- published: 27 Nov 2012

- views: 1558402

-

remove the playlistFinancial

- remove the playlistFinancial

- published: 06 Mar 2015

- views: 188199

- published: 02 Jul 2012

- views: 4055595

- published: 08 Jan 2015

- views: 57419

- published: 03 May 2013

- views: 1797794

- published: 03 Dec 2014

- views: 288310

- published: 17 Apr 2017

- views: 1869

- published: 24 Nov 2014

- views: 425161

- published: 06 Feb 2017

- views: 3332519

- published: 22 Sep 2015

- views: 645959

Finance

Finance is a field that deals with the study of investments. It includes the dynamics of assets and liabilities over time under conditions of different degrees of uncertainty and risk. Finance can also be defined as the science of money management. A key point in finance is the time value of money, which states that purchasing power of one unit of currency can vary over time. Finance aims to price assets based on their risk level and their expected rate of return. Finance can be broken into three different sub-categories: public finance, corporate finance and personal finance.

Areas of finance

Wall Street, the center of American finance.

Wall Street, the center of American finance.

London Stock Exchange, global center of finance.

London Stock Exchange, global center of finance.

Personal finance

Questions in personal finance revolve around:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Wealth

Wealth is the abundance of valuable resources or valuable material possessions. This includes the core meaning as held in the originating old English word weal, which is from an Indo-European word stem. An individual, community, region or country that possesses an abundance of such possessions or resources to the benefit of the common good is known as wealthy.

The modern concept of wealth is of significance in all areas of economics, and clearly so for growth economics and development economics yet the meaning of wealth is context-dependent. At the most general level, economists may define wealth as "anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been asserted by various individuals and in different contexts. Defining wealth can be a normative process with various ethical implications, since often wealth maximization is seen as a goal or is thought to be a normative principle of its own.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Berkshire Hathaway

Berkshire Hathaway Inc. is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States. The company wholly owns GEICO, BNSF, Lubrizol, Dairy Queen, Fruit of the Loom, Helzberg Diamonds, FlightSafety International, and NetJets, owns 26% of Kraft Heinz Company and an undisclosed percentage of Mars, Incorporated, and has significant minority holdings in American Express, The Coca-Cola Company, Wells Fargo, IBM and Restaurant Brands International. Berkshire Hathaway averaged an annual growth in book value of 19.7% to its shareholders for the last 49 years (compared to 9.8% from the S&P 500 with dividends included for the same period), while employing large amounts of capital, and minimal debt.

The company is known for its control and leadership by Warren Buffett, who is the company's Chairman of the Board, President, and Chief Executive Officer, and Charlie Munger, the company's Vice-Chairman of the Board of Directors. In the early part of Buffett's career at Berkshire, he focused on long-term investments in publicly traded companies, but more recently he more frequently bought whole companies. Berkshire now owns a diverse range of businesses including confectionery, retail, railroad, home furnishings, encyclopedias, manufacturers of vacuum cleaners, jewelry sales, newspaper publishing, manufacture and distribution of uniforms, and several regional electric and gas utilities.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Tony Robbins

Tony Robbins (born Anthony J. Mahavoric; February 29, 1960) is an American motivational speaker, personal finance instructor, and self-help author. He became well known from his infomercials and self-help books: Unlimited Power, Unleash the Power Within and Awaken the Giant Within.

In 2007, he was named in Forbes magazine's "Celebrity 100" list.Forbes estimated that Robbins earned approximately US$30 million in that year.

Early life

Robbins was born Anthony J. Mahavoric in North Hollywood, California, on February 29, 1960. Robbins is the eldest of three children and his parents divorced when he was 7. His mother then had a series of husbands, including Jim Robbins, a former semiprofessional baseball player who legally adopted Anthony when he was 12.

His father could not provide for their family, so he left them. His mother started abusing alcohol and prescription drugs sometime after. While growing up, Robbins was a primary care-giver, and helped provide for his siblings. Robbins was raised in Azusa and Glendora, California, and attended Glendora High School. He was elected student body president in his senior year, and grew 10 inches in high school, a growth spurt later attributed to a pituitary tumor. He has said his home life was "chaotic" and "abusive". When he was 17 years old, Robbins' mother chased him out of the house with a knife, and he never returned. Robbins later worked as a janitor, and did not attend college.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Bill Ackman

William Albert Ackman (born May 11, 1966), is an American hedge fund manager. He is the founder and CEO of Pershing Square Capital Management LP, a hedge fund management company. Ackman is considered a contrarian investor. He considers himself an activist investor.

