French rockstar economist Thomas Piketty ("Capital in the 21 Century") has updated some of his research on the rise in US inequality, and the new data shows just how much of a challenge incoming president Trump faces.

Despite the real economy more than doubling over the past 35 years, for half of all Americans, their share of the total economic pie has shrunk significantly, the new research has found.

This group - the approximately 117 million adults stuck on the lower half of the income ladder - "has been completely shut off from economic growth since the 1970s," Piketty and his team of economists found. "Even after taxes and transfers, there has been close to zero growth for working-age adults in the bottom 50 per cent."

The new findings, by Piketty, Emmanuel Saez and Gabriel Zucman, provide the most thoroughgoing analysis to date of how the income kitty - like paychecks, profit-sharing, fringe benefits and food stamps - is divided among the American population.

Stagnant wages have sliced the share of income collected by the bottom half of the population to 12.5 per cent in 2014, from 20 per cent of the total in 1980. Where did that money go? Essentially, to the top 1 per cent, whose share of the nation's income nearly doubled to more than 20 per cent during that same 34-year period.

Abundant documentation of income inequality already exists, but it has been challenged as incomplete. Studies have excluded the impact of taxes and value of public benefits, sceptics complained, or failed to account for the smaller size of households over time.

This latest project tries to address those earlier criticisms. What the trio of economists found is that the spectacular growth in incomes at the peak has so outpaced the small increase at the bottom from public programs intended to ameliorate poverty and inequality that the gap between the wealthiest and everyone else has continued to widen.

Average incomes, adjusted for inflation, grew by 61 per cent from 1980 to 2014. But nearly $US7 out of every additional $US10 went to those in the top tenth of the income scale.

Here's more at the New York Times

Mexico has dominated headlines from Latin America in 2016 thanks to the market swoons sparked by US president-elect Donald Trump. But the region has been far from a money-loser.

In fact, five of the year's 10 best-performing stock indexes can be found there, led by the 61 per cent surge in Brazil's Ibovespa through Wednesday. Four of the top 10 developing-nation currencies hail from the region. In the bond market, Venezuela has handed investors some of the largest gains in the world, with its debt returning 54 per cent.

Despite the pall over Mexico and prospect of higher US interest rates, Latin America watchers like Ashmore Group's Jan Dehn expect investments in the region to pay off handsomely in 2017.

He says Brazil looks poised to lead the way again as its economy - the region's largest - rebounds and policy makers chop borrowing costs, luring investors to its financial markets. Argentina and Peru, buoyed by business-friendly presidents and rebounding commodity prices, are also seen as destinations for potentially lucrative trades.

"Latin America will recover more than other regions in GDP terms and do more reforms," said Dehn, a London-based head of research at Ashmore Group, whose top pick is Brazil.

While Brazil's prospects continue to improve, Mexico's outlook is more mixed. Trump's pledges to rip up the North American Free Trade Agreement and build a wall along the southern border have unsettled investors in assets from the region's second-biggest economy, with the peso plunging 16 per cent this year. Mexico sends almost 80 per cent of its exports to the US.

Pessimism towards Mexico isn't universal.

The country's stocks and currency were actually the top investor picks for 2017 in a survey that UBS conducted at an emerging-market conference last week. Still, it was far from a consensus view: more than 10 per cent of respondents said they expected Mexico to be the worst-performing major market next year.

It's a fairly uneventful day on the ASX - except for gold stocks which are getting smoked again, in a terrible week for investors in the sector.

The All Ords gold index has slumped to its lowest in over 8 months, falling as much as 7.1 per cent, or more than 13.5 per cent this week, wiping nearly $5 billion off the value of gold mining stocks.

All 20 stocks in the index are posting losses over the week, with heavyweight miner Newcrest down 13.2 per cent (see table).

Meanwhile, the gold price is holding up in Asian trade, gaining 0.1 per cent to $US1131 an ounce. But it's fallen about $US30 or 2.5 per cent this week and is heading for a sixth weekly loss, down 17 per cent from its 2016 highs in July.

The falls come as a more aggressive Federal Reserve combines with investor enthusiasm about President-elect Donald Trump's policies to push prices closer towards bear-market territory.

