The Australian economy is in a bit of trouble. Just like the Turnbull government, writes Ian McAuley.

As expected, the Mid Year Economic and Fiscal Outlook, released on Monday, exposes the government’s economic and fiscal overconfidence in framing the 2016-17 budget – a budget presented less than a week before announcement of the federal election.

The short story is that the government has had to acknowledge Australia’s continued poor economic performance. Forecasts for employment and economic growth for this year and next year are revised downwards, before in 2018-19 they miraculously bounce back to original budget-time estimates. Real wage growth will stay below one per cent until 2019-20.

“Jobs and growth”, it seems, are on hold.

“Budget repair” – a partisan term implying that the Rudd-Gillard Government somehow “damaged” the budget – is deferred. Another $10 billion is added to the budget deficit and another $18 billion to the fiscal deficit over the four years to 2019-20.

Most of the shortfall is on the revenue side: income tax revenue this year is estimated to be down by $6 billion, and other tax revenue by $1 billion. On the expense side there are net cuts of about $2 billion this year, with steeper falls in subsequent years, the biggest hits being in social security and welfare.

This means that net Commonwealth debt will peak at 19.0 per cent of GDP, in 2018-19. Remember how terrible it was when, on Julia Gillard’s watch, it peaked at 12.7 per cent of GDP?

But for higher iron ore and metallurgical coal prices, the fiscal outlook would be worse. Commodity forecasts in this year’s MYEFO are guided by “broad and deep industry consultation”, and when we read further into the document to see what those consultations reveal we see “ there is no consensus as to when prices may fall and by how far.”

In other words, they haven’t got the first idea of how long the commodity sugar hit will last.

Such is the cost of having allowed our country to become a quarry – a country whose economic and fiscal outcomes are determined by people in other countries.

In any event, we shouldn’t take these budgetary and fiscal projections too seriously. Figure 1 below compares budget taxation estimates (coloured lines) with outcomes (heavy black lines) over the last 10 years. Ever since the Global Financial Crisis, Labor and Coalition treasurers have been persistently subject to overconfidence.

The reason for this overconfidence has to do with a misplaced faith in our whole economic system. That’s about structural weaknesses in the Australian economy – a bigger subject than can be covered in a short article.

MYEFO and budget projections are mainly about impression management, partly for the electorate, and partly for ratings agencies. All that Morrison has to offer in terms of impression management is a paltry $600 million reduction in this year’s budget deficit, which is more than offset in outer years.

No doubt some Treasury bureaucrat will get a koala stamp for his or her contribution to the government’s fortunes, but there is more chance that Cory Bernardi will accept the science of climate change than the Commonwealth holding its AAA credit rating over 2017.

To a hard-nosed financier, a downgrade shouldn’t matter much. But the Coalition has invested so much political capital into two myths, that a downgrade will hurt it politically.

The first myth is that fiscal management, particularly the capacity to have a budget cash surplus, is the be-all and end-all of economic management – a myth sustained by partisan Murdoch journalists and by other journalists who don’t know the difference between economic and fiscal management.

The other myth is that the Coalition, without question, is much more competent at economic management than Labor.

If a rating downgrade is the price we have to pay for busting those two myths, it will be well worth it, and may help steer us towards a more sensible economic debate.

In the meantime there remains the question of bringing the budget back to balance – at least ensuring that over the business cycle, recurrent spending is closely matched to public revenue.

On the capital account we have capacity to take on more debt, provided that debt is for productive purposes, but we should seek a recurrent balance (OK, some NM readers will say that balancing the recurrent budget doesn’t matter. In some circumstances, when there is a fundamental shortage of money in the economy, that’s right, but that’s not the situation now – the economy is sloshing in money which is pushing up housing prices).

The government’s path to balance – cut spending! That’s Morrison’s line, backed up by the so-called business lobbies. ACCI’s James Pearson was quick to say, “He [Morrison] is right to continue the Government’s efforts to curb recurrent spending”, before going on to call for a cut in corporate tax.

Have Morrison and his supporters learned nothing about what’s holding back the Australian economy and what’s driving the populist backlash against neoliberalism?

So committed is the Coalition to “small government” that it cannot bring itself to admit that we have insufficient taxation revenue to fund the public goods and welfare transfers necessary to sustain a competitive and prosperous economy.

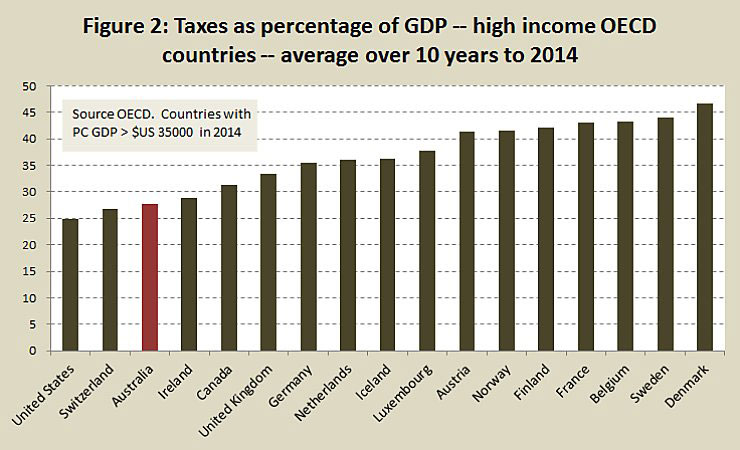

The graph below is of taxation revenue in high-income OECD countries. We’re a low-tax country, with only the USA and Switzerland behind us.

I don’t need to explain to NM readers how badly low taxes, small government and trickle-down economics have served the USA. And while Switzerland has a reasonably healthy economy, their taxation figures understate their public revenue, because at a cantonment level there are levies that in most other countries would be classified as taxes.

We’re down the low-tax-impoverished-public-sector end of the spectrum. Morrison and the ACCI want to keep us there.

If you’re after some holiday reading about the costs of “small government”, or a present for a recalcitrant neoliberal, I commend in all immodesty Miriam Lyons’ and my work Governomics: can we afford small government?.

Having seen the courts put Eddie Obeid in the slammer for a conflict of interest I want to protect myself from the charge of using NM to promote my financial interests. So if you buy a copy, let me know, and rather than using the money to add to my stock of Grange Hermitage (presently 0) I’ll forward my share of the royalty to the political party of your choice. Otherwise, have a happy Christmas and steel yourselves for a bumpy and interesting year ahead.

Comments