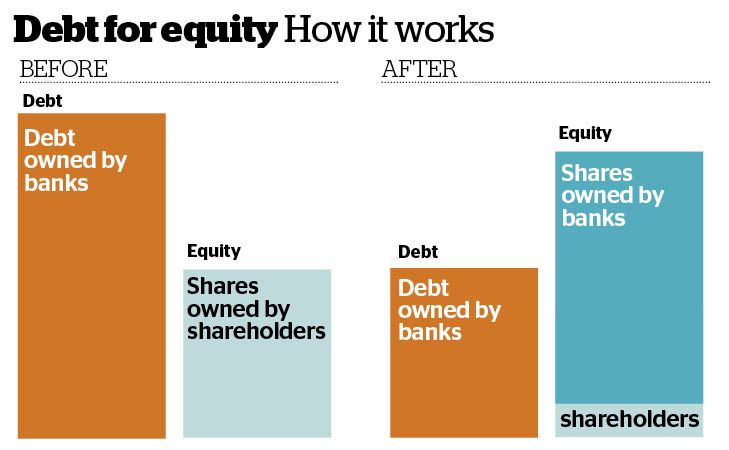

It's deal or die time for Australia's largest listed law firm, Slater and Gordon, after it pitched a life-saving debt for equity swap to its bankers that is expected to see investors wiped out.

Investors dumped shares in the troubled company on Thursday as it said it was yet to reach a deal with its lenders and revealed its trading performance was weaker than expected.

More BusinessDay Videos

ASIC investigating Slater & Gordon

The corporate watchdog is investigating whether the law firm deliberately falsified or manipulated financial records and accounts. Video courtesy ABC News 24.

The stock dived 23 per cent to close at 20¢ - it's lowest price since listing in 2007 - as its advisers scrambled to save the group which has debts exceeding the value of the business.

BusinessDay understands the initial recapitalisation deal put forward by legal adviser Arnold Bloch Leibler and investment bank Moelis has not yet won over the group's bankers, but talks are continuing.

Slater and Gordon has been in financial trouble since midway through 2015, when accounting issues were discovered shortly after its $1.3 billion purchase of the professional services arm Quindell, causing its shares tumble from more than $8 in April 2015.

Slater and Gordon had gross debt of $764.8 million and net debt of $682.3 million at the end of June 2016.

A key sticking point of the deal pitched on Wednesday night appears to be the reluctance of its biggest lenders, Westpac and National Australia Bank, to take up major stakes in the left-leaning, union-supporting law firm.

Both banks are believed to have around $300 million exposure each to the company and have already written down the loans, potentially paving the way for them to on-sell the debt.

Another of Slater and Gordon's lenders, Citi, has already offloaded its debt to distressed debt buyers. Those buyers are keen to push for a debt for equity swap.

Sources said the deal had been structured in a way to snuff out the impact of a $100 million-plus class action brought by Maurice Blackburn by restricting the assets that can been called upon in a settlement or court-awarded damages claims to the company's insurance.

Last year the Federal Court approved Atlas Iron's restructure which in effect ring-fenced the company's assets from claims from subordinated creditors.

Despite the potential impact of the recapitalisation deal on its case, a spokesman for Maurice Blackburn said it would continue to hold Slater and Gordon to account,

"But this is a complex case with multiple avenues of recovery, particularly in light of the fact that Slater and Gordon itself plans cross-claims against other parties, which may include some of its advisers on the PSD (professional services division) acquisition," the spokesman said.

Slater and Gordon has until 27 April to file its defence and will have to file any cross claim by then.

On Thursday Slater and Gordon also said revenue from its Australian business, previously the highlight of its weakening results, was lower than expected for the first half of 2017.

"Slater and Gordon's Australian business has more recently started to show signs of being impacted by negative sentiment about the business and increased competition in key segments," the company said in a statement to the Australian Securities Exchange.

It also said earnings from its UK business were lower than expected.

Still, the company said its first-half normalised earnings and cash from operations from its UK arm would be an improvement on the prior corresponding half.

"The company is projecting stronger billed revenue results in the second half of 2017 as it continues its UK performance transformation program," the company said.