How President-Elect Donald Trump Could Impact the Economy1:25

Donald Trump campaigned on his ability to create jobs and economic success, so how could the President-elect's plans impact the U.S. economy? WSJ's Shelby Holliday explains. Photo: Getty

President-elect Donald Trump is set to be loose with America’s purse-strings. Picture: Pablo Martinez Monsivais/AP

DONALD Trump has long cultivated an aura of unadulterated success, but those who scratch beneath the surface find a different story.

While the former reality television star is adept at captivating an audience, he has left a string of failures behind him, including six bankrupt businesses.

Economists are afraid he could do the same to the US economy — and there would be no coming back.

The President-elect campaigned on a platform of cutting taxes and increasing spending, and no one is quite sure where the savings would come from.

It could leave America buried under an even greater mountain of debt by the time his four-year term is over.

One of the first things Mr Trump plans to do after his inauguration in January is lower the corporate tax cap from 35 per cent to 15 per cent. In the short-term, this is likely to be a good thing, according to Tom Switzer from the US Studies Centre.

“Given the Republicans have control of the House of Representatives and the Senate, it’s more likely to pass and stimulate the economy,” Mr Switzer told news.com.au.

“That’s probably why Wall Street rallied [following the initial hit to the market after Mr Trump’s election]. He’s shown that, at least in the short-term, he’s pro-growth.

“But where’s he going to get the money for tax cuts and to increase spending, notably on infrastructure? He may face more deficit problems in four years.”

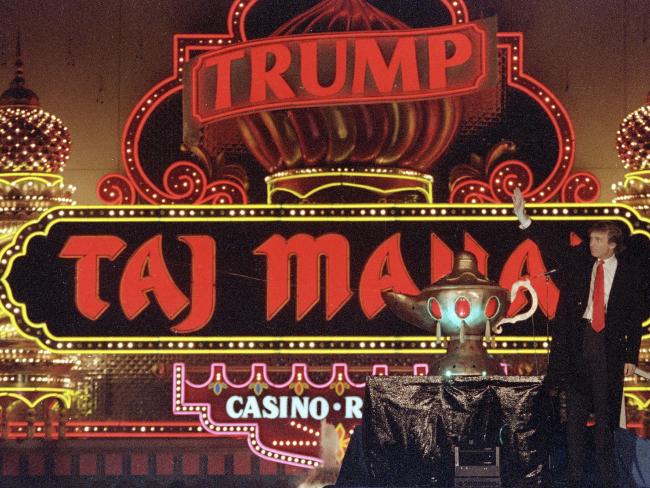

Mr Trump at the opening of the Trump Taj Mahal casino in Atlantic City, New Jersey, in 1990. Picture: Mike Derer/APSource:AP

GAME OF RISK

In 1991, the Trump Taj Mahal in Atlantic City was nearly $US3 billion in debt when it filed for bankruptcy, and Mr Trump gave up half his stake in the casino and selling his yacht and airline.

A year later, the Trump Plaza Hotel in New York filed for bankruptcy while $US550 million in debt, with the real estate mogul giving up a 49 per cent share but remained a figurehead CEO. Another casino, Trump Castle, also went bankrupt along with the Trump Plaza Hotel and Casino in Atlantic City, which was $US250 million in debt.

In 2004, Trump Hotels and Casinos Resorts, which includes the Taj Mahal, Trump Marina and Trump Plaza casinos in Atlantic City, filed for bankruptcy with an estimated $US1.8 billion in debt. The President-elect reduced his share in the company from 47 to 27 per cent and it was renamed Trump Entertainment Resorts, before it again went bankrupt in 2009 after a missed $US53.1 million bond interest payment during the global financial crisis. Mr Trump resigned as chairman and reduced his stake to 10 per cent.

Early this month the Trump International Hotel & Tower Toronto went bust, just four years after Mr Trump and his children cut the ribbon at its opening. He is not the developer or even an investor, but was paid for his name and management team.

As he and his children said in a CBS 60 Minutes interview on Monday, none of that matters any more. Some believe his bid for the presidency is simply his latest hubristic plan to gild his name and image.

A trader reacts to the US Presidential election result at the Frankfurt Stock Exchange. Picture: Alex Kraus/BloombergSource:Supplied

TRILLIONS IN DEBT

Global markets were thrown into disarray after the election result was announced, but recovered surprisingly quickly following Mr Trump’s conciliatory victory speech.

Traders around the world will be waiting to see whether the new president will carry out the campaign promises economists estimated would increase national debt by trillions of dollars.

Not only has he promised corporate tax cuts, he wants to reduce the top income tax bracket from 40 per cent to 33 per cent. The President-elect claimed the cuts will pay for themselves by eliminating some deductions and credits, but both left-of-centre Tax Policy Center and the right-of-centre Tax Foundation say this is nowhere near true, and the scheme would cost $US9 trillion in revenue over the first decade. The question, then, is where he will find the money to carry out his plan to both cut tax and raise government spending.

The Wall Street Journal’s economics blog reported that he would make savings with large tax cuts from repealing Barack Obama’s signature Affordable Care Act and slashing discretionary spending, but has promised far greater increases in spending on defence, veterans’ programs and childcare.

The Federal Reserve may try to put the brakes on Mr Trump by lowering interest rates. Pictured, chair Janet Yellen. Picture: Saul Loeb/AFPSource:AFP

THE WHEELER AND DEALER PRESIDENT

The United States’ debt already stands at 75 per cent of gross domestic product. The only “advanced economies” with higher debt are Italy, Japan, and Portugal, according to the International Monetary Fund.

History has already shown us what happens when a president follows such a strategy, according to Daniel Altman, an adjunct associate professor of economics at New York University’s Stern School of Business, writing in Foreign Policy.

Ronald Reagan and George W. Bush both spent heavily on the military while drastically cutting income tax, each leaving the nation in such great debt their successors were forced to raise taxes back up again.

But Mr Trump’s greatest hurdle could come from within his own party. “There is fear in the global markets, the global economy is showing signs of contraction and there could be a recession,” said Switzer. “Republicans could disagree more with Trump on spending than the Democrats.

“He changed political parties five times. He’s an erratic character, he’s not bound by ideology. He’s a pragmatic wheeler and dealer, he could be very loose with the strings.”

If Mr Trump and Congress do approve big cuts and spending to drive growth, it could lead to the debt becoming unsustainable, causing a “deficit crisis”, says Switzer.

“The Federal Reserve will likely put the brake on Trump via interest rates,” he said.

But the Treasury has already refinanced the nation’s debt at low interest rates so there are limits to what it can do, Altman writes in Foreign Policy. “If he stays true to his record in business, another bankruptcy could be on the horizon.”

The question is whether the billionaire businessman would stick around to watch his greatest vanity project implode.