For all the talk of the Aussie dollar weakening of late, on a trade-weighted basis the currency has climbed close to 6 per cent since mid-September, UBS economist Scott Haslem reckons.

Over that timeframe the Aussie is off 2 per cent against the US dollar, so the higher trade-weighted currency reflects strength against the Euro, the pound and the Chinese yuan, "among others", Haslem says.

So what now? Is it time for the RBA to start talking down the dollar? Or, as Haslem puts it, is now the moment for "renewed 'open mouth operations'"?

"For much of this year, the RBA has stayed sanguine on the AUD, but noted repeatedly that 'an appreciating exchange rate could complicate' the economy's rebalancing," Haslem writes.

"It's thus not surprising that each time the AUD approaches around 77-78 US cents, or the TWI rises above the RBA's forecasts (as it has done since their May and August statements), investors contemplate the extent the RBA may either heighten their 'open mouth operations' to talk the AUD lower, or ultimately respond by trimming the cash rate further."

But there are two reasons that the RBA won't begin leaning against the dollar, Haslem concludes. First, annual GDP growth is running at 3.3 per cent - "arguably above-trend". Secondly, commodity prices are up by around 30 per cent in 2016.

The attached chart shows Haslem's recreation of the RBA's fair-value model for the Aussie.

"Given the lagged manner in which trailing commodity prices enter the fair value calculation, today's AUD appears to be in the order of 5 per cent over-valued," he writes. "However, readjusting fair value to reflect today's spot prices – the red dot in the chart – the AUD appears much closer to fair."

In conclusion, Haslem writes:

The bottom line is that unless the AUD moves significantly higher, a moderate drift higher in the AUD from here under current conditions is unlikely to overly worry the RBA or be a catalyst for further RBA rate cuts.

The AUD's recent correction lower in US dollar terms is likely being welcomed by the RBA. Indeed, to approach the top of the RBA's (5 per cent) fair value range, when recent commodity price movements are largely reflected, the AUD would need to rise above US80 cents.

For iron ore, it is the morning after the night before. Prices have given up almost all of the gains inspired by Donald Trump's surprise win and a speculative frenzy in China, with a surge in port stockpiles in the top user reminding investors that fundamentals still count.

Iron ore futures in China have dropped 2 per cent as steel prices hit their weakest in almost three weeks, reflecting concern over slow demand as winter approaches. Chinese iron ore futures have fallen 16 per cent from a 33-month peak as a rally earlier this month lost steam last week following a series of measures by China's exchanges to crack down on speculative trading in commodities including increased transaction fees.

Iron ore for January delivery on the Dalian Commodity Exchange was down 2 per cent at 550.50 yuan ($US80) a tonne. On Friday, the spot iron ore price fell 1 per cent to $US72.79 a tonne, ending the week nearly 9 per cent lower, after rallying the previous five weeks.

"The price has increased too fast and away from fundamentals so going down should be natural," said a Shanghai-based iron ore trader. "Overall iron ore supply is still more than enough and the only issue was because of high coking coal prices, it created some short-term tightness in high-grade iron ore."

The surge in prices of coking coal, also used in steelmaking, had prompted Chinese mills to use better quality iron ore so they would use less of the fuel. But the ensuing retreat in coal prices had eased demand for high-grade iron ore, the trader said.

"The speed of the recent rally leaves it open to the charge that price action has been too much, too fast," Dane Davis, an analyst at Barclays, said in a note that asked "After the party....the hangover?"

The balance of risk for iron as well as copper is skewed to the downside as the US dollar strengthens and the effects of Trump's win wear off, according to Davis.

Iron ore prices barrelled to a two-year high this month as investors celebrated Trump's victory on the outlook for infrastructure spending at the same that commodities futures volumes surged in China.

"As it did earlier this year, China has cracked down on speculation in the iron ore market," Davis said. "With these stricter standards in place, the iron ore price should continue to ease off recent highs, though it may find support from continued highs in other steel raw materials, such as met coal, and a domestic steel market that looks to set to grow production in 2016."

Treasurer Scott Morrison has left open the door to considering a Grattan Institute proposal to curb or scrap three aged-based tax breaks that cost the budget $1 billion a year.

While he emphasised that the government already has a full program of savings measures it's pushing hard to win Senate approval for, he didn't reject the Grattan suggestions out of hand.