Early life

Ackman was raised in Chappaqua, New York, and he is the son of Ronnie I. (née Posner) and Lawrence David Ackman, the chairman of a New York real estate financing firm, Ackman-Ziff Real Estate Group. His family is Jewish.

Education

In 1988, he received a bachelor of arts degree magna cum laude in History from Harvard College. His thesis was "Scaling the Ivy Wall: the Jewish and Asian American Experience in Harvard Admissions." In 1992, he received an MBA from Harvard Business School.

Career

In 1992 Ackman founded the investment firm Gotham Partners with fellow Harvard graduate David P. Berkowitz. This investment firm made small investments in public companies. In 1995, Ackman partnered with the insurance and real estate firm Leucadia National to bid for Rockefeller Center. Although they did not win the deal, the high-profile nature of the bid caused investors to flock to Gotham Partners, growing it to $500 million in assets by 1998.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

43:57

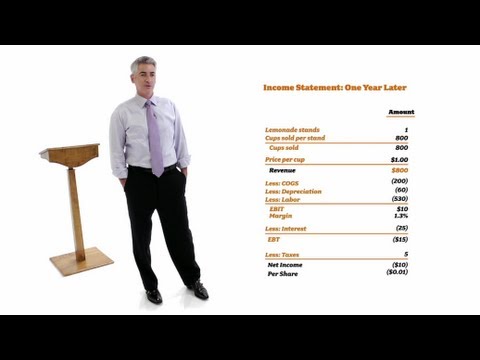

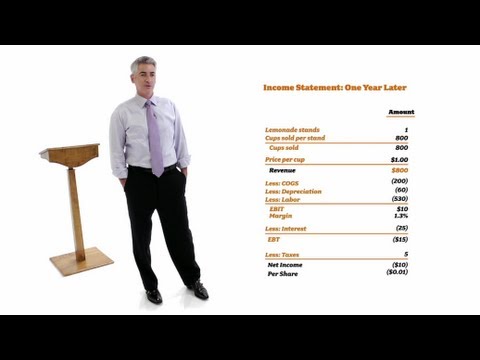

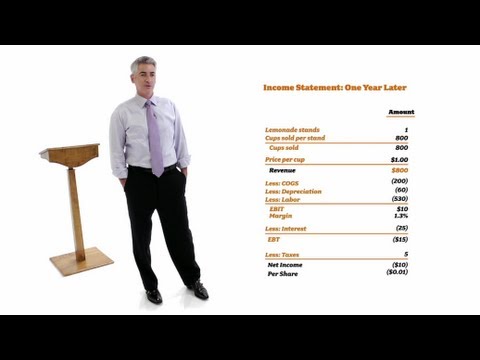

43:57William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an HourWilliam Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the Problem?) http://www.youtube.com/watch?v=2vr44C_G0-o Steven Pinker: Linguistics as a Window to Understanding the Brain http://www.youtube.com/watch?v=Q-B_ONJIEcE Leon Botstein: Art Now (Aesthetics Across Music, Painting, Architecture, Movies, and More.) http://www.youtube.com/watch?v=j6F-sHhmfrY Tamar Gendler: An Introduction to the Philosophy of Politics and Economics http://www.youtube.com/watch?v=mm8asJxdcds Nicholas Christakis: The Sociological Science Behind Social Networks and Social Influence http://www.youtube.com/watch?v=wadBvDPeE4E Paul Bloom: The Psychology of Everything: What Compassion, Racism, and Sex tell us about Human Nature http://www.youtube.com/watch?v=328wX2x_s5g Saul Levmore: Monopolies as an Introduction to Economics http://www.youtube.com/watch?v=FK2qHyF-8u8 Lawrence Summers: Decoding the DNA of Education in Search of Actual Knowledge http://www.youtube.com/watch?v=C6SY6N1iMcU Douglas Melton: Is Biomedical Research Really Close to Curing Anything? http://www.youtube.com/watch?v=Y95hT-koAC8 -

