Gas prices will rise and there's not much we can do to stop it

Updated

Video: Blackouts and soaring energy prices predicted for eastern states as looming gas shortfalls strike

(ABC News)

Video: Blackouts and soaring energy prices predicted for eastern states as looming gas shortfalls strike

(ABC News)

The gas price debate is full of hot air, so let's use some economic logic to cut through.

The most basic principle of economics is supply and demand.

This is the basis of the Federal Government's preferred solution to Australia's surging domestic gas prices — relaxing state restrictions on unconventional gas (such as coal seam gas, or CSG) to increase total production.

It seems logical until you consider this: the reason we have a shortage is because we are shipping the vast bulk of it to Japan, Korea and China, not because we don't have enough.

There are now seven, and soon to be 10, export plants liquefying gas and shipping it offshore.

If Australia simply produces more gas, it will find its way to the destination that pays the most. Right now, that's Asia.

But won't we be able to make the export dollars and produce enough to push prices down at home if we increase supply?

Again, it sounds logical — until you consider how huge the export demand is, much of which is already locked in through export contracts.

Australia needs to double production in six years

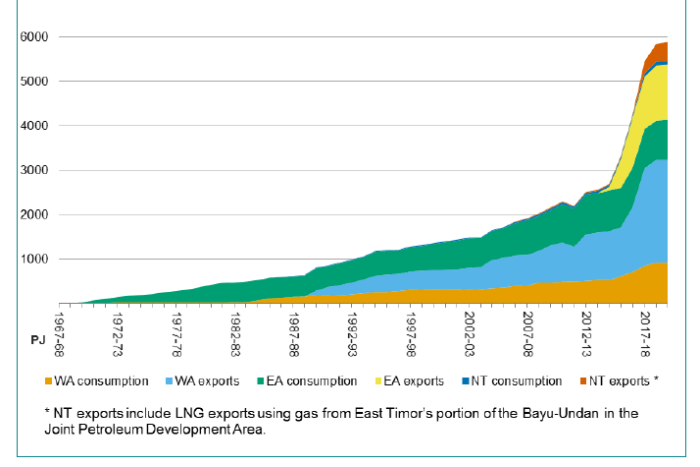

According to the International Energy Agency, Australia produced 2,462 petajoules (PJ) of gas in 2014.

Australia will need to lift that total output by 50 per cent just to meet its expected exports in 2020, according to an ANZ analysis from 2015.

Even if domestic consumption remains steady, the nation will need to more than double its gas output from 2014 levels to meet export and local needs — if that's indeed possible.

Photo:

Domestic gas consumption and LNG exports. (Supplied: Department of Industry, Innovation and Science)

Photo:

Domestic gas consumption and LNG exports. (Supplied: Department of Industry, Innovation and Science)

A large part of the increase will come from massive, proven conventional offshore gas resources located in WA's North-West Shelf.

But the export boom is also relying on three giant liquefaction plants located near Gladstone in mid-north Queensland.

Some of the Queensland coal seam gas fields that inspired the construction of those three plants have turned out to be less productive and costlier than originally hoped.

That has forced LNG operators to turn to the east coast's conventional gas supplies, mainly from South Australia and Victoria, to fulfil their export contracts.

These raids of the domestic market are putting huge upward pressure on local gas prices; gas was cheap until the LNG export boom kicked off.

Getting fracked won't slash prices

The Federal Government's response is — get fracked.

Lifting restrictions on hydraulic fracturing of coal seams, or 'fracking' — particularly in New South Wales — would boost output, taking pressure off prices, it argues.

Australia's estimated gas reserves

| Resource category | Conventional gas | Coal seam gas | Tight gas | Shale gas | Total gas |

|---|---|---|---|---|---|

| Reserves | 77,253 | 45,949 | 39 | 0 | 123,241 |

| Contingent resources | 108,982 | 33,634 | 1,709 | 12,252 | 156,578 |

| All identified resources | 186,235 | 79,583 | 1,748 | 12,252 | 279,819 |

| Prospective resources | 235,913 | 6,890 | 48,894 | 681,273 | 972,969 |

Source: Geoscience Australia

Once again, it sounds logical. But where does the Government think that extra gas will go?

Now that the Queensland LNG plants are in production, the gas can simply be shipped offshore if the price is right.

It's a dollars and sense equation.

If overseas prices, minus processing and shipping costs, are higher than domestic prices, then the gas will be exported.

The only way prices would fall is if we engineer a gas glut where the LNG plants are at full capacity, and there's a surplus.

But if that happens, and overseas prices were high enough, the gas producers could always build more export capacity.

You see, rising east coast gas prices are no accident, they were always an integral part of the energy companies' plans.

Firms such as Santos were no doubt sick of selling their gas at bargain basement prices and low profit margins to domestic industry and households.

Especially once they saw competitors in WA and the NT start shipping high-priced LNG cargoes overseas.

East coast gas producers knew that once they had the ability to ship overseas, the global gas price would be the benchmark upon which domestic gas prices are set.

The die is cast for higher gas prices

Now that Australia's east coast has entered the global gas marketplace, there is no turning back.

No reasonable, or achievable, amount of domestic supply is going to bring prices back to the levels they were at when Australian gas was isolated from global markets - unless governments are prepared to reserve a large percentage of gas for domestic use.

Photo:

Average residential gas prices have risen in every state since 2006. (Supplied: Department of Industry, Innovation and Science)

Photo:

Average residential gas prices have risen in every state since 2006. (Supplied: Department of Industry, Innovation and Science)

WA did this when prices started surging in 2006, keeping 15 per cent of output for the state's industry and households.

Even that didn't prevent WA prices taking off once the state's major producers had access to export markets, but they have eased back since 2009, with Queensland now passing it as the most expensive market.

Photo:

Large industrial gas price trends since 2002. (Supplied: Department of Industry, Innovation and Science)

Photo:

Large industrial gas price trends since 2002. (Supplied: Department of Industry, Innovation and Science)

But don't hold your breath for this to happen.

For Australian industry, it's another harsh introduction to the competitive pressures and costs its global counterparts have long confronted.

For households who have enjoyed several decades of falling real import prices for items such as clothes and electronics, its a lesson that globalisation doesn't always leave you better off.

Topics: oil-and-gas, manufacturing, economic-trends, mining-rural, australia

First posted