The sharemarket has ended sharply lower, pulled down by steep losses in the big miners following a plunge in metals prices.

The ASX fell 0.8 per cent to 5739, its fourth day in the red out of the past five sessions which adds up to a weekly loss of 1.15 per cent.

Falls in commodity prices continued during the session, with Chinese iron ore future dropping as much as 5 per cent.

Apart from falling commodity prices, lingering uncertainty around the Trump administration's tax plans have soured investor mood a little. US Treasury Secretary Steven Mnuchin's statement overnight that fiscal stimulus effects on the economy this year may be limited didn't help.

"While shares have generally continued to push higher they remain at risk of a short term correction being technically overbought again and with short term investor sentiment at levels often associated with corrections," says AMP Capital head of investment strategy Shane Oliver. "A major misstep on economic issues by Trump, worries about Eurozone politics, policy tightening in China or signs of faster Fed rate hikes could all be a trigger."

On a weekly basis, the highly capitalised materials sector proved the biggest drag on the index. The sector was down 4.1 per cent over the week.

Today, a 3 per cent fall in copper prices - the biggest one-day fall since September 2015 - helped push the miners lower - BHP fell 3.0 per cent, while Rio Tinto shed 4.2 per cent. Pure-play copper miners Oz Minerals and Sandfire Resources were 1.4 per cent and 2.2 per cent lower respectively.

The week's biggest losers all declined on the back of disappointing earnings results. Isentia lost 40.8 per cent after flagging turbulence in its content marketing division. Ardent Leisure lost a quarter of its value - down 24.7 per cent. WorleyParsons shed 19.5 per cent, while Sky Network Television was 14.0 per cent lower. Vitamin company Blackmores also fell heavily, down 12.8 per cent.

On the other end of the spectrum, Asaleo Care soared 21.1 per cent. NextDC was up 17.9 per cent after posting a 39 per cent profit jump on Friday, and McMillian Shakespeare added 12.6 per cent.

It's been 10 years since the major S&P ASX 200 index first crossed the milestone 6000 level but hopes are high there's enough good news from the current reporting season that it can get there again, says the AFR's Phil Baker:

And this time around, stay there. If the index is to reach 6000, it needs to gain another 250 points, and beyond it will have to be on the back of better earnings.

The days of shares getting a free kick from record low interest rates are over so any gains from the forward price earnings ratio expanding is unlikely.

According to Bloomberg the major index is trading on a forward PE of 15.8 times earnings, well above the average of the past ten years of 13.8 times.

The sharemarket can trade on a higher multiple if bond yields remain low. But most experts at the moment think they are heading higher.

Interest rates, once a tail wind for shares, are now set to be a headwind.

And it could all turn very quick.

MYOB shares have plunged after Bain Capital sold 100 million shares in the business management software maker.

The remaining holding of Bain Capital in the company is 237.2 million shares, or about 39.1 per cent of MYOB's issued share capital

MYOB said that as Bain Capital continues to hold more than 20 per cent of the issued share capital, it retains the right to nominate two directors to the board.

Shares fell as much as 11.4 per cent and are currently down 7.3 per cent at $3.42.

China's iron ore futures are sliding, heading for a weekly loss after a rapid rally underpinned by expectations that strong infrastructure spending would spur steel demand in the world's top consumer.

The fall pulled iron ore futures further away from a record high reached earlier in the week, and should similarly drag down spot prices, which have climbed to multi-year highs near $US100 a tonne.

The most-traded iron ore on the Dalian Commodity Exchange is down 4.5 per cent at 683 yuan ($US99.4) a tonne, after initially touching a two-week low of 674 yuan. The contract, which hit a record high of 741.50 yuan on Tuesday, is down about 2.5 per cent for the week.

"The size of today's move does reflect the speed with which iron ore has risen. But I suspect we will find a base over the next session or two before moving higher again," said Michael McCarthy, chief market strategist at CMC Markets.