The steady improvement in the US economy and firming inflation that was fairly apparent prior to the election have in turn raised the probability of future Fed rate hikes and a potentially stronger US dollar.

"The Trump victory has delivered the sum of all fears to gold investors due to the combination of anticipated pro-growth tax reform, a rollback of the hyper-regulation of the Obama administration, and the potential for fiscal stimulus," said Troy Gayeski, a senior portfolio manager at SkyBridge Capital.

There's also the "faster pace of Fed tightening, sharp increases in long-dated interest rates, and a stronger dollar. All of these factors have diminished the rationale for owning gold."

US bond yields are set to keep rising, thanks to tightening monetary policy and a growing uncertainty of just how the incoming president will manage the world's largest economy, say experts.

Investors are cashing in their bonds as global growth optimism coupled with rising inflation expectations sweeps through markets, sending the US 10-year yields to a fresh two-year high above 2.6 per cent overnight.

Aussie bonds have been caught up in the selloff, which this morning sent the yield on the 10-year government bond to a fresh 2016 high of 2.932 per cent (bond prices and yields move in opposite direction).

Capital Economics chief market economist John Higgins believes the selloff still has some way to go, saying a faster than expected pace of Fed rate hikes coupled with the unpredictability of the incoming Trump administration would keep investors from snapping up US bonds, thus sending yields even higher.

"We suspect that investors will demand more compensation for the uncertain outlook for policy under a Trump administration," Higgins said, citing Trump's attitude towards monetary policy as a possible risk.

"If the President-elect meddles with the Fed's independence, we think yields could rise substantially."

In addition, Higgins is wary of how much demand there will be for US government debt should the President-elect go ahead with his stimulus spending plans.

He points to the US Federal Reserve no longer adding to its holdings of Treasuries as one source of demand drying up, and suggests the central bank may in fact start selling them depending on who President-elect Trump appoints to the committee.

In addition, China is more focused on supporting its currency in the face of a surging US dollar, and is selling rather than increasing its holding of US government debt and banks' appetite for Treasuries, previously propelled by regulatory pressures, looks to have eased.

For these reasons, Capital Economics has revised up its forecasts for the 10-year Treasury yield, to 3.5 per cent for the end of 2017 and 4 per cent for the end of 2018.

AMP Capital Investors head of investment strategy Shane Oliver agrees that over the mid-term bond yields are set to rise further, but he reckons that in particular local bonds look oversold and could be in for a short-term rebound.

"Ten-year bond yields at 2.9 per cent look out of whack with the likelihood that the Reserve Bank will cut rates again next year or at the very least won't be raising them until 2018 at the earliest," he said.

The road back down for this year's best-performing commodity may be bumpy.

While spot prices for coking coal have dropped about 16 per cent this month from a record high above $US300 a tonne, possible heavy rain and flooding in Australia over the next few months may stall, or even reverse, the decline.

The region is forecast to see an above-average number of tropical cyclones this season and disruptions may blunt the impact of rising output from China, the world's biggest producer, which reached the highest in a year last month.

China's effort to curb production helped to tighten coal supply, leading to a near quadrupling of the spot metallurgical price this year and making it the best performing commodity in 2016.

The surge has been a boost to miners, with recent contract negotiations between producers and Japanese steelmakers resulting in the fourth quarterly gain and the highest accord since 2011.

"The industry remains vulnerable to a weather event in the next couple of months," said UBS analyst Daniel Morgan. "I don't think we're going to see a rapid price decline in the near-term because supply is still tight and there is an Australian wet season to navigate."

Spot hard coking coal was unchanged at $US260.50 a tonne on Thursday, according to data from The Steel Index. Prices have slipped from $US308.80 a tonne reached last month, a record for the gauge that started in January 2013. They opened the year just below $US80.

China's output of coking and thermal coal in November increased by 13 per cent from the previous month as the nation loosened its production policy. While miners boost supply ahead of winter for power generation, Macquarie Group estimates that restrictions have been lifted on about 55 per cent of lost metallurgical coal production capacity.

2016 has proved to be a turning point for a number of things, but in the sharemarket it put an end to the "momentum trade", where investors jump into stocks that have been rising and where consensus among analysts is most bullish.

