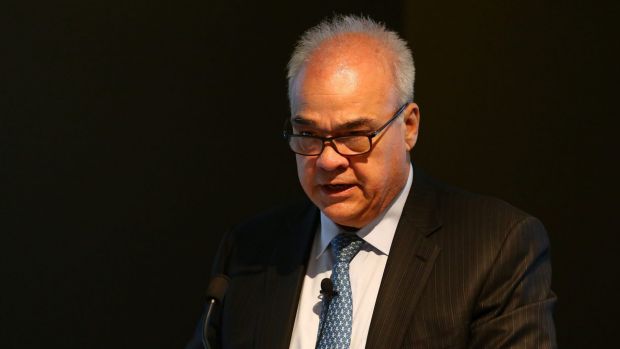

One of the biggest alleged corruption sagas in corporate Australia has led to the charging of a second former high-profile chief executive, one-time boss of engineering giant UGL, Russell Waugh.

Mr Waugh has been charged in relation to a $15 million offshore payment made while he was a senior executive at construction giant Leighton Holdings. He joins Peter Gregg - who was Leighton's finance chief at the time - in facing serious criminal charges connected to the 2011 payment.

Last year, as part of an expose highlighting alleged global corruption at Unaoil, Fairfax Media revealed the existence of the $15 million Leighton payment and the fact it was received by an allegedly crooked Dubai consultant.

Fairfax Media's previous investigation into Mr Waugh's role as managing director of Leighton's overseas operation led to his sacking by new employer UGL in 2013, despite Mr Waugh's strident denials of wrongdoing.

Fairfax Media understands ASIC will allege in court that Mr Gregg and Mr Waugh engaged in improper accounting practices in connection to the $15 million transfer and that the payment was made to facilitate a Leighton business deal in India.

At the time of the payment, Mr Waugh was the managing director of Leighton India and he and Mr Gregg were negotiating a merger with Mumbai company Welspun.

The charging of Mr Waugh by the corporate watchdog comes as the Australian Federal Police and ASIC continue to investigate a series of unrelated offshore payments made by Leighton's overseas subsidiaries in connection to large projects in Iraq, Indonesia and India.

Mr Gregg is not the subject of those ongoing investigations. But Mr Waugh remains the subject of intense federal police scrutiny over separate allegations linked to mysterious offshore payments.

The AFP investigation involves close co-operation with the FBI and UK Serious Fraud Office, who are investigating large European and American companies for using consultants linked to allegedly corrupt Monaco company Unaoil to win large oil industry deals. These consultants include a Dubai middleman who received two multi-million dollar cash transfers financed by Leighton.

Peter Gregg, the former chief financial officer of Leighton (now known as CIMIC), was charged earlier this month with two counts of falsifying the books and records of Leighton in relation to the $15 million payment.

Mr Gregg's criminal charges led to him resigning as the chief executive of Primary Healthcare, a $2 billion company that owns a host of clinics and pathology centres.

Mr Gregg, who strenuously denies the allegations, will remain in his role until the company completes an internal and external search for a new CEO.

Earlier on Monday, lawyers for former Leighton executive Peter Gregg appeared in the Downing Centre Local Court.

The charges relate to an allegation that Mr Gregg personally signed off on a $15 million offshore payment to a Dubai-based consultant in 2011 in exchange for steel at favourable prices while CFO of Leighton Holdings, as revealed by Fairfax Media last year.

If found guilty, Mr Gregg could face up to two years in prison, fines and would be banned from managing companies for up to five years.

A spokesman for ASIC declined to comment on the exact charges Mr Waugh is facing.

Mr Gregg and Mr Waugh are both due to appear in court on February 28.

Got a tip for Fairfax Media's investigations team? email nmckenzie@fairfaxmedia.com.au or contact us anonymously here