How to find the right home loan for your situation

Finding the best home loan for your personal situation can help you save money and provide you with features that make your home loan easier to manage, and quicker to pay off.

What's the 'best' for one person might not be the same for you, so read on to find out some of the most proven ways to guide you to the right home loan for you.

loans.com.au Essentials - Variable (Owner Occupier, P&I;)

variable rate

comparison rate

loans.com.au Essentials - Variable (Owner Occupier, P&I)

A low-interest rate loan suited for refinancing with no application or ongoing fees.

Compare home loans today

Rates last updated January 19th, 2017.

Fill in the form and you’ll be called by a specialist mortgage broker from eChoice to have an obligation-free discussion about your options.

Your eChoice broker will compare hundreds of home loans from more than 30 lenders to help you find the right loan for you. They’ll also help you calculate your borrowing power, and present your options in a free home loan report.eChoice is an award-winning broker with over 18 years of experience, and has helped more than 50,000 Australians to find the right home loan.

Compare some of the best* home loan rates for January 2017

| Home Loan | Interest rate (p.a.) | Comparison rate (p.a.) |

|---|---|---|

| loans.com.au Essentials - Variable (Owner Occupier, P&I;) | 3.59% | 3.61% |

| NAB Choice Package Home Loan - 2 Year Fixed (Owner Occupier) | 3.98% | 4.87% |

| Greater Bank Ultimate Home Loan - Discounted 1 Year Fixed ($150K+ Owner Occupier) | 3.59% | 4.42% |

| State Custodians Standard Variable Spring Special - LVR 80% (Owner Occupier) | 3.59% | 3.92% |

What the ‘best home loan’ means for you

The “best” home loan is a very individual proposition. To decide what the best home loan for you might be, you need to consider your individual circumstances. Some things to take into account might be:

Your current financial needs

What sort of repayment options are best suited to your current situation? Your interest rate and your loan term will impact your monthly repayments. Making interest only repayments is also an option usually popular with investors, because interest repayments are tax deductible and over the course of the year investors can claim this. You may also be paying only interest repayments during a construction loan if you are building a new house, as these repayments are lower than regular principal and interest repayments. This allows you to make smaller monthly repayments because you are probably still paying rent until your new house is built.

Your future financial needs

A home loan is a long term, financial tool that will help you buy one of the biggest assets you'll own. To find a home loan that grows with you, you’ll need to think about your needs and wants for now and the future. For young professionals for example, a no-frills home loan with a fixed interest rate could help you get used to repayments. When the fixed rate period ends, you have the ability to refinance to a more flexible home loan as you become a parent or have bigger, financial goals. When it comes to retirement, you may want to tap into the hard-earned equity of your home with a Line of Credit home loan.

The purpose of the home loan

Whether you are buying a property as an investment or as your own home can affect grants you are eligible for, and how you manage your repayments and interest at tax time. There can also be some small differences between home loans and residential investment loans so make sure you are comparing the right type of loan where your needs are being met.

In general, though, the “best” home loan for your situation might be broken down into three categories:

- The cheapest

- The easiest

- The most flexible

The cheapest home loan

A lot of factors go into determining the cheapest home loan for your situation. For a comprehensive rundown on finding the cheapest home loans, read our guide. But in general, an inexpensive home loan might be the one that offers:

The lowest rate

If a home loan rate is lower, then less interest is payable. Over time, this can amount to a big saving over other loans. In addition to advertised variable and fixed rates, many lenders offer big discounts for borrowers with good credit history or a larger deposit.

The lowest fees

If a home loan doesn't have expensive upfront fees such as application fees, or any ongoing fees such as annual package fees, this can save money. It’s important to remember that a low advertised rate might not add up to savings once fees are factored in.

Pros and cons of “cheap” home loans

| Pros | Cons |

|---|---|

| Can offer lower monthly repayments | May be light on features and flexibility |

| Can amount to a lower overall cost | May be harder to qualify for |

| May require a bigger deposit |

The easiest home loan

For some borrowers, the primary concern in finding a home loan is a quick and painless approval. Borrowers may be looking for a loan that can settle quickly or a lender willing to consider less-than-perfect credit.

A loan that’s easier to secure might be perfect for:

Pensioners and credit impaired borrowers

For a borrower receiving the age pension for example, the right home loan for them might simply be one that gets them approved without a huge interest rate. Likewise, a borrower with a few blotches on their credit score might find lenders willing to give them a second chance.

Those with a low deposit

For borrowers entering in the property market for the first time, a good home loan might be one which only requires a 5% deposit.

Self-employed borrowers

Many lenders require PAYG statements as proof of income and employment. This can be difficult for self-employed borrowers, but some lenders will accept alternative documents for income verification.