4:14

4:14The 3 Decisions That Will Change Your Financial Life

The 3 Decisions That Will Change Your Financial LifeThe 3 Decisions That Will Change Your Financial Life

Tony Robbins shares insights from his just-published book, Money Master the Game, about how a trio of choices frame your outlook and influence your chances at success. Read more at: http://www.entrepreneur.com/article/239312 Watch more videos at: http://www.entrepreneur.com/video Follow Us On Twitter: https://twitter.com/entrepreneur -

46:22

46:22Overdose: The Next Financial Crisis

Overdose: The Next Financial CrisisOverdose: The Next Financial Crisis

Overdose: The Next Financial Crisis. Award-winning youtube hit giving fresh insight into the greatest economic crisis of our age: the one still awaiting us. Support the filmmaker - Overdose is now available to buy in iTunes: https://itunes.apple.com/us/movie/overdose/id994792990 With the US raising their debt ceiling, are we in a global bail-out bubble that will eventually burst? This doc offers a fresh insight into the greatest economic crisis of our age: the one still awaiting us. The financial storm that has rocked the world began brewing in the US when congress pushed the idea of home ownership for all, propping up those who couldn't make the down payments. When it all went wrong the government promised the biggest financial stimulus packages in history and gargantuan bailouts. But what crazed logic is that: propping up debt with more debt? "They're giving alcohol to a drunk: it just sets him up for a bigger hangover." Subscribe to journeyman for daily uploads: http://www.youtube.com/journeymanpictures For downloads and more information visit: http://www.journeyman.tv/60895/documentaries/overdose.html Like us on Facebook: https://www.facebook.com/journeymanpictures Follow us on Twitter: https://twitter.com/JourneymanVOD https://twitter.com/JourneymanNews Follow us on Instagram: https://instagram.com/journeymanpictures 922 Stories AB - Ref: 4875 Journeyman Pictures is your independent source for the world's most powerful films, exploring the burning issues of today. We represent stories from the world's top producers, with brand new content coming in all the time. On our channel you'll find outstanding and controversial journalism covering any global subject you can imagine wanting to know about. -

26:45

26:45Napoleon Hill Secrets to Financial Freedom

Napoleon Hill Secrets to Financial FreedomNapoleon Hill Secrets to Financial Freedom

The Financial Freedom Mastermind are excited to share some key Napoleon Hill concepts. Edited by - The Financial Freedom Mastermind - More Notes Listed Below !!!https://www.facebook.com/FinancialFreedomMastermind/ Video Notes: You have to have a dream and a burning Desire for your dream, You must define your dream, You have to feel good when you think about your dream, You must associate with like-minded people, The words you speak will determine your success, Think about your dreams all the times and feel good about it because you will become your dream, You have to read books, Listen to audios everyday, Attend seminars on a regular basis, You need to get recognised and gladly recognise others achievements, Develop relationships with like-minded positive people, -

59:40

59:40How to Stay Out of Debt: Warren Buffett - Financial Future of American Youth (1999)

How to Stay Out of Debt: Warren Buffett - Financial Future of American Youth (1999)How to Stay Out of Debt: Warren Buffett - Financial Future of American Youth (1999)

