Your guide to finding an all-in-one bank account that meets your needs.

Filter products to match your search

- Deposit and withdraw my money without feesFee-Free Everyday Transaction Accounts

- Use a bank account while I'm studyingStudent Everyday Transaction Accounts

- Be rewarded just for using my bank accountCash Back, Free Wine, Qantas Points and More

- Use my bank account overseas and avoid feesTravel and International Everyday Transaction Accounts

- Be able to withdraw cash without my debit cardCardless Cash or Get Cash Bank Accounts

- Compare bank accounts designed for retireesRetirement Bank Accounts

- Meet family goals with a joint accountJoint bank accounts

- Find a flexible bank account for my businessBusiness bank accounts

Compare bank accounts below

Our comparison table lets you compare fees and product details at a single glance.

View our step-by-step guide on using the comparison table

Step 1: Personalise your results

Step 2: Filter

Step 3: Read our review or apply straight away

Want to know more about bank accounts?

Finding a bank account with the right features for your situation can save you a lot of time and money in the long run. At finder.com.au, we understand that everyone is different – so to help in your research, we explain the different types of accounts, their benefits and what you need to consider before opening it.

| Research | Compare | Calculators | Expert Help |

|---|---|---|---|

What is a bank account?

A bank account is a financial instrument offered by a financial institution to hold your money for everyday expenses. In simpler terms, it's an account that has features to help you pay bills, go grocery shopping and withdraw cash from an ATM. Financial institutions offer bank accounts because you need a secure location to hold your money.

The benefits of owning a bank account – what you need to know

Having a bank account can help you manage your everyday finances and keep track of your money. Benefits of owning one include:

- AÂ convenient way to organise your money. For example, paying bills, receiving your salary or Centrelink benefits, paying for goods and services or sending money to someone else.

- A safe place to keep your money. This is especially helpful during uncertain economic climates – the Australian Government offers a guarantee on deposits of up to $250,000 per person, per institution.

- A place that records your transactions. When applying for a loan, lenders will be able to refer to your transaction records to assess how well you can save money. You can also see where you're spending most of your income.

- A place to build your assets. Money held in your transaction account is easy to access – by linking it to a savings account, you can also earn interest.

Questions to ask when choosing a bank account

The best bank account will help you manage your finances efficiently and help you reach your savings goals. Since everyone is different, the definition of "best" will depend on your preferences. Here are some considerations to help you make an informed decision.

- What's your standout feature(s)? This is the one feature or characteristic that your bank account must have. Everyone has unique preferences when it comes to their favourite bank account. Some would prefer convenience and flexibility, some prefer to earn points on their purchases and some would rather have both or none at all. One of the great things about bank accounts are that they can be a short term commitment. So if you're unhappy with your current bank account, you can always switch to a new bank. Review your needs regularly to see if your bank account still meets them.

- Are the features worth the fees? For example, being able to access Australia's ATM network is a great feature but is it worth the monthly fee? If yes, then proceed with the account. You'll find that most bank accounts charge a monthly fee, but the good news is that as the space gets more competitive, banks are also offering new ways for you to avoid them. The rise of internet banking has meant that teller fees are almost a thing of the past and most banks waive the monthly fee if you deposit your pay or salary into your account.

- What stage in your life cycle are you currently in? Your life cycle plays a minor role when it comes to choosing a bank account, but plays a much larger role when choosing a savings account. Are you currently building, managing, or using wealth? If you're currently building your wealth, you'd want an account that restricts the way you spend so you only buy the essentials. These could be couples who are saving for a deposit for their first home, or couples who are expecting a child. These could be accounts that allow a certain number of transactions per month, otherwise a fee applies once you've exceed the limit. If you're currently managing your wealth, this tends to open up your options to most accounts. This life stage focuses on tax planning, strategies and management. And finally, the using wealth phase focuses on the effective use of your superannuation in either an account-based pension or an account that holds your lump sum.

