Balancing the budget

Ensuring that the Government lives within its means balancing the budget and reducing the burden of long term debt

Please note: some Budget measures may be subject to the passage of legislation.

Ensuring that the Government lives within its means

Balancing the budget and reducing the burden of long term debt

Living within our means

Like any Australian family or business, the Government is focused on keeping expenses down to balance the Budget and pay down debt

A stronger Budget supports jobs and growth and instils confidence as the economy transitions. Strengthening the nation’s finances is key to the Government’s economic plan. Working to balance the Budget will restore the buffers that protect Australia against the economic shocks and uncertainties that might otherwise threaten our future success. Importantly, the Government remains committed to balancing the Budget.

The Government’s plan is to balance the Budget over time by keeping expenditure under control, while creating the conditions for a stronger economy that will allow revenue to grow. As the Budget is repaired, we will create headroom to further ease the tax burden and invest in new priorities, including much needed infrastructure.

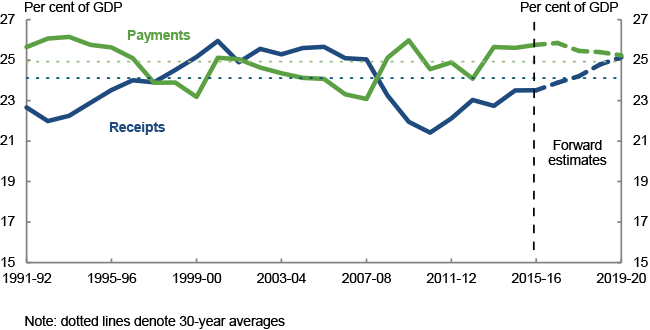

Government spending is projected to continue to fall as a share of the economy, but remains above its historical average. In contrast, tax receipts are projected to return to their long run average by 2017-18. It is for this reason the Government is committed to getting expenditure under control and ensuring every taxpayer dollar is spent efficiently, while not adding to the tax burden in Australia. This will help boost productivity and investment, and drive jobs and growth.

In this Budget, all new Government spending has been offset by reductions in spending elsewhere and not paid for by increasing taxes on Australians. We are ensuring spending is fit for purpose by continuing to cut waste and unnecessary spending, and reprioritising funding towards growth-enhancing policies.

Note: dotted lines denote 30-year averages

At the same time we are implementing targeted revenue measures to help ensure everyone pays the right amount of tax, and the revenue required to fund essential services is raised in a more sustainable way.

We are cracking down on those that abuse or game the system, and also making sure welfare is directed to those that need it most, so that a strong safety net is there for those most in need.

We are continuing to invest in important infrastructure like roads, rail and airports to connect Australians to each other and world markets. We are providing record levels of financial support to States and Territories for hospitals and schools to improve health outcomes and productivity.

Repairing the Budget means we can begin paying down debt and reduce the fiscal burden on future generations.

A sustainable path to budget balance

The Government is making careful and responsible choices to support jobs and growth, while also repairing the budget over time

Laying the foundations for a stronger economy

Since the 2013-14 mid-year budget review, the Government has announced overall savings of $144 billion through sensible reductions in spending and targeted measures to make Australia’s tax system more sustainable. The underlying cash balance is projected to improve from a deficit of $37.1 billion in 2016-17 to a deficit of $6.0 billion by the end of the forward estimates.

The Government has made careful and responsible choices in the 2016-17 Budget to ensure that the overall impact of new policy decisions is an improvement to the bottom line of $1.7 billion over the four years from 2016-17 to 2019-20. All increases in spending have been offset by reductions in payments elsewhere – the Government is not relying on new or higher taxes to pay for new spending. This is the responsible way to balance the Budget.

Since the 2014-15 Budget, payments growth has been limited by controlling expenditure, reflecting the Government’s strong commitment to fiscal restraint and budget repair. Getting expenditure under control and ensuring every dollar spent achieves its purpose will help boost productivity and drive jobs and growth.

New measures in this Budget are focused on supporting the transitioning economy to support jobs and growth.

Keeping spending under control

Payments remain steady or less than 2015-16 mid-year budget review levels.

Government payments as a share of GDP are declining from historic highs but more work is required to ensure that we keep expenditure under control.

This is necessary because while payments fall to 25.2 per cent of GDP at the end of the forward estimates, demographic factors and other spending decisions by earlier governments are expected to place significant pressure on payments over the medium-term.

Legislative delays

A key constraint in repairing the Budget has been the difficulty in passing legislation to implement key savings measures. At present, $13 billion worth of expenditure savings and $1.5 billion worth of revenue increases have not yet passed the Senate. The Government remains committed to securing the passage of these or alternative measures.

