Foreign investors jumped back into Australian banking stocks in recent months amid a massive global rethink on the sector following Donald Trump's shock election victory.

Blockbuster share price gains from the Australian lenders in the final stretch of last year were "largely underpinned" by foreign buying as the international investment community became less negative on the sector, Macquarie analysts said.

In contrast, over the final three months of last year local retail investors were once again happy to "sell the rally", the analysts conclude.

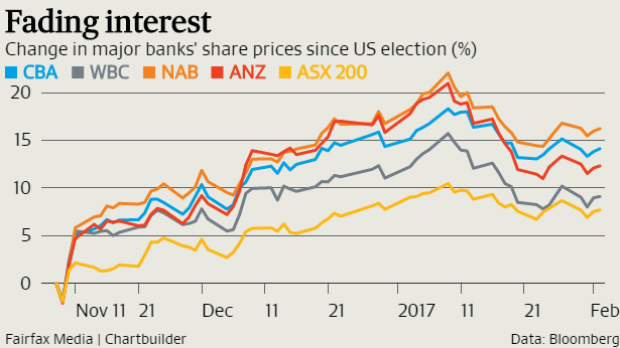

The election of Mr Trump as US president lit a fire under banking stocks around the world and Australia's lenders were no exception. Since November 8, the ASX 200 banks index is up 11 per cent.

Finding out which types of investors are buying or selling is not an easy process, with brokers wary of revealing their clients' activities.

But it is useful as a way of understanding the dynamics of market moves, particularly the rally in the banks since the election. It also comes at an interesting juncture as analysts and investors ponder whether now is the time to bank gains in the sector.

Macquarie's "trading analysis" finds that offshore investors "continued to close their underweight positions" and were net buyers of Australian banking stocks – bought more than they sold – over the final three months of last year. This shift meant foreign buying "largely underpinned" recent bank outperformance, the analysts write.

Despite the recent flurry of interest, Australian banks remain some of the largest underweights for global investors, according to Bank of America-Merrill Lynch analysis dated January 16.

Short interest in the majors continued to decline at the end of 2016. About 1.1 per cent of the big four's combined stock is sold short, or about $5.4 billion's worth. (A short position represents a bet that the share price will move lower.) This is down from about $6.6 billion at the end of September last year, Macquarie analysts note, and is "significantly lower", they say, than the peak observed leading into May 2016 reporting season of about 2.4 per cent, or $9.4 billion.

Interestingly, short positions in CBA bucked the trend of its rivals and increased over the final three months of the year.

Retail investors net sellers

But while overseas investors were buying, local retail investors – which make up about half of the big banks' share registries – were net sellers for the second quarter in a row.

"Retail investors appeared to maintain their fairly consistent strategy of buying the dip and selling the rally," the Macquarie researchers write.

About 30 per cent of the big fours' shares are in the hands of professional Australian investors and about 20 per cent in the hands of foreigners.

The Macquarie analysis also shows sharp differences in the "active positions" of professional and retail investors.

While the pros display a relative preference for ANZ, Westpac and NAB (offshore investors are particularly keen on ANZ) over CBA, retail investors are strongly "overweight" the Commonwealth Bank, and relatively less keen – or "underweight" – the other three.

The powerful post-US election gains mask a marked turnaround in 2017. The banking index was up by as much as 17 per cent before selling in the final three weeks of January transformed returns from recent months from stellar to solid. Investors appear to have concluded that after such stellar returns over such a short period, some prudence is warranted.

Share price gains peaked in January

That more cautious approach is reflected in their share price performances so far this year, with the four big banks peaking in January before sliding to be slightly lower in 2017: ANZ by 2.9 per cent, Westpac by 1.6 per cent, while CBA and NAB are down 0.3 per cent and 0.5 per cent, respectively.

"The performance reflects more profit taking than any deterioration in fundamentals, particularly as we saw no flattening in the yield curve," Macquarie analysts said. They point out that NAB raised fixed mortgage rates and that home lending growth came in better than expected, both positive for bottom lines.

Last week analysts produced hundreds of pages of research to suggest that banks now look fully valued, maybe a little expensive.