The institute on Monday called for government to remove a series of three perks it says are unjustified and flow primarily to people who are well off and over 65 at a time when younger households are carrying an ever-growing burden for budget repair.

With the government already cracking down on so-called middle-class entitlement to help repair the budget, the Grattan proposals are aimed at spreading to load to older Australians by bringing them into line with working-age households on lower incomes.

Asked whether the government would consider the ideas, Mr Morrison said his main focus was on ensuring an existing plan to impose savings on superannuation tax concessions that is currently before the parliament is passed.

"The Grattan Institute have speculated on any number of different types of measures that can be considered," Mr Morrison told reporters in Canberra.

"There is no shortage of advice or suggestions provided to the government but our priority at the moment is there is already a fiscal consolidation plan before the parliament.

"It's important the Parliament deals with that business and that business needs to be dealt with over the next fortnight and indeed in the autumn sittings of next year before we bring down the next budget."

The nation's peak welfare lobby group, the Australian Council of Social Service, lent its support to the Grattan proposals, which it says would help reduce a "budgetary time bomb".

"The report confirms that just one in six (16 per cent) of people aged over 64 pay any income tax, despite many of them being wealthy enough to pay rates more in line with the reset of the population," said ACOSS chief executive Cassandra Goldie.

"There is no valid reason to give people a higher tax threshold based on age alone," she said.

Cutting tax breaks for seniors?

Reducing tax breaks for seniors could save the government about $1 billion a year in lost tax returns, says the Grattan Institute. Vision courtesy ABC News 24

The three Australian employees of James Packer's Crown Resorts detained in China after a series of nationwide raids last month have been formally arrested, all but ensuring months more in custody as authorities prepare to move to trial.

A fourth Australian, who was detained in connection with the case but is not a direct employee of Crown, is also understood to have been formally arrested.

A total of 18 Crown employees – including Australians Jason O'Connor, Jerry Xuan and Pan Dan, Malaysian Alfread Gomez and 14 Chinese nationals – were detained in a coordinated police operation across several Chinese cities on October 13 and 14. Only one, Shanghai-based administrative assistant Jiang Ling, a Chinese national, has been released on bail.

Relatives of those in detention confirmed Chinese authorities had begun to issue formal notification of the arrests on Sunday.

"The notice just says they have been arrested under 'gambling crimes', that's it," said one family member, who declined to be named, adding they hoped to convene with their lawyers shortly.

The formalisation of the arrests came within the standard 37 days of detention allowed under Chinese law. Further investigation will now be carried out before charges are formally made and the case handed over to court prosecutors, a process that could drag on for months.

It is illegal to promote or organise gambling activities on mainland China. While the arrests have been made on the apparent basis of "gambling crimes", the final charges will not be determined until the case moves to trial.

The coordinated raids against Crown's operations comes amid a broader anti-corruption blitz targeting money laundering and illicit money transfers offshore.

Speculation remains rife in the Asian gaming industry as to why Crown has been targeted when other foreign casinos – and myriad junket operators – have also been active in marketing to potential customers on the mainland.

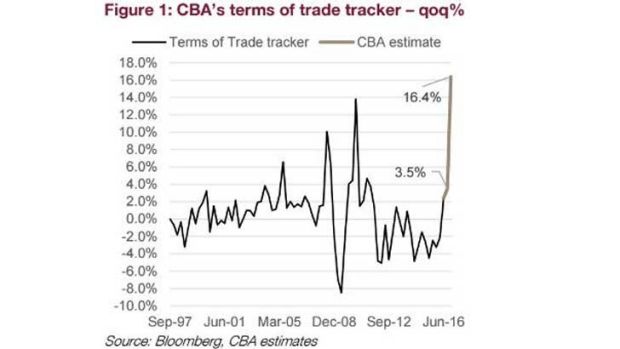

Despite a possible record spike in Australia's terms of trade this quarter, CBA commodities analyst Vivek Dhar does not believe in another resources-led renaissance of the economy.

"Commodity producers have not responded to rising commodity prices like they have previously. Investment in new greenfield projects remains subdued despite spot prices hovering well above incentive prices – particularly in iron ore and coal markets," Dhar says in a note to clients.