For some investors, it's "a shorting opportunity looking for a more normal iron ore price," he said.

Spot iron ore fell 3.1 per cent to $US91.34 a tonne overnight, retreating further from a 30-month peak of $US94.86 on Tuesday, but still up 1.1 per cent so far this week.

"The underlying supply-demand (condition) is supportive of higher prices in my view. I wouldn't be surprised to see an iron ore price above $US100 a tonne," said McCarthy.

Iron ore prices have tracked the rally in China's steel market that had been supported by hopes of a pickup in construction activity from next month as well as Beijing's efforts to boost infrastructure investment to spur the economy.

"While we continue to believe that steel and iron ore prices are factoring in overly optimistic demand projections, China is likely to keep infrastructure investment, particularly transport, supported to shore up growth before elections in November," CBA analyst Vivek Dhar said in a note.

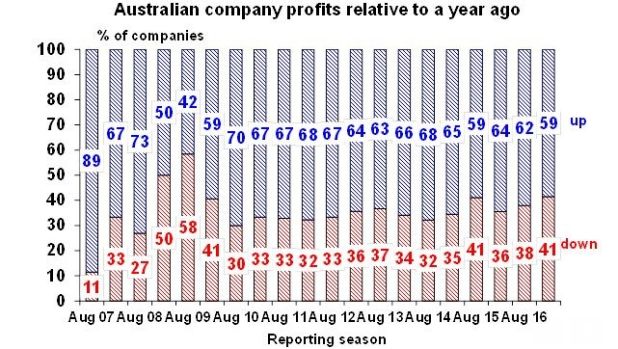

Here's AMP Capital Shane Oliver's overview of reporting season by the numbers.

The Australian December half profit reporting season is now just over 90% done. Results remain consistent with a strong return to profit growth but as always we have seen more soft results as the reporting season has progressed.

- 46% of companies have exceeded earnings expectations compared to a norm of 44%, 59% of companies have seen profits up from a year ago

- But reflecting the strong rally in the market ahead of the results only 50% of companies have seen their share price outperform the market on the day they reported as a lot of good news was already priced in.

- Consensus profit expectations for the overall market for this financial year have been revised up by around 2% through the reporting season to a strong 19%. This upgrade has all been driven by resources companies which are on track for a rise in profit of 150% this financial year reflecting the benefits of higher commodity prices and volumes on a tighter cost base

- Profit growth across the rest of the market is likely to be around 5% with mixed bank results and constrained revenue growth for industrials.

- Outlook comments have generally been positive and as a result the proportion of companies seeing earnings upgrades has been greater than normal.

- The focus has remained on dividends with 79% raising or maintaining their dividends.

Data this week showed that wages growth remains stuck at record lows, and Capital Economics says that's unlikely to change fast.

The idea that Australian employees could enjoy a period of "catch-up" wage growth is a pipe dream, says economist Paul Dales.

In the RBA minutes, released on Tuesday, the central bank flagged that wage growth could rise by more than expected "if employees were to demand wage increases to compensate for the period of low wage growth over recent years".

But Dales says that is unlikely as the large fall in wage growth in the past years meant that businesses didn't need to fire as many workers.

"Hours were cut, but the rise in the unemployment rate was small compared to the slowdown in GDP growth. In other words, the necessary adjustment in firms' labour costs was still achieved, so wages don't need to "catch-up" to reach equilibrium," he says in a note to clients.

"It's far more likely that cyclical and structural forces - such as technological progress and globalisation - will keep wage growth close to record lows for a few more years yet."

He lists two implications:

- With wage growth unlikely to be much higher than inflation, real consumption growth will slow this year.

- A prolonged period of low wage growth goes hand in hand with a prolonged period of low underlying inflation. That may eventually prompt RBA Governor Philip Lowe to reassess the merits of lower interest rates.

