- published: 06 Nov 2014

- views: 8921

-

remove the playlistReserve Bank Of Australia

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistReserve Bank Of Australia

- remove the playlistLatest Videos

- remove the playlistLongest Videos

Please tell us which country and city you'd like to see the weather in.

- published: 18 May 2009

- views: 83768

- published: 20 Jun 2011

- views: 22963

- published: 08 Apr 2012

- views: 13713

- published: 05 Oct 2008

- views: 40541

- published: 13 Nov 2014

- views: 7526

- published: 16 Mar 2016

- views: 415

- published: 01 Sep 2016

- views: 103

- published: 06 Jul 2016

- views: 1282

- published: 19 Feb 2014

- views: 509

- published: 31 Jul 2016

- views: 85

Central bank

A central bank, reserve bank, or monetary authority is an institution that manages a state's currency, money supply, and interest rates. Central banks also usually oversee the commercial banking system of their respective countries. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base in the state, and usually also prints the national currency, which usually serves as the state's legal tender.

The primary function of a central bank is to control the nation's money supply (monetary policy), through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis. Central banks usually also have supervisory powers, intended to prevent bank runs and to reduce the risk that commercial banks and other financial institutions engage in reckless or fraudulent behavior. Central banks in most developed nations are institutionally designed to be independent from political interference. Still, limited control by the executive and legislative bodies usually exists.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Reserve Bank

A reserve bank is a public institution that manages a state's currency, money supply, and interest rates.

Reserve Bank may also refer to:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Bank of Australia

The Bank of Australia was a failed financial institution of early colonial New South Wales formed in 1826 by a producers' and merchants' group as a rival to the Bank of New South Wales. It was dubbed the "pure merino" bank because its share register included the plutocracy of the colony but excluded the ex-convicts who had been associated with the Bank of New South Wales. When investors responded to the depression of the late 1830s by the abrupt withdrawal of capital leading to a chain of insolvencies, a number of colonial banks found that their unrestricted lending had sent prices land soaring as speculators borrowed to invest especially in urban areas. When the banks called in these loans further insolvencies occurred and a number of banks, including the Bank of Australia, failed in 1843. A number of leading colonial figures lost their fortunes with many taking advantage of the Insolvent Debtors Act 1841.

Opening

The bank opened on 3 July 1826 in George Street, Sydney. The first directors of the bank were: Thomas Macvitie (managing director), Edward Wollstonecraft, John Macarthur, Richard Jones, Thomas Icely, John Oxley, George Brown, W.J. Browne, Hannibal Macarthur, James Norton, and A.B. Spark.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Reserve Bank of Australia

The Reserve Bank of Australia (RBA) came into being on 14 January 1960 as Australia's central bank and banknote issuing authority, when the Reserve Bank Act 1959 (23 April 1959) removed the central banking functions from the Commonwealth Bank.

The bank has the responsibility of providing services to the Government of Australia in addition to also providing services to other central banks and official institutions. It currently consists of the Payments System Board, which governs the payments system policy of the bank, and the Reserve Bank Board, which governs all other monetary and banking policies of the bank.

Both boards consist of members of both the bank, the Treasury, other Australian government agencies, and leaders of other institutions that are part of the economy. The structure of the Reserve Bank Board has remained consistent ever since 1951, with the exception of the change in the number of members of the board. The governor of the Reserve Bank of Australia is appointed by the Treasurer and chairs both the Payment Systems and Reserve Bank Boards and when there are disagreements between both boards, the governor resolves them.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Australia

Coordinates: 27°S 133°E / 27°S 133°E / -27; 133

Australia (/ɒˈstreɪliə/, /ə-/, colloquially /-jə/), officially known as the Commonwealth of Australia, is an Oceanian country comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands. It is the world's sixth-largest country by total area. Neighbouring countries include Papua New Guinea, Indonesia and East Timor to the north; the Solomon Islands and Vanuatu to the north-east; and New Zealand to the south-east.

For about 50,000 years before the first British settlement in the late 18th century, Australia was inhabited by indigenous Australians, who spoke languages grouped into roughly 250 language groups. After the European discovery of the continent by Dutch explorers in 1606, Australia's eastern half was claimed by Great Britain in 1770 and initially settled through penal transportation to the colony of New South Wales from 26 January 1788. The population grew steadily in subsequent decades; the continent was explored and an additional five self-governing crown colonies were established. On 1 January 1901, the six colonies federated, forming the Commonwealth of Australia. Since federation, Australia has maintained a stable liberal democratic political system that functions as a federal parliamentary democracy and constitutional monarchy comprising six states and several territories. The population of 24 million is highly urbanised and heavily concentrated in the eastern states and on the coast.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Radio Stations - Canberra

SEARCH FOR RADIOS

- Loading...

-

4:39

4:39Reserve Bank - Role and Functions

Reserve Bank - Role and FunctionsReserve Bank - Role and Functions

The Reserve Bank of Australia is Australia's central bank. Its duty is to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people. It does this by setting the cash rate to meet an inflation target, working to maintain a strong financial system and efficient payments system, and issuing the nation's banknotes. The Bank also manages Australia's foreign exchange reserves and provides banking services to the government. -

7:16

7:16WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

UPDATE: AFTER this video was first made the RBA changed the word "Commonwealth" to "Australia" and the Guardian dropped the word "puppet" from their page. http://web.archive.org/web/20080213120219/http://www.rba.gov.au/FAQ/role.html It's an open secret even clowns like America's Glenn Beck have admitted in the recent past: America's money is made out of "thin air". www.youtube.com/watch?v=qw1hkEor6sM Australia's money NOT backed by gold since 1933 has been backed on America's "thin air". http://www.rba.gov.au/Museum/Displays/1920_1960_comm_bank_and_note_issue/currency_notes_of_the_1930s.html Who owns the "thin air" we have to sweat our guts out working 35+ hours a week for? Now days it's China. Our debt to China will be $300+ Billion. www.news.com.au/couriermail/story/0,20797,25504755-5003402,00.html Guess who set banking up in China? http://www.australiamatters.com/rothschina.html WAKE UP ZOMBIES!!!!! -

35:00

35:00Who REALLY owns the Reserve Bank of Australia?

Who REALLY owns the Reserve Bank of Australia?Who REALLY owns the Reserve Bank of Australia?

http://omf.gd/1vqu ←← You won't want to miss this high impact, edge-of-your-seat exposé of the men behind the wizard's curtain that pulled the strings on the global financial crisis and what you can do about it. =================================== [June 12, 2011] PODCAST CONTENTS The Reserve Bank is a foreign ADI. A "foreign ADI" means a body corporate that: (a) is a foreign corporation within the meaning of paragraph 51(xx) of the Constitution; and (b) is authorised to carry on banking business in a foreign country; and (c) has been granted an authority under section 9 to carry on banking business in Australia. Prior to 1959 the Commonwealth issued and printed its own money and had control of the printing of money. However after the 1959 Reserve Bank Act, the Reserve Bank was established as a stand alone independent foreign ADI, which took over the printing of money and lent the money it printed to the Commonwealth at interest. So instead of the Commonwealth printing its own money, we have a foreign body corporate printing our money and lending it to the Commonwealth which the Commonwealth needs to pay back! "RESERVE BANK ACT 1959 - SECT 77 Guarantee by Commonwealth The Commonwealth is responsible for the payment of all moneys due by the Bank" (Source: http://www.austlii.edu.au/au/legis/cth/consol_act/rba1959130/s77.html (The commonwealth of Australia is paying money is borrows back to the stand alone bank) "RESERVE BANK ACT 1959 - SECT 27 Bank to be banker for Commonwealth The Bank shall, in so far as the Commonwealth requires it to do so, act as banker and financial agent of the Commonwealth" (Source: http://www.austlii.edu.au/au/legis/cth/consol_act/rba1959130/s27.html (The reserve bank is the Commonwealths banker and lender and the Commonwealth must pay the money back to the Bank!) EVIDENCE THE BANK IS A FOREIGN ADI WITH FOREIGN LINKS AND BRANCHES: The below act shows how foreign coroporations have power of attorney over the Reserve Bank of Australia: RESERVE BANK ACT 1959 - SECT 76 Attorney of Bank The Bank may, by instrument under its seal, appoint a person (whether in Australia or in a place beyond Australia) to be its attorney and a person so appointed may, subject to the instrument, do any act or execute any power or function which he or she is authorized by the instrument to do or execute. (Source: http://www.austlii.edu.au/au/legis/cth/consol_act/rba1959130/s76.html Foreign Agents in control of the Reserve Bank of Australia: RESERVE BANK ACT 1959 - SECT 75 Agents etc. In the exercise of its powers and the performance of its functions, the Bank may: (a) Establish branches and agencies at such places, whether within or beyond Australia, as the Bank thinks fit; (b) Arrange with a person to act as agent of the Bank in any place, whether within or beyond Australia; and (c) Act as the agent of an ADI carrying on business within or beyond Australia. -

3:55

3:55RBA is a Rothchild Bank.