Producers were responding to higher commodity prices by restarting idled operations, such Glencore's Integra coking coal mine, where the capital cost is low and the return was more immediate, he said, adding that miners were also looking to return their cash back to shareholders, reducing debt or investing in further cost reduction initiatives.

"The reluctance reflects justifiable caution by miners on the outlook of the Chinese economy and whether there will be demand for additional commodity volumes when new projects come online. Chinese commodity demand has been supported this year due largely to Chinese policy providing a reprieve to its ailing commodity‑intensive sectors."

But he still expects the Aussie dollar, budget revenues, company profits and nominal GDP to get a boost from the higher terms of trade, signalling an end to risks of slowing income growth.

"Our export indicator also points to an imminent return to trade surpluses, another positive for the economy," he says.

Dhar says it's possible the rise in commodity prices, particularly iron ore and coal, could boost Australia's terms of trade by a record 16.4 per cent in the fourth quarter (from Q3), if spot commodity prices stay at their current levels, but reckons it's more likely the rise will be a bit below the current record of 14 per cent as commodity prices moderate over the rest of the quarter.

Donald Trump interviewed top investment executives for the role of Treasury Secretary as the president-elect continues stitching together the administration that will take over the White House in January.

Meetings at the Trump National Golf Club in Bedminster, New Jersey, on Sunday with Trump and Vice President-elect Mike Pence featured at least three potential candidates with deep Wall Street experience, including the billionaire investor Wilbur Ross and Jonathan Gray, global head of real estate at Blackstone Group.

David McCormick, president of the hedge fund Bridgewater Associates, also met with Trump. McCormick, a West Point graduate who served in the first Gulf War, later worked at Treasury and in the White House during the George W. Bush administration.

All three are in the running for Treasury secretary, said a person familiar with the hiring process. Steven Mnuchin, a member of the transition team's executive committee, is thought to be the front-runner. The final decision could hinge on whether Trump opts for a loyal and known quantity -- Mnuchin was also the finance chairman of his presidential campaign -- or looks outside his inner circle.

Ross, who may be on the short list for commerce secretary as well, spent about 30 minutes with Trump, with both men declaring it a "very good meeting." Ross, who turns 79 next week, was involved in high-profile bankruptcy restructurings in the 1980s and 1990s, including those of Eastern Airlines and Drexel Burnham Lambert.

The president-elect was due to head back to Manhattan Sunday evening and has at least one more day of meetings scheduled.

"When the president-elect is ready to announce folks, he will," spokesman Jason Miller said. "He wants to make sure he gets it right the first time."

The Aussie sharemarket could "potentially co-exist" with even higher bond yields, as long as the moves from here are less frenetic than the past couple of weeks, UBS strategists reckon.

The ASX looks "moderately expensive" on a price-to-earnings ratio basis, "somewhat cheap" on a price-to-book measure, but still "reasonably attractive" against what are still very low interest rates against history.

"A significant fresh leg-up in the bond yield sell-off is a potential negative for the market, although equities can likely cope with a 'grind-up' in yields, particularly if growth improves," the analysts write. "However, the 'grind-up' scenario would still likely keep pressure on the bond yield sensitive areas of the market."

They say, at current valuations, the ASX could "co-exist" with a higher bond yield in the range of 3-4 per cent. The 10-year Aussie bond currently yields 2.69 per cent, up from its recent low of 1.83 per cent in September. The rate started the year at 2.9 per cent.

"We prefer resources and banks to bond yield proxies and high P/E growth, though we believe the sell-off is beginning to create opportunities, particularly in the growth area."

Against this background, the UBS team has nominated their favourite stocks for 2017. They are: Aristocrat Leisure, Brambles, Harvey Norman, James Hardie, Lend Lease, Orora, Qantas and Resmed.

They forecast the ASX 200 to trade around 5700 by the end of 2017 as a central case, which is 6 per cent higher from where it trades now. With the market yielding 4.6 per cent, that puts the prospective total return at around 10 per cent.

The worst case scenario is that bond yields back up "hard and fast" and "the domestic housing supercycle finally begins to crack, driving negative wealth effects and consumer retrenchment". In that case the ASX 200 target is 5100 by the end of next year.

The upside scenario is that commodity prices only pull back a bit and bank earnings growth revives to mid-single digits, in which case the benchmark measure could reach 6000 points over the same timeframe.

