This year’s National Archives Cabinet papers release includes material related to the 1996 Budget changes to HECS.

The most important of these were replacing flat HECS rates with ‘differential HECS’, so that rates were based on subject disciplines, and lowering the HECS repayment thresholds, so that debtors began repaying earlier and repaid more at each income level (historical thresholds are at page 47 of this document).

The main submission released today does not have these final decisions, but outlines different views within the government and bureaucracy about how to proceed.

In public statements, differential HECS was justified by reference to both course costs and the expected future income of graduates. Neither Treasury nor Finance were keen on using future income. Finance noted, as others have since, that it varies a lot between graduates. Treasury thought that it was unfair that students in some disciplines would end up paying a much larger share of costs than others.

The idea that students should pay a share of course costs has regularly resurfaced since, most notably in the 2011 base funding review. But in the Cabinet submission we see an early version of why this idea has been consistently rejected. In the draft differential HECS rates based on cost recovery, law ends up in the cheapest band 1 (of 5; there were 3 in the end), while nursing is priced in the middle. Nurses paying more than lawyers is not an easy political sell. In the final announced decision, law was in the highest-priced band and nursing in the lowest-priced band.

The Cabinet submission also has a pricing rationale of expected demand that was not, so far as I know, used in public statements. If demand already greatly exceeds supply, prospective students are less likely to be price sensitive. But politically that raises the possibility that other students would be price sensitive, which the government wanted to downplay.

Capping access to subsidised higher education to one degree or to a time period was considered; the Fraser government had tried something similar. In the final policy this was sort-of implemented by concentrating funding cuts on postgraduate coursework places. A fuller version of the idea arrived with the 7-year learning entitlement under Brendan Nelson, which started in 2005. It was later abolished by Labor.

While mainly about course charges, the submission also mentions means-testing access to income-contingent loans by linking it income support thresholds. That would have been the most radical conceptual departure from current policy in the submission if it had been approved. There is also the Department of Finance’s usual attempt to get real interest on student debt, which wins the prize for the most-suggested change to student loans that has never been legislated.

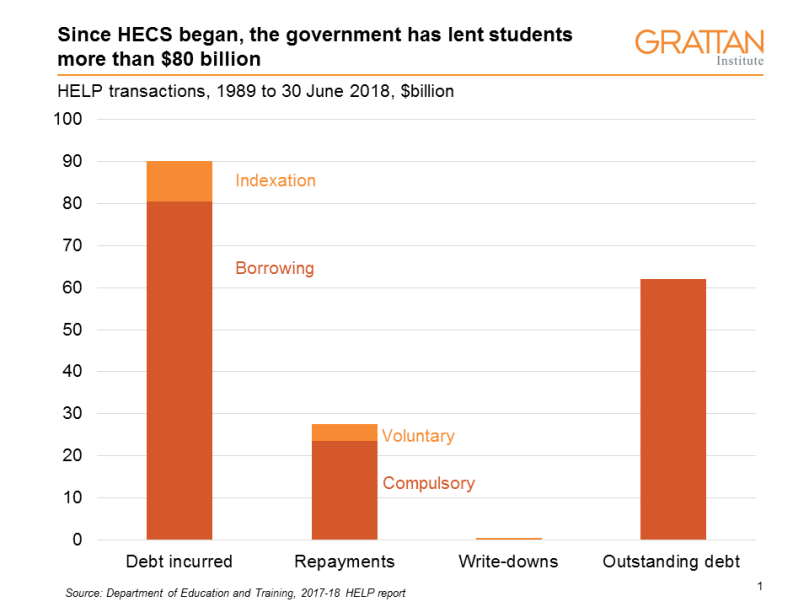

One omission is interesting in light of subsequent policy concerns. Although there is mention of the fact that (by design) not all HECS debt will be repaid, there are no estimates of how significant this is. Perhaps some numbers were in other submissions we have not seen yet, and could explain the big reduction in repayment thresholds.

In 1996 government accounting conventions struggled with income contingent loans, as they still do. The submission mentions which changes will and won’t count towards the politically-salient Budget deficit. Because expected losses from student doubtful debt are not counted in the deficit/fiscal balance, this biases policy towards cutting direct grants to universities, which do count.

Fortunately, however, accounting conventions did let 1996 policymakers see that selling the HECS debt was a bad deal for taxpayers. Another Cabinet submission makes this clear. This possibility was raised again in 2013, with the same eventual conclusion.

As these submissions show, many ideas around HECS/HELP recur repeatedly over time.