RBA is a Rothchild Bank.RBA is a Rothchild Bank.

The Australian banking system is typical of the world's. Central banks - ALL privately owned - control the creation and flow of money. The world is under siege by an elite banking cartel. The more debt, the more banks make. The only hope? Ron Paul for US President in 2012... The Australian Patriots Party is more then a Political Party we are a political movement dedicated to the protection of Australia's beliefs, people, culture and history from the threat of traitorous politicians who are selling us out to foreign interests and powers. TAPP will Abolish all Laws Regarding : Fluoride in the Water supply Chemtrails ie Weather Modification Spraying in our Skies GMO Foods Coal Seam Gas Minning Speeding Cameras Carbon TAX Raw Milk The Australian Patriots Party wants to educate the Australian population that this "Left / Right Wing" political paradigm we have in this country is a scam, APP knows that The Labor and Liberal parties in reality are "Two wings of the Same bird." APP is the only Political Party in the World to stand up to the implementation of a "New World Order" by Power hungry Elite Globalist's TAPP has great knowledge that their agenda is to create a cashless society implementing draconian laws and stripping away the People's common Law rights and creating a "One World Government" through the United Nations. Everyday we see their evil plans uncovered by the controlled mainstream media bit by bit your civil Liberties are being stripped away So Every Australian is immediately required to make a decision between debt controlled slavery in perpetuity - or the age of prosperity. Both are eminently possible, one we will have. Which one? Now rely on your gut feeling, ignore the controlled media propaganda -- it's owned by your would-be masters, but decide now between perpetual slavery or the age of prosperity. Website .. http://www.australianpatriotsassociation.com.au/ -

3:26

3:26Reserve bank of Australia explained

Reserve bank of Australia explainedReserve bank of Australia explained

Newstopia explains the workings of the Reserve Bank of Australia. -

5:49

5:49Reserve Bank of Australia - Monetary Policy Framework

Reserve Bank of Australia - Monetary Policy FrameworkReserve Bank of Australia - Monetary Policy Framework

The Reserve Bank of Australia is responsible for Australia's monetary policy. Its monetary policy objective is defined as an ‘inflation target’ of consumer price inflation of 2–3 per cent, on average, over the medium term. To meet this, the Bank influences interest rates in the economy by setting a target for ‘the cash rate’. Influencing interest rates in this way affects the behaviour of borrowers and lenders, economic activity and ultimately the rate of inflation. -

35:00

35:00Who Really Owns The Reserve Bank Of Australia (RBA)

Who Really Owns The Reserve Bank Of Australia (RBA)Who Really Owns The Reserve Bank Of Australia (RBA)

Tip its not the Government. Its privately owned like every Central Bank in the world. We have been tricked into assuming its serves Australians however its money lender to the Government and the wholesale lender to Australian Banks. It prints money backed by thin air and charges us interest great scam -

4:01

4:01Reserve Bank of Australia 'Worried' About Australian Housing Bubble

Reserve Bank of Australia 'Worried' About Australian Housing BubbleReserve Bank of Australia 'Worried' About Australian Housing Bubble

A report on the RBA's concern on high debt levels and property prices in Australia. As the economy weakens in Australia, what will this mean for historical high property prices in Australia? Source: ABC http://iview.abc.net.au/programs/business/NU1704H049S00 -

1:01

1:01Reserve Bank of Australia Next Generation Banknotes

Reserve Bank of Australia Next Generation BanknotesReserve Bank of Australia Next Generation Banknotes

We were asked by the Reserve Bank of Australia to launch the Next Generation of Australian Banknotes. The new banknotes feature a range of innovative security features including moving holographic images and the world’s first top to bottom window. Encompassing much more than traditional communications, we were charged to create a fully-integrated, Australia-wide, multi-touch point campaign. We even conceived the communications treatment of specific security features to be used across all traditional and digital formats, including the RBA website. And we brought all the diverse elements together under our campaign theme – clearly more secure. -

23:39

23:39Monetary Policy in Australia - Part 1

Monetary Policy in Australia - Part 1Monetary Policy in Australia - Part 1

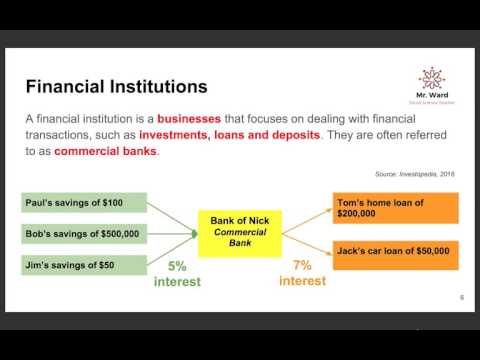

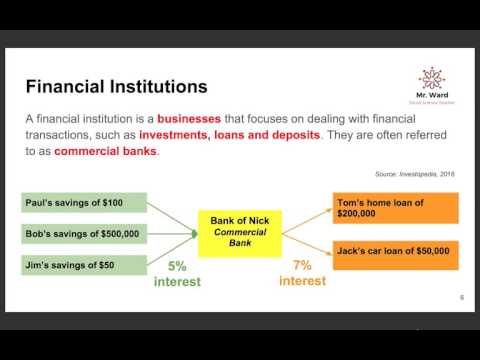

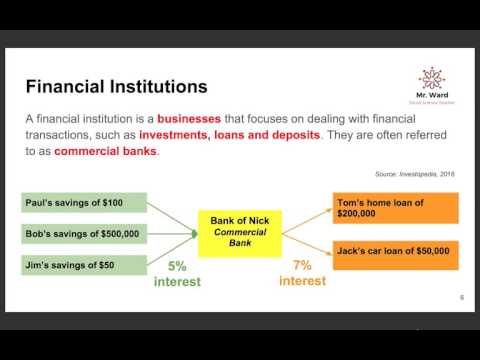

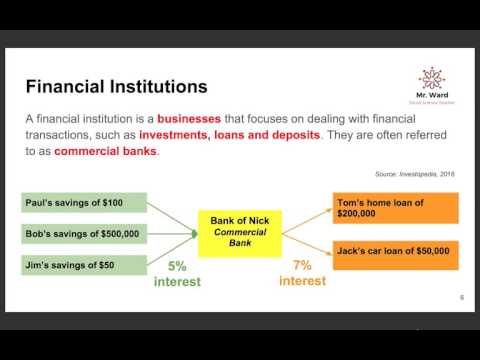

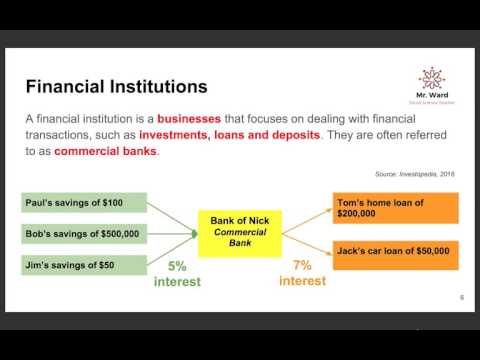

These videos are designed to complement the Stage 6 NSW Economics Syllabus. Specifically Preliminary Topic Five – Financial Markets Where Students learn about - Interest rates. Including - the types of rates in the short term and long term, - the role of the reserve bank of Australia in determining the cash rate and - the influence of the cash rate on interest rates. Today we will look at: - What is macroeconomics - What are the different types of Interest rates - What is a Financial institution and how do they make money - What is the role of the Reserve Bank of Australia - What is Monetary policy - What is Inflation, - The stances of monetary policy, and - Monetary policy during the global financial crisis -