- What type of bank account do I need? Transaction accounts are designed to meet your everyday banking needs – whether it's an account to deposit your pay, or just an account to pay for bills and groceries. Traditionally, bank accounts that offered unlimited transactions did so for a monthly fee, and some limited the amount of transactions you can conduct for no monthly fee. However, in this increasingly competitive market, banks are now offering accounts unlimited transactions for no monthly fee. See our table above to compare your options today.

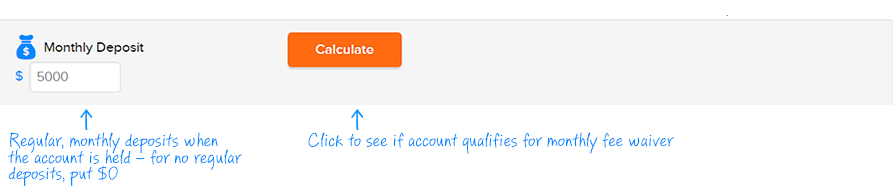

How do I find a bank account with the lowest fees?

We currently compare hundreds of bank accounts and it's easy to find the one that charges the lowest fees in our comparison. In the blue comparison tool above, click on 'Monthly Account Fee' and it will automatically sort the fees in ascending order. You can also do this for all the other headings in the table if you wish to sort through different features. You can also compare fee-free bank accounts using our comparison table.

finder.com.au is an informational site, and unable to provide advice on which accounts are better than others. We have however put together a listing of available transaction accounts in Australia, along with the fees they charge. You can use the table above to help you begin making comparisons of the other features these accounts offer in order to help you choose the one that is best for your circumstance.

Commonly asked questions about bank accounts

- How much tax do I need to pay from the interest I've earned from my account? The amount of tax payable depends on your income. The marginal tax rate is then calculated from there. See our tax returns guide for more information.

- How long does it normally take for a bank to refund a BPAY error? This process can take up to 14 working days as your bank will need to contact the biller.

- How do I find out what my account number is? You can find this information on your most recent bank statement or by logging into your internet banking account. Alternatively, phone your bank directly.

- Which banks let me deposit money into my account with an ATM? Many major banks offer this feature, including Commonwealth Bank, ANZ and St.George.

- What happens when I deposit a cheque with the incorrect name order? Unless a deposited cheque is made out in the depositor’s name or the name of the financial institution, the bank has the right to return it to you unpaid at their discretion.

- Where can I find more information on your site about joint accounts? Find more information on our joint everyday bank accounts or more information on banks that offer joint credit card accounts.

- Why are joint accounts helpful? Joint accounts are great if you want to share your finances with a trusted person, like your partner or family. You both hold the same liability, but usually the accounts will require both of your signature for a withdrawal to occur.

Going with an international bank could help, but be mindful that in each jurisdiction the banks are under their local regulations and are separate legal entities. Depending on how strict they are in the country that you're working in, it may not be worth switching to another bank.

Some banks, such as HSBC or Citibank may be able to offer you worldwide assistance.

An office or social club account is one where a group, usually employees who wish to be involved, deposit a specified amount of money every month to arrange of activities. There are a number of ways to structure it:

- Automatically payroll the deduction into a business BSB account that is dedicated for social events. This way the funds are post-tax and there are no tax considerations.

- You could also open a personal bank account, preferably with two holders and declare the account as a non-interest account.

The first option is the most popular as it has the least implications. Opening a personal account poses tax implications when it comes to what the funds are used for.

Having problems with your bank account?

Is the complaints process across the banks the same or is it different according to the bank?

Each bank will offer its own Internal Dispute Resolution service which is your first avenue of appeal when you have a complaint. If you’re not happy with the result of this process, you can then take your complaint to an external dispute resolution scheme such as the Financial Ombudsman Service or Credit and Investments Ombudsman.

I’ve just gone through a divorce and my partner refuses to close the joint account. What should I do?

If your joint account requires both you and your former spouse to sign in order for it to be closed, you can contact your solicitor to have the account frozen if your ex refuses to comply.

- Choosing the wrong type of account. Each type of account serves a very specific purpose. Not choosing the right one could result in paying unnecessary fees or penalty charges.

- Not having the right features. Look closely at each account to ensure that it has the features you need to make your banking needs easier.