Investors are giving the thumbs up to Cabcharge's acquisition of the Yellow Cabs Queensland business for $20 million to bolster its national footprint as it tries to blunt the impact of ride-sharing services such as Uber.

The company also said it will pay a big 80¢ per share special dividend after selling its stake in a private bus company.

The special dividend, along with a 10¢ interim dividend, both of which will be paid on April 28 to people who are on the Cabcharge register by March 31, put a temporary rocket under the company's share price, driving it up as much as 10 per cent. It's currently 6.9 per cent higher at $3.87..

But while the special dividend is a welcome short-term injection for shareholders, Cabcharge's first-half results underscore the uphill battle the firm has in a fast-changing taxi industry. The dismantling of regulations and cuts to commissions on a near-monopoly in its payments network is hurting the core business, with earnings before interest and tax down 19 per cent to $20.4 million in the first half of 2016-17. Revenues dropped by 11 per cent to $79.1 million.

Cabcharge has also appointed a new chairman, Paul Oneile, who was the former chief executive of poker machine manufacturer Aristocrat Leisure from 2003 to 2008.

Cabcharge is attempting to re-make itself under chief executive Andrew Skelton, who said on Friday the acquisition of Yellow Cabs Queensland would deliver an extra $40 million in revenue and earnings of up to $4 million, with an extra 1,200 taxis coming into the operations.

Shaver Shop was one of the silly season's doozies, when a profit warning two days before Christmas saw the shares dumped.

And amid the welter of reports today, it has confirmed that earnings in the year to June will fall short of prospectus forecasts, with earnings before interest, tax, depreciation and amortisation (EBITDA) to come in at $12.5-$13.5 million.

In its prospectus, issued for ts mid-2016 IPO when it sold shares for $1.05, it said the year to June EBITDA profit would run at $14.7 million. And there has been a big run-up of stock on the balance sheet.

"Whilst our recent trading performance is below our expectations, Shaver Shop remains confident in its future prospects," it said today, blaming "a few specific product areas" for its woes.

Investors aren't convinced, slashing the shares another 13 per cent to new lows of 58c.

Data centre business NextDC's shares are soaring after the company flagged it is poised for a record year in 2017, with more than $250 million in planned capital investments underway to cater for the accelerating transition to pay-as-you-consume software and cloud computing.

The business reported a revenue jump of 39 per cent to $58.7 million for the first half of the 2017 financial year and jump in profit from $644,000 to $19.3 million, supported by strong growth at its S1 and M1 data centres.

Contracted utilisation at NextDC's S1 facility jumped from 66 per cent to 88 per cent of total power capacity and M1 has jumped from 86 per cent to 89 per cent.

Consequently, the company announced that it was upgrading the S1 centre from 14 megawatts to 15MW and it was also fitting out an additional data hall at both S1 and M1 to meet customer requirements.

On the back of the results shareholders have pushed NextDC up more than 12 per cent to $3.56, the biggest winner among the top 200 today.

Troubled infant formula milk group Bellamy's Australia has signalled it will take 18 months to turn the group around, reporting a slide in profit for the December half as margins were squeezed due to lower production levels which left earnings short of forecasts.

In the six months to December, the net profit fell to $7.2 million from $13.6 million even as revenue rose 12 per cent o $118.3 million. The pretax profit of $10.1 million, down 47.2 per cent fell short of guidance, it said, with revenue in line with guidance.

The gross margin fell 6.2 percentage points to 39.5 per cent in the half, it said, due to a change in its mix of customers, the higher cost of its organic material inputs and also higher promotional costs.

Late Thursday, it also confirmed the papers relating to the anticipated class action have been received, with IMF Bentham funding action launched by lawyer Slater and Gordon.

It has been an eventful few months for the company as it restructured senior management, replaced the chief executive as it was forced to renegotiate a key supplier contract and has been faced with a shareholder revolt with a push to replace three directors.

