Cash Converters loans: Corporate watchdog ASIC grilled over investigation into payday lender

Posted

The corporate watchdog has been forced to defend its handling of an investigation into Australia's biggest payday lender, Cash Converters.

Key points:

- ASIC today confirmed it had agreed not to investigate loans taken out in store

- Executives said it would have been more difficult to investigate in-store loans

- Advocates say decision means thousands of people missing out on compensation

Consumer advocates have criticised the Australian Securities and Investments Commission (ASIC) for conducting a "half-baked" investigation into the lending practices of Cash Converters to vulnerable Australians.

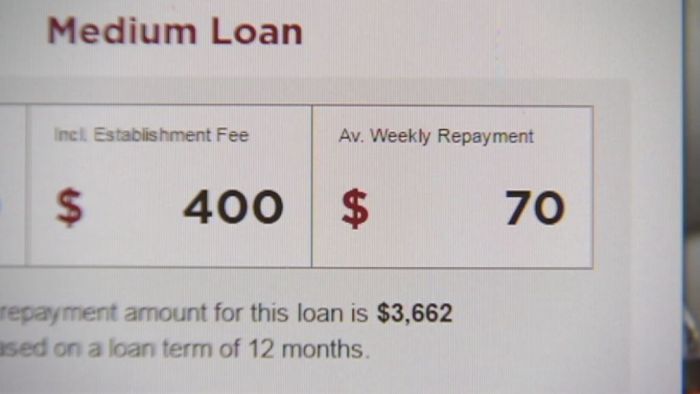

In November, Cash Converters agreed to pay fines and refund loans to the tune of $12 million after an ASIC investigation revealed it had not properly checked if customers who took out loans online could afford to pay them back.

Under the terms of that agreement, which were confirmed during a Senate Estimates Committee hearing today, ASIC agreed not to investigate loans taken out in store.

"As part of the agreement, the enforceable undertaking, ASIC would not take further action with the important exception in relation to debt collection practices where we have an investigation underway," ASIC deputy chair Peter Kell told the hearing.

"It allowed us to reach an agreement in a very timely way and to focus on changing the business model and to get an independent review into the Cash Converters business."

Advocates said that decision meant thousands of the most vulnerable Australians who took loans out in stores were missing out on automatic compensation.

ASIC chairman Greg Medcraft told the hearing it would have been more difficult to investigate the in-store loans.

"With online (loans) we had all the evidence online, exchanges between the borrower and the lender," Mr Medcraft said.

"Whereas if you had have gone in store, basically the communication would have been verbal, it may not have been documented in the same way."

Video: Corporate watchdog ASIC's investigation into Cash Converters loans labelled as half-baked

(Lateline)

Video: Corporate watchdog ASIC's investigation into Cash Converters loans labelled as half-baked

(Lateline)

Under further questioning from ACT Labor Senator Katy Gallagher, ASIC revealed as many as 55,000 customers who loaned in store would miss out on compensation and would instead have to pursue their cases individually through the Ombudsman.

"The number of online customers was 55,000, so my understanding is it's a similar number but we'll need to take that question on notice," ASIC executive Michael Saadat told the committee.

In response Senator Gallagher asked: "So for those 55,000, their avenue for resolution of this, noting that they'd be vulnerable consumers, is to go through FOS (Financial Ombudsmans Service) individually and argue their case?"

Mr Saadat replied: "I guess importantly, that number doesn't mean that all of them were the subject of a breach of responsible lending laws, that's just the theoretical number."

"There's an additional source of recourse as well, Senator, it's clearly through private litigation class action," Greg Medcraft added.

Maurice Blackburn already has a class action underway in Queensland, while its case for NSW Cash Converters customers in 2015 resulted in a settlement.

The Credit and Investments Ombudsman has told the ABC that it received an increase in complaints about Cash Converters after ASIC's case against it was made public last November.

Cash Converters said it works collaboratively with ASIC and it "takes very seriously its responsibility to operate with the highest levels of integrity".

"We recognise that there is more scope for improvement in our industry and we are proactively building relationships with regulators, ombudsmen and advocacy groups, to be at the forefront of regulatory reform that will benefit the industry generally and our customers specifically," the company said.

Topics: corporate-governance, business-economics-and-finance, australia