Is it possible to use mobile banking apps on rooted phones?

Yes it is, although you will need to confirm this with your bank. In some cases, certain app features may not be available.

Can I link my PayPal business account to my personal bank account?

This is possible, but only if the name on your PayPal business account matches the name on your personal bank account.

What should I do if I think I’ve been charged twice by accident?

If you’ve made a purchase, the first thing you should do is contact the merchant to see if you can sort out the problem. If this is not possible, contact your bank or financial institution to dispute the transaction.

How do I delete a transaction?

In certain situations, a bank or credit union might perform a small transaction in order to verify your account, such as transferring a very small amount into your account. This transaction is then deleted once your account has been verified.

My debit card has been blocked, what should I do?

You will need to contact the bank or financial institution that issued the card as soon as possible to find out why the card has been blocked.

Is it possible to have an unlimited amount of bank accounts? Are there any implications?

It’s possible to open several accounts with one bank to help you budget for different purchases. For example, some banks allow you to open up to nine or 10 sub-accounts inside another account to allow you to split up your funds into separate areas for saving and budgeting purposes.

The latest articles in banking

Using Paypal

Can I link my bank account to my PayPal account?

Yes in most cases you can link a bank account issued by an Australian financial institution with your bank account. PayPal can be both linked to your bank account, debit card or credit card. When you pay for items using PayPal, the default account it uses is your bank account. If you'd like to pay with your credit card, make sure you choose this option specifically before actually purchasing your goods or services.

To link your account, log into PayPal > Wallet and Click on 'Link a bank account' or 'Link a card'. Having PayPal linked to your account means you can buy things wherever PayPal is accepted (both online and offline).

How long do PayPal refunds usually take?

It could take up to 30 days for a PayPal refund to appear on your statement, depending on your card issuer. You are able to check the status of a refund by logging into your PayPal account and reviewing your transaction history.

But if I have a keycard and not one of those fancy security chip cards?

You will be able to link your transaction account to your PayPal account, but not the actual card. Alternatively, you could ask if your keycard can be upgraded.

Back to topWhat are the different types of bank accounts?

Let's have a look at the different bank account profiles below to see where you fit:

Let's have a look at the different bank account profiles below to see where you fit:

Convenient and flexible bank accounts

These are bank accounts that generally don't charge any fees and let you access nearly all the ATMs in Australia. If you're someone who is always on the go and want almost instant access to your money all the time, then this could be the bank account for you.

Rewards and cash back accounts

If you enjoy getting more value of your spending or thrive on being able to earn points, then a rewards and cash bank account could be for you. You can link your existing frequent flyer account to accumulate your points even faster.

International bank accounts

If you tend to travel a lot or shop online from overseas stores and could really benefit from no international transaction fees, then this could be a suitable account. Some travel transaction accounts let you withdraw money from eligible ATMs for free, though often they will need to share the same ATM network.

This is a bank charge issued when you make a transaction in a foreign currency which needs to be converted to the Australian dollar.

Bonus saver bank accounts

These accounts tend to waive the monthly fee if you meet the stated conditions each month. For example, you may need to deposit your salary or pay into it each month.

Student bank accounts

Student bank accounts waive the monthly fee if you can prove that you're a current student. This just involves showing your student card at your local branch. Some other concessional may apply too.

Basic bank accounts

These are transaction accounts designed specifically for low income or disadvantaged customers. To be eligible, you generally need to be receiving a Government benefit or hold Concession or Health card.

Deeming accounts

These are everyday transaction accounts designed to help those over 55 with the Federal Government's deeming rules.

Deeming is the amount of income that is used under the Income Test for the Age Pension to determine eligibility. The same deeming rules are used for all financial assets – which makes assessment fairer. Everyone is deemed the same rate, dependent on the income they receive on their assets.

Pensioner accounts

This includes Retirement Saving Accounts, account-based pensions and some SMSFs. When it comes to retirement planning, speaking to a certified financial planner is high recommended because they can design a tax-effective strategy that utilises your superfund.

