Shares have bounced in early trade as the local sharemarket plays catch-up following the Australia Day holiday, with gains in banks offsetting losses in miners.

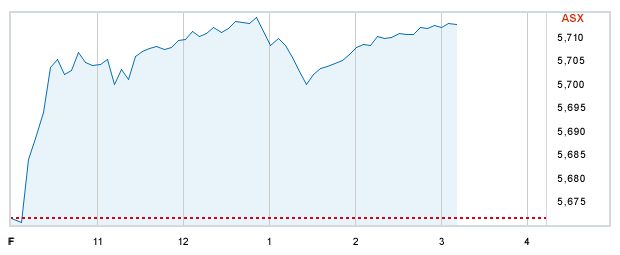

The ASX is nudging 5700 points, up 0.5 per cent, despite a 1.3 per cent slide in the materials sub-index.

The big four banks are all up more than 1 per cent, with NAB's 2 per cent gain leading the charge.

Woolies and Wesfarmers are also in demand, rising 2.1 per cnt at 1.3 per cent respectively.

On the other side, BHP has dropped 1.6 per cent, Rio is down 0.5 per cent and South32 has fallen 0.7 per cent.

But the real carnage is among gold miners, which are all deep in the red after the precious metal's price slid back below $US1200 an ounce.

Newcrest has plunged 5 per cent, Northern Star Resources is down 9.1 per cent and Evolution Mining has shed 6.6 per cent.

SPONSORED POST

The markets seem to have decided that 'Trumponomics' is back on and after a period of reflection, we can see that the reflation trade is back on, says IG's Chris Weston:

There has been some hesitation to push markets higher in the overnight US session, though, with most of the moves taking place on Wednesday night. The US 10-year treasury is back at 2.50%, moving up from 2.30% on 12 January and eyeing a move into 2.63%. The S&P 500 has broken out of the recent consolidation pattern and even poked its head above 2300, and on the weekly chart is looking ominously poised to print a bullish outside week reversal (where price traded below last week's low and closes above last week's high). US banks are finding buyers, amid the move higher in bond yields (and the translation effect of higher net interest margins).

Of course, the Dow breaking 20,000 has been widely noted and the deafening sounds of households staging a Dow 20k party were heard amid yesterday's Australia Day celebrations. Hardly…it is merely a round number, and market participants exposed to US equities are going to celebrate anything it would be the S&P 500 at all-time highs and the fact is the bulls are in control here. As mentioned before a market trading at all-time highs is undeniably bullish and must be traded as such. US earnings have been generally supportive and a nice tailwind to the optimism that perhaps Trump can generate higher nominal growth. Some 30% of S&P 500 corporate having released numbers and we can see 75% have beaten on the earnings line and 52% on sales.

The leads for Asian markets are clearly positive, with SPI futures 0.7% higher than the ASX 200 close on Wednesday. Our call then for the ASX 200 sits at 5700 (+29 points). One should expect support for the banks, but the open for mining stocks will be interesting with BHP down for the past two sessions in London and the ADR suggesting an open 2.4% weaker.

Here's the overview how global markets performed overnight:

- SPI futures down 2 points to 5649 (but up 0.7% from Wednesday)

- AUD -0.5% to 75.32 US cents

- On Wall St, Dow +0.2%, S&P 500 -0.1%, Nasdaq flat

- In New York, BHP -1.3%, Rio -2.4%

- In Europe, Stoxx 50 -0.2%, FTSE flat, CAC -0.2%, DAX +0.4%

- Spot gold -0.8% to $US1191 an ounce

- Brent crude +1.9% to $US56.15 a barrel

- Iron ore +1% to $US83.34 a tonne

- Steam coal -0.1% to $US83.60, Met coal +0.0% to $US185.00

- LME aluminium -0.7% to $US1820 a tonne

- LME copper -1.4% to $US5858

- 10-year bond yield: US 2.50%; Germany 0.48%; Australia 2.73%

President Donald Trump has endorsed a plan by Republican lawmakers to make Mexico pay for his border wall by imposing a 20 per cent tax on all imports into the United States from Mexico, raising billions of dollars that would cover the cost of the new barrier.

The proposal, which Sean Spicer, the White House press secretary, said the President discussed privately with congressional Republicans before giving remarks at a party retreat in Philadelphia, would be a major new economic proposal that could have far-reaching implications for consumers, manufacturers and relations between the two governments.

President Trump had previously criticised the proposal as too complicated.

"When you look at the plan that's taking shape now, using comprehensive tax reform as a means to tax imports from countries that we have a trade deficit from, like Mexico, if you tax that $US50 billion at 20 per cent of imports," Spicer said, "by doing that we can do $US10 billion a year and easily pay for the wall just through that mechanism alone. "

Spicer said the tax would easily pay for a border wall that is estimated to cost between $US8 billion and $US20 billion. The value of imported goods from Mexico in 2015 was $US296 billion. Spicer said taxing imports is something that 160 other countries already do.