Here's the AFR's Chanticleer columnist Tony Boyd on the big Boral acquisition:

Boral's American chief executive Mike Kane always had ambitions for the company beyond Australia's borders but no one suspected it would be a game changing $3.5 billion deal in the United States.

Kane had said he would take advantage of strategic expansion opportunities but the expectation was that there would be bolt-on acquisitions in the vicinity of $500 million to $1 billion.

On Monday, Kane explained the $3.5 billion purchase of Headwaters Inc as a series of simultaneous bolt-on acquisitions to existing businesses. He said that there were much lower risks involved in this strategic approach to mergers and acquisitions.

Boral's existing operations in roofing, stone and fly ash would be significantly larger with the largest expansion being in fly ash. Boral's fly ash business in the US will increase fivefold.

In one fell swoop, Boral Australia's revenue as a percentage of the total will fall from 67 per cent to 51 per cent while the revenue from Boral USA will rise from 19 per cent to 38 per cent.

When you add in the revenue from USG Boral plasterboard joint venture in Asia, then Boral's revenue is well balanced between domestic and international markets.

One of the most important strategic benefits from the transaction will be the significant expansion in the number of distribution outlets for Boral's existing products.

Kane says that Headwaters has 1200 wholesale distributors in the US whereas Boral's trim business in the US was serviced by 35 wholesale distributors. Also, Boral will now have access to Home Depot and Lowe's stores.

He describes the Headwaters acquisition as an "accelerant" for Boral's emerging light building products business.

The takeover of Headwaters comes at a time when the US housing sector is stabilising. Confidence in the market is strong.

The real estate confidence index published by the US National Association of Realtors is at the highest level in a decade for single-family homes, town homes and condominiums.

But there are headwinds from the country's high household debt and high student loan levels.

Kane has the advantage of having worked for most of his life in the US building products market. He has known the chief executive of Headwaters, Kirk Benson, for more than a decade.

The price being paid is relatively high at 10 times earnings before interest, tax, depreciation and amortisation but Headwaters has a proven track record as a growth company. It has delivered 20 per cent compound annual growth in earnings over the past five years, according to analysts at Macquarie.

IAG shares are up a solid 1.5 per cent at $5.51 after the insurer launched a $300 million issue of Tier I hybrid securities as it seeks to manage its regulatory capital needs.

The securities which rank as Tier I common equity will pay a margin of 4.70 to 4.90 basis points over the bank rate, including franking credits. At the current bank bill rate of 1.76 per cent, the initial interest rate will be around 6.46 to 4.66 per cent.

The notes are subject to clauses that could result in the securities being bailed in or written off if the institution is deemed 'non-viable' by the prudential regulator.

The raising is the insurer's third hybrid security issue in the past five years. IAG delayed the transaction, as it disclosed late last week a combined net peril cost of $200 million as a result of the New Zealand earthquake and trans-Tasman storm event.

The securities offer will refinance the $377 million IAG PC securities which are due to be called in May 2017. Holders of that security will be allowed to reinvest into the new offer.

The insurer's shares have also been profiting from the rise in global bond yields.

OPEC says it's close to a deal to cut oil output for the first time since 2008, a move that may halt a 2 1/2-year price slump. The actions of individual member states tell a different story. Here's a look at the prospects for an agreement ahead of OPEC's November 30 meeting:

Maths isn't the issue

The simple math supporting cuts looked solid at OPEC's meetings in June and December. Prices then were way below most members' fiscal break-even points.

An output cut now of 1.5 million barrels a day, or 5 percent, would need to boost the oil price by only $US2.50 a barrel for OPEC nations collectively to be better off. A $US5 price increase would boost the value of what they pump by about $100 million a day.

They didn't make those cuts. Why? Because Saudi Arabia was set on a policy of defending its own share of the global market and putting pressure on high-cost producers elsewhere, particularly surging output from US shale formations. The world's biggest exporter insisted that it wouldn't tackle a global surplus alone.

'Four pillars'

At an extraordinary OPEC meeting in Algiers on September 28, the 14-nation group agreed in principle to production cuts that are to be ratified in Vienna on November 30.

The first, most important, question that came out of the Algiers meeting was whether Saudi Arabia's approach had really changed and, if so, to what extent? What's now known is that the kingdom wants OPEC's policy built around four pillars: action must be collective, equitable, transparent and credible with the market.