3:06

3:06Australian Mortgages

Australian MortgagesAustralian Mortgages

Find out if you qualify for a home loan in Australia: Australian mortgages: http://www.homeloanexperts.com.au/non-resident-mortgages/australian-mortgages/ Temporary residents:http://www.homeloanexperts.com.au/non-resident-mortgages/temporary-resident-mortgage/ Foreign citizens: http://www.homeloanexperts.com.au/non-resident-mortgages/foreigner-mortgage/ Australian expats: http://www.homeloanexperts.com.au/non-resident-mortgages/overseas-australian-mortgage/ --------------------------------------------------------------------------------------- Video transcript: Wondering how Australian Mortgages work? Do you want to know how much you can borrow? In this video we walk you through what you need to know when applying for a mortgage in Australia. Sophie is looking to buy a house in Australia. She has done her research online but has been overloaded with conflicting information and she doesn't know where to start. So how do Australian Mortgages work? Most loans in Australia are set up over a 30-year term. You have two choices. You can choose a variable interest rate, where your interest rate will move up and down with the Reserve Bank of Australia. Or you can either choose a fixed interest rate where you can lock it in for a set period of time! In Australia, most fixed rate loans are for a maximum of 5 years, although some lenders will allow you to fix for longer. Variable rate loans are a lot more flexible. They allow you to make extra repayments and to access the additional repayments that you have made. You may not be allowed to do this with a fixed rate loan. In the long term, variable interest rates usually stay between 4 and 10 percent. However, there is no guarantee that they will stay in that range in the future. The great news is, if you have a variable rate, you can switch to a fixed interest rate at a later date or you can increase your repayments so that your loan will be paid off sooner. So what kinds of features are available to Sophie if she were to get an Australian mortgage? Most Australian mortgages have online access so they're really easy for Sophie to manage. Your repayments will be automatically deducted from an Australian bank account. You can also have your rent from your properties paid into that account as well. Some lenders allow you to setup this bank account to "offset" your mortgage. What this means is that they calculate interest on the overall balance of your loan and the bank account. So if you had a loan of $1,000,000 and you had $100,000 in your offset account, then they would only charge you interest on $900,000. This can save you a fortune in interest over the term of the loan. Most lenders will also give you the option to make interest only repayments. This is where you're just paying the interest. Your repayments will be lower, however you aren't actually reducing the balance. Many investors choose this option, so that they can put their money to better use elsewhere. But don't worry, if you want to you can still make extra repayments on an interest only loan. So how much can Sophie borrow on a property in Australia? In most cases, it's easy to borrow up to 80% of the value of a property. However, in some cases, it is possible to borrow as much as 95% of the value of the property. For commercial properties, it is quite common for lenders to limit your loan to 60% or 70% of the property value. So does Sophie need to be an Australian citizen to qualify for a mortgage? No, foreign investors can get loans too. However, if you aren't an Australian citizen you may be required to get approval from the Australian government. But don't worry. As long as you buy a property that meets their requirements this isn't too difficult. So what are the Australian banks like? Unfortunately, you will find banks in Australia are fairly disorganised compared to banks overseas, particularly if you come from the UK or United States. You need to be prepared for some delays and a few silly questions. If you know how their systems work then they won't be a problem. So which lenders can help you? The Home Loan Experts are mortgage brokers who specialise in helping foreign investors and Australian expats who are buying a property in Australia. Each bank has different lending guidelines, different requirements and they also have very different interest rates which is why mortgage brokers are so popular with non-residents. So what happened to Sophie? Well, she got her mortgage approved and is buying investment properties all over Australia! And you can too, but contacting us today -

3:51

3:51What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

http://bit.ly/1RhmvaZ Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report August 1-5, 2016. Monday is the first trading day of August, and the US Dollar is in sharp focus at 14:00 with the release of the ISM Manufacturing PMI for July. Traders are agonizing over whether the US economy has recovered, and are instantly reactive to any upside or downside surprises. Last seen at the level of 53.2, the ISM benchmark is an unmissable event for USD traders. The Reserve Bank of Australia’s Interest Rate Decision at 04:30 on Tuesday could move the AUD up or down, depending on whether the central bank makes a cut this time around. There’s speculation that low inflation results may force the RBA’s hand, so it’s definitely an event to add to your watch list. Wednesday’s investment highlight is at 08:00 when Markit releases the latest Services PMI for the Eurozone. Last seen at the level of 52.9, investors are watching this indicator to see if the Brexit has impacted confidence in the services sector. There could be an impact on the EURO, depending on the results. The Bank of England takes the spotlight on Thursday when it releases its Interest Rate Decision at 11:00. Following the Brexit crisis, the central bank is expected to ease its policy in the near future, and the markets are speculating that it will be sooner rather than later. The GBP is extremely vulnerable to volatility, and it’s likely that this major event will have an impact on its price. The world’s biggest economy releases Non-Farm Payroll results for July at 12:30. Last seen at the level of 287,000, the US jobs sector is a key indicator for USD traders. Bull or bear, this trading event is not to be missed. Title: Non-Farm Payrolls Drive the USD and Gold Key tags: Brexit, CHF, Non-Farm Payrolls, FOMC, GBP, Gold, GDP, ECB, Trading, NFP, USD, EURO, ADP, Reserve Bank of Australia, AUD, European Central Bank, Mario Draghi, USD, Federal Reserve, Janet Yellen, Bank of England, EURUSD, Binary Options, Banc De Binary, Retail Sales, Interest Rates, Trading, YEN, US GDP http://bit.ly/1RhmvaZ -

3:49

3:49How are binary options different to other types of online trading? Ahead Of The Week - September 26th

How are binary options different to other types of online trading? Ahead Of The Week - September 26thHow are binary options different to other types of online trading? Ahead Of The Week - September 26th

Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report for September 26th to 30th. The trading highlight is on Wednesday the 28th when the US releases the latest Durable Goods Orders for August, with an expected impact on the USD. In its latest interest rate decision, the Federal Reserve said its economic outlook is uncertain, meaning that the US Dollar is now open to more volatility. Monday the 26th brings trading opportunities on the USD with the release of New Home Sales for August at 14:00. Last seen at the level of 650,000 new homes, this indicator signals the health of the US housing market. On Tuesday the 27th, we’re watching the latest Markit Services PMI results for September in the US, released at 12:30 GMT. Previously at the level of 51, the benchmark provides valuable clues about the growth in the US Services sector. Any upside or downside surprises on the previous level of 51 could impact the USD. Traders are on high alert for the latest release of US Durable Goods Orders which hits the headlines on Wednesday the 28th at 12:30. The USD could be in for more volatility depending on the results for August. For comparison’s sake, the previous level was 4.4 percent. Another major economic indicator for the US is released at 12:30 on Thursday the 29th with the latest reading of the second-quarter GDP results. Last seen at the level of 1.1 percent, there could be a chain reaction on the USD if the news is better-or-worse than expected. Lastly for the trading week, the Eurozone releases its latest inflation results for September at 09:00 on Friday the 30th. Previously at the level of 0.8 percent, price growth is still too low, meaning less company profits and reduced investor trust in the Eurozone’s economy. Any upside or downside surprises could impact the Euro. -

3:12

3:12What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

http://bit.ly/1RhmvaZ Made for traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report for the 14th – 18th March, 2016. The event of the week is on Wednesday when the Federal Reserve releases its Interest Rate Decision, with a likely impact on the USD and Gold. Monday the 14th has a market-moving event at 06:30 with the Bank of Japan’s Press Conference. The Yen may see some action during this event, because Japan’s fourth-quarter GDP contracted by 0.3 percent in 2015, meaning that monetary policy makers might take further easing measures. The trading highlight on Tuesday the 15th is at 12:30 when the US Retail Sales figures for February are released, with an expected impact on the USD. Retail Sales inched up by 0.2 percent in January, so traders are looking for an improvement on this level. Wednesday the 16th is a big day for the USD, the Federal Reserve releases its Interest Rate Decision at 18:00 GMT. It’s our top trading alert for the week because it affects two assets, the USD and Gold. US Interest rates are under intense scrutiny – will the Fed make another hike from the current level of 0.5 percent or not? Thursday the 17th is just as intense, because the Bank of England releases its Interest Rate Decision at 12:00, with a likely knock-on effect on the Pound Sterling. BoE Governor Mark Carney is under pressure ahead of the Brexit vote in June, and the Pound is facing more potential losses as the referendum draws near. Finally for the trading week, Friday the 18th brings trading opportunities on the CAD with the release of Canada’s Consumer Price Index for February. Last seen at the level of 0.2 percent on a monthly basis, the new results could move the loonie UP or DOWN. http://bit.ly/1RhmvaZ

-

Reserve Bank - Role and Functions

The Reserve Bank of Australia is Australia's central bank. Its duty is to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people. It does this by setting the cash rate to meet an inflation target, working to maintain a strong financial system and efficient payments system, and issuing the nation's banknotes. The Bank also manages Australia's foreign exchange reserves and provides banking services to the government.

