Since 2012, whilst holidaying overseas, I visit the finance / investment section of bookstores as a barometer on their business climate. This year in Toronto, Canada, I visited Indigo Books in Fairview Mall. It had a number of books on technical analysis: reading price / volume charts to make investment and trading decisions.

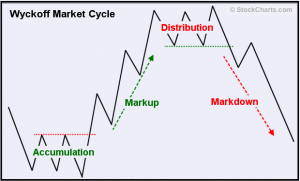

TA was popular from the mid-1970s until the 1987 stockmarket crash and regained popularity during the 1995-2000 dotcom crash. Since about 2003 it’s been a dead methodology — at least in its vanilla, popular treatments — due to high-frequency trading. TA books however continue to sell to uninformed retail investors.

Arvid O.I. Hoffmann and Hersh Shefrin’s new study of 5,500 trader accounts at a Dutch discount brokerage between 2000 and 2006 has some sobering insights on TA and retail traders:

- The study period coincides with the 2000-01 dotcom crash and the mark-up period of the 2003-07 speculative bubble in real estate.

- TA appeals to young, male, poor, overconfident traders who want to speculate or who treat trading as a hobby.

- TA traders had more concentrated portfolios than those who used fundamental analysis or professional advice.

- TA traders had higher turnover; personal ambition; a short-term timeframe; and often did not consider transaction costs or taxation implications.

- The average portfolio size in this study was $60,589 and the median age of traders was 49.79 years of age.

- The 95th percentile included traders aged 70; who turned over their portfolios 98.19% per month; who did 43.06 trades per year (mean of 10.66 trades per year); who had 72 months experience or 6 years experience (mean of 40.21 months experience or 3.35 years); and whose portfolio was valued at EUR166,840 compared with a median of EUR15,234 and a mean of EUR45,915.

Hoffmann and Shefrin’s study suggests several things to me:

- There are at least two identifiable sub-populations: (1) young traders who try to compound their risk capital to get rich; and (2) older investors using savings and retirement money.

- Most traders last less than 3 years. Many over-trade or blow-up their accounts within 10-to-15 trades – in part due to very small trading accounts.

- TA appeals to new retail traders who are really trading on rumours that can be traced back to Martin Zweig (“The trend is your friend”), Jesse Livermore, and the Edwards / Magee school of TA.

- Interest in trading occurs at distinctive life stages: early twenties (get rich); late forties (save for retirement); and post-retirement (create a financial buffer for future spending).

- Some trader success is due to the hot hand effect of winning streaks – which may in a social network influence a new cohort of traders – for what was more luck than skill.

- TA traders attempt to mix indicators / signals and psychology (state management). Yet the real gap for retail traders is an understanding of transaction / execution costs.

Hoffmann and Shefrin’s study suggests several things to me about myself:

- I’m in what Paul Fussell calls the High-Proletarian level of the middle class: university educated; but without the financial security of Fussell’s Upper Middle class.

- I had encounters with financial markets from my early teens to my early twenties, but was not an investor in early life due in part to the adverse experiences of recessions and stockmarket crashes.

- My serious interest in financial markets emerged after formative experiences around the 1995-2000 dotcom crash; the 1998 collapse of Long-Term Capital Management; and an encounter with Sir James Goldsmith’s life philosophy in 1995, re-explored in 2010.

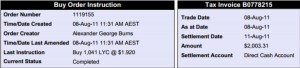

- I began research in 2009 and first traded on 5th August 2011 – days after a ratings agency downgrade in United States sovereign debt and into a Eurozone financial crisis.

- I started with an account size in the 25th-30th percentile of the study – about $A5,600 to trade. I soon ran into psychological barriers about getting out of trades in a deteriorating market situation where I had hoped a market retracement might occur. I continued to hold positions despite passing my stop-loss limit.

- This loss aversion led me later to more closely study the research on behavioural finance. I found that my initial trading hypothesis was correct — but the reason why was that it was also being ‘gamed by convertible arbitrageurs, prop desk traders, and high-frequency trading firms. I lost several thousand dollars before I exited the trade. In October 2011, whilst in Tokyo, Japan, I put the pieces together involving a series of trades by the Mitsubishi UFJ Bank which was warehousing trades for foreign hedge funds. This involved a Gurdjieffian shock – I knew what to do but emotionally I was unable to Act at the appropriate time to exit the trades. I sat in the Starbucks above the Shibuya Crossing and considered the implications.

- This initial experience in live trading led me to pull back and examine what I knew about financial markets; what algorithmic and high-frequency trading was; why retail traders fail; and how professional traders work.

- From 2011 to 2013, I bought most of the core literature on finance, wealth management, funds management, trading, behavioural finance, and market psychology to fill in some major knowledge gaps. This led to what will possibly be a post-PhD strand in my research program on the sociology of finance, and hedge funds / private equity funds as strategic subcultures.

- From 2011 to 2014, I made a series of personal oath-promises to myself about personal self-sufficiency (Nihonbashi), long-run gains (Long Gamma), and shifting from a naive retail trader to understanding the institutional mindset (Toronto-Dominion).

- Rather than trade I dealt with saving for retirement via employer defined contribution plans, employer co-payments, and legal tax minimisation strategies.

- Rather than TA signals I began to study market microstructure (the study of price dynamics in order book flows) and money market flows between funds. Recently, I have downloaded several Springer books on high-frequency econometrics from a university database.

- I found the major lesson about trading was about the psychology of decision-making and money management. These are skills I Needed to learn yet lacked.

In conclusion I fit one of Hoffmann and Shefrin’s sub-populations and past trading strategies. Reading their study is an important ‘reality check’ that helps me to identify what I can change to build a more resilient financial future. At least, I didn’t lose a million dollars.