Critically, this means Saudi Arabia thinks Iraq must cut and Iran must freeze crude output. The two nations are OPEC's second and third largest producers and the main drivers of the group's supply growth.

"The Saudis are in two minds," said Bill Farren-Price, chief executive officer of Petroleum Policy Intelligence, a Winchester, U.K.-based consultancy. "It's fairly straightforward what they need to do, but the willingness is not quite there as there's a considerable lack of trust at this stage."

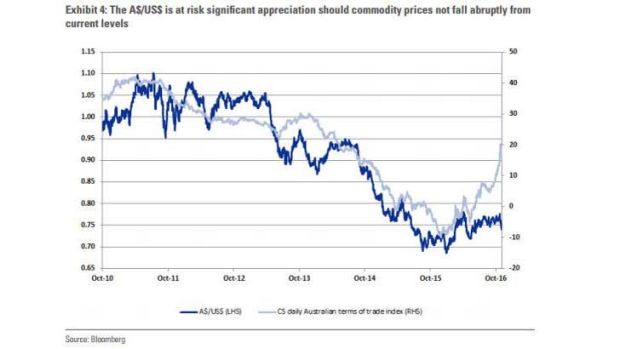

The Aussie dollar may have fallen steeply over the past 12 days, but Goldman Sachs reckons the currency is set for a rebound that could possibly take it over the US80¢ level if commodity prices sustain some of their recent strong gains.

In a surprisingly upbeat note on the Australian economy, Goldman Sachs chief economist Tim Toohey has upgraded his GDP growth forecasts for the coming four years by as much as 50 percentage point and says there is a growing chance the Reserve Bank will start lifting interest rates in the second half of 2017, which should all support the currency.

Key for Toohey's optimism - in marked difference to Macquarie, which last week downgraded its economic forecasts for Australia and is predicting two rate cuts early next year - is the unexpected surge in commodity prices, which has seen coking coal prices jump by 300 per cent this year and iron ore rise 80 per cent.

This has transformed the investment bank's expectation for a modest rise in Australia's terms of trade in 2017 to a solid 8 per cent gain, with most of the export price spike to be registered in late 2016 an early 2017.

Toohey says this shift is likely to set off a chain of events through the economy in coming months, including higher mining sector profits, a taxation windfall for the federal government, as well as rising employment and inflation.

Despite the mini-boom in commodity prices, the Aussie dollar has over the past months hardly strengthened, and since the US election actually lost more than 5 per cent in value, due to rising US bond yields as global investors bet a Trump stimulus plan will lift inflation and prompt the Federal Reserve to hike US interest rates more aggressively.

"The Aussie dollar has been caught in the crossfire between the strong rise in commodity prices and the selloff of yield based strategies which global investors had expressed in Australian assets," Toohey acknowledges.

"However, as the wash out in yield strategies matures we believe FX investors will take up the narrative of a sharply improving trade balance, improving private sector demand indicators and the risk that the RBA contemplates hiking rates in 2017 as key reasons for the A$ to commence an upswing."

That's led Goldman to upgrade its forecasts for the Aussie from US75¢ and US72¢ on a three- and 12-month view to US78¢ and US75¢, respectively. Toohey sees this as a conservative forecast, explaining his caution with the rising US dollar trend, a further unwind in yield-based strategies and incremental declines in coal and iron ore prices from late 2016 spike levels.

"Nevertheless, we now see very limited downside risk for the A$ and considerable upside risk. Indeed, a spike in the $A through US80¢ cannot be ruled out."

Toohey still reckons it's more likely the RBA will start lifting interest rates in early 2018, but he says the skew is now towards an earlier kick-off in the second half of 2017.

"At this stage we have kept our forecast for the RBA to commence its hiking cycle in 1Q18 with the RBA forecast to increase interest rates 75bps through 2018 and a further 75bps spread over 2019 and 2020 to a 3.0 per cent cash rate.

"Nevertheless, the risk of the RBA increasing the cash rate in 2H17 has risen materially and the evolution of financial conditions, house prices and underlying inflation will ultimately guide the decision."

Australia's biggest baby goods chain, Baby Bunting Group, has reported a "pleasing" start to the new financial year, with total sales up just over 20 per cent but same-store sales growth moderating.

