EXCLUSIVE

More National News Videos

The rise and rise of Transurban

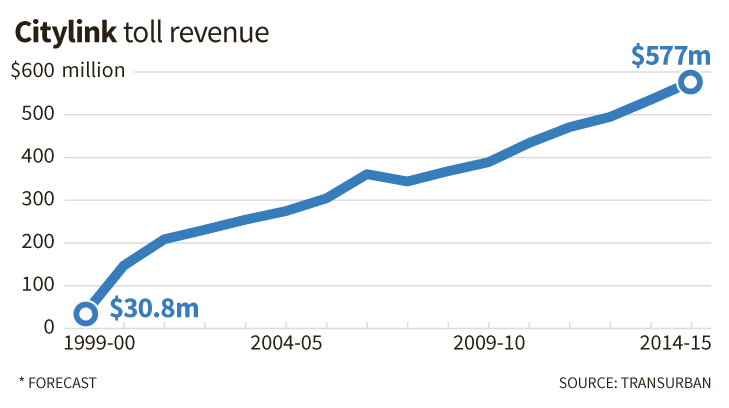

From the 'humble' beginnings Jeff Kennett's Citylink in Melbourne to an engineering behemoth. Royce Millar and Ben Schneiders report on the company swallowing up Australiaâs roads.

Toll road giant Transurban is positioning itself to manage the entire road networks of Australia's three major cities as governments make the "inevitable" shift to road pricing.

A senior Transurban executive told a private meeting of investors this month that the company wanted to be viewed as the "natural custodian" of the nation's motorways, in the likely event of motorists being charged to drive on them.

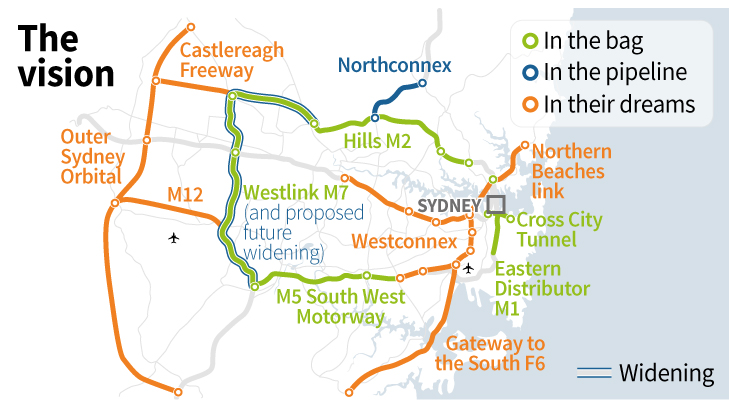

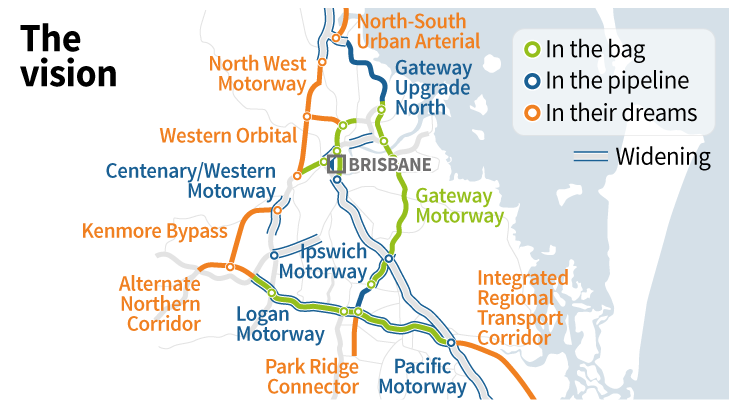

The Melbourne-based company has a near monopoly on private roads in Australia already, controlling 13 of the 15 toll roads in Melbourne, Sydney and Brisbane.

Analysts Morgan Stanley have described a Transurban-run, user-pays system across all roads as a "meta-monopoly".

Such a move would further entrench the company - which owns Citylink in Melbourne, the M2 in Sydney and all of Brisbane's toll roads - as a de-facto private sector planning agency in those major cities.

Few, if any, countries in the world have allowed a private operator to control so much of their road network.

Even Jeff Kennett, the man who in effect launched Transurban through its Melbourne CityLink contract in 1996, now warns governments against granting the company more toll road projects, arguing that taxpayers are being "ripped off".

"Transurban people must be laughing absolutely underwater," Mr Kennett said.

"They are a very successful company, they have been very clever in using their intellectual property and powers of persuasion to pull the wool right over the eyes of the government."

Company briefs to investors reveal how Transurban is seeking to further entrench its position.

It has earmarked the yet-to-be-built Outer Sydney Orbital, an Outer Ring Road in Melbourne, and the Western Orbital Motorway in Brisbane, as roads it hopes to include in its growing stable.

Transurban's strategic position in all three major cities has also helped it secure a string of lucrative projects under "unsolicited" or "market-led" proposal policies, which allow the private sector to propose and win infrastructure projects without competition.

The company's $5.5 billion Western Distributor proposal to build a second crossing in and out of Melbourne's western suburbs is close to being signed off by the Andrews state government.

The $1.3 billion Tullamarine freeway widening project, the $3 billion NorthConnex road in NSW and the $450 million Logan Enhancement in Queensland were all projects dreamed up by Transurban and ticked off by state governments.

Transurban told investors this month that reform of road pricing in Australia was "an inevitability," and that, before long, a form of tolling was likely to apply in future across entire road networks.

Australia's already inadequate system of road taxes, based on car registrations and fuel excise, is under threat with fuel efficient and electric cars likely to further reduce revenue.

Both sides of politics are gradually warming to the idea of introducing road user pricing across all roads.

In February, Prime Minister Malcolm Turnbull said a "better calibrated user pays system" clearly has "some attractions" but would need to be "fair and equitable".

The Productivity Commission, the Harper review into competition policy, Infrastructure Australia and the 2009 Henry report have all recommended various forms of road pricing.

Transurban has also initiated a study on the impact on the driving behaviour of 1200 customers of different road pricing schemes, with a view to advising governments how to introduce a user-pays system

The company's chief executive, Scott Charlton, declined to be interviewed by Fairfax Media.

But in records of a recent private briefing to investors - obtained by Fairfax Media - he boasts that the company was "one of the biggest, largest managed motorway networks in the world".

He denied it was a monopoly as it could not control prices.

Mr Charlton told investors he expected road pricing in the next decade or two.

"When we first started talking about it three years ago, it was shut down pretty quick by the federal politicians and some of the state politicians," he said.

Now with its Victorian road use study, Mr Charlton said, both major parties have said "yes, we should look at it."

The company's staggering growth since 1996 has led industry analyst Credit Suisse to note that it now operates "without strong competition" on the eastern seaboard.

Its tolls revenue has surged 400 per cent in a decade to $1.5 billion and is expected to rise a further 50 per cent to $2.3 billion a year within two years.

It also anticipates a big boost in business of up to 25 per cent from the introduction of driverless cars.

Since it announced last December it was in exclusive negotiations with the Andrews government over the Western Distributor, Transurban's shares have surged nearly 20 per cent.

A key part of the Western Distributor deal - funding for which includes $1.46 billion of Victorian taxpayers' money - will be the 10-year extension to the existing CityLink toll concession.

Victorian treasurer Tim Pallas refused to be interviewed.

Mr Kennett said the extension was overly generous.

"From an economic point of view it's the greatest windfall to Transurban and people should be buying its shares left, right and centre."