Foreign Policy‘s Dan Drezner asks: “Hey, remember when Standard & Poor’s downgraded U.S. sovereign debt back in 2011?”

I sure do.

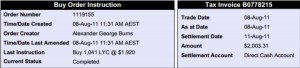

S&P downgraded US debt on 5th August 2011. I placed my first trade on 8th August 2011: 1041 ASX:LYC @$1.92 ($2003.31 including $15 brokerage fee).

(ASX:LYC closed Friday +4.44% @$0.47. I caught the tail end of the 2008-10 speculative bubble in rare earths. Lynas Corporation has since faced project delays in Malaysia; activist lawsuits; headline risk; and regular ‘shorting’ due to convertible bond arbitrageurs and exchange traded funds. I entered the market on a distribution phase — expecting a further rise — and instead faced a markdown, in terms of Richard D. Wyckoff‘s technical analysis methodology.)

The next five or so months got very interesting regarding market volatility and contagion effects. I read up again on international political economy. I also learned more about transmission shocks; political risk; hedge fund activism; and share ‘warehousing’. In October 2011, I did some further research whilst on holiday in Tokyo, Japan, including an eventful visit to the Tokyo Stock Exchange.

Drezner and I are both political scientists. One book I turned to was Timothy J. Sinclair’s The New Masters of Capital: American Bond Rating Agencies and the Politics of Creditworthiness (Ithaca, NY: Cornell University Press, 2005). A gem I discovered by accident in Sinclair’s book was about how Victoria’s conservative Kennett Government used S&P and Moodys ratings downgrades in 1993 to cut $A730 million “from Victoria’s education, health, and other programs” (Sinclair 2005: 103). In 1992, my father had co-founded Victoria’s nursing agency Psychiatric Care Consultants, which responded to the new competitive market environment. So, the S&P and Moodys downgrades had deeper personal and familial significance.

These examples illustrate how research can change the researcher.