Borrowers looking for a quick turnaround

A straightforward, no-frills loan might be the best course of action for borrowers who need to settle quickly. If you have a large deposit and good credit, you’re likely to find lenders who can turn around your home loan quickly and easily when time is of the essence.

Pros and cons of “easy” home loans

| Pros | Cons |

|---|---|

| Can offer approval to a wider range of borrowers | Might be accompanied by higher rates or fees |

| Could offer faster time to settlement |

The most flexible home loan

Home loans with added features can offer borrowers more flexibility in how they manage their loan, make their payments or use their credit. Some of the flexible options available to borrowers are:

- Additional or extra repayments. Put extra amounts towards your loan and pay it off faster.

- Redraw facility. Access extra repayments you made on your loan whenever you need the money.

- Offset accounts. A transaction account which reduces the amount of interest you pay when funds are deposited into it.

- Portability. Keep your home loan when moving to a new property, saving on entry and exit fees.

- Family guarantee. Get a home with your family's assistance even without an adequate deposit.

- Sign-up bonuses. Get a helping hand from your lender with a cash bonus or fee waiver on your home loan.

- Professional package. Get a rate discount in exchange for bringing your other banking products over to your lender.

- Split facility. Split your loan into fixed and variable portions to get the benefits of both.

- Loyalty discounts. Get a rate discount in exchange for your loyalty.

Pros and cons of flexible home loans

| Pros | Cons |

|---|---|

| Can offer access to home loan funds for other uses | May carry additional fees and costs |

| Can enable borrowers to pay off their loan faster | |

| Can make securing a loan easier | |

| Can offer money-saving discounts |

What do I do now?

If you’ve considered your circumstances and think you know what sort of loan will best suit your needs, it’s time to find a lender that matches your criteria.

There are a range of home loans available in Australia and we're quite spoilt for choice. However, too much choice can also be confusing so before you apply, compare a range of loans that may fit your needs.

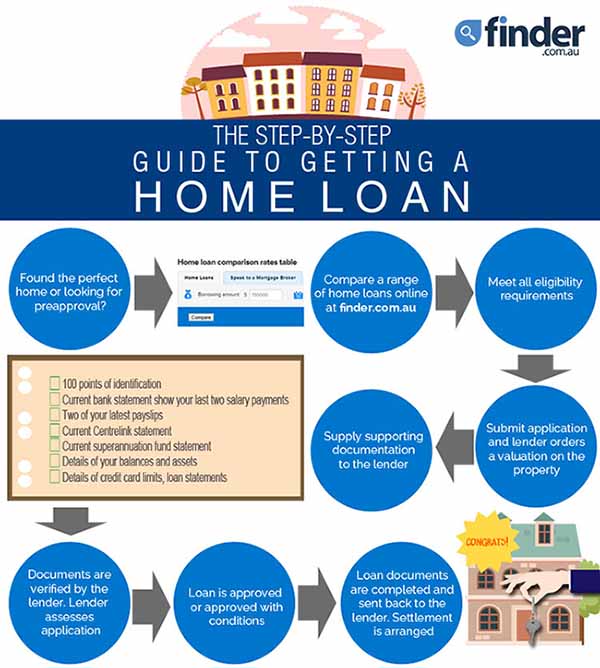

And if you’ve found a lender you think suits your circumstances, it’s important to understand the process you’ll need to follow to apply for your home loan:

Common home loan questions

What are the features of a home loan over other types of loans?

A home loan is designed to help you finance the purchase of your new or existing home. It is a long term financial commitment, lasting from 25 - 30 years or in some cases longer.

- Allows you to own a home. Unlike many other forms of credit, these loans are able to be used to purchase a home, as they have large maximum borrowing amounts and can be secured to property. They also generally have lower interest rates than personal loans or credit cards.

- Lenders have loans for most situations. Depending on your income, savings and financial commitments, most lenders can assist you with financing. This includes borrowers with negative listings on their credit files.

- You can borrow high amounts. Home loans allow borrowers to buy large sums of money, as property is generally a lot more expensive than cars and boats.

- Repayments can be fixed and easily calculated. If you opt for a fixed rate home loan you have the benefit of knowing what your repayments will be for the fixed period. But never fear, even if you have a variable rate you can use our calculator to calculate your repayments.

- Home loans can be flexible. You can make additional repayments, access your redraw facility or opt for an offset account with most variable rate loans. The market has become very competitive, so you can expect to find more feature packed fixed rate home loans popping up also.

- You can tap into your equity. If you've owned your home for a while and have built equity in it (the amount of your home you actually own versus what the bank owns), you can access this equity with a line of credit loan. How you reinvest the money is up to you, though experts recommend that you invest in assets that generate an income.