published: 06 Nov 2014 -

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

UPDATE: AFTER this video was first made the RBA changed the word "Commonwealth" to "Australia" and the Guardian dropped the word "puppet" from their page. http://web.archive.org/web/20080213120219/http://www.rba.gov.au/FAQ/role.html It's an open secret even clowns like America's Glenn Beck have admitted in the recent past: America's money is made out of "thin air". www.youtube.com/watch?v=qw1hkEor6sM Australia's money NOT backed by gold since 1933 has been backed on America's "thin air". http://www.rba.gov.au/Museum/Displays/1920_1960_comm_bank_and_note_issue/currency_notes_of_the_1930s.html Who owns the "thin air" we have to sweat our guts out working 35+ hours a week for? Now days it's China. Our debt to China will be $300+ Billion. www.news.com.au/couriermail/story/0,20797,25504755...

published: 18 May 2009 -

Who REALLY owns the Reserve Bank of Australia?

http://omf.gd/1vqu ←← You won't want to miss this high impact, edge-of-your-seat exposé of the men behind the wizard's curtain that pulled the strings on the global financial crisis and what you can do about it. =================================== [June 12, 2011] PODCAST CONTENTS The Reserve Bank is a foreign ADI. A "foreign ADI" means a body corporate that: (a) is a foreign corporation within the meaning of paragraph 51(xx) of the Constitution; and (b) is authorised to carry on banking business in a foreign country; and (c) has been granted an authority under section 9 to carry on banking business in Australia. Prior to 1959 the Commonwealth issued and printed its own money and had control of the printing of money. However after the 1959 Reserve Bank Act, the Reserve Bank was...

published: 20 Jun 2011 -

RBA is a Rothchild Bank.

The Australian banking system is typical of the world's. Central banks - ALL privately owned - control the creation and flow of money. The world is under siege by an elite banking cartel. The more debt, the more banks make. The only hope? Ron Paul for US President in 2012... The Australian Patriots Party is more then a Political Party we are a political movement dedicated to the protection of Australia's beliefs, people, culture and history from the threat of traitorous politicians who are selling us out to foreign interests and powers. TAPP will Abolish all Laws Regarding : Fluoride in the Water supply Chemtrails ie Weather Modification Spraying in our Skies GMO Foods Coal Seam Gas Minning Speeding Cameras Carbon TAX Raw Milk The Australian Patriots Party wants to educate the Australi...

published: 08 Apr 2012 -

Reserve bank of Australia explained

Newstopia explains the workings of the Reserve Bank of Australia.

published: 05 Oct 2008 -

Reserve Bank of Australia - Monetary Policy Framework

The Reserve Bank of Australia is responsible for Australia's monetary policy. Its monetary policy objective is defined as an ‘inflation target’ of consumer price inflation of 2–3 per cent, on average, over the medium term. To meet this, the Bank influences interest rates in the economy by setting a target for ‘the cash rate’. Influencing interest rates in this way affects the behaviour of borrowers and lenders, economic activity and ultimately the rate of inflation.

published: 13 Nov 2014 -

Who Really Owns The Reserve Bank Of Australia (RBA)

Tip its not the Government. Its privately owned like every Central Bank in the world. We have been tricked into assuming its serves Australians however its money lender to the Government and the wholesale lender to Australian Banks. It prints money backed by thin air and charges us interest great scam

published: 16 Mar 2016 -

Reserve Bank of Australia 'Worried' About Australian Housing Bubble

A report on the RBA's concern on high debt levels and property prices in Australia. As the economy weakens in Australia, what will this mean for historical high property prices in Australia? Source: ABC http://iview.abc.net.au/programs/business/NU1704H049S00

published: 13 Apr 2017 -

Reserve Bank of Australia Next Generation Banknotes

We were asked by the Reserve Bank of Australia to launch the Next Generation of Australian Banknotes. The new banknotes feature a range of innovative security features including moving holographic images and the world’s first top to bottom window. Encompassing much more than traditional communications, we were charged to create a fully-integrated, Australia-wide, multi-touch point campaign. We even conceived the communications treatment of specific security features to be used across all traditional and digital formats, including the RBA website. And we brought all the diverse elements together under our campaign theme – clearly more secure.

published: 01 Sep 2016 -

Monetary Policy in Australia - Part 1

These videos are designed to complement the Stage 6 NSW Economics Syllabus. Specifically Preliminary Topic Five – Financial Markets Where Students learn about - Interest rates. Including - the types of rates in the short term and long term, - the role of the reserve bank of Australia in determining the cash rate and - the influence of the cash rate on interest rates. Today we will look at: - What is macroeconomics - What are the different types of Interest rates - What is a Financial institution and how do they make money - What is the role of the Reserve Bank of Australia - What is Monetary policy - What is Inflation, - The stances of monetary policy, and - Monetary policy during the global financial crisis

published: 06 Jul 2016 -

Australian Mortgages

Find out if you qualify for a home loan in Australia: Australian mortgages: http://www.homeloanexperts.com.au/non-resident-mortgages/australian-mortgages/ Temporary residents:http://www.homeloanexperts.com.au/non-resident-mortgages/temporary-resident-mortgage/ Foreign citizens: http://www.homeloanexperts.com.au/non-resident-mortgages/foreigner-mortgage/ Australian expats: http://www.homeloanexperts.com.au/non-resident-mortgages/overseas-australian-mortgage/ --------------------------------------------------------------------------------------- Video transcript: Wondering how Australian Mortgages work? Do you want to know how much you can borrow? In this video we walk you through what you need to know when applying for a mortgage in Australia. Sophie is looking to buy a house in Austra...

published: 19 Feb 2014 -

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

http://bit.ly/1RhmvaZ Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report August 1-5, 2016. Monday is the first trading day of August, and the US Dollar is in sharp focus at 14:00 with the release of the ISM Manufacturing PMI for July. Traders are agonizing over whether the US economy has recovered, and are instantly reactive to any upside or downside surprises. Last seen at the level of 53.2, the ISM benchmark is an unmissable event for USD traders. The Reserve Bank of Australia’s Interest Rate Decision at 04:30 on Tuesday could move the AUD up or down, depending on whether the central bank makes a cut this time around. There’s speculation that low inflation results may force the RBA’s hand, so it’s definitely an event to add t...

published: 31 Jul 2016 -

How are binary options different to other types of online trading? Ahead Of The Week - September 26th

Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report for September 26th to 30th. The trading highlight is on Wednesday the 28th when the US releases the latest Durable Goods Orders for August, with an expected impact on the USD. In its latest interest rate decision, the Federal Reserve said its economic outlook is uncertain, meaning that the US Dollar is now open to more volatility. Monday the 26th brings trading opportunities on the USD with the release of New Home Sales for August at 14:00. Last seen at the level of 650,000 new homes, this indicator signals the health of the US housing market. On Tuesday the 27th, we’re watching the latest Markit Services PMI results for September in the US, released at 12:30 GMT. Previously a...

published: 26 Sep 2016 -

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

http://bit.ly/1RhmvaZ Made for traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report for the 14th – 18th March, 2016. The event of the week is on Wednesday when the Federal Reserve releases its Interest Rate Decision, with a likely impact on the USD and Gold. Monday the 14th has a market-moving event at 06:30 with the Bank of Japan’s Press Conference. The Yen may see some action during this event, because Japan’s fourth-quarter GDP contracted by 0.3 percent in 2015, meaning that monetary policy makers might take further easing measures. The trading highlight on Tuesday the 15th is at 12:30 when the US Retail Sales figures for February are released, with an expected impact on the USD. Retail Sales inched up by 0.2 percent in January, so traders...

published: 14 Mar 2016 -

How is a benchmark’s previous performance used? Ahead Of The Week - 15th August 2016

http://bit.ly/1RhmvaZ Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report August 15-19, 2016. The USD is back on the top of our watch list ahead of the FOMC release on Wednesday, which is our trading event of the week. The latest US job results may have been better-than-expected, but traders are still skeptical about the Federal Reserve’s intentions to hike interest rates. On Monday the 15th of August, it’s Assumption Day in many EU markets, but the US is open for business. At 14:00 the NAHB Housing Market Index for August is released. Last seen at the level of 59, this benchmark measures the health of the US housing market. Any upside or downside surprises are likely to impact the USD. Tuesday the 16th brings trading opportun...

published: 15 Aug 2016 -

5 Dollar Note

To celebrate the launch of the new 5 dollar note, Lightwell created a 4 screen multi-touch installation for the New Banknote Generation exhibition at the Reserve Bank of Australia museum in Martin Place.

published: 02 Jan 2017 -

How Will An Unstable China Affect My Trades?

