Just added to my radio archive (click on date for link):

September 28, 2017 Lukas Hermsmeier on German politics after the election (and AfD’s breakthrough) • Margaret Corvid on the UK Labour Party conference

Just added to my radio archive (click on date for link):

September 28, 2017 Lukas Hermsmeier on German politics after the election (and AfD’s breakthrough) • Margaret Corvid on the UK Labour Party conference

Posted in radio | Tags: far right, Germany, Jeremy Corbyn, Labour Party, neo-Nazis

My review of Hillary’s What Happened has just been posted on Washington Babylon.

Posted in gloating, self-promotion | Tags: Hillary

Just posted to my radio archive (click on date for link):

September 21, 2017 Michael Lighty of CNA/NNU on Republican efforts to repeal Obamacare, and on Sanders’ single-payer bill • Natasha Lennard, author of this article, on felony prosecution of Standing Rock protesters

Posted in radio | Tags: health insurance, protest, single-payer, Standing Rock

Just added to my radio archive (click on date for link):

September 15, 2017 Andrew Cockburn, author of this article, on the Saudi involvement in 9/11 • Asad Haider, author of this article, on identity, Mark Lilla, and Ta-Nehisi Coates

Posted in radio | Tags: 9/11, identitarianism, Saudi Arabia

Just posted to my radio archive (click on date for link):

September 7, 2017 Christo Sims, author of Disruptive Fixation, on school reform and techno-fetishism • Christian Parenti, author of this article, on climate change and the threat to coastal cities

Posted in radio | Tags: climate change, education reform, techno-fetishism

In a post yesterday, I showed how public investment, net of depreciation, in the U.S. is barely above 0, meaning that fresh expenditures on long-lived assets like schools and roads are running just slightly ahead of the decay of existing infrastructure. You might think, given neoliberal orthodoxy, that the private sector is taking up the slack. It isn’t.

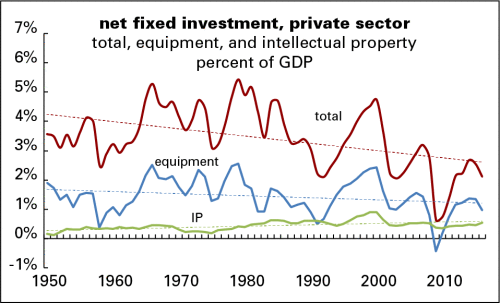

The graph below shows net private nonresidential fixed investment as a percent of GDP. Net means less depreciation (the declining monetary value of existing assets over time, as they wear out and grow obsolete); private means not-government; nonresidential should be self-explanatory; and fixed means sticking around, as opposed to inventories, which are considered a form of investment, since businesses accumulate them for later sale.

Several things stand out from the graph. First, the declining trendlines on both total investment and investment in equipment, and the slow rise in intellectual property investment. Investment in equipment and software—machinery, computers, telecommunications equipment, etc.—is particularly crucial to long-term productivity growth. Although the fruits of productivity growth can be distributed in any number of ways, like higher profits and/or higher wages, the growth in productivity (meaning the dollar value of an hour of labor) puts an upper limit on income growth over the long term.

At 2.1% of GDP in 2016, total net fixed investment is just over half its 1950–2000 average of 3.8%; at 1.0% of GDP, investment in equipment is more than a third below its average over the same period of 1.6%. (Preliminary figures for 2017 show little change from 2016 levels.) The recent peak of 2.7% in total investment, set in 2014, was below the recession lows of 1975 and 1983, and matches the recession low of 2003. In other words, in the best recent year, corporations invested at a rate matched or exceeded in earlier bad years. Not graphed is investment in structures—like factories, office buildings, and warehouses—whose trajectory is very similar to equipment. Its 2016 share of GDP, 0.6%, was a third its 1950–2000 average.

Intellectual property (IP) investment deserves a few words. It’s been rising as a share of GDP, but it remains a tiny 0.5%. When it comes to its social benefits, it’s a mixed bag. About half of it, 47% in 2016, is accounted for by software, both commercial and custom-made. Some software is useful, like the WordPress code that makes this blog possible and the Excel and Illustrator code that made the above graph possible, but some is overpriced and bloaty, like the monstrosities that many universities run on. A bit less, 42% last year, is research and development (R&D). Some R&D produces useful products, but an awful lot of it is just the pursuit of rents from branding and patent scheming. (The leading culprit here is the pharmaceutical industry, whose basic research is largely funded by governments and universities; drug companies just come up with patentable products they can charge a bundle for.) And the remaining 11% is accounted for by “entertainment, literary, and artistic originals,” which includes Game of Thrones and Taylor Swift’s recorded oeuvre. While these can produce pleasure, their contribution to long-term prosperity is hard to measure.

