That's it for Markets Live today.

Thanks for reading and your comments.

See you all again tomorrow morning from 9.

The ASX managed to eke out a small gain despite the worst day for Telstra shares in six-and-a-half years.

Late support for heavyweight bluechips in the banking, mining and healthcare sectors was enough to swing shares into the positive in late trade, leaving the benchmark ASX 200 index up 7 points higher at 5816.

The national telco slumped 6.6 per cent after the unveiling of disappointing half-year profit figures, the stock's worst day since August 2010, when it plunged over 10 per cent. That dragged smaller peers lower as well: TPG dropped 5.2 per cent and Vocus 4.7 per cent.

There were more stocks lower than higher on another busy day of earnings, and most sectors were also down, but CSL jumped 3.7 per cent and Cochlear 4.5 per cent, leading healthcare names higher.

BHP added 1.5 per cent and Rio 1.3 per cent, offsetting a 1.9 per cent loss for South32 after its earnings. The Big Four banks also climbed by around 0.7 per cent each, all of which formed the backbone for the ASX 200 clinging on above 5800 points.

The Aussie dollar was pretty much flat for the day at 77.1 US cents following a bit overnight push to totally reverse its post US-election losses. Uninspiring but hardly disastrous jobs numbers didn't move the currency too much either way.

The day's best was Domino's, up 7.7 per cent and retracing about half of yesterday's losses triggered by its profit result.

Among other companies reporting today and swaying the index were Origin, which dropped 2.2 per cent, and Sydney Airport, which lost 2.1 per cent.

Rio Tinto has asked banks to pitch for a role advising on the divestment of its last remaining coal operations in Australia, Bloomberg is reporting quoting people with knowledge of the matter.

The miner has decided to pursue a sale of its Hail Creek and Kestrel mines after receiving unsolicited approaches from potential buyers, according to the people. The assets in the Bowen Basin, which mainly produce coking coal used in steelmaking, could fetch as much $2 billion, people familiar with the matter said earlier this month.

Rio, the world's second-biggest miner, has been divesting coal assets since dismantling its energy division in 2015 and last month agreed to sell $US2.45 billion of Australian mines to a company controlled by China's Yanzhou Coal Mining.

The producer is focusing on key divisions including iron ore, which generated more than 60 per cent of profit last year, as well as copper and aluminum, according to Chief Executive Officer Jean-Sebastien Jacques.

There's no certainty the deliberations will lead to a transaction, and Rio could still decide to keep Hail Creek and Kestrel, the people said. A spokesman for Rio declined to comment.

Is the RBA's optimism signal or spin? Capital Economics economist Paul Dales asks.

Dales says that of late RBA chief Philip Lowe is sounding more optimistic than the central bank's own forecasts.

As an example, he notes the policy statement released after last week's board meeting said that the "bank's central scenario remains for economic growth to be around 3 per cent over the next couple of year", when the forecasts published in the quarterly monetary policy statement just three days later showed very clearly that growth is expected to be below 2.0 per cent in the first half of this year.

The RBA's economic growth forecasts are also more bullish than most analysts' predictions, with consensus estimates flagging 2.5 per cent growth in 2017 and 2.8 per cent in 2018.

Even more concerning, he says, is that the main forecast table in the SMP showed that the RBA expects underlying inflation to rise from 1.6 per cent now to its target rate of between 2 per cent and 3 per cent by June 2019. But a chart in the document showed very clearly that in June 2019 it actually expects underlying inflation to be only a touch above 2.0 per cent.

Dales says it is possible that the figure in the table was just a typo, or that the RBA is trying to use some subtle forward guidance to prod the economy in the right direction.

"More worrying would be if the RBA actually thinks inflation will be 2-3 per cent in June 2019, but it didn't want to raise the forecast in the chart in case it needs to revise it down again later," Dales says. "Or if it thinks inflation will be 2 per cent in June 2019, but it didn't want to highlight that inflation could be below the target range for three-and-a half years.

"In either situation, the argument for further interest rate cuts would look stronger. Perhaps the bank just doesn't want to cut rates regardless of how the economy evolves."

Whatever the motivation, it's dangerous for two reasons, he says:

- By sending an overly optimistic signal on GDP growth and inflation the RBA is actually making its job harder as any resulting rise in market interest rate expectations and strengthening in the Australian dollar will weigh on growth and inflation.