Back to topQuick tips for using everyday bank accounts

- If you're paying for purchases using EFTPOS, ask for cash out at the same time rather than withdrawing at an ATM. This counts as one transaction, not two, and lets you avoid any potential ATM fees.

- If your everyday account has a limit on the number of transactions you can make each month before fees apply, monitor your account regularly and try to work out ways to minimise your transactions where possible

- If you have a debit card linked to your everyday account, you might be able to press the 'credit' option as you make your payments. The purchase is paid for using your own money, so you're not adding to debt by doing this, but you'll be activating enhanced security or the complimentary insurance policies offered on your card if you press 'credit'.

- If you're currently paying a monthly account-keeping fee on your everyday account, ask your bank what options you have for getting that fee waived. They may suggest opening a savings account or depositing your salary into the account or maintaining a minimum balance in cash in order to get rid of that fee. They may also suggest a different transaction account that could end up suiting your needs better in the long run.

How do I open a bank account?

Once you've made a decision, it's time to open your account! Applying for a bank account from finder.com.au is easy. Once you've chosen a bank account that you'd like to apply for, click on the green 'Go to Site' button and you'll be taken to the bank's website to start your application. Depending on your personal situation, you may need to consider the following:

Are you eligible?

- Typically you'll need to be at least 18 years old to apply online (you can confirm this when you reach the bank's website). If you're not 18 yet, don't worry, you can apply over the phone or in person at your local branch.

- You'll need to be an Australian resident for tax purposes. Again, if you're not an Australian resident, don't worry, you can apply over the phone or in person at your local branch.

- Generally the accounts displayed on finder.com.au are only available for personal use. If you intend to use it for business purposes or your SMSF, these will be need to be over the phone or in your local branch.

Do you have your documents ready?

- You'll need all your personal details on hand, including your full name, address, contact phone number, email address, etc.

- You'll need a Tax File Number (TFN) to ensure that you get taxed effectively and not at the highest marginal tax rate.

- You'll also need identification for your application, this includes birth certificates, driver's licence or your Australian passport.

What happens after I've submitted my application?

Depending on the bank, your account could be opened immediately, or within a few business days. Your bank will send you a package confirming the details of your new bank account, along with its linked debit card. You'll need to activate your debit card online too and the instructions are provided in the package.

Should I provide my TFN?

Your Tax File Number (TFN) is a unique 9 digit number that is issued to you, but the Australian Tax Office (ATO). It's not required by law for you to supply your TFN, but if you don't banks are required by law to deduct the highest amount of tax from any interest earned on your account over a certain threshold. This tax is named 'withholding tax'.

I've already opened an account, how do I provide my TFN?

To provide your TFN or if you're not sure if you have already supplied it, you can contact your bank directly to provide it. Alternatively, if this feature is offered to you, you can supply it through online banking.

Is it possible to get a savings account as a couple?

Yes, many of our Australian financial institutions allow for joint savings accounts. Compare the features of these joint savings accounts.

What if I can't open a bank account online?

Not to worry – you can always open the account at your local branch or over the phone. However, applications may be restricted to business hours.

What are the typical features of a bank account?

You don't really earn interest

From the bank's point of view, your bank account hold funds that are readily accessible and so don't accumulate interest as there is no incentive for holding your funds there. If you're looking for a high interest rate, a savings account may be more suitable.

It comes with a linked debit card

This is a card that is linked to your bank account so you can access your money at EFTPOS facilities, online and at an ATM. In Australia, the two most common brands are MasterCard and Visa. Both also utilise the security chip technology, where you can use MasterCard PayPass or Visa PayWave to make purchases under $100 within a few seconds by holding your card in front of the reader.

You can sometimes get cash back

Some bank accounts offer cash benefits, giving you more value of your spending. There are normally a number of conditions, like the purchase needs to be conducted using PayWave or PayPass in Australia and under $100 in value. There are also time limitations to this benefit so make sure you read the terms and conditions beforehand.