These low rates of investment are not driven by corporations’ lack of money; though profits are down from their peak several years ago, Corporate America is still rolling in it. But they’re not investing the profits. Instead, they’ve been shipping out gobs of money to their shareholders—an average of $1.2 trillion a year since 2015. These shareholder transfers take the form of traditional dividends and stock purchases—purchases of other firms’ stock in takeovers, and of their own in efforts to boost their prices. If corporations returned to the practices of the pre-neoliberal era (1952–1983 to be precise), stuffing not half but less than a fifth of their cash flow in their shareholders’ pockets, that could take net investment back to its old average. But under today’s model of capitalism, it’s more important to keep the shareholders happy.

Posted in corporate behavior | Tags: investment, rentiers, stock market

If I were a debased purveyor of clickbait, I’d call this “Everything that’s wrong with America in two charts.” But I’m not, so I won’t. But still….

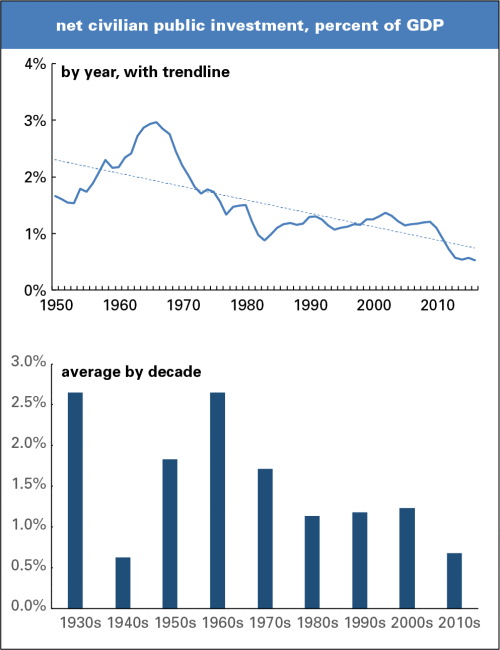

Hurricane Harvey is only the latest reminder that the U.S. infrastructure is falling apart—a situation that become more urgent as the climate crisis bites harder. Here’s a data series that goes a long way to explaining why. In simple English, the public sector is barely investing enough to keep up with normal decay, let alone doing anything to improve things.

The series is net civilian public investment from the national income accounts. (The source is table 5.2.5, here.) “Net” means after depreciation, aka wear and tear. Public investment means expenditures on long-lived assets like schools and roads. Prisons are in there too. If we took those out, the numbers would be slightly lower—though not profoundly so, because most of the costs of maintaining the carceral state come from day-to-day operations—96%, according to this estimate—not from building new prisons.

Of course, it’s hard to put exact dollar values on the decay of physical assets over time. Economic stats are always highly imperfect, even if they seem precise, carried out to several figures beyond the decimal point. But they’re the best we’ve got—and these are the numbers that American capitalism produces to understand itself, even if they don’t bother to pay much attention to what the numbers are saying.

Here are the graphs—the first, net public (meaning by federal, state, and local government) as a percent of GDP since 1950. I started the graph in 1950, even though the figures begin in 1929, because the extreme values of the Great Depression and World War II years would distort the scale dramatically. The second presents the averages by decade. As the graphs show, net public investment is in a long downtrend and is now at near-record-low levels. The only years with lower levels were 1942–1945, when the civilian economy was starved to fund the war effort.

Net civilian investment was 0.5% of GDP in 2016; preliminary numbers for 2017 suggest it hasn’t budged. It declined during the Great Recession and its aftermath, and is now less than half 2007’s 1.2%. The contrast with the Great Depression is stark. Net civilian public investment rose from 1.9% of GDP in 1929, the year of the crash, to 3.2% ten years later. For the full decade of the 1930s, it averaged 2.6%—the same as the 1960s, a time of dramatic expansion in the public sector. Since then, it’s been mostly downhill.

To get back to that 2.6% average would mean an increase of $400 billion a year in public investment. (For details on the shortfall, and where the spending needs to be directed, see the American Society of Civil Engineers’ annual report on the topic.) There’s no doubt the U.S. could afford that. But our political system is completely incapable of formulating the problem. (Trump’s infrastructure plan is a ludicrous patchwork of tax breaks and privatizations.) And it’s only going to get worse, as the rot deepens and the climate challenges mount.