Buffett became a billionaire on paper when Berkshire Hathaway began selling class A shares on May 29, 1990, when the market closed at $7,175 a share. More on Warren Buffett: https://www.amazon.com/gp/search?ie=UTF8&tag;=tra0c7-20&linkCode;=ur2&linkId;=9113f36df9f914d370807ba1208bf50b&camp;=1789&creative;=9325&index;=books&keywords;=Warren%20Buffett In 1998, in an unusual move, he acquired General Re (Gen Re) for stock. In 2002, Buffett became involved with Maurice R. Greenberg at AIG, with General Re providing reinsurance. On March 15, 2005, AIG's board forced Greenberg to resign from his post as Chairman and CEO under the shadow of criticism from Eliot Spitzer, former attorney general of the state of New York. On February 9, 2006, AIG and the New York State Attorney General's office agreed to a settlement in which AIG would pay a fine of $1.6 billion. In 2010, the federal government settled with Berkshire Hathaway for $92 million in return for the firm avoiding prosecution in an AIG fraud scheme, and undergoing 'corporate governance concessions'. In 2002, Buffett entered in $11 billion worth of forward contracts to deliver U.S. dollars against other currencies. By April 2006, his total gain on these contracts was over $2 billion. In 2006, Buffett announced in June that he gradually would give away 85% of his Berkshire holdings to five foundations in annual gifts of stock, starting in July 2006. The largest contribution would go to the Bill and Melinda Gates Foundation. In 2007, in a letter to shareholders, Buffett announced that he was looking for a younger successor, or perhaps successors, to run his investment business. Buffett had previously selected Lou Simpson, who runs investments at Geico, to fill that role. However, Simpson is only six years younger than Buffett. Buffett ran into criticism during the subprime crisis of 2007--2008, part of the late 2000s recession, that he had allocated capital too early resulting in suboptimal deals. "Buy American. I am." he wrote for an opinion piece published in the New York Times in 2008. Buffett has called the 2007--present downturn in the financial sector "poetic justice". Buffett's Berkshire Hathaway suffered a 77% drop in earnings during Q3 2008 and several of his recent deals appear to be running into large mark-to-market losses. Berkshire Hathaway acquired 10% perpetual preferred stock of Goldman Sachs. Some of Buffett's Index put options (European exercise at expiry only) that he wrote (sold) are currently running around $6.73 billion mark-to-market losses. The scale of the potential loss prompted the SEC to demand that Berkshire produce, "a more robust disclosure" of factors used to value the contracts. Buffett also helped Dow Chemical pay for its $18.8 billion takeover of Rohm & Haas. He thus became the single largest shareholder in the enlarged group with his Berkshire Hathaway, which provided $3 billion, underlining his instrumental role during the current crisis in debt and equity markets. In 2008, Buffett became the richest man in the world, with a total net worth estimated at $62 billion by Forbes and at $58 billion by Yahoo, dethroning Bill Gates, who had been number one on the Forbes list for 13 consecutive years. In 2009, Gates regained the position of number one on the Forbes list, with Buffett second. Their values have dropped to $40 billion and $37 billion, respectively, Buffett having lost $25 billion in 12 months during 2008/2009, according to Forbes. In October 2008, the media reported that Warren Buffett had agreed to buy General Electric (GE) preferred stock. The operation included extra special incentives: he received an option to buy 3 billion GE at $22.25 in the next five years, and also received a 10% dividend (callable within three years). In February 2009, Buffett sold some of the Procter & Gamble Co, and Johnson & Johnson shares from his portfolio. In addition to suggestions of mistiming, questions have been raised as to the wisdom in keeping some of Berkshire's major holdings, including The Coca-Cola Company (NYSE:KO) which in 1998 peaked at $86. Buffett discussed the difficulties of knowing when to sell in the company's 2004 annual report: That may seem easy to do when one looks through an always-clean, rear-view mirror. Unfortunately, however, it's the windshield through which investors must peer, and that glass is invariably fogged. http://en.wikipedia.org/wiki/Warren_Buffett -

19:26

19:26The real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoad

The real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoadThe real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoad

This talk was given at a local TEDx event, produced independently of the TED Conferences. The Great Economic Myth of 2008, challenging the accounting to accounting principal. Brian Wesbury is Chief Economist at First Trust Advisors L.P., a financial services firm based in Wheaton, Illinois. Mr. Wesbury has been a member of the Academic Advisory Council of the Federal Reserve Bank of Chicago since 1999. In 2012, he was named a Fellow of the George W. Bush Presidential Center in Dallas, TX where he works closely with its 4%-Growth Project. His writing appears in various magazines, newspapers and blogs, and he appears regularly on Fox, Bloomberg, CNBCand BNN Canada TV. In 1995 and 1996, he served as Chief Economist for the Joint Economic Committee of the U.S. Congress. The Wall Street Journal ranked Mr. Wesbury the nation’s #1 U.S. economic forecaster in 2001, and USA Today ranked him as one of the nation’s top 10 forecasters in 2004. Mr. Wesbury began his career in 1982 at the Harris Bank in Chicago. Former positions include Vice President and Economist for the Chicago Corporation and Senior Vice President and Chief Economist for Griffin, Kubik, Stephens, & Thompson. Mr. Wesbury received an M.B.A. from Northwestern University’s Kellogg Graduate School of Management, and a B.A. in Economics from the University of Montana. McGraw-Hill published his first book, The New Era of Wealth, in October 1999. His most recent book, It’s Not As Bad As You Think, was published in November 2009 by John Wiley & Sons. In 2011, Mr. Wesbury received the University of Montana’s Distinguished Alumni Award. This award honors outstanding alumni who have “brought honor to the University, the state or the nation.” There have been 267 recipients of this award out of a potential pool of 91,000 graduates. About TEDx, x = independently organized event In the spirit of ideas worth spreading, TEDx is a program of local, self-organized events that bring people together to share a TED-like experience. At a TEDx event, TEDTalks video and live speakers combine to spark deep discussion and connection in a small group. These local, self-organized events are branded TEDx, where x = independently organized TED event. The TED Conference provides general guidance for the TEDx program, but individual TEDx events are self-organized.* (*Subject to certain rules and regulations) -

2:03

2:03Roja REVEALS Shocking FACTS about her FINANCIAL STATUS | నా సంపాదన ఎవరు కాజేసారో తెలుసా ? - రోజా

Roja REVEALS Shocking FACTS about her FINANCIAL STATUS | నా సంపాదన ఎవరు కాజేసారో తెలుసా ? - రోజాRoja REVEALS Shocking FACTS about her FINANCIAL STATUS | నా సంపాదన ఎవరు కాజేసారో తెలుసా ? - రోజా

Roja REVEALS Shocking FACTS about her FINANCIAL STATUS!! Checkout what happened and why Roja Started doing TV Shows Revealed in this video on News Mantra. For more latest news and Updates: Subscribe: https://www.youtube.com/channel/UCg5NrxgQSWaK2N5Tbb1yk1Q Like : https://www.facebook.com/newsmantra/ Follow us on: https://twitter.com/news_mantra Website : http://www.newsmantra24.in/ Welcome to the Official YouTube channel of News Mantra. Catch all the Latest Telugu Movie News, Tollywood Gossips, Health Tips, Political News & Unknown Facts in the World. -

44:38

44:38Tony Robbins 7 Simple Steps to Financial Freedom - Lewis Howes

Tony Robbins 7 Simple Steps to Financial Freedom - Lewis HowesTony Robbins 7 Simple Steps to Financial Freedom - Lewis Howes

Discover the 7 Simple Steps to Financial Freedom in MONEY Master the Game with Tony Robbins and Lewis Howes http://lewishowes.com/109 In this interview Lewis Howes dives in with the world's leading high performance coach Tony Robbins to talk about the secret to generating wealth. Learn more at http://lewishowes.com/109 -

![Phyno - Financial Woman [Official Video] ft. P Square; updated 06 Feb 2017; published 06 Feb 2017](http://web.archive.org./web/20170423102555im_/https://i.ytimg.com/vi/pyWWMZVfOOQ/0.jpg) 4:31

4:31Phyno - Financial Woman [Official Video] ft. P Square

Phyno - Financial Woman [Official Video] ft. P SquarePhyno - Financial Woman [Official Video] ft. P Square

Music video by Phyno performing Financial Woman [Official Video]. Penthauze Get "The Playmaker" Album on Apple Music/iTunes - http://apple.co/2f17jUU Spotify - http://bit.ly/2kHNjMT Deezer - http://bit.ly/2kNq03w Tidal - http://bit.ly/2kmmH2T MTN Music Plus - http://bit.ly/2jX5CZU Curated by http://www.freemedigital.com http://vevo.ly/gbsdRh -