Ensuring spending is fit for purpose

Continuing our efforts to cut waste and unnecessary spending

Smaller government

The Government has introduced a range of Smaller Government reforms designed to improve the efficiency and productivity of the Commonwealth public sector.

The Government continues to closely manage the size and shape of government.

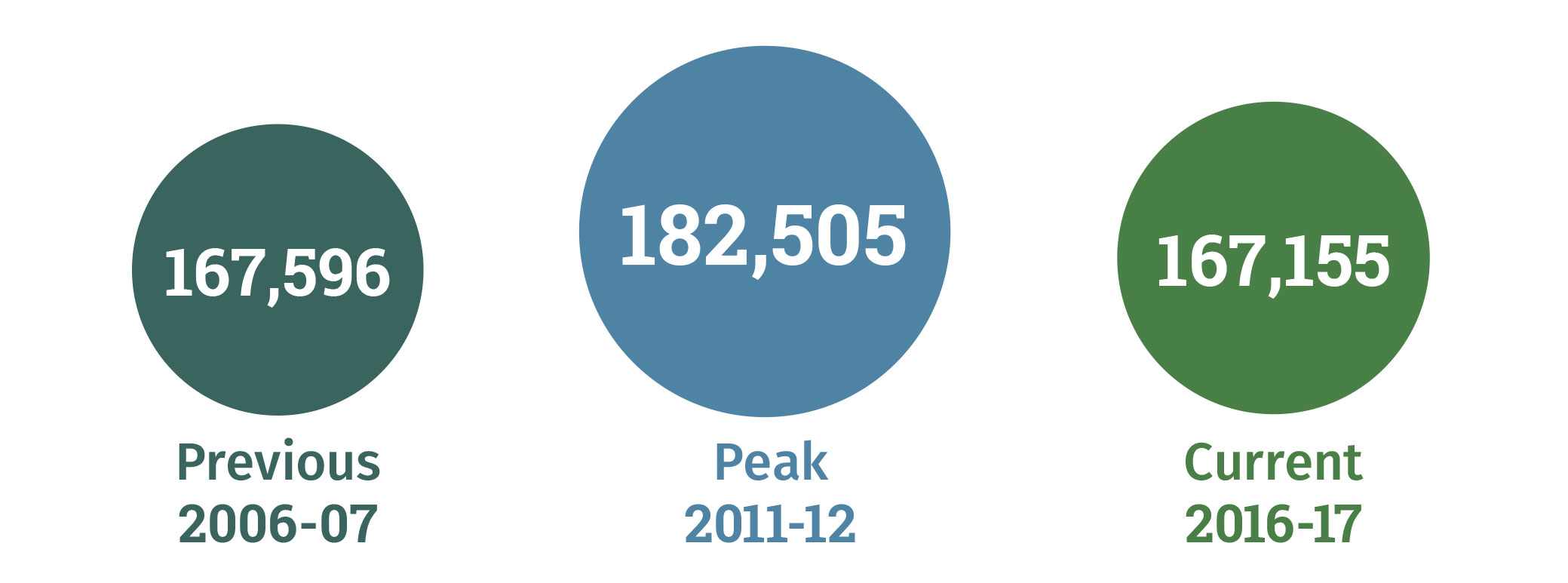

Staffing levels in the General Government Sector (excluding military and reserves) are being maintained at around, or below 2006-07 levels.

A rolling programme of Portfolio Stocktakes, Contestability Reviews and Functional and Efficiency Reviews is underway to streamline agencies.

The goal is to deliver accessible services, affordably and efficiently. The public sector needs to be smaller, more digital and more flexible.

Measures in this Budget will continue to drive the transformation of the public service.

Cutting waste and unnecessary spending

Maintaining a commitment to fiscal discipline requires difficult choices. In the context of the Government’s scrapping of the carbon tax on 1 July 2014, the Government has reviewed the need to provide assistance for cost of living increases.

As a result, the Government will close carbon tax compensation to new benefit recipients from 20 September 2016. All existing recipients at this date will continue to receive the payment. Savings from this measure will be quarantined to offset new social services priorities and contribute to the National Disability Insurance Scheme (NDIS) Savings Fund to help pay for the NDIS.

Similarly, carbon tax compensation through the Single Income Family Supplement will also be closed to new recipients from 1 July 2017, with families who are eligible prior to this date continuing to receive the payment.

Steps such as these are designed to better target spending, without causing undue hardship, and ensuring that the welfare system is fit for purpose.