Posted in statistics | Tags: climate change, infrastructure, public investment, rot

Just added to my radio archive:

August 31, 2017 Stan Collender on the ludicrous politics of the federal budget • Tim Shorrock on what’s behind North Korea’s apparent “irrationality”

Posted in radio | Tags: federal budget, fiscal crisis, North Korea

Just added to my radio archive (click on date for link):

August 24, 2017 Jodi Dean on class vs. identity, and the online life vs. practice • Jason Wilson on Charlottesville and the far right

Posted in radio, Uncategorized | Tags: class, fascism, gender, identitarianism, neo-Confederates, neo-Nazis, race, right-wing, sexuality

Just added to my radio archive (click on date for link):

July 13, 2017 Alex Kotch (articles here and here) on the Koch campus network • Alfredo Saad Filho on the economic and political crisis in Brazil (Temer’s indictment, Lula’s sentencing)

Posted in radio, Uncategorized | Tags: academia, Brazil, Koch Brothers, libertarianism, Lula, Michel Temer, right-wing

Just added to my radio archive (click on date for link):

July 6, 2017 James Forman, Jr., author of Locking Up Our Own, on race and mass incarceration • Keeanga-Yamahtta Taylor, author of From #BlackLivesMatter to Black Liberation, in a reprise of her June 2016 interview, on a political response to mass incarceration and racist cop violence

Posted in radio, Uncategorized | Tags: #BlackLivesMatter, criminal justice, incarceration, racism

My radio guest the other week, Nancy MacLean, author of Democracy in Chains, is under attack by libertarians for her criticism of the doctrine, one of its leading propagandists James Buchanan, and its funders, the Koch Bros. It’s an excellent book and she needs help. Here’s a note she posted to Facebook with more:

Friends, I really, really NEED YOUR HELP. If you trust me based on all that you know about me, please read this, help me as indicated, and share this post with anyone interested the Koch operations and the mayhem they have caused.

This will sound nutty, I know, but it’s actually happening: the Koch operatives and the riders of their academic “gravy train,” as James Buchanan called it, are working very hard to kill DEMOCRACY IN CHAINS –and to destroy my reputation (as they have done to climate change scientists and others bearing inconvenient truth).

It appears they are using Washington Post blogposts as a seemingly respectable pivot for a coordinated and interlinked set of calculated hit jobs. By using the WAPO blogposts, they make it appear to the ordinary web surfer that the WAPO itself is trashing my book when it’s really the Koch team of professors who don’t disclose their conflicts of interest and the operatives who work fulltime for their project to shackle our democracy. The other side was getting top placement because their team was clicking and re-clicking and sending embedded links, and the velocity of their activity drove up their links.

Here’s how you can help if you want to stop the suppression of my research and the reputation assassination underway:

• Google me and the book and click on the REAL listings (e.g. my department page and the actual Viking book page or reviews by honest reviewers) to drive them above the paid “top stories” position.

• Go to DEMOCRACY IN CHAINS on Amazon, and click as “helpful” honest reviews by real reviewers and scholars who have read the book. The operatives are juking the Amazon stats so that their hit jobs (by people who in nearly every case never read the book) come up first by the number of “helpful” votes they got, no doubt from their fellow apparatchiks.

Oh, and one of them—under the name NPalgan2–also set up a wiki site on me (s/he also added criticism of another academic, who wrote on mass incarceration). We are trying to fix it now. And UnKoch My Campus is posted the undisclosed conflicts of interest.

People: this is real. Please help, if you’re willing, and then share this post with any journalists you know and anyone concerned about the Koch’s power to undermine our institutions.

I won’t be the last they set out to get; anyone who challenges them is subject to that have called “upping the transaction costs for the other side.”

Help me stand up to them, for all of our sakes?

Posted in polemic, Uncategorized | Tags: harassment, Koch Brothers, libertarianism

Just added to my radio archive (click on date for link):

June 29, 2017 Robert Pollin works out the economics of single-payer in California (paper here) • Michael McCarthy, author of Dismantling Solidarity, on the history of pension funds in the U.S.

Posted in radio, Uncategorized | Tags: California, financial markets, pensions, single-payer, Wall Street

Just added to my radio archive (click on date for link):

June 22, 2017 Kate Gordon of the Paulson Institute on climate, the Paris Accords, and China • Nancy MacLean, author of Democracy in Chains, on right-wing scheming, particularly James Bucahan and Charles Koch

Posted in radio, Uncategorized | Tags: China, climate change, Koch Brothers, Mt Pelerin, Paris Accords, public choice