The new tax would be imposed on Mexico as part of a tax overhaul that Trump intends to pursue with the Republican Congress. Mr Spicer said the tax initially would apply only to Mexico, but that the President supports imposing a 20 per cent tax on all imports.

Later, Spicer summoned reporters to his office and said the tax was only one idea to finance the wall, and that its economic impact would have to be examined. Trump would need new legislation to enact such a comprehensive tax on Mexican imports.

The cross-border sparring prompted a drop in the Mexican peso, which fell 0.7 per cent to trade at 21.2149 per US dollar following Pena Nieto's announcement. Mexico's currency has plunged almost 14 per cent since Trump's election on concern that Trump will renegotiate or scrap the North American Free Trade Agreement.

After Pena Nieto said in an address Wednesday that his country would refuse to pay for a barrier on the US southern border, Trump blasted him with a tweet Thursday morning. "If Mexico is unwilling to pay for the badly needed wall, then it would be better to cancel the upcoming meeting," Trump wrote.

Pena Nieto, who was to meet with Trump January 31, responded a few hours later with his own tweet: "This morning we've informed the White House that I won't attend the working meeting scheduled for next Tuesday with @Potus."

Esta mañana hemos informado a la Casa Blanca que no asistiré a la reunión de trabajo programada para el próximo martes con el @POTUS.

— Enrique Peña Nieto (@EPN) January 26, 2017

Mexico doesn't pay for the wall," said Jared Bernstein, a senior fellow at the Center on Budget and Policy Priorities. "American consumers who shop at places that import, like Walmart and Target, pay for the wall, making it a regressive tax supporting a dumb, wasteful idea."

US stocks were little changed overnight as investors paused following a two-day rally that pushed the Dow Jones above the 20,000 mark, while the latest wave of earnings rolled in.

The post-election rally reignited this week following a solid start to earnings season and optimism over US President Donald Trump's pro-growth initiatives, giving the benchmark S&P 500 its best two-day performance in seven weeks and catapulting the Dow above 20,000 for the first time.

Trump's business-friendly decisions since taking office on Friday include signing executive orders to reduce regulatory burden on domestic manufacturers and clearing the way for the construction of two oil pipelines.

The S&P 500 and the Nasdaq Composite edged higher at the open to hit record levels but finished the day little changed.

Qualcomm weighed on both the S&P 500 and Nasdaq as the chipmaker fell 5.0 per cent to $US54.05 after posting a lower-than-expected rise in quarterly revenue.

Early fourth-quarter US corporate earnings have boosted sentiment and are expected to show growth of 7 per cent, their biggest increase in two years.

"If all the economic data is good, if the earnings are good and the market doesn't really seem to think anything (Trump) says or does is negative, I don't see any downside," said Randy Frederick, vice president of trading and derivatives for Charles Schwab.

The Dow Jones Industrial Average rose 32.4 points, or 0.16 per cent, to end at 20,100.91, the S&P 500 lost 1.69 points, or 0.07 percent, to close at 2,296.68 and the Nasdaq Composite dropped 1.16 points, or 0.02 percent, to finish at 5,655.18.

European shares climbed to a one-year high supported by merger and acquisition-related optimism. Johnson & Johnson's $US30-billion deal to buy Actelion lifted shares in the Swiss biotech firm. Europe's broad FTSEurofirst 300 index closed up 0.21 per cent at 1,451.12.

The US dollar rebounded from its slide in recent weeks, but gains were tempered by persistent uncertainty surrounding Trump's leanings toward protectionist trade policy.

Still, investors believed the US dollar could make up some lost ground in the next few weeks, with the Federal Reserve holding its first policy meeting this year on February 1.

"Although the Fed is not expected to raise rates further at that meeting, the central bank is likely to provide a clearer outlook for rate hikes in 2017, especially in view of the projected US inflation trajectory under Trump's proposed fiscal stimulus plans," said James Chen, head of research at Forex.com.

The Mexican peso weakened 0.7 per cent after the White House said Trump wants a 20 percent tax on imports from Mexico to pay for a wall on their shared border, deepening a crisis after a planned summit between the countries' leaders fell through.

Good morning and welcome to the Markets Live blog for Friday.

Your editor today is Jens Meyer - please send any tips, suggestions, feedback, jokes, criticism, praise etc to jmeyer@fairfaxmedia.com.au

This blog is not intended as investment advice.

Fairfax Media with wires.

1 new post(s) available. View post(s) Dismiss