The momentum trade worked well in 2014 and also in 2015, but this year it burnt many investors badly, mainly because many macro indicators fund managers keep an eye on turned abruptly, eg iron ore price, oil price or bonds.

"There hasn't been a turnaround year like this since 2009," says Credit Suisse analyst Hasan Tevfik. "As momentum strategies struggle around turning points we find both the buy-side and broker consensus stock picks also struggled over the last 12 months."

What specifically went wrong?

Tevfik finds the poor performance was concentrated in the short ideas.

"A year ago, when the iron ore price was hovering around a 10-year low of $US37 both sides of consensus (fundies and brokers) were expecting more downside to come," he says, citing Fortescue's meteoric 250 per cent rally as an example how many shorts were punished.

Going into 2017 the buy-side is again putting on the momentum trade but now this means a long position on commodity stocks such as South 32, Origin, Aurizon and Bluescope, while the brokers have a clear long position in gaming and are owners of Star Entertainment, Crown and Aristocrat, Tevfik says.

"They are also taking a more contrarian view on commodities and are, yet again, shorting Fortescue."

Tevfik notes that stocks in Credit Suisse's portfolio of shares bought by both fund manager and brokers have generated positive returns in each of the last six years and also beaten the market in five of those.

Going into 2017 these stocks are Aristocrat, Bluescope, Caltex and ResMed.

Turmoil has erupted in Chinese bond markets as panicked investors have dumped Chinese bonds on fears that Beijing will be forced to respond to rising US rates by raising Chinese interest rates, even though this would deliver a hefty blow to debt-laden Chinese companies.

In trading yesterday, Chinese authorities took the the unprecedented step of halting trade in key bond futures contracts, after heavy selling pushed prices sharply lower. Trading only resumed after China's central bank, the People's Bank of China, eased worries about a shortage of liquidity by injecting $US22 billion nto the short-term money market.

All the same, the yield on Chinese 10-year bond finished at a 16-month high of 3.4 per cent, extending the sell off in the bond market that began in November, but which has picked up pace this week. (Yields rise as bond prices fall.)

Investors are worried that this week's move by the US Federal Reserve to hike official interest rates will put pressure on Beijing to raise interest rates for the first time since 2011 in order to stem huge capital outflows. Chinese investors have responded to the outlook for higher US interest rates and the strengthening US dollar by channelling more funds offshore, putting massive downward pressure on the Chinese yuan, which is now trading at a fresh eight-year low against the US dollar.

Analysts argue that unless Beijing can find some way of stemming capital outflows, the decline in the yuan, which is already down more than 6 per cent against the US dollar so far this year, is set to continue.

But the devaluation in the yuan is set to intensify conflicts between Washington and Beijing. US President-elect Donald Trump has accused China of devaluing its currency, raising the likelihood that he will label China a currency manipulator when he takes office. This would allow the US to impose tariffs on Chinese imports.

To stem the yuan's slide, China's central bank has been selling down its foreign exchange reserves, which have dropped 25 per cent to $US3 trillion in the past two years. But some analysts believe Beijing will be forced to take tougher action - including interest rate increases - in order to support the Chinese currency.

Mayne Pharma shares have plummeted after the company confirmed it is facing lawsuits brought by multiple US states over allegations it engaged in a conspiracy with others to fix prices on two generic drugs.

Mayne is one of a number of US generic drug companies facing proceedings in the US District Court of Connecticut over anti-competitive conduct in relation to the drug doxycycline hyclate.

"The board continues to believe the investigation and the legal proceedings will not have a material impact on its future earnings," the company said in a statement to the ASX.

The civil lawsuit is one piece of a broader generic drug pricing probe under way in the US. It has grown over the past two years to include multiple drugs and companies.

Twenty US states filed the a lawsuit overnight, saying the drug makers conspired over steak dinners and "girls nights out" on pricing of two common generic drugs, according to a copy of the complaint.

The civil lawsuit, led by antitrust investigators in Connecticut, came one day after the US Department of Justice filed criminal charges against two generic drug industry executives, alleging that they colluded to fix prices and split up market share.

