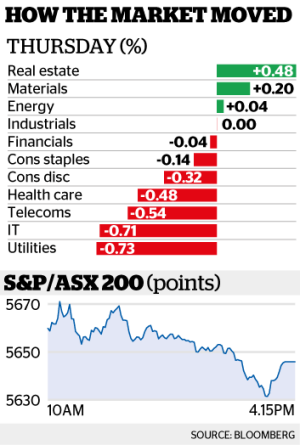

Shares took a turn for the worse on Thursday with utilities and technology stocks dragging the bourse south after lunch, while the Australian dollar shot over US76¢ on positive trade data.

The ASX failed to follow markets around the region higher after the US Federal Reserve kept interest rates on hold at the end of its two-day meeting on Thursday morning (Australian time).

The benchmark S&P;/ASX 200 Index and the broader All Ordinaries Index each slid 0.1 per cent to 5645 and 5696 points respectively.

"Shares remain vulnerable over the short term, as they have become technically overbought following the big expectations of a Trump boost to the economy," said Shane Oliver, head of investment strategy at AMP Capital.

"But despite the rough start we think the pragmatic growth-focused Trump will ultimately dominate the populist Trump."

But for the meantime, the Trump trade, which saw investors pour into equities on the promise of fiscal stimulus and a boost to global growth, has stalled and investors are instead drilling down into earnings season, which kicked off this week.

Shares in mining contractor Downer EDI rocketed higher early on Thursday after the company raised its full year profits guidance. The stock closed up 13.1 per cent after it delivered an 8.5 per cent increase in interim net profit to $78.2 million. The rise was higher than some analysts expected. Citi had forecast net profit of $69.5 million.

Vocus Group shares bumped up 5.3 per cent after Macquarie analysts upgraded the stock to "outperform".

Gambling company Tabcorp shares fell 5.3 per cent after the company delivered a fairly subdued first-half earnings report. Revenue growth was clocked at 2.1 per cent and headline profits were eroded by a number of one-off charges.

Technology firm Aconex watched its share price fall another 2.7 per cent, reaching a 52-week low after a profit downgrade earlier in the week.

Gold prices lifted modestly, belying the nervous sentiment in the market. Gold producer Resolute Mining rallied 6 per cent as it makes more progress towards expanding its Ravenswood mine.

However, shares in OceanaGold slumped 15.6 per cent after a statement by the Philippine government saying it may force the closure of the Aussie company's Dipidio mine, which has been the subject of recent wrangling between the company and the government.

Profiting from the move which also affected a number of nickel mines, local nickel miners Western Areas and Independence Group added 10.9 per cent and 3.2 per cent respectively.

Stock watch: Bellamy's

Shares in embattled infant formula maker Bellamy's rose 1.4 per cent to $4.26, continuing their roll of recent days. Since US hedge fund Delta Partners popped up on the company's share register last Friday, Bellamy's shares have risen 11.2 per cent Battle for control of the company's board is heating up, with the company bringing in a proxy firm to help canvass shareholders ahead of a vote that will decide the fate of four independent directors it is trying to keep on its board. The board has unanimously recommended shareholders vote against all resolutions proposed by 14.48 per cent shareholder Black Prince Private Foundation, which first came to light on January 4. Black Prince is connected to Tasmanian entrepeneur and Kathmandu founder, Jan Cameron, the defacto leader of dissident shareholder group that claims they represent 35 per cent of the register.

Market movers

US Fed

The Fed Reserve, as expected, kept interest rates unchanged in its first meeting since President Donald Trump took office. While the Fed painted a relatively upbeat picture of the US economy that suggested it was on track to tighten monetary policy this year, analysts said the central bank's reference to low inflation measures dampened optimism that it would take a more aggressive line on raising interest rates. The Fed said it still expected inflation to rise to its 2 per cent target in the medium term, although it noted that market-based measures of inflation compensation are still low.

Trade balance

Australia's economists were stunned on Thursday when the Australian Bureau of Statistics released a trade surplus higher than any in recorded history. The $3.51 billion surplus, almost entirely the result of rising iron ore and coal prices and volumes, is expected to feed through to corporate profits, shore up Australia's AAA credit rating, and ensure Australia avoids a technical recession after the negative GDP growth in 2016's third quarter. But the impact on households is expected to be muted - unlike last time, this boom does not come on top of an overheating economy.

Australian dollar

The Aussie dollar jumped on the bumper trade data, pushing strongly past 76 US cents - a recent resistance level - and has now pretty much reversed the post-US election decline triggered by the surging greenback. January has been an incredible month for the currency as much of the Trump enthusiasm leached out of the US dollar, while continued strength in key commodity prices has buoyed export values and mining stocks. At 76.34 US cents, the Aussie is now up 5.8 per cent in 2017 and the best performer against the US dollar among the 16 major currencies.

Housing approvals

New housing approvals slipped to their weakest monthly total in more than two years in December, in a further sign of a sector tightening the taps on new developments. New dwellings given the nod slipped 1.2 per cent in the last calendar month of the year, the lowest since September 2014. Approvals of detached houses led the fall, dropping 2.2 per cent month on month to a three-year low. The figures continue the notion that Australia's housing construction sector is slowing new projects in response to tighter credit conditions for consumers and greater constraints on construction finance.