Baby Bunting, which targets parents of children aged 0 to 3 with products such as prams, cots, nappies and car seats, said excluding new stores, sales were up 10 per cent since late June.

This is a lower rate of same-store growth than the 15 per cent growth Baby Bunting reported in August - although in line with the company's forecasts that same-store sales growth would moderate.

Baby Bunting today also reaffirmed itsEBITDA guidance of between $21.5 million and $24.5 million, representing year-on-year growth of between 15 and 31 per cent.

"I have been pleased with our operational and trading performance so far this financial year. We have ticked off many items on our agenda and trading has been meeting our expectations," chief executive Matt Spencer said at the company's first annual general meeting as a listed company.

Now with 39 stores, Baby Bunting expects to open between six and eight stores this year, including in Belrose in Sydney's north before Christmas. It plans more than 80 stores by opening between four and eight a year.

The Melbourne-based company has more than doubled its share price since listing on the sharemarket in October 2015. Its shareholders include Australia's biggest super fund, AustralianSuper.

In August, it beat prospectus forecasts by posting same-stores sales growth of 12.5 per cent, a 31 per cent jump in total sales to $236.8 million and a 38 per cent rise in net profit to $8.3 million.

BB's shares are 3.6 per cent higher at $2.85. The company listed at $1.40 in December last year.

Japan posted a trade surplus for a second straight month in October, according to data released by the Ministry of Finance this morning.

The surplus was driven by a continued decline in the value of imports, which have fallen faster than exports.

"Even though the drag from the stronger yen has started to fade, the annual growth rate of both export and import values fell deeper into the red last month," Capital Economics economist Marcel Thieliant said. "Nonetheless, net exports may still provide another small boost to GDP growth in the current quarter."

The yen has weakened by 10 per cent against the US dollar in under a month, but is still 8 per cent stronger for the year.

Key Points:

- Exports fell 10.3 per cent in October from a year earlier (median estimate of economists surveyed by Bloomberg predicted an 8.5 per cent decline).

- Shipments have also dropped in every month for more than a year.

- Imports decreased 16.5 per cent during the same period, leaving a trade surplus or deficit of 496.2 billion yen ($6.1 billion).

Despite the drop in exports, trade continues to boost to Japan's recent growth. Net shipments, which subtracts imports from exports, added 0.5 percentage point to growth last quarter. The trade surplus is underpinned by drops in imports, with persistently weak energy prices causing imports to drop at double-digit rates for more than a year.

"Looking ahead, the yen has weakened sharply since the US elections and we expect it to decline further next year which should lift trade values," Thieliant said.

"We also expect growth among Japan's main trading partners to pick up marginally, and have pencilled in a 1.5 per cent rebound in export volumes next year following a 0.5 per cent fall this year."

Japanese shares are around 0.5 per cent higher, shaking off a broadly negative session across Asian bourses.

There is a lot to like about Boral's $US2.6 billion bid for Headwaters and how it fits in with recent US political, macro-economic and currency moves, says APP securities private wealth adviser Matthew Felsman.

The acquisition increases Boral's revenue in US dollars by 63 per cent, from $US1.1 billion to $US1.8 billion, he notes - quite handy with the US dollar index last week hitting a 13-year high, while even the Aussie is extending its slump against the greenback.

"With much being written about the enormous commitment from Trump to dramatically increase spending on all aspects of US infrastructure, Headwaters' fly ash business will be particularly valuable to Boral as the material is used as a concrete replacement in heavy construction," Felsman says.

He points out that last month the annualised number of new US residential buildings that began construction during the previous month had the biggest jump in percentage terms since July 1982, and is expected to continue to increase into 2018.

"An added kicker is the fact Boral had seen short sellers increase their positions by 38 per cent from November 7 to November 14, taking the share register to 3 per cent of shares on issue short sold. If the market reacts favourably to this announcement short sellers may scramble to cover and have to buy.

"In short, it is an earnings accretive deal in a sector of the market with political tailwinds, and as more US rate hike talks are priced in for 2017 it is hard not to imagine a higher US dollar, all positives. Add in a little short squeeze and good US housing start numbers moving forward and things look very optimistic for Boral."

Bankwest and Westpac are clashing over the outlook for inner city apartments following the RBA's claims that over-supply in high rise hotspots in Melbourne and Brisbane risk sharp price corrections.