1:53:02

1:53:0210 Secrets to Achieve Financial Success

10 Secrets to Achieve Financial Success10 Secrets to Achieve Financial Success

Education http://www.instutrade.com/education/ Seminars http://www.instutrade.com/seminars/ Mentoring http://www.instutrade.com/seminars/personal-training Contact Us http://www.instutrade.com/contact-us/ Twitter @AntonKreil @instutrade In June 2015, Managing Partner of the Institute of Trading and Portfolio Management Anton Kreil was interviewed whilst on a business trip from Singapore to New York and London. In this fly on the wall documentary style interview, Anton is probed by interviewer Tom Murray on what it takes for people to become financially successful and to obtain personal freedom. The result is an epic journey around the world, providing a glimpse into the life of one of the most successful financial markets traders in the world over the last 20 years and his philosophies on money, business and life. During the interview Anton provides 10 key messages that if followed and implemented properly over time, will help anybody achieve financial success and win their freedom. 10 Secrets to Achieve Financial Success 1. Respect Money and be Indifferent towards it (20:59) 2. Rent to Own – Define Assets and Liabilities Properly (42:33) 3. Build and Own your own Infrastructure (50:16) 4. Go Travelling, Get Perspective, Get your Dream Life (1:01:00) 5. Know that Risk is Subjective not Two Dimensional (1:07:33) 6. Seek out Alternative Education (1:17:45) 7. Learn to Value your Time Properly (1:24:30) 8. Ditch the Smart Phone (1:33:12) 9. Mainstream Media is Useless. Don’t consume it (1:40:51) 10. Choose Role Models that suit Your Objective (1:45:09)

-

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement. The Floating University Originally released September 2011. Additional Lectures: Michio Kaku: The Universe in a Nutshell http://www.youtube.com/watch?v=0NbBjNiw4tk Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the P...

published: 27 Nov 2012 -

The 3 Decisions That Will Change Your Financial Life

Tony Robbins shares insights from his just-published book, Money Master the Game, about how a trio of choices frame your outlook and influence your chances at success. Read more at: http://www.entrepreneur.com/article/239312 Watch more videos at: http://www.entrepreneur.com/video Follow Us On Twitter: https://twitter.com/entrepreneur

published: 06 Mar 2015 -

Overdose: The Next Financial Crisis

Overdose: The Next Financial Crisis. Award-winning youtube hit giving fresh insight into the greatest economic crisis of our age: the one still awaiting us. Support the filmmaker - Overdose is now available to buy in iTunes: https://itunes.apple.com/us/movie/overdose/id994792990 With the US raising their debt ceiling, are we in a global bail-out bubble that will eventually burst? This doc offers a fresh insight into the greatest economic crisis of our age: the one still awaiting us. The financial storm that has rocked the world began brewing in the US when congress pushed the idea of home ownership for all, propping up those who couldn't make the down payments. When it all went wrong the government promised the biggest financial stimulus packages in history and gargantuan bailouts. But ...

published: 02 Jul 2012 -

Napoleon Hill Secrets to Financial Freedom

The Financial Freedom Mastermind are excited to share some key Napoleon Hill concepts. Edited by - The Financial Freedom Mastermind - More Notes Listed Below !!!https://www.facebook.com/FinancialFreedomMastermind/ Video Notes: You have to have a dream and a burning Desire for your dream, You must define your dream, You have to feel good when you think about your dream, You must associate with like-minded people, The words you speak will determine your success, Think about your dreams all the times and feel good about it because you will become your dream, You have to read books, Listen to audios everyday, Attend seminars on a regular basis, You need to get recognised and gladly recognise others achievements, Develop relationships with like-minded positive people,

published: 08 Jan 2015 -

How to Stay Out of Debt: Warren Buffett - Financial Future of American Youth (1999)

Buffett became a billionaire on paper when Berkshire Hathaway began selling class A shares on May 29, 1990, when the market closed at $7,175 a share. More on Warren Buffett: https://www.amazon.com/gp/search?ie=UTF8&tag;=tra0c7-20&linkCode;=ur2&linkId;=9113f36df9f914d370807ba1208bf50b&camp;=1789&creative;=9325&index;=books&keywords;=Warren%20Buffett In 1998, in an unusual move, he acquired General Re (Gen Re) for stock. In 2002, Buffett became involved with Maurice R. Greenberg at AIG, with General Re providing reinsurance. On March 15, 2005, AIG's board forced Greenberg to resign from his post as Chairman and CEO under the shadow of criticism from Eliot Spitzer, former attorney general of the state of New York. On February 9, 2006, AIG and the New York State Attorney General's office agreed to a...