What fees are associated with home loans?

There are a number of fees charged on a home loan, including:

- Upfront fees. This includes application fees, settlement fees, legal fees and valuation fees paid when opening your home loan.

- Ongoing fees. These fees are charged regularly, for example each month or each year, and are generally service fees and account keeping fees.

- Exit fees. When leaving your home loan you'll generally need to pay discharge fees, and if you have a fixed rate home loan, you'll need to pay break costs too, which are charged by your lender to recoup the costs of you leaving your loan before the agreed term ends.

The fees that come with a home loan will ultimately be up to the lender, but this doesn't mean that they're non-negotiable. With a bit of negotiating or by opting for a package, you can get some of these fees waived.

Click here for our comprehensive guide on home loan fees, from application all the way to the exit.

How do I find a home loan with the lowest interest rate?

We currently compare hundreds of loans so it's easy to find the lowest interest rate in our comparison. In the blue comparison table above, click on 'interest rate (p.a.)' and the table will automatically sort the interest rate in ascending order. You can also do this with the comparison rate if you wish to take into account fees and charges.

I'm awaiting a property settlement, can I still borrow a higher amount for my next property as I'm waiting for the extra funds?

This will require your lender to reassess your application and the decision will be based on that assessment. It will also depend on the LVR of your new or existing loan - if you want to borrow more than the set LVR then you need to opt for bridging finance instead.

What happens to my home loan when I die? Will the debt be transferred to my next of kin?

If no legal document, such as a will, has been written before the time of death then the debt is usually transferred to your next of kin. Read our guide for information on what happens to your home loan after death.

Is topping up my home loan or tapping into my equity better?

This question should be answered by your financial advisor, as we are not in a position to be giving financial advice.

Tapping into your equity can be done through a line of credit loan, though a top up will require a reassessment from your lender. You need to use your equity wisely and ensure you reinvest the funds rather than spending it all in one go.

I am currently in a strange or irregular situation. Am I still eligible for a home loan?

In most cases you'll still be eligible for a home loan. Speaking to a mortgage specialist can put you in the right direction to finding a lender who is willing to consider your application. No matter how strange or irregular your situation.

Why don't lenders publish their eligibility requirements online, or anywhere?

This is because the eligibility requirement tend to change on a case by case basis. While the main elements are there: steady income and good credit history, the lender needs to assess your individual assets, liabilities and capital to make a proper decision as to whether you can service the loan for the property you wish to buy.

Do I need to pay capital gains tax when I sell my property?

Your main residence (MR) is generally exempt from capital gains tax (CGT) - and you can use your MR to generate income for up to six years before any CGT is payable. For more information, see our comprehensive CGT guide with over 500 questions asked by our users.

Is my principal place of residence included in the assets test for Centrelink benefits?

The value of your real estate, apart from your main residence is included into the asset test when Centrelink or the Department of Human Services assesses your assets.

How long does the home loan application process take?

You could get your home loan approved within a few days, though the proper answer is that it depends. Each loan and application process is different, so it's hard to give a ballpark figure. If you're in a hurry, your lender can usually arrange settlement within a few days when your application has been conditionally approved.

Do you have historical home loan rates anywhere on the site?

Yes we do, check our historical home loans interest rate page and rate it against the official cash rate.

How do I find the Bill Swap Bank Rate (BBSW) on a certain date?

You'll need to contact the Australian Financial Markets Association if the BBSW you're looking for dates more than 10 days back. Note that a fee may be involved to retrieve this information.

I've recently divorced, what happens to my home loan?

If you're in the process of divorcing, you will need to sort out how the property is to be divided. It's best to speak to your solicitor or lawyer in this case, as a legal document will need to be written up recording all of this information.

Generally stamp duty is not payable upon a divorce, but this is only if the all the paperwork is done on time. See our guide on refinancing your home loan debt after a divorce.

How do I know how much I can borrow?

Get an estimate of how much you can borrow with our calculator by entering a few of your details. This can give you an idea of how much you can afford to spend.

Can I borrow 100% of the property's value?

Post-GFC, these types of loans are only possible if you have a guarantor. This is someone, usually family, who is willing offer their property as security for the loan. Compare 95% LVR home loans and lenders that allow guarantors on our page.

Where can I get personal advice about my home loan?

Speaking to a mortgage broker is a great idea if you would like specific advice about your home loan. Brokers work on a commission basis, so they don't get paid until they've helped you settle with your loan. By law, they are required to disclose all commissions to you, so don't be afraid to ask about how they're paid to ensure you're not getting biased advice.

Can I get a home loan in Australia as a non-resident?