- If growth and inflation fail to live up to the RBA's rhetoric then the markets would presumably lose more faith in the RBA than if they just failed to meet its actual forecasts. This could mean that as and when the RBA really needs to send the markets a signal, it's more likely to fall on deaf ears.

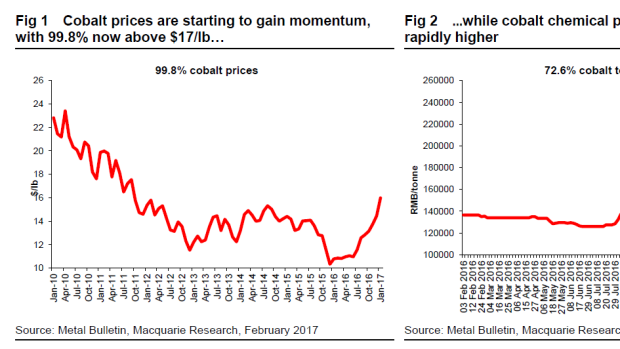

The lesser known mineral component of batteries, cobalt, is gearing up to have its year in the sun, with hedge funds stockpiling the commodity in preparation for the "Tesla boost", ethical dilemmas tainting existing supply and miners exploring the developed world.

Prices for the mineral are starting to see a conspicuous recovery; low-grade cobalt was at a high of $US16.50 a pound on the spot market today, up more than 80 per cent from lows in December 2015, according to Bloomberg data.

"If last year was lithium's time, for 2017 its battery peer cobalt may be the one receiving more attention," Macquarie analysts wrote in a recent note to clients.

"Prices have accelerated to levels last seen in 2011, and with demand from the core portable electronics sector recovering and supply growth relatively stagnant, this can be fundamentally justified."

The hard, grey mineral has piqued interest in recent years for its potential widespread use in smartphones and the lithitum-ion batteries used in Tesla vehicles. As an efficient electrode, cobalt can help store power for longer.

Analysts expect the likes of General Motors and Volkswagon, in addition to smartphone makers Apple and Samsung, to soon crank up demand as they experiment with their own electric cars.

According to commodity researcher CRU Group, this is set to boost demand for the nickel byproduct on average by 16 per cent annually through to 2022.

At this year's African Mining Indaba, which finished up last week in Cape Town, cobalt sprung up at numerous booths, with companies turning their exploration sights towards the commodity which is usually found as a byproduct of nickel.

ASX-listed Clean TeQ, backed by Regal Funds Management, has a scandium deposit in central New South Wales, with high grade nickel and cobalt features. Billionaire Canadian investor Robert Friedman has taken an almost 20 per cent slab of the company's stock and is a vocal proponent of the cobalt story.

A plunge in performance fees saw Magellan Financial Group post a 20 per cent drop in first-half net profit as its global investment strategies failed to beat the market.

Net profit fell to $87 million in the six months to December 31 from $109.3 million in the first-half of 2015-16 and performance fees plummeted to just $3.6 million from $42.8 million. Magellan still managed to increase funds under management, supporting 10 per cent growth in management fees which rose to $146.1 million from $132.7 million.

Chief executive Hamish Douglass said performance fees "fluctuate materially from period to period" and were investors to exclude that income, profit would have grown 9 per cent.

He revealed Magellan was targeting potentially $US30 billion in new funds by adding "low carbon" strategies which could take three to five years to contribute materially to the size of its portfolios.

"We believe that managing carbon risk is becoming increasingly important to many institutional investors and asset consultants globally and we are encouraged by the interest shown to date," Mr Douglass said. "It will take time for each of these products to build investment performance track records and it is unlikely that any of these products will attract meaningful funds under management for at least three to five years."

Revenue fell 16 per cent to $153.5 million and average funds under management climbed 10 per cent to $42.9 billion. The Sydney-based international funds manager will pay a dividend of 38.4¢ a share on March 2 versus 51.3¢ it confirmed on Thursday.

The Magellan Global Fund, which has a track record of 11 per cent annual returns exceeding the market since inception, only managed to add 3 per cent over 2016, lagging behind the 8 per cent return of its benchmark index. The Magellan Infrastructure Fund, similarly ahead of the market over its lifespan, posted a 6.7 per cent one-year return versus 14.1 per cent by its benchmark.

"Expenses aren't going to be as high as they thought," said Morphic Asset Management joint chief investment officer Chad Slater. "If anything, it's slightly better than I expected."

UBS analysts noted that profits earned from Magellan's principal investments, not the core funds business, disappointed.

