You know house prices in Melbourne are giving Sydney a run for its money when corporate titan after corporate titan is forced to sell stock in their company to afford a roof over their head.

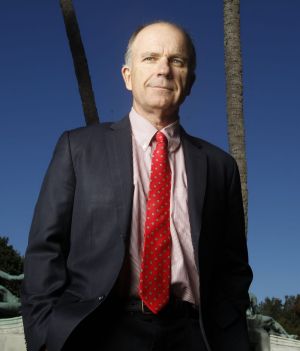

The latest victim is Tabcorp boss David Attenborough, who is being forced to offload $4 million of shares and will "use the proceeds to fund the purchase of a family home", says the Tabcorp release to the ASX.

More Videos

Economy goes backward

GDP contracted 0.5 per cent in the September quarter. The Treasurer points the finger at weak business investment.

CBD is not sure if Attenborough it trying to send a message, given he has been with the gambling group for more than five years and is set to take the top job if the Tabcorp/Tatts merger goes through.

It just so happens some British bookies – such as his former employer Ladbrokes – might be looking to gatecrash the party.

But Attenborough is hardly the first prominent Melbourne chief executive to be forced into such drastic measures.

Just this year Premier Investments boss Mark McInnes sold all of his Premier shares for the second time in two years in order to find appropriate shelter.

The $4 million share sale in 2014 just managed to cover the asking price for a shack on the Mornington Peninsula. But it took the sale of his entire $12 million stake this year to pay for a block in Toorak and build a suitable pile of bricks on the site.

It seems 2014 was a particularly tough year for Melbourne-based CEOs. ANZ Group's boss at the time, Mike Smith, was forced to offload $17 million of shares to acquire the historic farm and vineyard Spray Farm at Bellarine, with a price tag of about $10 million.

The only comparable sale in Sydney came last year, from Blackmores boss Christine Holgate, who chose a particularly opportune time to sell $4 million of stock.

"I am soon to be married and I have sold the shares to help fund a new home," she said in her disclosure to the ASX last November.

Heavy pedal

Cycliq – the cycling industry's answer to GoPro – got a yellow-jersey debut on the ASX on Thursday. It opened at 4¢, which is double what investors paid before its backdoor listing.

The grinners on the winners' podium include prominent investors such as fundie David Paradice, who might also want to introduce Cycliq's Fly6 high-definition cameras to the polo set.

Paradice is helping Ros Packer keep the Ellerston polo operations going after her billionaire son Jamie abandoned the sport for Hollywood.

Taking stock

Given the way investors took to its share price with a chainsaw following last week's business update, it was only a matter of time before the ASX cops issued a "please explain" notice to Bellamy's Organic.

"The company first became aware of the information, the subject of the announcement on December 2, 2016, during the board meeting which began at 8am," said Bellamy's in response to some ASX questions about the shock turnaround in its performance.

The "business update" went out to the market roughly two hours later, with the bad news hidden on the bottom of the third page.

It would not have been a fun week for chairman Robert Whoolley, but he could always call on fellow board member Launa Inman for assistance. The former Billabong boss knows all about keeping your footing in stormy conditions.

Social media

It was a rather sedate shareholder meeting for the Ten Network on Thursday.

There was the obligatory bleating about the unfair TV licence fees that our broadcasters are forced to pay. Gina Rinehart's recent appointee to the board, former trade minister Andrew Robb, will no doubt help sort out his former mates in Canberra.

But it was so ho-hum that even Bermudan billionaire Bruce Gordon could not be bothered offering any comment from the cheap seats when given the opportunity. Maybe he was still feeling a little jet-lagged from the flight.

It was left to Ten Chairman David (no relation to Bruce) Gordon to spice things up a bit with a spray at social media giants such as Facebook.

"In my opinion, 'fake news' is just lies and deception by another name," he told investors before the tea and biscuits were wheeled out.

Got a tip? ckruger@fairfaxmedia.com.au

0 comments

New User? Sign up