China made two decisions that were felt around the world's financial markets, including Asian, US and European indices. First, it devalued its currency to make its exports more competitive. Second, it cut its interest rate to increase liquidity to local businesses. This made investors believe there is a problem in the Chinese economy and the massive international companies that are listed on world stock exchanges started to see their share prices lose value. Many traders saw this volatility as an opportunity to trade on global stock indices going DOWN. _________________________________________________________________ The focus this week is on data coming out of the Eurozone, including updated inflation numbers, a new interest rate decision, and producer prices. This means that it'...

published: 31 Aug 2015 -

AHEAD OF THE WEEK REPORT 31st October 2016

published: 31 Oct 2016 -

1300 HOME LOAN on SkyNews

Managing Director of 1300 HOME LOAN, John Kolenda talks to Sky Business News regarding the state of the economy, housing and mortgages, and commentary surrounding the Reserve Bank of Australia's decision on July cash rate position. With continuous fluctuations in interest rates consumers can get the best deal by speaking to a local broker via 1300HOMELOAN (1300 466 356) or enquiries@1300homeloan.com.au. www.1300homeloan.com.au

published: 05 Jul 2012 -

URGENT, must attend webinar!

It is very important that you join me and my team of experts as we discuss matters from the budget and the recent interest rate cuts that will have an immediate (and long term) effect on you . Last Tuesday evening two BIG events happened: The first was the announcement from Reserve Bank of Australia (RBA) to cut the official cash rate; down from 2 percent to 1.75 percent The second big event last Tuesday was the handing down of the 2016/17 Federal Budget The webinar will take about 45 minutes and we will then answer your questions.

published: 11 May 2016

Reserve Bank - Role and Functions

- Order: Reorder

- Duration: 4:39

- Updated: 06 Nov 2014

- views: 8921

- published: 06 Nov 2014

- views: 8921

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

- Order: Reorder

- Duration: 7:16

- Updated: 18 May 2009

- views: 83768

- published: 18 May 2009

- views: 83768

Who REALLY owns the Reserve Bank of Australia?

- Order: Reorder

- Duration: 35:00

- Updated: 20 Jun 2011

- views: 22963

- published: 20 Jun 2011

- views: 22963

RBA is a Rothchild Bank.

- Order: Reorder

- Duration: 3:55

- Updated: 08 Apr 2012

- views: 13713

- published: 08 Apr 2012

- views: 13713

Reserve bank of Australia explained

- Order: Reorder

- Duration: 3:26

- Updated: 05 Oct 2008

- views: 40541

- published: 05 Oct 2008

- views: 40541

Reserve Bank of Australia - Monetary Policy Framework

- Order: Reorder

- Duration: 5:49

- Updated: 13 Nov 2014

- views: 7526

- published: 13 Nov 2014

- views: 7526

Who Really Owns The Reserve Bank Of Australia (RBA)

- Order: Reorder

- Duration: 35:00

- Updated: 16 Mar 2016

- views: 415

- published: 16 Mar 2016

- views: 415

Reserve Bank of Australia 'Worried' About Australian Housing Bubble

- Order: Reorder

- Duration: 4:01

- Updated: 13 Apr 2017

- views: 114

Reserve Bank of Australia Next Generation Banknotes

- Order: Reorder

- Duration: 1:01

- Updated: 01 Sep 2016

- views: 103

- published: 01 Sep 2016

- views: 103

Monetary Policy in Australia - Part 1

- Order: Reorder

- Duration: 23:39

- Updated: 06 Jul 2016

- views: 1282

- published: 06 Jul 2016

- views: 1282

Australian Mortgages

- Order: Reorder

- Duration: 3:06

- Updated: 13 Apr 2017

- views: 509

- published: 19 Feb 2014

- views: 509

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

- Order: Reorder

- Duration: 3:51

- Updated: 13 Mar 2017

- views: 85

- published: 31 Jul 2016

- views: 85

How are binary options different to other types of online trading? Ahead Of The Week - September 26th

- Order: Reorder

- Duration: 3:49

- Updated: 03 Mar 2017

- views: 22

- published: 26 Sep 2016

- views: 22

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

- Order: Reorder

- Duration: 3:12

- Updated: 27 Mar 2017

- views: 82

- published: 14 Mar 2016

- views: 82

How is a benchmark’s previous performance used? Ahead Of The Week - 15th August 2016

- Order: Reorder

- Duration: 3:54

- Updated: 26 Jan 2017

- views: 62

- published: 15 Aug 2016

- views: 62

5 Dollar Note

- Order: Reorder

- Duration: 1:02

- Updated: 20 Apr 2017

- views: 49

- published: 02 Jan 2017

- views: 49

How Will An Unstable China Affect My Trades?

- Order: Reorder

- Duration: 3:42

- Updated: 01 Apr 2017

- views: 59

- published: 31 Aug 2015

- views: 59

AHEAD OF THE WEEK REPORT 31st October 2016

- Order: Reorder

- Duration: 3:43

- Updated: 31 Jan 2017

- views: 8

- published: 31 Oct 2016

- views: 8

1300 HOME LOAN on SkyNews

- Order: Reorder

- Duration: 3:06

- Updated: 06 Jul 2015

- views: 208

- published: 05 Jul 2012

- views: 208

URGENT, must attend webinar!

- Order: Reorder

- Duration: 1:22:04

- Updated: 23 May 2016

- views: 12

- published: 11 May 2016

- views: 12

-

Reserve Bank - Role and Functions

The Reserve Bank of Australia is Australia's central bank. Its duty is to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people. It does this by setting the cash rate to meet an inflation target, working to maintain a strong financial system and efficient payments system, and issuing the nation's banknotes. The Bank also manages Australia's foreign exchange reserves and provides banking services to the government.

published: 06 Nov 2014 -

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

UPDATE: AFTER this video was first made the RBA changed the word "Commonwealth" to "Australia" and the Guardian dropped the word "puppet" from their page. http://web.archive.org/web/20080213120219/http://www.rba.gov.au/FAQ/role.html It's an open secret even clowns like America's Glenn Beck have admitted in the recent past: America's money is made out of "thin air". www.youtube.com/watch?v=qw1hkEor6sM Australia's money NOT backed by gold since 1933 has been backed on America's "thin air". http://www.rba.gov.au/Museum/Displays/1920_1960_comm_bank_and_note_issue/currency_notes_of_the_1930s.html Who owns the "thin air" we have to sweat our guts out working 35+ hours a week for? Now days it's China. Our debt to China will be $300+ Billion. www.news.com.au/couriermail/story/0,20797,25504755...

published: 18 May 2009 -

Who REALLY owns the Reserve Bank of Australia?

http://omf.gd/1vqu ←← You won't want to miss this high impact, edge-of-your-seat exposé of the men behind the wizard's curtain that pulled the strings on the global financial crisis and what you can do about it. =================================== [June 12, 2011] PODCAST CONTENTS The Reserve Bank is a foreign ADI. A "foreign ADI" means a body corporate that: (a) is a foreign corporation within the meaning of paragraph 51(xx) of the Constitution; and (b) is authorised to carry on banking business in a foreign country; and (c) has been granted an authority under section 9 to carry on banking business in Australia. Prior to 1959 the Commonwealth issued and printed its own money and had control of the printing of money. However after the 1959 Reserve Bank Act, the Reserve Bank was...

published: 20 Jun 2011 -

RBA is a Rothchild Bank.