You should get free domestic ATM network and access

Your debit card lets you access your funds from an Automatic Teller Machine (ATM). Your bank will also provide you with a network of ATMs that you can use for free. For example, Commonwealth Bank users can also use Bankwest ATMs for free. Westpac users can use BankSA, St.George and Bank of Melbourne ATMs for free. NAB users also have access to the RediATM network.

You can also use an international ATM network – but usually for free

Very limited bank accounts let you withdraw funds from an overseas ATM for free. But for the ones that do, there are a range of specific, partner ATMs that you can use for free globally.

You can link them to a savings account so you can easily transfer funds back and forth

Many financial institutions also give you the option of linking your bank account to a savings account. That way, you can easily transfer money back and forth to make the most of the higher interest rate from your savings account.

General bank account questions

Is there a fee involved for requesting a copy of my statement?

You will need to check with your specific bank for statement frequency and any fees. With most banks now offering online banking, you could also view and print a copy from there for no fee.

Is it possible to reverse a foreign exchange transaction on my transaction account?

You will need the help of your bank in most circumstances, but if you have the supporting documentation then you should be able to reverse a foreign exchange transaction.

Is it possible to cash out an international cheque?

Yes, some Australian financial institutions will accept an international cheque deposit, although the funds could take longer to clear and you may be charged international transaction fees.

Do foreign banks charge a fee to receive an international money transfer?

Yes, there are foreign banks who will charge your recipient upon receiving funds from an international money transfer. Remember to take into account exchange rates and recipient fees.

What's the difference between a bank and savings account?

The typical account holder should have one bank account for everyday use and a savings account to hold their savings. See the table below for a summary of the similarities and differences.

| Bank account | Savings account | |

|---|---|---|

| Purpose | Designed for spending and basically gives no interest | Designed for savings or accumulating wealth and generally gives a higher rate of interest |

| Features |

|

|

- Help! I've transferred money into the wrong bank account.

If the account you've transferred to by accident doesn't exist, then the transfer usually bounces back and a fee is charged from the bank for incorrectly entering the details. If the account does exist, then owner of the recipient account is legally required to notify the bank if they notice any extra funds that have been wrongfully put into their account. As soon as you've noticed that you may have transferred it to the wrong account, call up your bank to try and fix the problem ASAP. The whole process may take up to a month, as banks usually need to communicate with each other to attempt to get the money back.

If the account you've transferred to by accident doesn't exist, then the transfer usually bounces back and a fee is charged from the bank for incorrectly entering the details. If the account does exist, then owner of the recipient account is legally required to notify the bank if they notice any extra funds that have been wrongfully put into their account. As soon as you've noticed that you may have transferred it to the wrong account, call up your bank to try and fix the problem ASAP. The whole process may take up to a month, as banks usually need to communicate with each other to attempt to get the money back.

- Help! I think someone is trying to take money from my bank account.

If you're suspicious that someone is trying to take money from your account, or possibly be attempting to steal your identity, speak to your bank straight away. Ask exactly what information would have had to be provided to your bank for them to be able to access your account. If you're worried about identity fraud, speak to your local police station straight away – they may request that you change your driver's licence. You may also want to speak to some Government departments, such as Medicare and Centrelink for additional security features to your account.

And lastly, consider registering for VEDA credit alerts so you'll be notified if anyone tried to apply for credit in your name.

- Help! How can I apply for a Tax File Number?

If you're currently a student studying in Australia, you can apply for a Tax File Number through your school. You can speak to the school office or the careers advisor to organise your application. If you're not currently a student, you can apply for one through the Australian Tax Office.

- Help! What should I do if an ATM crashes halfway through my withdrawal?

If you do not receive your money first check with your bank to see if the funds were withdrawn from your balance. If so, you will need to lodge a complaint and wait to have the issue reconciled.

- Help! How do I find out what my bank transfer limit is?

You could either look through the terms and conditions document sent to you when the account was opened, access that document online through the bank’s website or call the bank directly and ask them.

- Help! Can overdrawing on my bank account affect my credit history?

No, overdrawing on your bank account should not affect your credit rating. However, if you were to apply for a loan with the same bank in the future, any overdraws would be displayed in your account records and your bank may query you as to why they occurred.