A meeting of shareholders is to be held next Tuesday to vote on a series of proposals that could deliver effective control of the company to its largest shareholder, Kathmandu co-founder Jan Cameron, who has a 17.7 per cent stake held largely via an offshore entity, the Black Prince Private Foundation.

Much of Bellamy's woes can be traced back to a change in its approach to the so-called 'daigou' trade, with product bought by private traders locally for supply into China, with much of this trade moving across to rival A2 Milk, which has enjoyed a surge in earnings.

Shares are down 5.4 per cent at $4.23, on track for a weekly loss of more than 11 per cent.

Ardent Leisure stocks remain under pressure, following yesterday's disappointing earnings report that showed the theme parks owner fell to a net loss of $49.5 million in the half.

Shares dropped as much as 8 per cent to $1.555, the lowest since June 13, 2013, following yesterday's 22 per cent wipe-out. They're currently down 4 per cent as the stock trades ex-dividend.

Adding to pressure, Deutsche Bank cut the price target to $2.1 from $2.5, maintaining a "hold" recommendation on the stock.

Shares have plunged more than 30 per cent cent since the fatal Dreamworld theme park accident in October that killed 4 people.

When a chief executive says there's room for a $US20 billion dividend payout, you know a company has its mojo back.

Ivan Glasenberg, the boss of miner and trader Glencore, told analysts overnight that the company's much lower net debt ($US15.5 billion at the year end, $US10 billion lower than the prior year and on track to fall further) would, in theory, allow for a huge windfall.

As usual, Glasenberg was being provocative. Shareholders aren't about to drown in Glencore cash. Yet his remarks show confidence is flowing back through the Swiss-based commodity house. "What a difference a year makes", he said at the start of his presentation.

Eighteen months ago, Glencore had to raise capital when short-sellers scented a kill amid cratering commodity prices and fears that China's economy would implode. It has since disposed of about $US6 billion of assets and cut operating costs and capex.

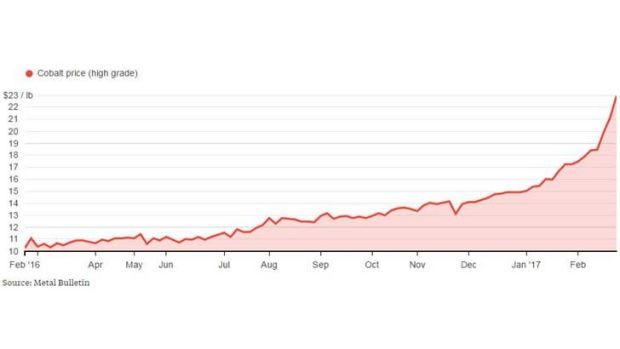

Meanwhile, commodity prices have rebounded, to put it mildy. Take cobalt, an ingredient of lithium-ion batteries for electric cars. Glencore controls a big chunk of the market and prices have surged this year (see chart).

Commodity prices aren't set in stone, of course. But should things stay as they are, Glencore would generate about $US15 billion of earnings before interest, tax, depreciation and amortisation in 2017 and roughly $US7 billion in free cash flow.

With around $US1 billion set aside for dividends in 2017, net debt would fall to about $US9 billion by the end of the year and leave the balance sheet looking rather tame. The guidance implies net debt of just 0.6 times EBITDA by the end of 2017, versus 1.5 times at the end of 2016. Glencore promises that net debt will not exceed two times EBITDA

So Glencore's problem, if you can call it that, is what to do with all that extra cash. It still has mothballed reserves and doesn't need to spend vast amounts on capex. This will stay at close to $US4 billion for the next three to five years, a relief given the industry's reputation for frittering away money.

While Glencore will want to keep credit rating agencies sweet and powder dry for sensible M&A, it can afford to be a bit kinder to shareholders. After all, they've had a heart-stopping time of it.

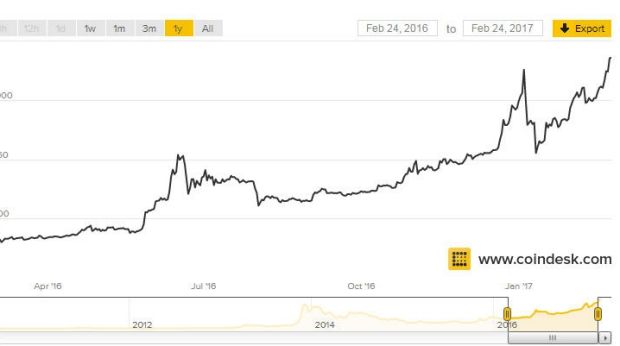

Digital currency bitcoin has hit an all-time high, amid speculation that the first bitcoin exchange-traded fund (ETF) is set to receive approval from the US financial regulator.

Traditional financial players have largely shunned the web-based "crytpocurrency," viewing it as too volatile, complicated and risky, and doubting its inherent value.

The digital currency jumped as high as $US1186.09 overnight on the CoinDesk exchange, more than $US20 above its previous all-time high of $US1165, which it hit in November 2013, at the height of Bitcoin-mania. It's currently at $US1181.62.

Some analysts say regulatory approval of a bitcoin ETF would make the currency relatively attractive to the often more cautious institutional investor market.

Three ETFs that track the value of bitcoin have been filed with the US Securities and Exchange Commission for approval.

The SEC will decide by March 11 whether to approve one filed almost four years ago by Cameron and Tyler Winklevoss. If approved, it would be the first bitcoin ETF issued and regulated by a US entity.

"If approved this would certainly give a dramatic condoning of bitcoin by the authorities and powers that be," digital currency analytics firm Cryptocompare CEO, Charles Hayter, said.

"Perhaps key would be the institutional money which would flow into bitcoin. This would bring a certain amount of stability eventually but could see short-term exuberance by retail traders," he said.

Over the past year, bitcoin's biggest daily moves have been about 10 per cent - very volatile compared with traditional currencies, but far lower than the daily swings of up to 40 per cent seen in 2013.

Bitcoin climbed 125 per cent in 2016, outperforming every other currency, as it did every year since 2010 bar 2014.

The cryptocurrency surged more than 20 per cent in the first week of 2017 amid heavy buying interest from China as Beijing tightened capital controls. Then, the price crashed 35 per cent amid fears China was going to crack down on trading.

Graincorp shares have gained following comments by the company that full-year earnings could rise by as much as two thirds and underlying profit more than treble after a record eastern Australian crop.

Long-serving GrainCorp chairman Don Taylor will retire in May and be replaced by former lawyer and businessman Graham Bradley.

Taylor told GrainCorp's annual general meeting on Friday the agricultural giant was "in excellent shape, with world-class assets, strong cash flows and a healthy balance sheet."

Underlining the current financial position, GrainCorp said it expects to report underlying net profit after tax in 2016-17 in the range of $130 million to $160 million, which could more than triple last year's $53 million. The average estimate among 11 analysts surveyed by Bloomberg was for net profit of $141.9 million.

The $2 billion company will benefit from estimates of a record eastern Australian crop flowing through its storage and logistics division this year.

The stock is up 1.2 per cent at $9.35, not far from a 12-month high of $9.75 hit in January.

RBA chief Philip Lowe says that market pricing for steady rates this year seems "reasonable", in a clear signal that more cuts in interest rates are off the table.

The futures market has almost priced out any chance of a rate cut this year, with some investors even toying with the idea of a rate hike by early 2018.

Lowe told a parliamentary economics committee that the bank was paying "close attention" to the trends in household borrowing, highlighting the risks of a debt-fuelled boom and bust.

"There is a balance to be struck. Too much borrowing today can create problems for tomorrow, because debt does have to be repaid," said Lowe before a parliamentary economics committee.

Since taking over the reins at the RBA in September, Lowe has repeatedly emphasised the limits to monetary policy and earlier this week said further cuts in interest rates would not be in the national interest.

"The balance that is required is to support spending in the economy today while avoiding creating fragilities in household balance sheets that could cause problems for the economy later on," he said.

Lowe said the Australian economy was set to rebound as the "headwind from falling commodity prices turned into a gentle tailwind".

Lowe hopes the current setting will be low enough to deliver economic growth of about 3 per cent this year, but has said a further slowdown in the labour market could be a catalyst for lower interest rates.

The unemployment rate has been steady for a little over a year at around 5.7 per cent, although Lowe said a "sustainably lower unemployment rate should be possible in Austalia."

Recent jobs data has shown a high level of slack in the market with employment growth driven by part-time work. That has also put pressure on wages growth, which has stayed stuck at record lows.

Lowe also clarified his recent intervention in the company tax cut debate, saying he doesn't necessarily support the move but believes it's up to parliament to decide whether Australia should join a global race to the bottom.

"You could argue that this is - from a global perspective - not actually that useful," Dr Lowe said.

"The lowering of the corporate tax rate just changes the location of the investment" without necessarily the amount, he said.

Shares have opened lower following a wobbly night on global markets as investors tweaked their expectations on the timing of US fiscal stimulus and major metals prices fell.

The ASX is down 0.3 per cent at 5766.9, putting it on track for a 0.7 per cent weekly loss.

Like yesterday, the big miners are once again weighing heaviest on the index, with BHP falling 2.4 per cent and Rio down 2.7 per cent.

"US Treasury Secretary Mnuchin's remarks on tax reform have served as a reminder of the scope of the task ahead of the US government in introducing major tax changes," said CMC chief market analyst Ric Spooner. "Markets are reacting to the risk of delay in fiscal stimulus and unwinding some of the recent optimism that followed President Trump's phenomenal tax package remarks."

Gold was a winner in the market's adjustment to caution on the risks and timing surrounding US fiscal stimulus, making gold stocks a likely winner of today's session, Spooner said.

Evolution Mining is up 4.5 per cent and Regis Resources has added 3.2 per cent.

Among stocks reporting:

- Super Retail Group: +8.8%

- Ramsay: -1.5%

- Bellamy's: -2.7%

- NextDC: +12.5%

- Mayne Pharma: +0.7%

- Automotive Holdings: -1.7%

- Billabong: flat

- Quickstep: flat

- Graincorp: +0.4%

- Charter Hall: +2%

- RCG: -15%

- Cabcharge: +8.8%

Another case of good cop / bad cop? President Donald Trump has declared China the "grand champions" of currency manipulation, just hours after his new Treasury secretary pledged a more methodical approach to analysing Beijing's foreign exchange practices (see post at 9.24am).

In an exclusive interview with Reuters, Trump said he has not "held back" in his assessment that China manipulates its yuan currency, despite not acting on a campaign promise to declare it a currency manipulator on his first day in office.

"Well they, I think they're grand champions at manipulation of currency. So I haven't held back," Trump said. "We'll see what happens."

During his presidential campaign, Trump frequently accused China of keeping its currency artificially low against the dollar to make Chinese exports cheaper, "stealing" American manufacturing jobs.

But Treasury Secretary Stephen Mnuchin told CNBC on Thursday he was not ready to pass judgment on China's currency practices.

A formal declaration that China or any other country manipulates its currency requires the US Treasury to seek negotiations to resolve the situation, a process that could end in punitive tariffs on the offender's goods. The US Treasury designated Taiwan and South Korea as currency manipulators in 1988, the year that Congress enacted the currency review law. China was the last country to get the designation, in 1994.

The current situation is complicated because China's central bank has spent billions of dollars in foreign exchange reserves in the past year to prop up the yuan to counter capital outflows.

The International Monetary Fund said last year that the yuan's value was broadly in line with its economic fundamentals. The US Treasury also said in its last currency report in October that its view of China's external imbalances had improved somewhat.

SPONSORED POST

Have markets run too hard or are we just getting started? The market is split, writes IG analyst Gary Burton:

Since the global equities market rally inspired by Trump inflation, the trading community is now falling into two camps. The first believe this equities and commodities rally is just getting underway, this is highlighted by the trading and hedge fund investment houses being net long everything from equities to property and commodities.

The second, is the group that are waiting in angst for the potential correction or significant pull back for an entry point but they watch the markets march higher every trading day.

For markets to continue higher all of the players must be of one mind, bullish. The Dow moved higher again, however the Dow transports came off a full one per cent or 100 points, the Nasdaq fell by half a per cent at 5835. This is often the warning shot across the bow that price weakness may be coming and may offer an entry point to those left behind.

A few other earnings:

1. Murray Goulburn has suffered a half-year loss of $31.87 million after taking an impairment on its milk supply support package and making step-up payments to suppliers.

The dairy co-operative was hit by lower milk supplies and very wet conditions in the southern milk region in August and September dragging it into the red for the six months to December 31, compared to a $10 million profit the previous corresponding period.

It declared a fully-franked interim distribution of 1.7 cents per share, down from 3.5 cents.

2. Super Retail Group returned to profit growth in the December-half, lifting bottom-line profit by 65.7 per cent to $74.4 million after completing restructuring at outdoor retailer Ray's and achieving solid sales and earnings growth at all three divisions - auto, sports and leisure retailing.

Normalised net profit - excluding one-off restructuring costs for Ray's in the year-ago period - rose 26.3 per cent to $74.4 million, beating consensus forecasts around $67.3 million.

The results received a fillip from timing differences. The latest results covered 26 weeks to 31 December, while the prior period results were for the 26 weeks to 26 December. The extra five days trade contributed an extra $28 million to sales and $7 million to earnings before interest and tax.

Total sales rose 6.6 per cent to $1.29 billion and like-for-like sales across the group were up 5 per cent, with the strongest gains in leisure and sporting goods chains Rebel and Amart.

3. Aged care provider Regis Healthcare has lifted half-year net profit by 9 per cent to $30.9 million, helped by increased inflows and a recent acquisition.

Revenue for the six months to December 31 jumped 20 per cent to $284.7 million and the company declared a fully-franked interim dividend of 10.3 cents a share.

The company said it expects second-half earnings to be in line with those in the first half of the fiscal year, and has reaffirmed its previous guidance.

4. Automotive Holdings Group's first-half net profit has tumbled 19.8 per cent to $38.6 million on the back of Western Australia's economic downturn and a loss in its refrigerated logistics division.

The retailer and logistics firm said revenue jumped 7.6 per cent to $2.96 billion in the six months to December 31. Automotive Holdings will pay an interim dividend of 9.5 cents per share, unchanged.

All of today's earnings at the AFR's reporting season blog

Footwear retailer RCG Group's net profit rose 31.7 per cent to $21.2 million in the December-half, buoyed by the acquisition of rivals Hype DC and the Accent Group.

Underlying net profit rose 34 per cent to $23.3 million, in line with market forecasts.

Underlying earnings before interest, tax, depreciation and amortisation jumped 42 per cent to $42.9 million as sales rose 40 per cent to $301.3 million.

RCG is now the largest specialty footwear retailer and distributor in Australia following the acquisition of the Accent Group in May 2015 and Hype DC in August 2016.

It has more than 400 stores across 10 different retail banners and exclusive distribution rights for 10 international brands in Australia and New Zealand including The Athlete's Foot, Platypus Shoes, Hype DC, Skechers, Merrell, CAT, Vans, Dr.Martens, Saucony, Timberland, Sperry Top-Sider, Palladium, Shubar and Grounded.

Search pagination

1 new post(s) available. View post(s) Dismiss