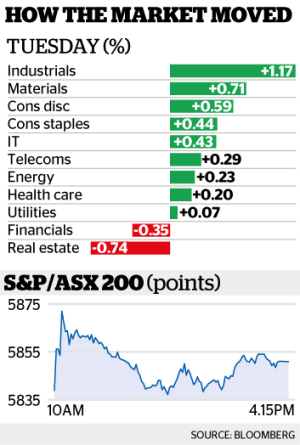

A turnaround in appetite for banking stocks helped the ASX claw into the black on Tuesday, after a midday lull.

Investors poured into the index at the open, but a sharp reversal just before lunchtime saw financial stocks begin to drag the bourse south.

More BusinessDay Videos

ASX winners and losers - a snapshot

The stand out listings traded on the ASX captured at key moments through the day, as indicated by the time stamp in the video.

The late-morning release of Reserve Bank of Australia minutes didn't help matters, but distaste for the banks eased in the early afternoon and appetite for industrials and mining stocks kept the ASX clawing higher.

The benchmark S&P;/ASX 200 Index and the broader All Ordinaries Index each closed up 0.2 per cent to 5850.5 points and 5882.2 points, respectively.

Despite the market struggling higher, some investors are wary of entering.

"I don't see the market as a buy here," said Bell Potter's Richard Coppleson, veteran stockbroker and author of the Coppo Report.

"It looks and feels like it's got a drop coming soon. The banks were weak early, but after the huge falls they have had there was always going to be some buyers coming in.

"I'd stay clear of the banks for now - there will be a wall of selling if they rally much further."

NAB closed down 3.5 per cent and Macquarie Group closed down 2.1 per cent, after both financial stocks went ex-dividend. The rest of the big four banks finished the day higher.

A pick up in brent crude provided buying support for resource giant BHP Billiton, which closed up 0.8 per cent.

While iron ore futures were trending down throughout Tuesday, more broadly the market is enjoying a rally when it comes to Australia's largest export. Data out of China revealed that steel production hit a record high in April and as such Rio Tinto and Fortescue Metals ignored Tuesday's iron ore price falls and closed up 1.4 per cent and 2.3 per cent, respectively.

In other equities news, Qantas jumped 2.9 per cent to fresh nine-year highs, a day after ratings agency Moody's lifted its credit rating on the airline. Explosives manufacturer Orica dropped 3.4 per cent after releasing half-year earnings.

Stock Watch: Coca-Cola Amatil

Shares in bottler Coca-Cola Amatil shed 0.2 per cent to $9.60 after the company indicated beverage sales haven't picked up since it first flagged problems last month. The shock profit downgrade last month sent shares tumbling, as the company warned all its channels were experiencing volume and price pressure. The group's expecting underlying net profits after tax to decline in the first half of 2017, leading to lower franking credits. On the plus side for investors, the share buyback program started in April is still progressing, with $268 million still to be spent taking shares off-market. Most analysts have a "hold" on the stock, which is trading 33.7 per cent below the highs it reached in 2013 and above the consensus 12-month price target of analysts, which is $9.47.

Aussie bulls

Hedge funds are giving up on the Australian dollar, according to data from the Commodity Futures Trading Commission. Leveraged funds cut net long positions to 12,879 contracts in the week through May 9, the sixth straight reduction and down from as high as 53,601 at the start of March. Rising Chinese iron ore stockpiles are fuelling concerns over the extent of the price rout, while the narrowing bond yield differential between Australia and the US adds to the concerns that have made the Aussie the worst-performing Group of 10 (G10) currency in the quarter.

Fairfax takeover

Analysts at Citi seem to like TPG Consortium's latest bid for Fairfax Media, the publisher of this paper. They note the $1.20 a share all-cash offer made by TPG to Fairfax's board on Sunday is at a "substantial premium to our fundamental valuation", making the offer "highly likely to proceed, although we do see scope for a higher offer". Citi raised its price target on Fairfax to $1.20, and its rating to neutral, from its previous sell rating. UBS analysts told clients that TPG Capital could afford to pay about 5¢ a share more. The stock last fetched $1.18.

Offshore surge

A number of overseas markets - including the S&P500;, Nasdaq, FTSE100 and DAX - hit record highs on Monday night, in the most positive session for global stocks in three weeks. "The oil markets are acting well and that's helping," said R.J. Grant, head of trading at Keefe, Bruyette & Woods in New York, who also cited the strong US corporate earnings season. About 75 per cent of S&P; 500 companies that have reported quarterly results so far have beaten Wall Street expectations. Also on Tuesday night, oil rose to the highest level in more than three weeks.

Kiwi bust?

New Zealand's housing market is the most over-valued among the so-called G10 economies and the most at risk of a correction, according to Goldman Sachs. The investment bank said there was about a 40 per cent chance of a housing "bust" in New Zealand over the next two years, which it defines as house prices falling 5 per cent or more. The report looks at housing markets in the G10 countries - those with the 10 most-traded currencies in the world - and finds they are most elevated in small, open economies such as New Zealand.