A Caterpillar and Komatsu cavalry is arriving just in time to save the next two federal budgets from the effects of slowing residential building approvals, solving one of Treasurer Scott Morrison's fiscal dilemmas.

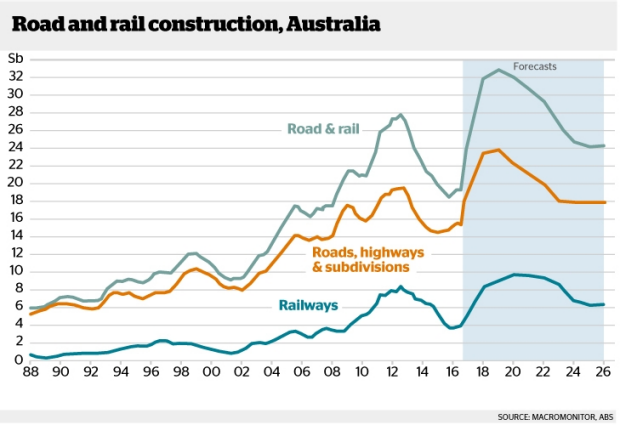

National spending on transport infrastructure is in the process of soaring 73 per cent from last financial year to 2018-19, according to industry research company Macromonitor.

More BusinessDay Videos

Michael Pascoe: Building the future

Australiaâs spending on road and rail is picking up the slack from housing construction. Michael Pascoe comments.

Spending on road and rail hit a cyclical low of about $19 billion in 2015-16. In constant dollars, the cycle is expected to peak at $33 billion in 2018-19. That spending would more than cover a 10 per cent decline from last year's $63 billion worth of new residential building.

The transport infrastructure surge is big enough to add credence to this week's more optimistic International Monetary Fund global forecast that our economy will grow by a healthy 3.1 per cent this year, producing a fall in the unemployment rate to 5.2 per cent from the present 5.9 per cent.

The IMF's stated reasons for the upgraded forecast after discussions with Treasury and the Reserve Bank were limited to an improved global outlook – but more than a prettier global picture is required to make up for stubbornly low non-resources investment, weak wages growth and the methods regulators are being forced to use to hose down the housing market.

With the government locked into refusing to limit negative gearing to new properties, there's little beyond rhetoric to encourage supply while investors are being curtailed.

Thus, just as the housing boom helped pick up the slack as the resources construction boom went bust, road and rail work should cover for any immediate reduction in residential work.

Among other things, Macromonitor collates transport construction data, adding the confirmed projects and the expected projects and then adjusting for the overall public sector funding cycle.

Macromonitor says our spending on roads has tended to grow by about 5 per cent after inflation over the past three decades, but a number of major projects are making the cyclical swing unusually large. Such wild swings limit the economic benefits of the investment.

Despite the rhetoric of the Abbott government, spending bottomed in 2015-16 and it's the states, led by NSW and Victoria, that have been stepping up the pace.

The not-so-good news is that, on present government policies, the Macromonitor analysts expect a steady slide in road and rail spending back to $24 billion in the 2024-25 year, reducing growth. We'll need to come up with another trick by then.

But that challenge is a couple of elections away. In the meantime, the infrastructure spend is particularly set to carry the NSW and Victorian economies higher, reinforcing the new "two-speed" economy.

The increasingly wild swings of the cycle also demonstrate the failed opportunity of a more rational approach to infrastructure investment. We're not gaining as much from the stimulus as we could.

In a landmark speech after Joe Hockey's 2015 budget, the RBA's then-governor, Glenn Stevens, set out the case for better planning of our infrastructure spending beyond the reach of political pork barrelling, the case the RBA continues to push.

Said Stevens: "As often remarked, infrastructure spending has a role to play in sustaining growth and also in generating confidence. I am doubtful of our capacity to deploy this sort of spending as a short-term counter-cyclical device. The evidence of history is that it takes too long to start and then too long to stop.

"But it would be confidence-enhancing if there was an agreed story about a long-term pipeline of infrastructure projects, surrounded by appropriate governance on project selection, risk-sharing between public and private sectors at varying stages of production and ownership, and appropriate pricing for use of the finished product."

The projects would have an effect across the economy, Stevens said.

"The suppliers would feel it was worth their while to improve their offering if projects were not just one-offs. The financial sector would be attracted to the opportunities for financing and asset ownership. The real economy would benefit from the steady pipeline of construction work – as opposed to a boom and bust. It would also benefit from confidence about improved efficiency of logistics over time resulting from the better infrastructure. Amenity would be improved for millions of ordinary citizens in their daily lives. We could unleash large potential benefits that at present are not available because of congestion in our transportation networks."

The usually-reserved governor was blunt about infrastructure projects being held back by political, rather than financial, factors.

"The impediments to this outcome are not financial. The funding would be available, with long-term interest rates the lowest we have ever seen or are likely to.

"The impediments are in our decision-making processes and, it seems, in our inability to find political agreement on how to proceed.

"Physical infrastructure is, of course, only part of what we need. The confidence-enhancing narrative needs to extend to skills, education, technology, the ability and freedom to respond to incentives, the ability to adapt and the willingness to take on risk. It is in these areas too, where there are various initiatives in place or planned, but which often do not get enough attention, that we need to create a positive dynamic of confidence, innovation and investment.

"That is the upside we need to create."

That ideal has not changed, nor have the impediments to it. By the looks of Macromonitor's graphs, we are again going through a boom-and-bust cycle, getting out of the jail of an immediate problem, but missing another opportunity to realise the nation's great potential.

0 comments

New User? Sign up