First home buyer tax breaks won't help affordability

Updated

We've been here before ... the Victorian Government is cutting stamp duty for first time buyers to give them a leg up, but this has been tried there and elsewhere and it just doesn't work.

Or, more precisely, it works wonderfully to prop up home prices in a shaky market, but it does little or nothing to improve affordability and accessibility for first home buyers. In fact, it may actually make things worse for them.

That was certainly the Productivity Commission's finding, when the Federal Government's peak economic research body looked at first home ownership all the way back in 2004.

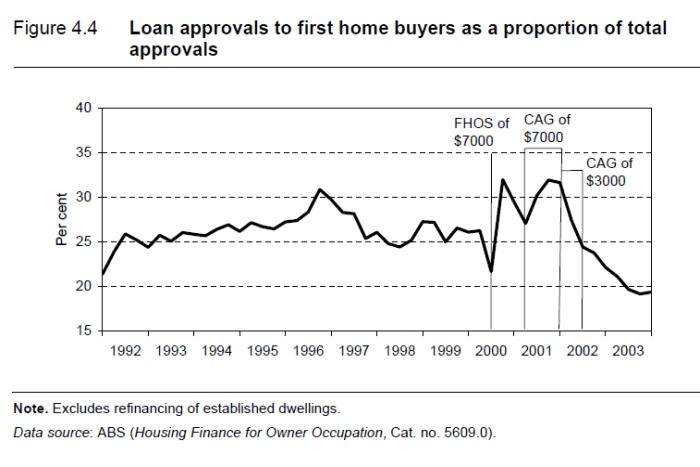

At the time, the big direct assistance to first time buyers was the Howard government's First Home Owner Scheme (FHOS), which provided a $7,000 grant, which temporarily got bumped up to $14,000 for new builds.

"The case for providing direct financial assistance to foster home ownership is not strong," the commission found.

There were a couple of reasons for this conclusion.

The first is that the grant just tended to bring forward home purchase by a year or two for people who were eventually going to buy anyway.

Photo:

Loan approvals to first home buyers as percentage of total. (Supplied: Productivity Commission)

Photo:

Loan approvals to first home buyers as percentage of total. (Supplied: Productivity Commission)

Another is the likelihood that the grant would be capitalised into home prices - potentially lifting purchase costs by the full amount of the grant, unless it prompted a rapid supply response (which is all but impossible when it comes to building homes).

Grants likely to lift prices by five times their size

On this aspect, the Productivity Commission actually made a careless error in its analysis.

It assumed that, with no supply response, prices would only rise by the value of the grant.

It completely ignored how the housing market actually works and therefore completely underestimated how much the grant might boost prices.

Virtually all first home buyers need a bank loan to buy. Most loans would be for around 80 per cent of the property's value. If you give someone $7,000 cash, which boosts the size of their deposit, it means they can borrow an extra 28,000, so you actually push up property prices by $35,000.

We saw this phenomenon at play again when the Rudd government introduced the First Home Owner Boost during the global financial crisis, generating a jump in first home buyer numbers and a much bigger rise in prices than the extra $7,000 or $14,000 the government was handing out.

Victoria's stamp duty exemptions and reductions for first home buyers are equivalent to a grant. By reducing the upfront costs of purchase, they effectively leave home buyers with a bigger deposit that will allow them to borrow more.

As we know from theory and experience, this will do nothing to make housing more affordable for first time buyers, and everything to push stratospheric home prices that bit higher.

Crocodile tears about affordability

That's why economist Steve Keen dubbed the First Home Owner Grant the First Home Vendor Grant - in the end, existing owners, banks and real estate agents are the main beneficiaries.

But that's exactly what governments want.

For all the crocodile tears about housing affordability, politicians do not want to see home prices falling. Former prime minister Tony Abbott candidly admitted as much in one of his parliamentary faux pas.

As my colleague Ian Verrender recently explained, falling home prices are the only answer to improving housing affordability, at least while income growth is next to nothing.

All these grant schemes and stamp duty exemptions end up doing is dragging more unsuspecting first home buyers into the bottom level of Australia's property Ponzi.

When it blows up, it's the people at the bottom who will be most crushed by its collapse.

Swap stamp duty for land tax to help new buyers

Credit where credit is due, the Victorian Government's plan to introduce a tax on empty homes may push some owners to put their properties on the market for sale and rent.

But if you really wanted to help ease the upfront tax burden on first home buyers, the best way to do it would be to copy the ACT and replace stamp duty with land tax.

That way, first time buyers still benefit from not having to save a huge amount up front for tax, but property prices wouldn't jump significantly, because buyers (and their banks) will have to factor in the ongoing land tax payments when calculating how much they can borrow and afford to repay.

Also, having an across the board land tax means you don't need a special, and administratively complex, vacant properties tax. If all owners are paying land tax most won't want to leave their properties vacant for any length of time.

Another way to assist first home buyers would be to reduce the tax benefits going to investors that mean they can afford to pay relatively more and then write it off at other taxpayers' expense, namely the generous capital gains tax discount and negative gearing.

After all, adding demand to an already red hot market is never going to improve affordability.

But, with a glut of apartments flooding into the Melbourne market, improving affordability may not be the Victorian Government's biggest concern.

Topics: housing-industry, tax, states-and-territories, australia

First posted