Com Sec Market Close 8 Nov 16: Early gains fade as US voting gets underway2:18

Local shares gave up early gains to end the session with a small gain. Buyers retreated to the sidelines as voting in the US election was set to get underway.

Global stock markets are steady following strong Wall Street gains yesterday, as investors focused on the final hours of a tight US presidential race. Picture: AFP/Stan Honda

GLOBAL stock markets remained steady following strong Wall Street gains yesterday, as investors focused on the final hours of a tight US presidential race.

Germany’s DAX was 0.1 per cent lower at 10,449 and France’s CAC-40 was down by the same rate at 4,458. London’s FTSE 100 was stable at 6,805.

Wall Street looked set for a subdued opening, with futures for the Dow Jones industrial average and Standard & Poor’s 500 down 0.1 per cent and 0.2 per cent, respectively.

FOLLOW LIVE ELECTION UPDATES HERE

Hillary Clinton appeared to gain an edge over rival Donald Trump but analysts said the race was too close to call and traders hedged their positions.

“This is going to be a coin flip,” Ash Alankar, portfolio manager at Janus Capital Group, told The Wall Street Journal. “Everything is going to trade on the US election, just like everything traded on Brexit.”

Ms Clinton’s position improved after the FBI announced its review of newly discovered emails found no evidence to warrant charges. Unease had ratcheted up in recent weeks over signs the race was tightening.

Global markets gain ahead of the US electionhttps://t.co/hyJYZ4Yt8D pic.twitter.com/yfvXLsEEKP

— Markets Insider (@MktsInsider) November 8, 2016

Ms Clinton is seen as more favourable to trade while Mr Trump has unnerved markets by calling for controls on imports and immigration. That triggered the longest losing streak for the S&P; 500 since 1980.

“Markets are moving toward pricing in a Clinton victory, but not fully, given the painful lesson from Brexit,” Mizuho Bank said in a report. “We expect market volatility to increase somewhat tomorrow as US exit polls and elections results start streaming in.”

China’s exports fell again in October in a fresh sign of weak global demand that is complicating Beijing’s efforts to shore up economic growth and reduce reliance on trade and investment.

Stocks, bonds and currency markets freeze as voters head to the polls https://t.co/7GURsKSISx 🔓 pic.twitter.com/ojY0ffcVKm

— Wall Street Journal (@WSJ) November 8, 2016

Exports contracted by 7.3 per cent from a year earlier while imports fell 1.4 per cent. Similarly downbeat figures emerged from Germany, where exports dropped 0.7 per cent in September over August, while imports fell 0.5 per cent in season- and calendar-adjusted terms.

The Shanghai Composite Index gained 0.5 per cent to 3,147.89 points and Hong Kong’s Hang Seng advanced 0.5 per cent to 22,909.47.

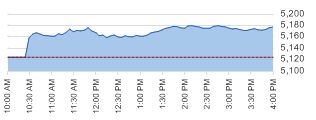

Seoul’s Kospi added 0.3 per cent to 2,003.38, India’s Sensex rose 0.1 per cent to 27,500.95 and Sydney’s S&P-ASX; 200 gained 0.1 per cent to 5,257.80. Tokyo’s Nikkei 225 was nearly unchanged at 17,171.38. Benchmarks in New Zealand, Taiwan and Southeast Asia also rose.

Democrat candidate Hillary Clinton. Picture: AFP/Brendan SmialowskiSource:AFP

Republican candidate Donald Trump. Picture: AP Photo/Paul SancyaSource:AP

The dollar rose to 104.53 yen from Monday’s 104.39 yen. The euro gained to $1.1064 from $1.1042.

Benchmark US crude dropped 18 cents to $44.71 per barrel in electronic trading on the New York Mercantile Exchange. The contract gained 82 cents on Monday. Brent crude, used to price international oils, shed 15 cents to $46.00 in London after adding 57 cents the previous session.