ethical questions raised by superintelligent machines.

A few things that stood out for me:

- various surveys of AI experts (who are plausibly at the optimistic end of the spectrum :) ) peg the likelihood that we will see machines with human level intelligence by 2040 at 50%, and 90% by 2075

- Bostrom convincingly argues that once human level machine intelligence emerges we may rapidly see an ‘intelligence explosion’ where the intelligent machines self-enhance their own software/intelligence at high speed. This leads to machines that are superintelligent. Since software can be copied the population of superintelligent machines can grow rapidly.

- He then argues that given the kinetics of such an explosion one entity may end up rapidly accelerating past other machine intelligence projects and forming a dominant position. This echoes the writing of Lanier and others on the increasing centralisation of power within the technology industry. He makes a particularly interesting point that digital agents may tend to greater centralisation of control due to reduced inter-agent transaction costs. For example the idea that firms or nations of machines could massively increase in size.

- the majority of the book focuses on what happens after a superintelligence emerges. He draws an interesting distinction between having more intelligence and more wisdom - and the risks of one developing without the other. He gives a hilarious example, worthy of Foster-Wallace where a superintelligent machine is tasked with producing 1000 paperclips. The machine, being superintelligent and supercapable rapidly produces 1000 paperclips. However, being a perfect Bayesian agent it is also aware that observational error may mean that it has actually produced fewer paperclips than this - there is a tiny but real chance it has only produced 999. So to remedy this it commandeers all the resources in the known universe to more accurately count whether it has actually produced 1000 paperclips or not. He lays out various types of superintelligence and various ways that things could go badly wrong for humanity from goal functions that on first glance seem to be bounded, but per the paperclip example are not. At lot of this seems to be the difference between programatic logic and 'common sense’ and the complexity in creating a bridge from one to the other.

- he draws an interesting parallel between the fate of humans in a world with superintelligent machines, and the fate of horses in a human world. The horse population grew massively through the 1900s as a complement to carriages and ploughs, but then declined with the arrival of automobiles & tractors. The population of horses was 26m in the US in 1915 but declined to 2m by the early 1950s. The flipside of this is that the horse population subsequently returned to 10m driven by economic growth that have allowed more humans to indulge in leisure activities involving horses.

- He explores how superintelligent machines might acquire their values. This section on value loading techniques is very interesting and summarises some of the most interesting mathematical and philosophical challenges facing the AI space. For example in one unfinished solution to the value loading problem we have a subset of intelligent machines that are known to have values that are safe for humans. These machines are allowed to develop a incrementally more intelligent machine - where the step in intelligence between the first group of machines and the mutation is small enough that the earlier machines can still test the new, slightly smarter machine to see if its values remain compatible with humanity’s safety. He makes the terrifying point that if there is an arms race going on for one company or nation to develop superintelligent machines first, this kind of caution is unlikely to be on the path of the 'winning’ project - 'move fast and break things’ seems like a bad motto when you are playing with something this powerful.

- Having framed the challenges of loading a superintelligence with values, he then moves to what values we want this superintelligent to have. Bostrom argues that humanity may have made relatively little progress on answering key moral questions and is likely still labouring under some grave moral misconceptions. Given that are we in a position to specify a moral framework for a superintelligent machine? He introduces the concepts of Indirect Normativity and coherent extrapolated volition in response to this - a hedge against our own limited moral framework and a bet that the machine can do better:

“Our coherent extrapolated volition is our wish if we knew more, thought faster, were more the people we wished we were, had grown up farther together; where the extrapolation converges rather than diverges, where our wishes cohere rather than interfere; extrapolated as we wish that extrapolated, interpreted as we wish that interpreted” - Yudakowski

- finally he asks how to ensure that the immense economic windfall resulting from superintelligence should be distributed to benefit all of humanity, not just a narrow set of people (or machines).

Overall I found it very stimulating and would recommend.