The Australian banking system is typical of the world's. Central banks - ALL privately owned - control the creation and flow of money. The world is under siege by an elite banking cartel. The more debt, the more banks make. The only hope? Ron Paul for US President in 2012... The Australian Patriots Party is more then a Political Party we are a political movement dedicated to the protection of Australia's beliefs, people, culture and history from the threat of traitorous politicians who are selling us out to foreign interests and powers. TAPP will Abolish all Laws Regarding : Fluoride in the Water supply Chemtrails ie Weather Modification Spraying in our Skies GMO Foods Coal Seam Gas Minning Speeding Cameras Carbon TAX Raw Milk The Australian Patriots Party wants to educate the Australi...

published: 08 Apr 2012 -

Reserve bank of Australia explained

Newstopia explains the workings of the Reserve Bank of Australia.

published: 05 Oct 2008 -

Reserve Bank of Australia - Monetary Policy Framework

The Reserve Bank of Australia is responsible for Australia's monetary policy. Its monetary policy objective is defined as an ‘inflation target’ of consumer price inflation of 2–3 per cent, on average, over the medium term. To meet this, the Bank influences interest rates in the economy by setting a target for ‘the cash rate’. Influencing interest rates in this way affects the behaviour of borrowers and lenders, economic activity and ultimately the rate of inflation.

published: 13 Nov 2014 -

Who Really Owns The Reserve Bank Of Australia (RBA)

Tip its not the Government. Its privately owned like every Central Bank in the world. We have been tricked into assuming its serves Australians however its money lender to the Government and the wholesale lender to Australian Banks. It prints money backed by thin air and charges us interest great scam

published: 16 Mar 2016 -

Reserve Bank of Australia 'Worried' About Australian Housing Bubble

A report on the RBA's concern on high debt levels and property prices in Australia. As the economy weakens in Australia, what will this mean for historical high property prices in Australia? Source: ABC http://iview.abc.net.au/programs/business/NU1704H049S00

published: 13 Apr 2017 -

Reserve Bank of Australia Next Generation Banknotes

We were asked by the Reserve Bank of Australia to launch the Next Generation of Australian Banknotes. The new banknotes feature a range of innovative security features including moving holographic images and the world’s first top to bottom window. Encompassing much more than traditional communications, we were charged to create a fully-integrated, Australia-wide, multi-touch point campaign. We even conceived the communications treatment of specific security features to be used across all traditional and digital formats, including the RBA website. And we brought all the diverse elements together under our campaign theme – clearly more secure.

published: 01 Sep 2016 -

Monetary Policy in Australia - Part 1

These videos are designed to complement the Stage 6 NSW Economics Syllabus. Specifically Preliminary Topic Five – Financial Markets Where Students learn about - Interest rates. Including - the types of rates in the short term and long term, - the role of the reserve bank of Australia in determining the cash rate and - the influence of the cash rate on interest rates. Today we will look at: - What is macroeconomics - What are the different types of Interest rates - What is a Financial institution and how do they make money - What is the role of the Reserve Bank of Australia - What is Monetary policy - What is Inflation, - The stances of monetary policy, and - Monetary policy during the global financial crisis

published: 06 Jul 2016 -

Australian Mortgages

Find out if you qualify for a home loan in Australia: Australian mortgages: http://www.homeloanexperts.com.au/non-resident-mortgages/australian-mortgages/ Temporary residents:http://www.homeloanexperts.com.au/non-resident-mortgages/temporary-resident-mortgage/ Foreign citizens: http://www.homeloanexperts.com.au/non-resident-mortgages/foreigner-mortgage/ Australian expats: http://www.homeloanexperts.com.au/non-resident-mortgages/overseas-australian-mortgage/ --------------------------------------------------------------------------------------- Video transcript: Wondering how Australian Mortgages work? Do you want to know how much you can borrow? In this video we walk you through what you need to know when applying for a mortgage in Australia. Sophie is looking to buy a house in Austra...

published: 19 Feb 2014 -

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

http://bit.ly/1RhmvaZ Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report August 1-5, 2016. Monday is the first trading day of August, and the US Dollar is in sharp focus at 14:00 with the release of the ISM Manufacturing PMI for July. Traders are agonizing over whether the US economy has recovered, and are instantly reactive to any upside or downside surprises. Last seen at the level of 53.2, the ISM benchmark is an unmissable event for USD traders. The Reserve Bank of Australia’s Interest Rate Decision at 04:30 on Tuesday could move the AUD up or down, depending on whether the central bank makes a cut this time around. There’s speculation that low inflation results may force the RBA’s hand, so it’s definitely an event to add t...

published: 31 Jul 2016 -

How are binary options different to other types of online trading? Ahead Of The Week - September 26th

Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report for September 26th to 30th. The trading highlight is on Wednesday the 28th when the US releases the latest Durable Goods Orders for August, with an expected impact on the USD. In its latest interest rate decision, the Federal Reserve said its economic outlook is uncertain, meaning that the US Dollar is now open to more volatility. Monday the 26th brings trading opportunities on the USD with the release of New Home Sales for August at 14:00. Last seen at the level of 650,000 new homes, this indicator signals the health of the US housing market. On Tuesday the 27th, we’re watching the latest Markit Services PMI results for September in the US, released at 12:30 GMT. Previously a...

published: 26 Sep 2016 -

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

http://bit.ly/1RhmvaZ Made for traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report for the 14th – 18th March, 2016. The event of the week is on Wednesday when the Federal Reserve releases its Interest Rate Decision, with a likely impact on the USD and Gold. Monday the 14th has a market-moving event at 06:30 with the Bank of Japan’s Press Conference. The Yen may see some action during this event, because Japan’s fourth-quarter GDP contracted by 0.3 percent in 2015, meaning that monetary policy makers might take further easing measures. The trading highlight on Tuesday the 15th is at 12:30 when the US Retail Sales figures for February are released, with an expected impact on the USD. Retail Sales inched up by 0.2 percent in January, so traders...

published: 14 Mar 2016 -

How is a benchmark’s previous performance used? Ahead Of The Week - 15th August 2016

http://bit.ly/1RhmvaZ Made for event traders to prepare their trading calendar, coming up in Banc De Binary’s Ahead of the Week Report August 15-19, 2016. The USD is back on the top of our watch list ahead of the FOMC release on Wednesday, which is our trading event of the week. The latest US job results may have been better-than-expected, but traders are still skeptical about the Federal Reserve’s intentions to hike interest rates. On Monday the 15th of August, it’s Assumption Day in many EU markets, but the US is open for business. At 14:00 the NAHB Housing Market Index for August is released. Last seen at the level of 59, this benchmark measures the health of the US housing market. Any upside or downside surprises are likely to impact the USD. Tuesday the 16th brings trading opportun...

published: 15 Aug 2016 -

5 Dollar Note

To celebrate the launch of the new 5 dollar note, Lightwell created a 4 screen multi-touch installation for the New Banknote Generation exhibition at the Reserve Bank of Australia museum in Martin Place.

published: 02 Jan 2017 -

How Will An Unstable China Affect My Trades?

China made two decisions that were felt around the world's financial markets, including Asian, US and European indices. First, it devalued its currency to make its exports more competitive. Second, it cut its interest rate to increase liquidity to local businesses. This made investors believe there is a problem in the Chinese economy and the massive international companies that are listed on world stock exchanges started to see their share prices lose value. Many traders saw this volatility as an opportunity to trade on global stock indices going DOWN. _________________________________________________________________ The focus this week is on data coming out of the Eurozone, including updated inflation numbers, a new interest rate decision, and producer prices. This means that it'...

published: 31 Aug 2015 -

AHEAD OF THE WEEK REPORT 31st October 2016

published: 31 Oct 2016 -

1300 HOME LOAN on SkyNews

Managing Director of 1300 HOME LOAN, John Kolenda talks to Sky Business News regarding the state of the economy, housing and mortgages, and commentary surrounding the Reserve Bank of Australia's decision on July cash rate position. With continuous fluctuations in interest rates consumers can get the best deal by speaking to a local broker via 1300HOMELOAN (1300 466 356) or enquiries@1300homeloan.com.au. www.1300homeloan.com.au

published: 05 Jul 2012 -

URGENT, must attend webinar!

It is very important that you join me and my team of experts as we discuss matters from the budget and the recent interest rate cuts that will have an immediate (and long term) effect on you . Last Tuesday evening two BIG events happened: The first was the announcement from Reserve Bank of Australia (RBA) to cut the official cash rate; down from 2 percent to 1.75 percent The second big event last Tuesday was the handing down of the 2016/17 Federal Budget The webinar will take about 45 minutes and we will then answer your questions.

published: 11 May 2016

Reserve Bank - Role and Functions

- Order: Reorder

- Duration: 4:39

- Updated: 06 Nov 2014

- views: 8921

- published: 06 Nov 2014

- views: 8921

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

- Order: Reorder

- Duration: 7:16

- Updated: 18 May 2009

- views: 83768

- published: 18 May 2009

- views: 83768

Who REALLY owns the Reserve Bank of Australia?

- Order: Reorder

- Duration: 35:00

- Updated: 20 Jun 2011

- views: 22963

- published: 20 Jun 2011

- views: 22963

RBA is a Rothchild Bank.