Taken together, the cases are part of a broader generic drug pricing probe that remains under way at the state and federal level, as well as in the US Congress. In 2014, media reports of sharply rising drug prices led to Congressional hearings.

Mayne Pharma shares are down 17 per cent at $1.19, the worst performer on the ASX.

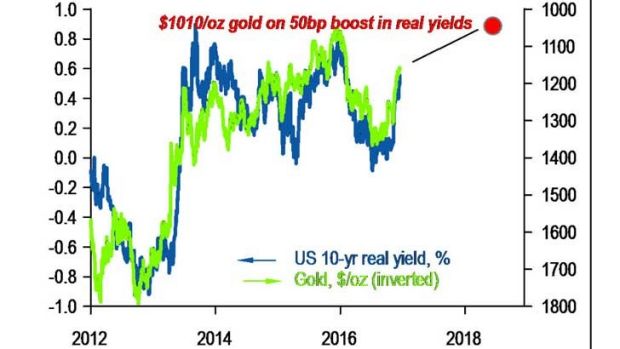

The bad news for gold bulls just keeps coming, as surging bond yields take the shine off the precious metal and prompt predictions of further falls.

The Fed's hints at a faster pace of rate hikes in 2017 sparked another rally in the US dollar, pressuring assets priced in the currency, while US Treasury yields soared, lifting the opportunity cost of holding non-yielding gold.

The precious metal is trading just above a 10-month low of $US1122 an ounce it hit overnight.

And JPMorgan head of commodities John Normand reckons it could fall another $US100 if US yields continue to rise.

"If real yields rise another 50 basis points – since inflation will offset some of the rise in nominal rates – then gold could fall another 12 per cent to $US1010 an ounce," he predicted.

After its best first half in almost four decades, gold's gains for the year have deteriorated, with prices headed for the worst quarterly loss in more than three years.

Sentiment turned negative for bullion as investors found better returns elsewhere, with US equities rising to records, the US dollar strengthening and Treasury yields climbing amid speculation that President-elect Donald Trump's spending plans may accelerate the nation's growth.

"The economy seems to be doing good, and you've also got the Trump effect, which has been bad for gold and good for stocks," said Fain Shaffer, the president of Infinity Trading Corp. "We're recommending to short gold. There's really no reason to own gold."

ANZ chief executive Shayne Elliot says the current operating environment is dominated by headwinds, none of which are likely to change soon.

"Left unmanaged, they will drive down shareholder returns and further distance banks from customers as we become more internally focused," Elliot told shareholders at the company's annual general meeting.

Elliot said ANZ is in a period of consolidation, simplification and transition, aimed at making the bank leaner and more focused.

Meanwhile, over at the NAB AGM, chairman Ken Henry focused on infrastructure spending, saying Australia needed a much more considered and forward-looking approach to infrastructure planning.

Henry told shareholders meeting there needs to be significant infrastructure investment over the next few decades to fully harness the economic opportunities after an uncertain 2016.

He said NAB expected the non-mining economy to "grow moderately"

led by the services sector, but business investment "has not yet

picked up".

Like ANZ's Elliot, Henry, a former Federal Treasury secretary from 2001 to 2011, warned that headwinds were persisting, and Australia needed to step up to become more productive.

Shares have opened flat as gains in iron ore miners and energy stocks are offset with losses in most other sectors.

The ASX is up just 0.2 of a point at 5538.6, despite stronger gains on Wall Street overnight.

Stock markets are continuing to do relatively well in the face of rising interest rates, says CMC chief market analyst Ric Spooner.

"While this partly reflects an improved earnings outlook, it's also about funds flowing out of bond markets needing a home," he said. "Stock markets appear to be one of the main beneficiaries of the bond sell-off."

However, gold is a continued casualty of the rise in bond yields and the US dollar and it's showing in early trade.

Newcrest is one of the biggest losers, falling another 5 per cent. Other gold miners are also under pressure.

Mayne Pharma is the biggest loser among the top 200 stocks, sliding more than 16 per cent after a US subsidiary was hit by a lawsuit against generic drug makers over alleged price fixing.

Meanwhile, Fortescue is rallying 3 per cent after iron ore prices jumped around that level overnight.

Rio Tinto has been hit with a new class action in the US, which claims the company's Guinean scandal has caused damages and losses for holders the of Rio's American securities.

The class action complaint was filed in a New York court in recent days, and also names two former Rio chief executives (Sam Walsh and Tom Albanese) and two of the company's former chief financial officers (Guy Elliott and Chris Lynch) among the defendants.

The plaintiff, Jeffery P. Weiner Supplemental Trust, bought Rio American Depositary Receipts (ADR's) between March 16, 2012 and November 14, 2016.

Weiner alleges that Rio Tinto and the four former executives made materially false and misleading statements when they claimed in multiple annual reports that the company was "operating within all applicable laws and regulations" in the nations where the company operated.

Weiner claimed that updates on progress toward developing the iron ore deposit at the heart of the Guinea scandal, Simandou, also contained false and misleading statements.

The claim is ironic on one level, given that the value of Rio ADR's has risen since the scandal emerged on November 9 when Rio announced that it had contacted fraud and securities regulators over a series of leaked emails that discussed a controversial $US10.5 billion payment to a political advisor in Guinea.

Rio's ADR's were fetching $US38.24 on November 9, and had risen to $US41.50 by the day Weiner filed his case in a New York court this week. Rio's Australian shares have also risen since the scandal became public.

But the value of Rio's ADR's have fallen by about 28 per cent over the 56 month period outlined by the class action, which covers much of the mining industry downturn.

SPONSORED POST

The Trump trade is back on, but it lacked the momentum to push the Dow above 20,000 points, says IG analyst Gary Burton:

The Dow was led up by the financials on expected margin improvements with still positive data flowing which saw the core CPI up 0.2 per cent for November.

This is what the global economies are looking for, real price growth, this has seen energy prices rise, and reaffirms the FOMC rate decision and the forward dot plot.

2017 could be described as the year the central bankers start to move off stage.

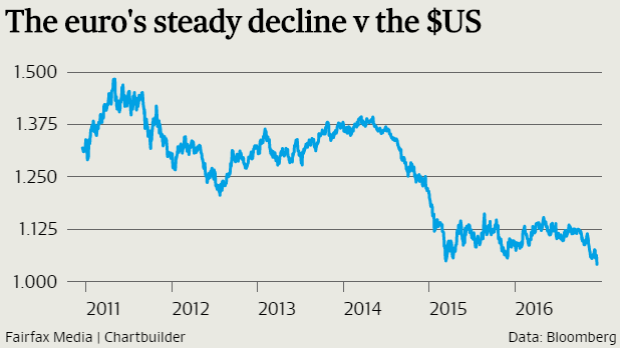

The US dollar continues to crush everything in its path, the benchmark dollar index has traded clear of the 1.02 resistance, making a high overnight at 1.0356 the highest since 2002 a continuation of the current bullish trend. Our technical price target for the USD basket DXY now sits at DXY 1.077, inferring the pressure will remain on the EURUSD pair which last night traded below the key 1.05 level and briefly thru 1.04 to make a low at 1.0366 to find support back over the key 1.04 level.

USDJPY trades at 118.11 and the weakening yen will lift the Nikkei again as the Japanese goods and services appear cheaper on an exchange rate basis.

Gold marching towards the technical price target of $US1100oz last night trading below $US1130 a solid $US30 move lower form the time of the US rate decision.

Australian gold miners are expected to remain under pressure as the spot price looks for price support. The AUD price of Gold also makes a new 2016 low overnight at $1536oz adding pressure to the current equity price levels.

The US dollar keeps chugging higher, hitting its highest level in 14 years against a basket of major currencies in anticipation of a more hawkish Federal Reserve and a boost in US economic growth under President-elect Donald Trump.

The dollar index, which measures the greenback against a basket of six major rivals, jumped as much as 1.5 per cent to a roughly 14-year high of 103.320. It was on track for its biggest daily percentage gain in nearly six months.

The Aussie dollar remained under pressure, falling as low as US73.38¢ overnight as investors shrugged off strong local jobs growth and focused on the greenback.

Westpac senior market strategist Imre Spizer said the momentum in the Aussie has "flipped to negative", thanks to the US dollar's surge.