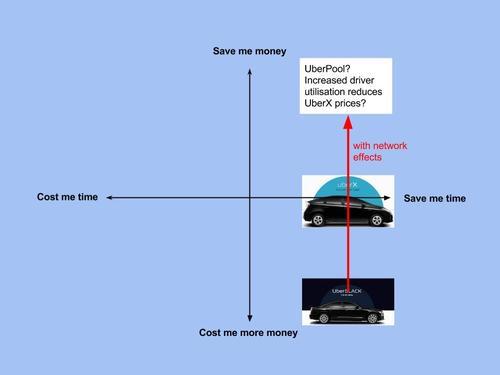

Consumer technology can find a mass market when it saves us time, or money. Every person has their own preference for how they spend time and money. While some people would prefer to save time by spending more money (for example paying to avoid a queue at an airport) others prefer to save money by spending their time (for example going down to the venue to buy a concert ticket to save money on booking fees). Sometimes technology can save us both - for example how at launch Amazon saved both time and money when purchasing books.

If you plot this out on a chart it seems that start-ups can successfully enter a market in one of three quadrants - saving time, saving money, saving both. The logos correspond to my understanding of the proposition that the initial users of these services were compelled by:

So for example Priceline offered a cheaper airline ticket if you were willing to be more flexible with your time. Uber offered SF residents a way to spend more money but save time by waiting for a cab. In both cases users traded time for money or vice versa. On the axes, Groupon saved their first users money without requiring extra time, and Google saved their users time by getting them to information faster, but without costing more.

In the ticketing space, the launch of TicketMaster (over 30 years ago now) offered a step change in convenience by saving you the time it took to go down to the venue, providing you were willing to pay a new service charge. Continuing this trend, Stubhub offered the ability to skip the onsale process entirely and buy from the resale market at a higher price later. Most of the concert goers I’ve spoken to who prefer to buy tickets from Stubhub are clear that they are deliberately spending more money to save time.

It would seem that to get initial growth a start-up needs to save users time, money or both. (That is unless you can solve some next level Mazlow need and get us all self-actualised a la Snapchat :-)

What surprised me is how these value propositions can shift over time as network effects develop. I’ve been thinking about this a lot recently as Uber has grown. When it first launched I saw it as somewhat similar to Stubhub - a service for affluent consumers to save themselves time in exchange for more money. What’s been fascinating to watch is how over time as more drivers and riders join the network it has become a multi-tiered service that can save both time and money with the introduction of UberX, greater taxi utilisation, and soon, ride-sharing. So over time you see:

The big takeaway for me is that a start-ups initial time/money proposition isn’t always a predictor of its eventual market impact. A service that started with "We just wanted to push a button and get a ride…And we wanted to get a classy ride. We wanted to be baller in San Francisco. That’s all it was about.“ might end up reducing transportation costs and saving time for the mass market.

“A man gotta have a code” - Omar

The average person checks their phone 150 times/day. Setting aside whether that’s a ridiculous number or not, that got me thinking about the fact that we look at one image - our lock screen image - 150 times/day.

There are probably quite a few interesting product opportunities that fall out from an image we look at 150 times/day or 55k/year. Other than a tattoo I can’t think of an image we looked at in the past as frequently or in as many contexts.

The specific thing I’ve been noodling on is how to use that image to reinforce behaviour. I have a few principles** I try to keep in mind as I go through life, but it can be easy to lose sight of them in the swirl of daily emotion. I’ve been experimenting with putting that list on my lock screen so I end up looking at it in passing 100+ times/day.

I’ve been doing it for a month or so now and have noticed that for the most part I’ll just tune out the image of the list en route to completing a task on my phone. But from time to time it does pull me in (often when I’m just getting out my phone to kill time). I’ll re-read them and perhaps something is reinforced or questioned.

I wonder what else could be done with an image we look at 150 times/day?

** 1. YOLO, 2. FOMO, 3. BRB, 4. what would ‘ye do, 5. what would bill murray do