- Order: Reorder

- Duration: 3:55

- Updated: 08 Apr 2012

- views: 13713

- published: 08 Apr 2012

- views: 13713

Reserve bank of Australia explained

- Order: Reorder

- Duration: 3:26

- Updated: 05 Oct 2008

- views: 40541

- published: 05 Oct 2008

- views: 40541

Reserve Bank of Australia - Monetary Policy Framework

- Order: Reorder

- Duration: 5:49

- Updated: 13 Nov 2014

- views: 7526

- published: 13 Nov 2014

- views: 7526

Who Really Owns The Reserve Bank Of Australia (RBA)

- Order: Reorder

- Duration: 35:00

- Updated: 16 Mar 2016

- views: 415

- published: 16 Mar 2016

- views: 415

Reserve Bank of Australia 'Worried' About Australian Housing Bubble

- Order: Reorder

- Duration: 4:01

- Updated: 13 Apr 2017

- views: 114

Reserve Bank of Australia Next Generation Banknotes

- Order: Reorder

- Duration: 1:01

- Updated: 01 Sep 2016

- views: 103

- published: 01 Sep 2016

- views: 103

Monetary Policy in Australia - Part 1

- Order: Reorder

- Duration: 23:39

- Updated: 06 Jul 2016

- views: 1282

- published: 06 Jul 2016

- views: 1282

Australian Mortgages

- Order: Reorder

- Duration: 3:06

- Updated: 13 Apr 2017

- views: 509

- published: 19 Feb 2014

- views: 509

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

- Order: Reorder

- Duration: 3:51

- Updated: 13 Mar 2017

- views: 85

- published: 31 Jul 2016

- views: 85

How are binary options different to other types of online trading? Ahead Of The Week - September 26th

- Order: Reorder

- Duration: 3:49

- Updated: 03 Mar 2017

- views: 22

- published: 26 Sep 2016

- views: 22

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

- Order: Reorder

- Duration: 3:12

- Updated: 27 Mar 2017

- views: 82

- published: 14 Mar 2016

- views: 82

How is a benchmark’s previous performance used? Ahead Of The Week - 15th August 2016

- Order: Reorder

- Duration: 3:54

- Updated: 26 Jan 2017

- views: 62

- published: 15 Aug 2016

- views: 62

5 Dollar Note

- Order: Reorder

- Duration: 1:02

- Updated: 20 Apr 2017

- views: 49

- published: 02 Jan 2017

- views: 49

How Will An Unstable China Affect My Trades?

- Order: Reorder

- Duration: 3:42

- Updated: 01 Apr 2017

- views: 59

- published: 31 Aug 2015

- views: 59

AHEAD OF THE WEEK REPORT 31st October 2016

- Order: Reorder

- Duration: 3:43

- Updated: 31 Jan 2017

- views: 8

- published: 31 Oct 2016

- views: 8

1300 HOME LOAN on SkyNews

- Order: Reorder

- Duration: 3:06

- Updated: 06 Jul 2015

- views: 208

- published: 05 Jul 2012

- views: 208

URGENT, must attend webinar!

- Order: Reorder

- Duration: 1:22:04

- Updated: 23 May 2016

- views: 12

- published: 11 May 2016

- views: 12

-

Question and answer with Philip Lowe, Governor, Reserve Bank of Australia

Question and answer with Philip Lowe, Governor, Reserve Bank of Australia. CEDA welcomed Governor of the Reserve Bank of Australia, Philip Lowe, to present the 2016 Annual Dinner address. CEDA -- the Committee for Economic Development of Australia -- is a respected independent national organisation with an engaged cross-sector membership. For more details visit: http://www.ceda.com.au Follow us on Twitter: https://twitter.com/ceda_news

published: 15 Nov 2016 -

Glenn Stevens, Governor Reserve Bank of Australia - Meet the CEO 31 October 2007

Glenn Stevens, Governor Reserve Bank of Australia - Meet the CEO 31 October 2007

published: 07 Aug 2013 -

Australian currency is clearly the best in the world, and this video proves it!

Secure, well designed next generation bank notes by Reserve Bank of Australia, set a benchmark for #RBI to design new currencies in India.

published: 16 Dec 2016 -

Innovation and Resilience: Key Objectives for Payments Infrastructure Operators

Speaker: Greg Johnston, Reserve Bank of Australia; The global payments landscape is evolving rapidly to meet new demands and challenges. Greg Johnston of the Reserve Bank of Australia will share how Australia’s payments systems are changing to meet these needs. In particular, he will highlight Australia’s New Payments Platform and the implications for faster payments and innovation. Greg will also speak to another emerging driver - the need for high operational resilience and cyber security.

published: 05 Aug 2016 -

Episode 1 - Why Lowering the Interest Rate is Harmful 12 Jan 2017

Note that the Treasurer does not set the interest rate at the Reserve Bank of Australia. This is the responsibility of the Board of Governors of the RBA. For Mike Maloney's "The Hidden Secrets of Money" - go to https://www.youtube.com/watch?v=DyV0OfU3-FU Intro and Closing Music - "The Legend of Cao Cao/Sangokushi Sousouden - Opening Theme" by Koei (Copyright 1998)

published: 12 Jan 2017 -

Who Really Owns The Reserve Bank Of Australia (RBA)

Tip its not the Government. Its privately owned like every Central Bank in the world. We have been tricked into assuming its serves Australians however its money lender to the Government and the wholesale lender to Australian Banks. It prints money backed by thin air and charges us interest great scam

published: 16 Mar 2016 -

Forex Time - Banche centrali, la parola d’ordine è ancora espansione

- A sorpresa la Bank of Japan ha portato in negativo il tasso sui depositi, seguendo il percorso già inaugurato da altre Banche centrali e, forse anticipando una nuova riduzione da parte di Mario Draghi nella prossima riunione della Bce. -La Cina continua a deludere e il dollaro australiano ne paga le conseguenze. La Reserve Bank of Australia sceglie di non tagliare i tassi ma rimane pronta a intervenire. - Forte debolezza sulla sterlina. Il governatore della BoE Mark Carney si mantiene molto prudente sul rialzo dei tassi. Giovedì la riunione con la revisione sulle stime di crescita e inflazione, probabilmente al ribasso. http://www.finanzaonline.com/video/forex-time/

published: 03 Feb 2016 -

Guy Debelle gives the George Wilson Oration

Guy Debelle gives the George Wilson Oration at the 2013 Nuffield Australia 2013 Presentation Dinner, Perth September 19th. Guy Debelle is Assistant Governor (Financial Markets) of the Reserve Bank of Australia The George Wilson Oration is an annual event that honours the founding Chairman of the Australian Nuffield Farming Scholars Association

published: 22 Oct 2015 -

Joseph Trevisani: The Federal Reserve Against the World

Date of issue: 15 June 2015. Speaker: Joseph Trevisani. The Reserve Bank of New Zealand cut rates on Wednesday. The Reserve Bank of Australia did so in May, the Bank of Canada in January, the ECB last September. The Fed rate hike has been pushed back to September or later, depending of course, on the data. Does the Fed know something exclusive to bankers in Washington? Is the U.S. economy that disconnected form the world? Or is the reluctance of the Fed governors to do what they say they must do, evidence that all is not well in the U.S. or the world economy? What does the Fed fear? Join us for theory, evidence and practice in the world of Fed policy.

published: 12 Jan 2016 -

#Video 01- The Launch - Brad Smith - Trust in your labour

Trust in your labour Brad Smith is an Australian entrepreneur, speaker, champion Superlite MX motocross rider and advocate for safe motocross riding practices. He was knocked back by over 50 manufacturing plants during the start-up of his motocross brand “braaap” however, his drive and tenacity lead him to successfully build Australia's only motorcycle company. Brad is the recipient of several achievement awards including two times Australian Young Entrepreneur of the year and four times Australian Retail Business of the year. Brad is also on the advisory board to the Reserve Bank of Australia. In 2008 Brad launched the first braaap store, a retail outlet intended to be “the motocross equivalent of a surf shop”. Braaap has since expanded and has four retail outlets across Tasmania and Vict...

published: 23 Jan 2017

Question and answer with Philip Lowe, Governor, Reserve Bank of Australia

- Order: Reorder

- Duration: 32:08

- Updated: 15 Nov 2016

- views: 120

- published: 15 Nov 2016

- views: 120

Glenn Stevens, Governor Reserve Bank of Australia - Meet the CEO 31 October 2007

- Order: Reorder

- Duration: 50:12

- Updated: 07 Aug 2013

- views: 549

- published: 07 Aug 2013

- views: 549

Australian currency is clearly the best in the world, and this video proves it!

