A few weeks ago, I made fun of Sean Spicer for this word salad:

I think there’s a question between the total number of people that are employed, and the President’s comments in the past have reflected that his big concern was getting to the bottom of how many people are working in this country, and that the denominator—meaning the percentage rate of the total number of people—is not the most accurate reflection of how many people are employed in this country.

And, God knows, he deserves a strong dose of mockery. But he seemed to be staggering around a serious point: the unemployment rate tells only a partial story about the job market. If that rate is low because a lot of people have given up on the job search as hopeless, and are therefore not counted as unemployed, then a low unemployment rate would be telling a misleading story. (For more on that, see the post linked to above.) So does Spicer—channeling Trump—have an actual point here, even if he’s incapable of expressing it?

Yes he does. Despite years of recovery from the depths of the Great Recession (GR), the so-called employment/population ratio (EPOP)—the share of the noninstitutional population over the age of 16 working for pay—remains below earlier cyclical peaks. (“Noninstitutional” means not in a prison, mental hospital, or a nursing home. Given the vast size of the U.S. prison population, this is not a small consideration—but it’s one for another post.) If the same share of the population were employed today as was in December 2007, just as the GR was taking hold, 4.3 million more people would have jobs. If it were the same share as the all-time high in April 2000, 7.3 million more people would be working for pay. Either one is a big number, even in a country where 153 million people are employed.

Here are some graphs to make the point. First, the broad EPOP since the modern monthly numbers—computed from a very large survey of households—began in 1948.

Several things stand out from this graph. First, compared to those for men and women, the “all” line looks rather flat. It began at 56.6% in 1948, and was at 60.1% in March 2017—down from a peak of 64.7% in April 2000. But the gendered lines take very different trajectories. The male EPOP has been in a steady downtrend, intensified during the GR—for most of the past seven decades, from 83.8% in January 1948 to 66.0% in March 2017. At the overall peak in 2000, 72.1% of adult men were working. In contrast, the women’s line rose more steadily than men’s fell, from 30.9% to a peak of 58.0% in 2000, a near-doubling; it’s since drifted lower, to 54.7% last month. To return to the peak 2000 EPOPs, 4.9 million more men and 2.8 million more women would need to find work. Though women suffer plenty of discrimination in the labor market, and more men are employed than women, the GR was a lot harder on men (though the recovery from those lows has been kinder to them).

Why has the U.S. economy failed to generate enough jobs to return to pre-2007 levels of employment? (I’ll bracket the gender angle for now, except to say that long-term structural changes have taken a toll on male-heavy industries like manufacturing while they’ve boosted female-heavy ones like retail and health care.) It’s not that robots are taking our jobs. Productivity growth is close to zero now—a sharp contrast with the years leading up to the 2000 employment peak, when it was very strong, as was employment growth. (More on this in another future post.)

An explanation favored by Democrats during the Obama years was the aging of the population; older cohorts are employed at a lower rate than younger ones. But that’s only a partial explanation. Economic growth has been very slow in this expansion, the slowest of any since the end of World War II. Strange as it may seem, employment growth has actually been stronger than GDP growth would suggest, based on their tight historical correlation. If robots really were the culprit, the reverse would be true.

Let’s look more closely at the aging issue. Here are some graphs showing the EPOP by age cohort. First, so-called prime-age workers, those aged 25 to 54.

The long-term decline in male employment is softer, and the rise in female, stronger, but the story is not profoundly different from the overall graph above.

Next, younger workers.

Teen employment is sharply below where it was in 2000, though it’s recovered some since the depths of 2009–2010. These trends are milder for the 20–24 set, and milder still for the 25–34 group. One reason for the weakness among the younger is that more people in their late teens and early 20s are going to school. This will presumably lead to improved job prospects in the future, contrary to some of the fashionable clichés to the contrary floating around now. (More on this too in a future post.) But even those aged 25–34, who are getting established in the job market rather than just setting out, are employed at lower levels than in 2000 or 2007. Some of this may be lingering damage to their careers inflicted during the GR, but we don’t know for sure yet.

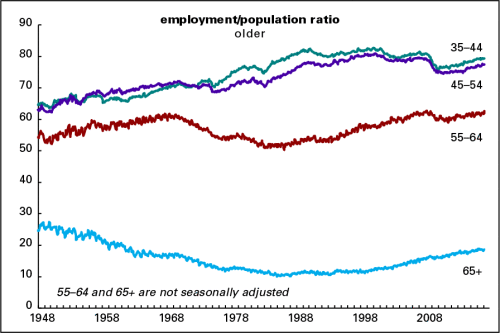

And now older workers.

Those aged 35–44 and 45–54 have yet to return to their 2000 and 2007 peaks—but those aged 55–64 have, and those over 65 have surpassed them (though obviously a much smaller share of the 65+ population is working than the rest). One can only surmise that a weakening pension system is at least partly responsible: many older people just can’t afford to retire as they once did.

Here’s a summary graph of the change in EPOPs since 2000.

On this evidence, the aging population theory doesn’t hold much water, since EPOPs for the five youngest cohorts have fallen, and those for the oldest have risen.

Another approach would be to do a statistical simulation of what the EPOP would look like were the population’s age structure like it was back in the early days of the millennium. That’s what I did here: the simulation is done by taking the EPOPs of each cohort and creating a weighted average using 2001 population shares. (I used 2001 because that’s when the business cycle peak happened, even though EPOP peaked a year ahead of the broad economy. The difference between using 2000 and 2001 shares is trivial.) These calculations are rough. I used only broad age ranges for the cohorts; doing it more precisely would use much narrower age ranges. But that wouldn’t change the broad conclusion: an aging population explains about half the shortfall in the EPOP.

What else is responsible for EPOP’s sluggish behavior? The prime culprit is slow GDP growth, which is running at less than half the post-World War II average for a business cycle expansion (2.1% vs. 4.4%). Growth rates have been declining with each successive upswing since 1991, but this one is the weakest by a fairly wide margin.

Why has growth been so slow? This too is a topic in itself but there are several reasons. One, popular among mainstream economists, is that very deep recessions, like the 2008–2009 affair, have historically left deep scars that make recovery slow and difficult. Another, less orthodox, way of interpreting those “scars” is that a very deep recession is itself a sign of serious structural problems beyond the normal ups and downs of capitalist economies. In the U.S. case, the long-term problem is that the squeeze on wages and living standards that began in the early 1980s succeeded in raising corporate profitability (and in making the rich very much richer), but at the expense of undermining the foundations of an economy dependent on high levels of mass consumption. That contradiction was resolved for a while by rampant levels of borrowing, which compensated for stagnant wage and salary income. But with the financial crisis of 2007–2008, that aggressive borrowing was thrown into reverse, and households began to reduce their debts—which made sense at the level of the individual household, but put a lid on consumer demand. That problem could be mitigated by policies to shift income downward, through higher wages and more generous spending on social programs and infrastructure, but those routes look politically impossible. In other words, the neoliberal model has run out of steam, but there’s nothing to take its place.

And yet another explanation is that despite copious profits, firms are shoveling vast pots of cash to their executives and shareholders rather than investing in capital equipment and hiring workers. From 1952 to 1982, nonfinancial corporations distributed 17% of their internal cash flow (profits plus depreciation allowances) to shareholders; that rose to about 30% in the 1980s and 1990s, and to 48% since 2000. (In 2016, the average was an incredible 64%.) This is one result of the shareholder revolution that began in the early 1980s: the whole point of corporations’ existence is to raise the stock price and make their shareholders, who contribute literally nothing for all their taking, richer. More on all that in a future post too.