The fund manager's shares are 6.4 per cent lower at $23.57.

We've been talking a lot about the Aussie being the best-performing major currency against the greenback this year, but that fails to acknowledge that it's also soaring against other currencies.

Today, while it hit a three-month high of US77.32¢ against the US dollar following a surprise dip in the unemployment rate, it's powered up to multi-year peaks against the yen, Swiss franc and euro.

Much of the recent Aussie strength has come as investors borrow at low rates in yen and Swiss francs to buy higher-yielding assets such as the Aussie, a popular strategy known as the carry trade.

The Aussie rose as far as 88.17 yen, the highest since December 2015. It looked poised to test 92 yen, a level last seen mid-2015, while it scaled two-year peaks against the Swiss franc at 0.7764 francs.

It also swung higher against the euro, to 72.86 euro cents largely because of market jitters about the outcome of elections in several European countries this year.

AxiTrader chief market strategist Greg McKenna, who has been Aussie bullish for a while, said a raft of positives – strong commodity prices, reduced rate of an RBA cut, improving risk appetite and a fairly quiet US dollar – were supporting the Aussie.

"While the US dollar remains the world's most crowded trade and the Aussie dollar comes into the spotlight, the bulls have it (the Aussie)," McKenna said.

He noted that this current environment in global markets has always historically been associated with strong bids and a rally for the Australian dollar.

The retail job losses continue to pile up, with the shut-down of 13 Marcs and David Lawrence stores putting at least 20 more staff out of work, and another 50 facing an uncertain future as the administrator tries to secure them new roles in the shrinking store network.

Four David Lawrence stores and one Marcs outlet in Victoria will shut by next week, along with one David Lawrence boutique and one Marcs shop in Sydney.

The job losses from the two Australian fashion chains come just days after 10 staff were axed from smart suit-maker Herringbone and sister brand Rhodes & Beckett after administrator Cor Cordis turned out the lights in seven of its boutiques, including three Sydney stores, one Victorian outlet and both its Perth shops.

The collapse of six high-profile apparel brands since December has triggered a jobs rout that threatens to push close to 4000 workers onto the unemployment line, and insolvency professionals warn there are more retail failures on the horizon as Australian chains without the scale, distribution infrastructure or brand identity to compete with global giants like Zara falter.

Economists are sending through their initial impressions of the jobs data, and they are not overly impressed. They are focusing on the persistent theme of new jobs being mostly part-time, which doesn't bode well for a lift in wages, inflation or spending.

JP Morgan's Ben Jarman said the composition (part-time v full-time) of the job gains was "not good":

The labour market recovery remains tepid and has lost some steam recently, with minimal improvement in the unemployment rate over the last year. Job gains also are services-tilted and so are more part-time, with lower attachment, and lower average hours.

On this basis it is hard to see how income growth and consumption will improve in the near-term, and of course how [labour market] slack will be eroded (unemployment still 0.5 percentage points above the RBA's estimate of NAIRU) to bring core inflation back toward target.

Capital Economics's Paul Dales also highlights "the now-familiar problem of the new jobs being mostly part-time", but added that jobs gains recorded their "fourth decent increase in as many months":

Although the rise in the annual [total jobs] growth rate from 0.8% to 0.9% left it very low by historical standards, the increase in the average three-month change in the level of employment from -8,600 in August to +22,300 shows that conditions have improved since last year's weak patch.

The prevalence of part-time employment is restraining incomes as lots of people are working fewer hours and the excess supply is keeping wage growth low. This problem will linger for a number of years yet.

Looking ahead, subdued GDP growth will probably keep the unemployment rate close to 6% this year. But even if it fell further, the high rate of part-time employment and associated high level of underemployment will keep a lid on wage growth. The labour market won't generate any major inflationary pressure for a couple of years yet.

And here's UBS's George Tharenou:

Overall, the trends in the labour market over recent months show ongoing modest jobs growth, but with negative full-time contrasted by booming part-time – while the unemployment rate holds ~5¾%. This implies little change in labour market slack, and hence is consistent with our view of low inflation and wages.

That said, the leading indicators of employment continue to suggest somewhat better jobs growth over coming months (closer to ~1½ - 2% y/y). Nonetheless, for now, the jobs data is broadly consistent with the RBA remaining on hold ahead (as we expect).

Evolution Mining has opted to push ahead with two projects at its Cowal gold mine in New South Wales which it says will increase the mine's operating life by eight years.