"The US dollar has had an impressive rise since the US election and has potential to rise further during the months ahead," he said

The US dollar's gains, which included a roughly 14-year high against the euro and a nearly 10-1/2-month high against the yen, came a day after the Fed raised interest rates for the first time in a year and signalled it was likely to hike three more times in 2017, up from the two increases forecast at the central bank's September meeting.

"There is an expectation that there is going to be a strong economy next year with the Fed raising rates, and that is being reflected in the dollar's strength globally," said Douglas Borthwick, managing director at Chapdelaine Foreign Exchange.

Analysts said the US dollar was also gaining on expectations that the incoming Trump administration's economic plans would complement the Fed's pace of rate increases and boost the dollar further.

Barclays expects the euro to reach parity with the US dollar by the third quarter of 2017 and then to fall below $US1, while JP Morgan Asset Management expects the two currencies to become equal in the first quarter of next year.

US stocks rebounded overnight, led by gains in bank shares, a day after the Federal Reserve raised interest rates for the second time in nearly a decade.

Investors initially hit sell in response to a more hawkish Fed, which now sees three rate hikes next year instead of the two foreseen in September. But a day after the decision the market shifted tack, focusing more on the strengthening economy.

Growth is likely to benefit as a result of the fiscal stimulus expected to hit under President-elect Donald Trump. Trump's spending plans could trigger inflation and bring about higher interest rates, making banks a likely winning sector in the new administration.

Art Hogan, chief market strategist at Wunderlich Securities in New York, said the advance in bank shares also reflects a rotation into a sector which had been stagnant during most of the multi-year rally that has seen major indexes hit record highs.

He added that if Trump's deregulation plans come through, lenders will benefit as they are "one of the most regulated sectors. The one Trump sector you can be sure of is financials," Hogan said.

The S&P 500 has risen just under 6 per cent since the November 8 election, but its banks component has risen almost 25 per cent since.

The Dow Jones industrial average rose 59.71 points, or 0.3 per cent, to 19,852.24, the S&P 500 gained 8.75 points, or 0.39 per cent, to 2,262.03 and the Nasdaq Composite added 20.18 points, or 0.37 per cent, to 5,456.86.

The strength of the rally in stocks has triggered concern that the market is technically vulnerable, or overbought, while the recent rally in the US dollar, while indicative of a strong economy, has also raised alarms over the negative effect on earnings of companies with overseas exposure.

"The thought is that earnings will be better and the economy is strong enough to be able to withstand higher interest rates, and that is why we're not seeing a decline in stocks," said Paul Nolte, portfolio manager at Kingsview Asset Management in Chicago.

"That being said, the stronger dollar and higher interest rates will at some point filter through to earnings. It's just a matter of when and how."

Economic data on Thursday showed US consumer prices moderated in November, but the underlying trend continued to point to firming inflation pressures.

Let's start off with the overnight scoreboard:

- SPI futures up 14 points to 5499

- AUD -0.7% to 73.57 US cents (overnight low 73.38)

- On Wall St, Dow +0.3%, S&P 500 +0.4%, Nasdaq +0.4%

- In New York, BHP -1.4%, Rio -2%

- In Europe, Stoxx 50 +1.2%, FTSE +0.7%, CAC +1.1%, DAX +1.1%

- In London, BHP -3.2%, Rio -2.5%

- Spot gold -1.3% to $US1128.69 an ounce

- Brent crude +0.4% to $US54.09 a barrel

- Iron ore +3.2% to $US81.50 a tonne

- Coking coal flat at $US270 a tonne; thermal coal +1.5% at $US88.9 a tonne

- LME aluminium -0.6% to $US1736 a tonne

- LME copper +0.2% to $US5732 a tonne

- 10-year bond yield: US 2.60%, Germany 0.36%, UK 1.48%, Greece 7.15%, Australia 2.87%

Good morning and welcome to the Markets Live blog for Friday.

Your editors today is Jens Meyer, who welcomes your feedback at jmeyer@fairfaxmedia.com.au

This blog is not intended as investment advice.

Fairfax Media with wires.

1 new post(s) available. View post(s) Dismiss