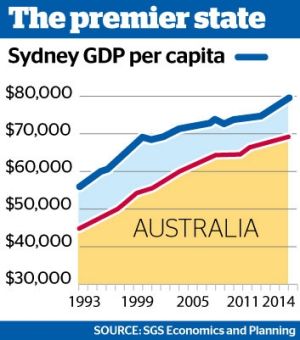

Income per person in Sydney's booming economy has climbed to $80,000 a year, eclipsing the rest of NSW by more than $32,000.

The value of goods and services produced in Sydney topped $400 billion for the first time last financial after the city's economy grew by 4.5 per cent, the fastest rate in 15 years and the third best on record.

More BusinessDay Videos

How to save money in Sydney

A strategic guide to cutting the cost of living in Australia's most expensive city.

That pushed Sydney's share of the national economy to a decade-high of 24.1 per cent, a report on the economic performance of Australia's cities and regions shows.

Terry Rawnsley, the report's author and an economist at SGS Economics and Planning, said the analysis underscored how important Sydney was to the national economy.

"These numbers just reinforce how Sydney is in a different league compared to the rest of the country," he said.

Nearly 40 per cent of all growth in the Australian economy last financial year was generated in Sydney – the largest proportion in nearly a quarter of a century.

But as Sydney prospers, the rest the state is languishing. Regional NSW grew by just 0.4 per cent in 2015-16 following zero growth the year before.

Mr Rawnsley said a prolonged downturn in regional manufacturing had been a factor.

"Over the past decade, manufacturing production has declined by more than 20 per cent in regional NSW," he said.

Income per person in regional NSW stood at $47,800 in 2015-16, having fallen in each of the past four years.

A $32,200 gap has opened up between Sydney's per capita income and the rest of NSW. That was the biggest disparity on record, Mr Rawnsley said.

Sydney's GDP per person was also $10,600 higher than the national figure – the highest margin since 2004-05.

NSW Treasurer Gladys Berejiklian said key indicators including jobs growth and housing approvals were strong in regional NSW last financial year but she acknowledged "pockets of challenge" across the state.

About a third of infrastructure spending planned by the state government will be in regional areas.

"We believe public investment encourages private investment, and as we continue to deliver infrastructure in our regions we expect to see ongoing growth in the years to come," she said.

The report on city and regional economies, prepared annually by SGS Economics and Planning using Bureau of Statistics data, drew attention to a growing growth gap between Australia's two biggest capitals and the rest of Australia.

Sydney and Melbourne together generated 67 per cent of all growth in Australia's gross domestic product in 2015-16 – the highest level of record.

Mr Rawnsley said the wide variation in regional growth rates was a challenge for the Reserve Bank.

"The RBA has to manage booming economies in Sydney and Melbourne while the rest of the country is struggling to grow in the face of a range of headwinds," he said.

Mr Rawnsley estimates that if Sydney had its own hypothetical Reserve Bank its official interest rate would have been 3.75 per cent last year – well above the current national rate of 1.5 per cent. A hypothetical Reserve Bank of Melbourne would have a rate of 2.25 per cent.

However, six other regions – including regional NSW and regional Victoria – would have a hypothetical interest rate of just 0.25 per cent, Mr Rawnsley estimates.

Sydney had the highest GDP per capita among the major cities ($80,000) followed by Perth ($71,800) Brisbane ($67,300), Melbourne ($65,400) and Adelaide ($59,600). Regional NSW ($47,800), regional Victoria ($48,800) and Tasmania ($50,300) have the lowest GDP per capita.

Regional Western Australia has by far the highest regional GDP capita ($278,100). But it is driven by the unique production methods used for the extraction of iron ore and other minerals.

Sydney's biggest industries

Banking and finance has become more deeply entrenched as Sydney's biggest industry, accounting for about one in every six dollars generated by the city's economy.

Financial services had a 16 per cent share of the Sydney economy last financial year, a record high according to the SGS Economics and Planning report.

"Sydney's role as a major financial hub has provided access to global capital flows, which over the past few years have been flooded with liquidity," it said.

"The strong growth in Sydney's largest industry, and low interest rates, have helped support growth across a broad range of industries."

Figures on Sydney's industrial structure emphasised how knowledge-based services now drive the city's economy. The city's second biggest sector was professional services (about 8.5 per cent) and third biggest was health care (almost 6 per cent).

Manufacturing was one of the few sectors to contract last financial year. Two decades ago manufacturing was Sydney's biggest industry by a considerable margin but last year its share slumped to an historic low of 5.7 per cent.

While financial services made the biggest contribution to Sydney's growth in 2015-16, both construction and real estate services were also prominent economic drivers thanks to the city's robust property market. The construction industry's contribution (0.7 percentage points) to Sydney's GDP growth was the highest on record, the report said.

Sydney's labour productivity grew faster (1.2 per cent) than the national average (1.0 per cent) in 2015-16, and is now at a record high of $90 per hour worked.