Just 18 months after acquiring Cowal for $US550 million from Canada's Barrick Gold, Evolution said its board had given the green light for two extension projects – a cutback at the mine and a processing improvement – which would secure production at the mine until 2032.

When Cowal acquired the mine it had a mining permit until 2024 and 1.56 million ounces of ore reserves.

Earlier this month, Evolution received NSW regulatory approval to mine at Cowal until 2032. Combined with the results of expansion drilling work and feasibility studies, the board approved the projects.

Chairman Jake Klein said the company was "delighted" with the results of its expansion drilling program.

It came as Evolution recorded a record interim net profit of $136.7 million for the six months to 31 December, swinging from a loss of $15.5 million in the first half of fiscal 2016.

Revenue was 17 per cent higher compared to the previous corresponding period, at $711.2 million.

Evolution produced more ounces at a marginally higher cost during the period and received a higher price for its product.

Mr Klein said the company's record profit result and 50 per cent EBITDA margin reflected "a clear reflection of the quality of Evolution's asset portfolio and consistent operational performance".

EBITDA jumped 21 per cent to $345.3 million.

Evolution had cash of $14.5 million and outstanding bank debt of $600 million as at 31 December.

Last month the company confirmed it planned to continue funnelling excess cash toward early debt repayments after its net debt peaked at $647 million during the December quarter.

The miner declared an interim dividend of 2¢ per share, up from 1¢ in 2016 after increasing its dividend policy to pay out the equivalent to 4 per cent of group revenue every six months.

Evolution shares are up 1.3 per cent to $2.38.

Embattled law firm Slater & Gordon has confirmed it is in talks with its lenders to recapitalise the group as it recognises the debt it owes exceeds the value of the business. The firm also acknowledged its Australian business was starting to be hurt by negative sentiment.

Slater & Gordon said in a statement that it will "continue to work with its lenders to agree on a recapitalisation plan" which it expects to conclude in the "coming months".

The statement to the ASX followed a meeting between Slater & Gordon and its lenders to discuss a recapitalisation plan.

The group's cash flows remained weak, and it flagged a further write-down of UK assets ahead when it reveals interim results for the 2017 financial year, due February 28.

Slater & Gordon shares have plunged 22 per cent to 21¢ on this morning's announcement, valuing the equity of the company at $74 million.

"It is clear that based on performance expectations and liquidity, the continued support of the company's lenders is fundamental, as current levels of bank debt exceed total enterprise value," the company said.

The company said its troubled UK operations were showing signs of improvement, but the recovery was slower than expected. Revenues were lower than expected, but earnings and cash were forecast to show an improvement as it cut costs.

Slater & Gordon flagged further potential write-downs of the $327.2 million of goodwill relating to its UK assets as recent trading experience and a slower than expected recovery weighed on its earnings.

The 80-year old personal injury law firm also pointed out that the Australian business was starting to show signs of being affected by negative sentiment about the business and increased competition in key segments.

The announcement came after a meeting was held with lenders late on Wednesday evening to accommodate UK banks. The meeting had to be held this week under new terms agreed to with lenders that are owed around $700 million.

The company said group cash flow remained a challenge, and while net operating cash flow would be better than the $20.9 million outflow over the second half of 2016, it would remain negative.

LNG-dominated write-downs dragged Origin Energy into a wider first-half loss of $1.68 billion from $254 million in the year-earlier period.

Underlying profit in the six months ended December 31 fell 28 per cent to $184 million from $254 million a year ago, falling short of some analysts' expectations.

The heavy bottom line loss was expected after $1.9 billion of impairments revealed by the energy producer and retailer on Wednesday, mostly on the new $25 billion Australia Pacific LNG project in Queensland.

Origin blamed the decline in profit excluding one-time items on lower returns from APLNG, where low oil prices resulted in "insufficient LNG revenue to cover interest, tax, depreciation and amortisation."

Chief executive Frank Calabria still described operating performance during the first half of 2016-17 as "solid", highlighting increased contributions overall from both core business units, integrated gas and energy markets.

But Citigroup analyst Michael Dargue described the energy markets result as "weak", noting Origin seemed have have been "caught short" by rising electricity wholesale prices in the half.

Investors look to be taking a dim view on the result, with Origin shares down 2.6 per cent at $7.07.