published: 03 May 2013 -

The real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoad

This talk was given at a local TEDx event, produced independently of the TED Conferences. The Great Economic Myth of 2008, challenging the accounting to accounting principal. Brian Wesbury is Chief Economist at First Trust Advisors L.P., a financial services firm based in Wheaton, Illinois. Mr. Wesbury has been a member of the Academic Advisory Council of the Federal Reserve Bank of Chicago since 1999. In 2012, he was named a Fellow of the George W. Bush Presidential Center in Dallas, TX where he works closely with its 4%-Growth Project. His writing appears in various magazines, newspapers and blogs, and he appears regularly on Fox, Bloomberg, CNBCand BNN Canada TV. In 1995 and 1996, he served as Chief Economist for the Joint Economic Committee of the U.S. Congress. The Wall Street Journ...

published: 03 Dec 2014 -

Roja REVEALS Shocking FACTS about her FINANCIAL STATUS | నా సంపాదన ఎవరు కాజేసారో తెలుసా ? - రోజా

Roja REVEALS Shocking FACTS about her FINANCIAL STATUS!! Checkout what happened and why Roja Started doing TV Shows Revealed in this video on News Mantra. For more latest news and Updates: Subscribe: https://www.youtube.com/channel/UCg5NrxgQSWaK2N5Tbb1yk1Q Like : https://www.facebook.com/newsmantra/ Follow us on: https://twitter.com/news_mantra Website : http://www.newsmantra24.in/ Welcome to the Official YouTube channel of News Mantra. Catch all the Latest Telugu Movie News, Tollywood Gossips, Health Tips, Political News & Unknown Facts in the World.

published: 17 Apr 2017 -

Tony Robbins 7 Simple Steps to Financial Freedom - Lewis Howes

Discover the 7 Simple Steps to Financial Freedom in MONEY Master the Game with Tony Robbins and Lewis Howes http://lewishowes.com/109 In this interview Lewis Howes dives in with the world's leading high performance coach Tony Robbins to talk about the secret to generating wealth. Learn more at http://lewishowes.com/109

published: 24 Nov 2014 -

Phyno - Financial Woman [Official Video] ft. P Square

Music video by Phyno performing Financial Woman [Official Video]. Penthauze Get "The Playmaker" Album on Apple Music/iTunes - http://apple.co/2f17jUU Spotify - http://bit.ly/2kHNjMT Deezer - http://bit.ly/2kNq03w Tidal - http://bit.ly/2kmmH2T MTN Music Plus - http://bit.ly/2jX5CZU Curated by http://www.freemedigital.com http://vevo.ly/gbsdRh

published: 06 Feb 2017 -

10 Secrets to Achieve Financial Success

Education http://www.instutrade.com/education/ Seminars http://www.instutrade.com/seminars/ Mentoring http://www.instutrade.com/seminars/personal-training Contact Us http://www.instutrade.com/contact-us/ Twitter @AntonKreil @instutrade In June 2015, Managing Partner of the Institute of Trading and Portfolio Management Anton Kreil was interviewed whilst on a business trip from Singapore to New York and London. In this fly on the wall documentary style interview, Anton is probed by interviewer Tom Murray on what it takes for people to become financially successful and to obtain personal freedom. The result is an epic journey around the world, providing a glimpse into the life of one of the most successful financial markets traders in the world over the last 20 years and his philosophies...

published: 22 Sep 2015

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Order: Reorder

- Duration: 43:57

- Updated: 27 Nov 2012

- views: 1558402

- published: 27 Nov 2012

- views: 1558402

The 3 Decisions That Will Change Your Financial Life

- Order: Reorder

- Duration: 4:14

- Updated: 06 Mar 2015

- views: 188199

- published: 06 Mar 2015

- views: 188199

Overdose: The Next Financial Crisis

- Order: Reorder

- Duration: 46:22

- Updated: 02 Jul 2012

- views: 4055595

- published: 02 Jul 2012

- views: 4055595

Napoleon Hill Secrets to Financial Freedom

- Order: Reorder

- Duration: 26:45

- Updated: 08 Jan 2015

- views: 57419

- published: 08 Jan 2015

- views: 57419

How to Stay Out of Debt: Warren Buffett - Financial Future of American Youth (1999)