Westpac is attempting to allay market fears with claims that surging population growth will absorb any short-term oversupply and that long-term demand will sustain frenetic central business district and inner suburban apartment building.

But generous new lending policies for investors from Bankwest, a subsidiary of CBA, are targeting Sydney and Perth but snubbing Melbourne and Brisbane amid concerns of a supply glut exceeding demand.

"Melbourne's (and Brisbane's) requirements appropriately reflect the market rise with regard to off-the-plan approvals," a Bankwest spokesman said in a prepared statement about tougher lending requirements for borrowers.

Mortgage brokers, who are intermediaries between borrowers and lenders, claim Bankwest is backing RBA's recent concerns and is nervous about over-supply of investment-grade apartments.

Many of the brokers are being offered commissions of up to 10 per cent by anxious developers for successfully recommending apartments to clients.

AMP Capital chief economist Shane Oliver has predicted apartment prices could fall by 15 to 20 per cent by 2018 in the most over-supplied areas.

George Frazis, chief executive of Westpac's consumer bank and a member of the executive team, is downplaying concerns of a looming glut in Sydney, Melbourne and Brisbane.

Over the next two years, about 16,000 apartments are expected to be completed in Melbourne, and 10,000 in Sydney.

Mr Frazis is reported as claiming the bank has "absolutely no concerns" about its exposure to inner-city units.

Other lenders, such as National Australia Bank and AMP, are circulating confidential 'blacklists' of suburbs it fears face over-supply and could be facing a tipping point where demand begins to fall.

Some market analysts are issuing "red alerts" about potential over-supply in Brisbane's apartment market.

Bankwest's plans for a push into the high-density, off the plan market is targeting Sydney and Perth where it has dropped maximum deposits from 40 per cent to 30 per cent.

"Bankwest has not previously offered off the plan approvals. But in recognition of the demographic shift in the Australian housing market, Bankwest is taking a risk-conscious approach in entering the market," a bank spokesman said.

With traders pricing in near certainty that US borrowing costs will rise next month, silver investors are heading for the exit.

This month through Thursday, almost $US79 million was pulled from iShares Silver Trust, the largest exchange-traded fund backed by the metal. That would be the biggest monthly outflow since January. Holdings in all silver-backed ETF tracked by Bloomberg worldwide fell by 2.9 million ounces, set for the first monthly decline in 10 months.

Silver has been a victim of the same negative sentiment sweeping haven assets from gold to US Treasuries, as traders price in increasing odds that the Federal Reserve will raise interest rates next month. Fed Chair Janet Yellen reinforced that speculation as she told Congress Thursday that a rate hike "could well become appropriate relatively soon." The Bloomberg US Dollar Spot Index is set for a second weekly gain.

Silver is down by just shy of 20 per cent since its June highs and last fetched $US16.57 an ounce, while the gold is 17 per cent lower over the same timeframe to $US1206.32 and ounce.

"What's been dominating the headlines has been the comments from Janet Yellen," Tim Evans, the chief market strategist at Long Leaf Trading Group in Chicago, said. "Precious metals are not interest-bearing assets, and those investments are less valuable in an environment where rates are higher. Therefore, they demand a lower price."

Investors have also been pulling out of gold ETFs. Holdings declined by 3.1 per cent since Nov. 9, the biggest six-day slide since July 2013, data compiled by Bloomberg show.

Shares are a touch lower in early trade with the energy and real estate sectors the only corners of the market making gains, although many gold miners are also doing nicely.

The ASX 200 is off 6 points at 5354, as selling in three of the big four banks and in healthcare giant CSL weighing.

BHP is up 0.1 per cent but Rio is off 0.8 per cent, the former likely buoyed by a climbing oil price in early Asian trade. Brent crude has added 0.9 per cent to $US47.27 with OPEC's meeting next week looming. Woodside is up 0.4 per cent, Oil Search 1 per cent and Santos 1.3 per cent.

Fortescue is down 1.4 per cent after the iron ore price dropped a bit on Friday night, but gold miners are shaking off the recent weakness in the precious metal to make gains, with the unfortunate exception of the biggest, Newcrest, as it hosts an investor day. We're sure to hear more on that later.

Westpac is the only big bank in the green, up 0.4 per cent, although the other three are only down a touch.