Underlying EBITDA rose 32 per cent to $1.15 billion, and Origin on Wednesday slightly upgraded its guidance for full-year earnings on this basis, to $2.45 billion-$2.615 billion.

Origin declared no interim dividend, compared with 10¢ a share for the first half a year earlier. It was the second consecutive half that shareholders have received no payout as the company puts the priority on reducing debt.

Chairman Gordon Cairns said the board "will continue to review each dividend decision in light of our focus on debt reduction."

As announced in December, Origin is preparing for a major restructuring involving the separation of its conventional oil and gas business, to be sold in a public float this year.

Origin is understood to be provisionally planning the IPO for the June quarter, but timing and details of the float have yet to be confirmed.

The jobless stats below are the volatile, seasonally-adjusted numbers, but the ABS is promoting its "trend" figures which it says "smooth the more volatile seasonally adjusted estimates and provide the best measure of the underlying behaviour of the labour market".

So, in trend terms, full-time employment has actually increased for the fourth straight month, the statistician says. Here's more from their release:

Total trend employment increased by 11,700 persons to 11,984,300 persons in January 2017, reflecting an increase in both full-time (6500) and part-time (5100) employment. Total employment growth over the year was 0.8 per cent, which was less than half the average growth rate over the past 20 years (1.8%).

"We are still seeing strong growth in part-time employment in January 2017, and in recent months, increasing growth in full-time employment. There are now around 129,800 more people working part-time than there were a year ago, and around 40,100 fewer people working full-time," said the general manager of ABS's Macroeconomic Statistics Division, Bruce Hockman.

The trend unemployment rate was 5.7 per cent for the ninth consecutive month.The trend participation rate was unchanged at 64.6 per cent.

Jobs numbers are in for January and there has been a big jump in part-time and almost equally big fall in full-time roles.

A fall in the participation rate has helped the jobless figure drop to 5.7 per cent from 5.8 per cent. Economists had forecast the jobless rate to hold steady.

The Aussie is pretty steady at 77.2 US cents in the aftermath of the release.

The ABS data shows a 44,800 fall in full-time employment but 58,300 more part-time jobs. The total employment change of 13,500 new jobs is similar to the December figure, but the composition is very different: in that month FT jobs increased 9300 and part-time roles also added 4200.

The participation rate dropped slightly to 64.6 per cent from 64.7 per cent.

Jobs data coming in about 15 minutes: the unemployment rate is expected to have been flat at 5.8 per cent in January, with jobs growth subdued but not many people looking for work.

The number of Australians with a job is expected to have risen by about 15,000 in the first month of 2017, after jumping by 13,500 in December.

TD Securities chief Asia-Pacific macro strategist Annette Beacher said January is seasonally the weakest month for the labour market as summer jobs growth grinds to a halt. She said that despite benign jobs growth in the month, the headline unemployment rate would likely be flat because of a fall in the participation rate - the proportion of the working age population either employed or looking for work.

"Assuming a dip back in the participation rate from 64.7 to 64.6 per cent leaves the unemployment rate at 5.8 per cent," Beacher said in a note."We will also be watching closely for the composition of hours worked, looking for a pick-up in full-time (work) that the RBA noted this week."

CBA senior economist Gareth Aird said the jobs market had been softer over 2016, but the latest NAB business survey and the ANZ job advertisements surveys, a rise in commodity prices and higher capacity utilisation indicated jobs growth could pick up, at least temporarily.

However, he warned that fragile consumer confidence and the uncertain global geopolitical outlook posed risks.

NAB was more optimistic, saying it saw possible upside risks to employment this month following the recent pick-up in a number of indicators and is expecting employment growth of +20k.

"That growth rate is consistent with the NAB survey with the employment index out of the survey suggestive of employment growth averaging around 21k a month for the next three months or so. It's also worth noting here that employment has generally undershot leading indicators for the past six months and some catch up could be expected over the next few months – though of course picking the right month has proven to be bit of a lottery in the past."

The bulk of mortgage debt in Australia is held by higher-income households best able to service it, a top central banker says, though there are pockets of stress where those on lower incomes had to take on a lot of debt to buy a home.

RBA assistant governor Luci Ellis noted that higher-income households were not only likely to own their own home but also to have other properties as investments.

"This is why we say that most of the mortgage debt in Australia has been borrowed by those most able to service it," Ellis told a housing conference in Melbourne.

"That said, the lower-income households that do have debt, tend to have quite a lot of debt relative to their incomes," she added. "Overall it does speak to the need to be aware of pockets of potential stress within a more benign overall picture."

