On the 2nd of August the Reserve Bank of Australia (RBA) reduced the cash rate to the historic low of 1.5%. The actions of the central bank often seem either arcane or uninteresting to the vast majority of us – except perhaps for those playing the markets and various gold-bugs, currency cranks and other tin-foil hat aficionados. However we should pay attention to the RBA. The RBA’s action was an attempt to intervene on the level of money in a way to forestall a further decline in the prospects for the capitalist mode of production in Australia and thus dampen any intensification in social conflict or malfunctioning such a decline might contribute to. Therefore it also tells us much about the health of capitalism in Australia on a whole and gives us an insight into the terrain on which our efforts for emancipation play out.

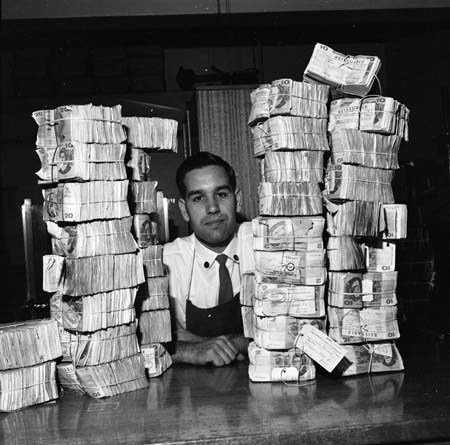

It is important to place an understanding of money right in the centre of radical critiques of capitalist society. Money is a coagulant that holds together so much of capitalist society as well as the form in which capital finds its clearest expression. Money dominates our lives. ‘The individual carries his social power, as well as his bonds with society, in his pocket’ (Marx 1993, 157). In our world money is incredibly heavy: ‘the wealth of societies in which the capitalist mode of production prevails appears as an “immense collection of commodities”…’ and it is our access to money which allows us to access this wealth which is the collective product of our vast creative capacities and their metabolism with the world (Marx 1990, 127). There are very few moments of the day when the amount of money in my pocket, in my bank account and the level of debt on my credit card isn’t on my mind. Yet on the other hand money is now incredibly insubstantial: since the end of the direct linkage of the US dollar to gold and all other currencies to the US dollar money no longer has any other references than itself. This has facilitated a vast and dizzying explosion of liquidity. This contradiction was seen so starkly in the response to the crisis when vast sums of money were either willed into existence by states or appeared as state debts as the financial system was bailed out whilst money for many people evaporated and plunged them into poverty.

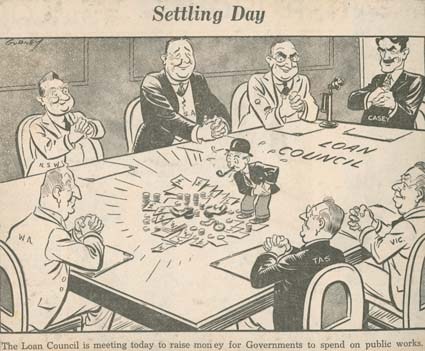

Anti-capitalists in Australia have not been very good at making sense of money and finance nor popularising this critique. We rely too much on very general arguments about the madness of markets or robotic interpretations of the tendency of the rate of profit to fall. We haven’t been very good at explaining the specifics of this crisis or why crises and malfunctions that appear on the level of money are actually products and expressions of much deeper systemic dynamics. This space has been filled by less savoury types: currency cranks, Larouchites, anti-Semites and other species of reactionaries. Part of our collective self-emancipation is demystifying the operations of capital on all levels.

Continue reading “Easy Money: The Reserve Bank of Australia and the tremors in capital accumulation”