The overarching theme this morning again seems to be an unwinding of the "Trump trade", with bond proxies such as listed property plays and the likes of Transurban and Sydney Airport also gaining - all not by much, but against the recent trend.

Italy's constitutional referendum is giving the newly empowered currency vigilantes their latest chance to pounce.

Investors see the euro, not Italian bonds, as the best way to express concern that Prime Minister Matteo Renzi's reforms will become the latest victim of a rising populist mood. While both assets have fallen in the run-up to the December 4 vote, traders are speculating that the European Central Bank could backstop bonds in the event of a "no" result - supporting debt markets but further undermining the single currency.

Making the hedge more attractive is the fact that the euro's decline is seen enduring even after a "yes" vote as Donald Trump's election continues to boost the US dollar.

While so-called bond vigilantes used to prowl the market dispensing fiscal discipline by forcing up borrowing in countries they saw as erring from the right path, in Europe at least, central-bank easing has nullified their impact. Currency traders have picked up the mantle. Their impact was seen in the aftermath of the UK's vote to leave the European Union. The pound bore the brunt of investors' displeasure, while bonds jumped amid expectations of more quantitative easing and rate cuts.

Selling the euro before Italy's vote "makes a lot of sense given the potential for more expansionary fiscal and tighter monetary policy in the US, coupled with the increased focus on political risk and the increased likelihood of more policy from the ECB," said James Athey, a money manager in London at Aberdeen Asset Management.

"For FX, politics is the new economics," HSBC analysts including David Bloom wrote in a note last week. "QE has constrained the bond market, distorted equity prices and narrowed yield differentials. This means FX is uniquely placed to reflect political developments."

Trump's election has boosted speculation that Italians will reject the reforms on which Renzi has staked his political future. Deutsche Bank economists say there's a 60 per cent chance the vote will fail, while political risk advisory firm Eurasia Group changed its call this month, and now assigns a 55 per cent probability to a "no" vote.

Here's quick rundown of the market:

- SPI futures up 7 points or 0.1% to 5369

- AUD -1% to 73.29 US cents

- On Wall St, Dow -0.2%, S&P 500 -0.2%, Nasdaq -0.2%

- In New York, BHP -1.2%, Rio -2.7%

- In Europe, Stoxx 50 -0.7%, FTSE -0.3%, CAC -0.5%, DAX -0.2%

- Spot gold -0.7% to $US1208.56 an ounce on Friday

- Brent crude +0.7% to $US46.81 on Friday

- Iron ore -1% to US$72.79 a tonne on Friday

- LME aluminium +0.4% to $US1694 on Friday in London

There's no local economic data releases today, but tonight we have:

- Japan trade

- ECB's Draghi speaks

- US Fed governor Fischer speaks

- OPEC officials gather ahead of official November 30 meeting

And in corporate news:

- Breville's annual meeting is scheduled

- BHP: Brazilian judge accepts homicide charges in Samarco disaster

- Cleanaway is considering a bid for Bingo Industries, AFR reports

- Newcrest holding an investor day; the miner is in a JV with Randgold to expand exploration in the Cote d"ivoire

Finally, the analysts:

- QBE raised to buy at Bell Potter

- IAG raised to hold at Morgans

- Alacer Gold raised to outperform at Macquarie

- Sigma Pharma cut to underweight at Morgan Stanley

Donald Trump's economic policies remain the No. 1 consideration for world markets, says CMC chief market analyst Ric Spooner:

"Investors are trying to strike the right balance between positioning for a major dose of US fiscal stimulus and not getting too far committed, given the uncertainty surrounding what policies the new Trump administration will actually implement," he said.

"The upside momentum in stock markets has stalled in recent days given full valuations; the potentially negative impact of rising bond yields and signs that commodities are correcting. Even so stock markets are holding their levels and the ASX 200 looks set for a firm open this morning supported by a solid performance by banks on US markets on Friday and the weaker $A."

Myer will be another stock in focus today, Spooner said.

"Friday's sales report provided further evidence that Myer's turnaround strategy is not only well conceived but is being effectively implemented. Traders have been too pessimistic about this strategy and Friday's big rally may have further to play out as short positions are covered and the stock is re-rated."

Back to topSearch pagination

1 new post(s) available. View post(s) Dismiss