Australian households hold a relatively large amount of debt compared to other developed nations, which has been considered a threat to financial stability by some.

Another massive day for earnings, with quite a few misses this time. Here's an overview of how stocks of companies that reported this morning are doing:

- Telstra: -3.85%

- South32: -1.1%

- Tatts: -3.4%

- Origin: -1.4%

- Goodman Group: +2.35%

- Mirvac: flat

- Ten: -5%

- Sydney Airport: -1.6%

- Magellan: -5.3%

- Spark NZ: -3%

- Bapcor: -8.5%

- Evolution Mining: +0.85%

- IPH: -1.8%

- Adacel: +5.9%

- NRW Holdings: +3.8%

- Hansen Technologies: -10.6%

For more on the numbers, here's the AFR's reporting season blog

Away from earnings, the government has rejected a report it will curb capital gains tax concessions for property investors in an attempt to improve housing affordability and boost revenue as budget cuts continue to falter in the Senate.

According to the AFR, the policy will be formally announced in the May budget and will not apply to shares and other investments, nor would it target negative gearing. It would come after more than a year of savaging Labor's proposal to halve the capital gains discount as an assault on badly needed investment.

But Prime Minister Malcolm Turnbull and Finance Minister Mathias Cormann dismissed the story.

Don't believe everything you read in the newspaper. The story on the front page of the Financial Review today is wrong, there is no such proposal before the government," Senator Cormann said.

"The government has absolutely no intention of reducing the capital gains tax discount or making changes to negative gearing.

Options being worked on include following Labor in halving the 50 per cent discount on capital gains tax to 25 per cent, or reducing it by another amount, the AFR said.

The local sharemarket has nudged up to a fresh 21-month high in early trade, but massive losses in Telstra following a disappointing earnings report are holding the market back.

The ASX is up 0.2 per cent at 5820.1, after shooting up to 5833.2 in the first minuted of trade, its highest since May 2015.

The big banks as well as a 3.5 per cent rise in CSL are buoying the benchmark index, while a nearly 5 per cent slump in Telstra, the most in 2.5 years, is the biggest headwind.

The telco this morning reported underwhelming earnings of $1.79 billion, lower than its own guidance and well below analyst expectations of $2.04 billion.

Investors were likely to take a breather after the rally of the past sessions and ahead of local employment data at 11.30am, said CMC chief market strategist Michael McCarthy.

Well, it's clear the AUD is the king of the G10 currency block right now and the market has an insatiable love affair with the 'Aussie', IG strategist Chris Weston says:

As long as financial conditions stay as they are then the AUD really only goes one way. Great for those thinking of holidaying in southern Europe in August. Over the past month the AUD has had its biggest move relative to the EUR (EUR/AUD has lost 3.1%), followed closely by moves in the SEK and USD.

If playing the AUD the preference is still to be long relative to EUR and JPY, but we can add the USD, with AUD/USD breaking out of the consolidation pattern from early February. Next stop would seem to be US77.80¢ (the November highs).

The event risk for AUD, fixed income and to a far lesser extend equity traders is the January employment data at 11:30am. The market is looking for 10,000 jobs to be created (the economist range is 28,000 to -11,000 jobs), with the unemployment and participation rate to stay at 5.8% and 64.7% respectively.

These are about as favourable conditions for AUD appreciation as you will see. We can also add in the positive flow in developed market equities, which is also helping to keep positive sentiment going in the AUD.

The S&P 500 is really unstoppable at present, but we have nice break-outs and in some case record highs in so many major markets. Data wise, we have seen good numbers overnight in the January inflation (ex-food and energy) read at 2.3%, while retail sales gained 0.4%, as did the retail control group, which feeds into the GDP calculation. This is another good indicator that the good-will towards equities has not just been driven by feel good factor about the future with tax cuts and other fiscal measures providing stimulus, but we are actually seeing this reflected in economics right now. The US is seeing signs of 'animal spirits'.

Locally, the ASX 200 failed to breach the January 9 high yesterday of 5827, but a close above 5800 is still positive. SPI futures are fairly flat overnight, so let's see how the bulls act after 10:15 to 10:30am, as this could be the time we see a renewed push into 5827. With sentiment upbeat globally, but not euphoric I still don't see this as the time to be tactically short equities, although that time will come.

Search pagination

1 new post(s) available. View post(s) Dismiss