- Order: Reorder

- Duration: 59:40

- Updated: 03 May 2013

- views: 1797794

- published: 03 May 2013

- views: 1797794

The real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoad

- Order: Reorder

- Duration: 19:26

- Updated: 03 Dec 2014

- views: 288310

- published: 03 Dec 2014

- views: 288310

Roja REVEALS Shocking FACTS about her FINANCIAL STATUS | నా సంపాదన ఎవరు కాజేసారో తెలుసా ? - రోజా

- Order: Reorder

- Duration: 2:03

- Updated: 17 Apr 2017

- views: 1869

- published: 17 Apr 2017

- views: 1869

Tony Robbins 7 Simple Steps to Financial Freedom - Lewis Howes

- Order: Reorder

- Duration: 44:38

- Updated: 24 Nov 2014

- views: 425161

- published: 24 Nov 2014

- views: 425161

Phyno - Financial Woman [Official Video] ft. P Square

- Order: Reorder

- Duration: 4:31

- Updated: 06 Feb 2017

- views: 3332519

- published: 06 Feb 2017

- views: 3332519

10 Secrets to Achieve Financial Success

- Order: Reorder

- Duration: 1:53:02

- Updated: 22 Sep 2015

- views: 645959

- published: 22 Sep 2015

- views: 645959

- Playlist

- Chat

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Report rights infringement

- published: 27 Nov 2012

- views: 1558402

The 3 Decisions That Will Change Your Financial Life

- Report rights infringement

- published: 06 Mar 2015

- views: 188199

Overdose: The Next Financial Crisis

- Report rights infringement

- published: 02 Jul 2012

- views: 4055595

Napoleon Hill Secrets to Financial Freedom

- Report rights infringement

- published: 08 Jan 2015

- views: 57419

How to Stay Out of Debt: Warren Buffett - Financial Future of American Youth (1999)

- Report rights infringement

- published: 03 May 2013

- views: 1797794

The real truth about the 2008 financial crisis | Brian S. Wesbury | TEDxCountyLineRoad

- Report rights infringement

- published: 03 Dec 2014

- views: 288310

Roja REVEALS Shocking FACTS about her FINANCIAL STATUS | నా సంపాదన ఎవరు కాజేసారో తెలుసా ? - రోజా

- Report rights infringement

- published: 17 Apr 2017

- views: 1869

Tony Robbins 7 Simple Steps to Financial Freedom - Lewis Howes

- Report rights infringement

- published: 24 Nov 2014

- views: 425161

Phyno - Financial Woman [Official Video] ft. P Square

- Report rights infringement

- published: 06 Feb 2017

- views: 3332519

10 Secrets to Achieve Financial Success

- Report rights infringement

- published: 22 Sep 2015

- views: 645959

Erin Moran: actor who played Joanie Cunningham in Happy Days dies at 56

Edit The Guardian 23 Apr 2017North Korea: 'US has now gone seriously mad'

Edit Al Jazeera 22 Apr 2017France goes to vote in first round of cliffhanger presidential election

Edit Hindustan Times 23 Apr 2017Afghanistan Declares National Mourning After Army Base Attack Kills More Than 130

Edit Radio Free Europe 22 Apr 2017Thousands march in Venezuela in honour of those killed in unrest

Edit The Observer 23 Apr 2017SE Asia Stocks-Indonesia hits record high, Singapore near 20-month peak

Edit Sify 29 Mar 2017US STOCKS-Dow set to break 12-day winning run; Trump speech looms

Edit Sify (NewsDB Live) 28 Feb 2017SE Asia Stocks-Down; Thailand gains on cbank economy view

Edit Sify (NewsDB Live) 08 Feb 2017SE Asia Stocks-Largely tepid ahead of U.S. jobs data

Edit Sify (NewsDB Live) 03 Feb 2017Should CNN get rid of Corey Lewandowski and other surrogates?

Edit The Oregonian 02 Nov 2016Could Brexit Save The BBC News TV Channel?

Edit Forbes 01 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »