With key stock indices in the US trading at record highs, investors and analysts are taking stock of whether the current bull market can last.

An analysis by Barclays argues soaring stock valuations are supported by fundamentals and expectations of policy shifts, but fund managers remain cautious.

The S&P500; was widely expected to fall after President Donald Trump's January 20 inauguration, as has been the historical case for new presidential terms in the past, but the benchmark index has soared ever higher, continuing an eight-year bull run that's seen it hit various records over the start of this year with few significant moderations.

Using one definition of a bull market - a period in which stocks rise 20 per cent or more after a 20 per cent decline - the S&P500; is on its second-longest bull run ever. A broad recovery in US equities has been taking place since 2008, without large correction. Meanwhile the Dow, for which financial stocks like Goldman Sachs have driven most of the recent rally, closed on Wednesday at its ninth-consecutive all-time high, at 20,775.6, its longest run of record closes since 1987

Are US markets being supported by economic fundamentals, or an outbreak of animal spirits? One new analysis, by Barclays, argued it is the former.

The investment bank's researchers used historical analysis to argue a series of factors - including low interest rates, expectations of lower taxes due to President Trump enacting his policy agenda, higher earnings per share growth, low volatility and favourable credit-to-growth spreads - explain almost all the S&P500s; current valuations.

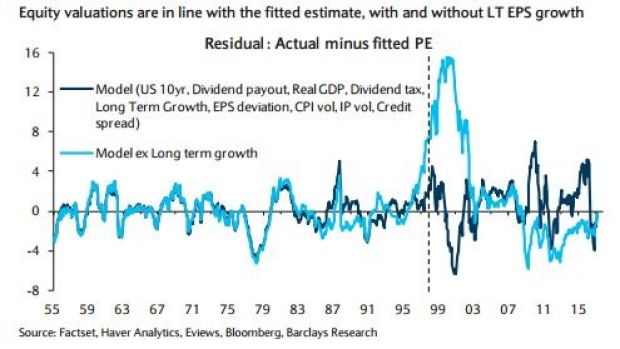

The model takes 'animal spirits' to be the price-earnings ratio of the S&P500; unexplained by a series of fundamental factors. On its analysis, market exuberance was the only way to explain the high equity valuations of the late 1990s, and a downward drag from investor sentiment is needed to explain the low equity valuations after the financial crisis.

But the model does not find such an unexplained gap between projected S&P500; multiples based on its multi-factor model and current multiples, leading the analysts to conclude it isn't animal spirits driving the markets.

"According, the current price/earnings ratio of 19.4x, although high by historical standards, is far from pricing in excessive optimism, based on our model," the bank's US equity strategy team wrote.

For others, the fact that US equities are trading so far above long-run averages is a cause for concern.

Andrew Baud, the deputy portfolio manager for Antipodes Global Investment Partners, said the fund manager was cautious of US equities, investing selectively in favoured sectors while remaining aware of the high price-to-book ratios of US stocks, particularly in domestic-focussed stocks.

Price-to-book ratios in the United States have grown far more quickly in the United States than in Western Europe. And on a cyclically adjusted price-earnings basis, US stocks are trading at 25 times their value when the 25-year mean is 19 times. Western European stocks are trading at a discount to long-term averages.

"We'd rather be investing in European stocks - we think there's more upside there than the US is presenting today," Mr Baud said.

"Trump has come along and given the market a boost, but the issue we have is he's given a boost to an already expensive market."

Wingate Asset Management chief investment officer Chad Padowitz said there may be opportunities in US markets in the short term, and perhaps in the long-term with unconventional trading strategies that seek to take advantage of volatility.

"But if you buy today and hold the market as part of the index, you're expecting something that hasn't generally been delivered in the past," he said. "From that point of view, we think one needs to be quite prudent."