- Order: Reorder

- Duration: 41:08

- Updated: 16 Dec 2016

- views: 109

- published: 16 Dec 2016

- views: 109

Innovation and Resilience: Key Objectives for Payments Infrastructure Operators

- Order: Reorder

- Duration: 48:30

- Updated: 05 Aug 2016

- views: 14

- published: 05 Aug 2016

- views: 14

Episode 1 - Why Lowering the Interest Rate is Harmful 12 Jan 2017

- Order: Reorder

- Duration: 38:10

- Updated: 12 Jan 2017

- views: 159

- published: 12 Jan 2017

- views: 159

Who Really Owns The Reserve Bank Of Australia (RBA)

- Order: Reorder

- Duration: 35:00

- Updated: 16 Mar 2016

- views: 415

- published: 16 Mar 2016

- views: 415

Forex Time - Banche centrali, la parola d’ordine è ancora espansione

- Order: Reorder

- Duration: 32:40

- Updated: 03 Feb 2016

- views: 10783

- published: 03 Feb 2016

- views: 10783

Guy Debelle gives the George Wilson Oration

- Order: Reorder

- Duration: 37:59

- Updated: 22 Oct 2015

- views: 30

- published: 22 Oct 2015

- views: 30

Joseph Trevisani: The Federal Reserve Against the World

- Order: Reorder

- Duration: 56:35

- Updated: 12 Jan 2016

- views: 6

- published: 12 Jan 2016

- views: 6

#Video 01- The Launch - Brad Smith - Trust in your labour

- Order: Reorder

- Duration: 47:45

- Updated: 23 Jan 2017

- views: 2563

- published: 23 Jan 2017

- views: 2563

- Playlist

- Chat

Reserve Bank - Role and Functions

- Report rights infringement

- published: 06 Nov 2014

- views: 8921

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

- Report rights infringement

- published: 18 May 2009

- views: 83768

Who REALLY owns the Reserve Bank of Australia?

- Report rights infringement

- published: 20 Jun 2011

- views: 22963

RBA is a Rothchild Bank.

- Report rights infringement

- published: 08 Apr 2012

- views: 13713

Reserve bank of Australia explained

- Report rights infringement

- published: 05 Oct 2008

- views: 40541

Reserve Bank of Australia - Monetary Policy Framework

- Report rights infringement

- published: 13 Nov 2014

- views: 7526

Who Really Owns The Reserve Bank Of Australia (RBA)

- Report rights infringement

- published: 16 Mar 2016

- views: 415

Reserve Bank of Australia 'Worried' About Australian Housing Bubble

- Report rights infringement

- published: 13 Apr 2017

- views: 114

Reserve Bank of Australia Next Generation Banknotes

- Report rights infringement

- published: 01 Sep 2016

- views: 103

Monetary Policy in Australia - Part 1

- Report rights infringement

- published: 06 Jul 2016

- views: 1282

Australian Mortgages

- Report rights infringement

- published: 19 Feb 2014

- views: 509

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

- Report rights infringement

- published: 31 Jul 2016

- views: 85

How are binary options different to other types of online trading? Ahead Of The Week - September 26th

- Report rights infringement

- published: 26 Sep 2016

- views: 22

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

- Report rights infringement

- published: 14 Mar 2016

- views: 82

- Playlist

- Chat

Reserve Bank - Role and Functions

- Report rights infringement

- published: 06 Nov 2014

- views: 8921

WHO REALLY OWNS THE RBA? (RESERVE BANK AUSTRALIA)

- Report rights infringement

- published: 18 May 2009

- views: 83768

Who REALLY owns the Reserve Bank of Australia?

- Report rights infringement

- published: 20 Jun 2011

- views: 22963

RBA is a Rothchild Bank.

- Report rights infringement

- published: 08 Apr 2012

- views: 13713

Reserve bank of Australia explained

- Report rights infringement

- published: 05 Oct 2008

- views: 40541

Reserve Bank of Australia - Monetary Policy Framework

- Report rights infringement

- published: 13 Nov 2014

- views: 7526

Who Really Owns The Reserve Bank Of Australia (RBA)

- Report rights infringement

- published: 16 Mar 2016

- views: 415

Reserve Bank of Australia 'Worried' About Australian Housing Bubble

- Report rights infringement

- published: 13 Apr 2017

- views: 114

Reserve Bank of Australia Next Generation Banknotes

- Report rights infringement

- published: 01 Sep 2016

- views: 103

Monetary Policy in Australia - Part 1

- Report rights infringement

- published: 06 Jul 2016

- views: 1282

Australian Mortgages

- Report rights infringement

- published: 19 Feb 2014

- views: 509

What is the difference between a bull market and a bear market? - Ahead Of The Week 1st August 2016

- Report rights infringement

- published: 31 Jul 2016

- views: 85

How are binary options different to other types of online trading? Ahead Of The Week - September 26th

- Report rights infringement

- published: 26 Sep 2016

- views: 22

What’s the most important thing to do before you start trading? - Ahead of The week 14th March 2016

- Report rights infringement

- published: 14 Mar 2016

- views: 82

- Playlist

- Chat

Question and answer with Philip Lowe, Governor, Reserve Bank of Australia

- Report rights infringement

- published: 15 Nov 2016

- views: 120

Glenn Stevens, Governor Reserve Bank of Australia - Meet the CEO 31 October 2007

- Report rights infringement

- published: 07 Aug 2013

- views: 549

Australian currency is clearly the best in the world, and this video proves it!

- Report rights infringement

- published: 16 Dec 2016

- views: 109

Innovation and Resilience: Key Objectives for Payments Infrastructure Operators

- Report rights infringement

- published: 05 Aug 2016

- views: 14

Episode 1 - Why Lowering the Interest Rate is Harmful 12 Jan 2017

- Report rights infringement

- published: 12 Jan 2017

- views: 159

Who Really Owns The Reserve Bank Of Australia (RBA)

- Report rights infringement

- published: 16 Mar 2016

- views: 415

Forex Time - Banche centrali, la parola d’ordine è ancora espansione

- Report rights infringement

- published: 03 Feb 2016

- views: 10783

Guy Debelle gives the George Wilson Oration

- Report rights infringement

- published: 22 Oct 2015

- views: 30

Joseph Trevisani: The Federal Reserve Against the World

- Report rights infringement

- published: 12 Jan 2016

- views: 6

#Video 01- The Launch - Brad Smith - Trust in your labour

- Report rights infringement

- published: 23 Jan 2017

- views: 2563

'A gift for the American bastards': North Korea's Kim fires back at Trump

Edit The Guardian 05 Jul 2017Ice block the size of Delaware about to break away from Antarctica as global temperatures rise, scientists warn

Edit The Independent 03 Jul 2017Qatar responds to Arab nations' demands before crisis meeting

Edit Irish Independent 05 Jul 2017ISIS will lose Mosul and Raqqa. What happens next?

Edit The Washington Post 05 Jul 2017Forty-Four States Refuse To Turn Over Voter Data For Trump Commission

Edit WorldNews.com 04 Jul 2017Decrease Your Problems With Black Magic+91-9876425548 (काला जादू हटाने Wazifa molvi ji)in Aruba Australia uk

Edit Community news 05 Jul 2017Australia condemns DPRK missile test

Edit Xinhua 05 Jul 2017How To Get Rid Of Someone Who Is Bothering You vinodkumar ji+91-9876425548 (काला जादू हटाने Wazifa molvi ji)in Aruba Australia uk

Edit Community news 05 Jul 2017Australia debutant Sarah Aley oldest in almost half a century

Edit Sydney Morning Herald 05 Jul 2017Keep Your Shop Clean From All Kind Of Hurdles+91-9876425548 (काला जादू हटाने Wazifa molvi ji)in Aruba Australia uk

Edit Community news 05 Jul 2017Australia has endured its equal-worst Wimbledon men's campaign since World War II

Edit Sydney Morning Herald 05 Jul 2017Australia 'A' players practice despite SA tour boycott threat

Edit Mid Day 05 Jul 2017'Slow and expensive' internet is inhibiting Australia's digital readiness, according to new report

Edit TechRadar 05 Jul 2017Grey Magic Wazifa For Love+91-9876425548 (کالا جادو ہٹانے منتر)in Aruba Australia uk

Edit Community news 05 Jul 2017Get Marriage Quickly With These Steps+91-9876425548 (काला जादू हटाने Wazifa molvi ji)in Aruba Australia uk

Edit Community news 05 Jul 2017Easy Tips To Remove Black Magic+91-9876425548 vinod ji(काला जादू हटाने Wazifa molvi ji)in Aruba Australia uk

Edit Community news 05 Jul 2017Pakistan vs Australia, Live Streaming, ICC Women’s World Cup 2017: Watch PAK vs AUS live ...

Edit Cricket Country 05 Jul 2017Performing Hajj For Someone Else baba vinodkumar +91-9876425548 (کالا جادو ہٹانے منتر)in Aruba Australia uk

Edit Community news 05 Jul 2017- 1

- 2

- 3

- 4

- 5

- Next page »