If you're an expat, currently hold a 457 Visa or Spouse Visa, you may be eligible for a home loan issued in Australia. Australia's big four banks, Commonwealth Bank, Westpac, NAB and ANZ have migrant banking services that can assist with this.

If you're a foreign resident and you intend to invest in Australian property, you'll need to seek Foreign Investment Review Board (FIRB) approval first.

Find the best home loan* for you with some expert help

* The home loans compared on this page are chosen from a range of home loans finder.com.au has access to track details from and is not representative of all the products available in the market. The use of terms 'Best' and 'Top' are not product ratings and are subject to our disclaimer. You should consider seeking independent financial advice and consider your own personal financial circumstances when comparing home loans.

If I am eligible to borrow 450k home loan for 30 years, what would be minimum repayment per week?

Hi Jamil,

thanks for the question.

You can find out what your loan repayments would be for different loan rates using our loan repayment calculator.

I hope this helps,

Marc.

What is the “advertised rate”? And “comparison rate”? And what is the difference?

Hi Degsy, the advertised rate is a interest rate charged for a home loan, and it’s decided by your lender. It’s used to work out what your loan repayments will be.

The comparison rate is the advertised rate including some of the fees of the home loan (The application fee and any ongoing monthly fees for example), and is accurate for the example of a $150,000 loan over 25 years. By law, comparison rates must be included on all home loan advertisements, as it gives you a way to see what the actual cost of a home loan is because of the inclusion of these fees.

You can find out more about it in our comparison rate guide.

I hope this helps,

Marc.

Will I be able to borrow with my Income being from Income protection payments

Hi Tony,

Thanks for your enquiry.

Generally, income protection insurance is designed to help you cover expenses, such as mortgage repayments, in the event that you are unable to work due to injury or illness. Please note that your ability to service a mortgage using this benefit will depend on the type of cover that you have, but most policies provide up to 75% of your monthly income.

As lenders have different eligibility criteria to qualify for home loans, it would be best to contact the lender directly to see whether you can borrow using the benefit from your income payments.

Thanks,

Belinda

What is the difference beteen the interest rate and the comparison rate?

Hi Steve,

Thanks for your enquiry.

The interest rate is the percentage of your home loan that you’ll end up paying in addition to the original loan amount.

Whereas the comparison rate is a percentage amount calculated by adding together the interest rate plus any additional fees or charges associated with the loan. The figure is then converted into a percentage to reflect the true cost of the home loan.

If you compare home loans based on the comparison rate, you’ll get a more accurate idea of the true cost of the loan.

I hope this clarifies things for you.

Thanks,

Belinda

Are there any fees if you choose to pay out the Essentials home loan (on Interest only terms) earlier? If so, what are they? Thank you

Hi,

Thank you for contacting finder.com.au, we have followed up directly via email.

Regards

Jodie

what is interest rate for fixed an varible.. and what charges are there?

Hi Raelene,

thanks for the question.

The interest rates for fixed and variable rate home loans is different depending on the product. The table on this shows some of the different rates and fees for some home loans.

I hope this helps,

Marc.

Does it cost $ to ask a question of a 1300Home Loan broker through this website? I already have a home loan and want to compare rates to see if I am still getting the best deal. What if the broker decides that I am and so do not ned to change, will I have to pay them?

Hi Jeff,

Thanks for your question.

It doesn’t cost anything to ask a question of a 1300 Home Loan broker through our website.

Please note that 1300 Home Loan consultants provide advice free of charge for all residential mortgages.

I hope this helps.

Thanks,

Belinda

Hi was wondering if you can borrow money for a house and get extra to pay off your outstanding debts. I would be eligable for first home owners grant but have no deposit as pay 550 per week rent, thanks

Hi Derek,

Thanks for the question.

Home loans can be used to consolidate your debts through refinancing, please see our page for further discussion of this topic. To get any further advice on this type of borrowing you can also contact a lender or mortgage broker who can help your specific needs.

Regards

Jodie

Anyone able to offer a mortgage on an over 50′s townhouse? 50% deposit, bricks and mortar.

Hi Garry,

thanks for the question.

I would recommend contacting a mortgage broker, as they’ll be able to steer you in the right direction and help you to apply with lenders who are more likely to approve your application.

I hope this helps,

Marc.

Is the interest rate on a 15 year loan the same as a 30 year loan?

Hi Matthew,

Thanks for your question.

Generally the loan itself stays the same, assuming that stick with the loan the entire time. However, the rates are subject to change during the life of your loan.

If you opt for a variable rate home loan it’s likely that your interest rate will change according to the RBA cash rate decisions. Even with a fixed rate home loan, it would need to revert to another interest rate at the end of the fixed term.

Cheers,

Shirley