- Help! How do I find unclaimed money or money from bank accounts and bank dividends?

You can find unclaimed money that you may be entitled to using the Australian Securities and Investment Commission’s ‘Unclaimed money search’ tool on its MoneySmart website. You can search using your name or the Original Transaction Number (OTN) and review the results that appear. If you find unclaimed money in a bank account you will need to approach the relevant financial institution to make a claim for your funds.

- Help! How do I transfer money to another account in Australia?

You can do this by visiting your nearest bank branch or using your financial institution’s phone banking service, but the simplest way to transfer money is through your online banking account. The exact transfer process varies depending on your bank, but you’ll typically have to select the account you want to transfer funds from, provide details about your recipient (their name, BSB and account number) and specify the amount that you would like to transfer.

But wait, I still have more questions!

Q. I'm currently a pensioner and looking for a high interest savings account, can you recommend anything?

A. Please be mindful that finder.com.au is an online comparison and information service and is not in a position to be recommending products. Should you require financial advice, we highly recommend speaking to a financial planner.

Q. Do you have any information about refinancing a home loan due to divorce or separation?

A. Our article Refinancing after a divorce might be helpful.

Q. I'm going on exchange next year, what type of account should I use?

A. An international transaction account that doesn't charge foreign transaction fees or fees for using ATM overseas could be suitable. If you're staying there for longer than 6 months, a prepaid travel card may not be suitable.

Q. Does ANZ or Suncorp offer SMS alerts? I prefer that extra level of security.

A. Yes both ANZ and Suncorp offer this option if you chose it. Commonwealth Bank also provides this.

Q. Who declares the interest in a children's savings account?

A. Generally the parent is responsible for declaring the income received from a children's savings account, in the parent's income tax return. The child is only liable to declare the interest if they have opened the account themselves, the funds are their own (i.e. earned form employment) and the parents have no control or ownership over the account.

Q. What is the customer experience like with ME Bank?

A. Please be mindful that finder.com.au is an online comparison and information service and is not in a position to be providing subjective comments. Other sites, such as productreview.com.au may be a better source for this.

finder.com.au featured bank accounts

Compare the features of these bank accounts.

| Bank account | Debit card access | ATMÂ Withdrawal Fee |

|---|---|---|

| NAB Classic Banking | Visa | $0 |

| HSBC Day to Day | Visa | $0 |

| ING Direct Orange Everyday | Visa | $0 |

| CommBank Smart Access | MasterCard | $0 |

| Westpac Choice | MasterCard | $0 |

Hi i have a new account with bank sa what id the maximum daily funds transfer amount to s third party bank sa account

Hi Nae,

Thanks for your question.

If you are transferring to somebody else’s account within BankSA via Internet Banking, there is a cumulative limit of $5,000 per account per day with a maximum limit of $25,000 per day. For example, if you are transferring to 5 different accounts, you may transfer $5,000 to each account per day.

You can also increase your daily limit to $100,000 by completing the Internet and Phone Banking Payee Account Information form found on BankSA website. It normally takes up to 2 business days for the form to be processed.

Cheers,

Anndy

please help me with National Australia Savings Bank

Hi Joseph,

Thanks for your question.

How can we help you today with National Australia Savings Bank? :)

I’m travelling to Phuket, Thailand do Wednesday morning and will be needing to access some funds on my debit anz bank card, but I am unsure of the cost of fees that I explained be charged to get money out. Any information would be greatly appreciated. I have rung and asked the same question to an anz team member but they sent me an email which did not advise of the cost of fees.

Hi Scott,

Thanks for your question.

Assuming that you’re referring to the ANZ Access Advantage, here are the fees:

Overseas transaction fees – 3% of value (charged whenever you transact in a currency other than AUD)

Overseas ATM transaction fee – $5 (charged when you withdraw from a non-Aussie ATM)

Local ATM transaction fee – $Varies (charged by the ATM you’re withdrawing from, fee is decided on a case by case basis)

Hope this helps.

Can I do cardless cash

Hi there and thanks for your question.

Yes you can apply for an account that support cardless cash on this page.

Cheers,

Shirley