- published: 11 Nov 2014

- views: 137714

-

remove the playlistHealth Insurance

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistHealth Insurance

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 09 Jun 2011

- views: 172347

- published: 22 Dec 2014

- views: 30943

- published: 06 Dec 2015

- views: 637

- published: 03 Nov 2013

- views: 83817

- published: 04 Sep 2014

- views: 2060

- published: 06 Jan 2014

- views: 23059

- published: 08 Apr 2016

- views: 515

- published: 23 Sep 2014

- views: 46455

Health insurance

Health insurance is insurance against the risk of incurring medical expenses among individuals. By estimating the overall risk of health care and health system expenses, among a targeted group, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to ensure that money is available to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization such as a government agency, private business, or not-for-profit entity. According to the Health Insurance Association of America, health insurance is defined as "coverage that provides for the payments of benefits as a result of sickness or injury. Includes insurance for losses from accident, medical expense, disability, or accidental death and dismemberment" (pg. 225).

Background

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

5:25

5:25Health Insurance Explained – The YouToons Have It Covered

Health Insurance Explained – The YouToons Have It CoveredHealth Insurance Explained – The YouToons Have It Covered

This cartoon explains health insurance using fun, easy-to-understand scenarios. It breaks down important insurance concepts, such as premiums, deductibles and provider networks. The video explains how individuals purchase and obtain medical care and prescription drugs when enrolled in various types of health insurance, including HMOs and PPOs. This is the third YouToons video written and produced by the Kaiser Family Foundation. The video is narrated by former U.S. Senate Majority Leader Bill Frist, a nationally-recognized surgeon and Foundation trustee. Also available in Spanish: http://youtu.be/mDPhCo11z0E To download the video, please visit: http://www.kff.org/youtoons-health-insurance-explained This year's open enrollment period begins on Sunday, November 1, 2015, and ends Sunday, January 31, 2016. -

6:31

6:31How Health Insurance Works

How Health Insurance WorksHow Health Insurance Works

When I consider purchasing an individual health insurance plan for myself or my family, do I have any financial obligations beyond the monthly premium and annual deductible? Answers: It depends on the plan, but some plans have the following cost-sharing elements that you should be aware of. Co-Payments: Some plans include a co-payment, which is typically a specific flat fee you pay for each medical service, such as $30 for an office visit. After the co-payment is made, the insurance company typically pays the remainder of the covered medical charges. Deductibles: Some plans include a deductible, which typically refers to the amount of money you must pay each year before your health insurance plan starts to pay for covered medical expenses. Coinsurance: Some plans include coinsurance. Coinsurance is a cost sharing requirement that makes you responsible for paying a certain percentage of any costs. The insurance company pays the remaining percentage of the covered medical expenses after your insurance deductible is met. Out-of-pocket limit: Some plans include an out-of-pocket limit. Typically, the out-of-pocket limit is the maximum amount you will pay out of your own pocket for covered medical expenses in a given year. The out-of-pocket limit typically includes deductibles and coinsurance. But, out-of-pocket limits don't typically apply to co-payments. Lifetime maximum: Most plans include a lifetime maximum. Typically the lifetime maximum is the amount your insurance plan will pay for covered medical expenses in the course of your lifetime. Exclusions & Limitations: Most health insurance carriers disclose exclusions & limitations of their plans. It is always a good idea to know what benefits are limited and which services are excluded on your plan. You will be obligated to pay for 100% of services that are excluded on your policy. Beginning September 23, 2010, the Patient Protection and Affordable Care Act (health care reform) begins to phase out annual dollar limits. Starting on September 23, 2012, annual limits on health insurance plans must be at least $2 million. By 2014 no new health insurance plan will be permitted to have an annual dollar limit on most covered benefits. Some health insurance plans purchased before March 23, 2010 have what is called "grandfathered status." Health Insurance Plans with Grandfathered status are exempt from several changes required by health care reform including this phase out of annual limits on health coverage. If you purchased your health insurance policy after March 23, 2010 and you're due for a routine preventive care screening like a mammogram or colonoscopy, you may be able to receive that preventive care screening without making a co-payment. You can talk to your insurer or your licensed eHealthInsurance agent if you need help determining whether or not you qualify for a screening without a co-payment. There are five important changes that occurred with individual and family health insurance policies on September 23, 2010. Those changes are: 1. Added protection from rate increases: Insurance companies will need to publically disclose any rate increases and provide justification before raising your monthly premiums. 2. Added protection from having insurance canceled: An insurance company cannot cancel your policy except in cases of intentional misrepresentations or fraud. 3. Coverage for preventive care: Certain recommended preventive services, immunizations, and screenings will be covered with no cost sharing requirement. 4. No lifetime maximums on health coverage: No lifetime limits on the dollar value of those health benefits deemed to be essential by the Department of Health and Human Services. 5. No pre-existing condition exclusions for children: If you have children under the age of 19 with pre-existing medical conditions, their application for health insurance cannot be declined due to a pre-existing medical condition. In some states a child may need to wait for the state's open-enrollment period before their application will be approved. -

4:55

4:55Understanding Your Health Insurance Costs | Consumer Reports

Understanding Your Health Insurance Costs | Consumer ReportsUnderstanding Your Health Insurance Costs | Consumer Reports

Baffled by premiums, deductibles and out-of-pocket maximums? Here is an overview of health insurance that will help clear things up and give you a better sense of how your money is spent. -

19:39

19:39Policy Bazaar: Ideal Health Insurance

Policy Bazaar: Ideal Health InsurancePolicy Bazaar: Ideal Health Insurance

In this episode of 'policy Bazaar', we talk about the ideal health insurance policy, the need for multiple plans, when you must start saving and its other benefits etc. Follow us: YouTube: https://www.youtube.com/channel/UCYPvAwZP8pZhSMW8qs7cVCw?sub_confirmation=1 Twitter: https://twitter.com/IndiaToday Facebook: https://www.facebook.com/IndiaToday -

11:20

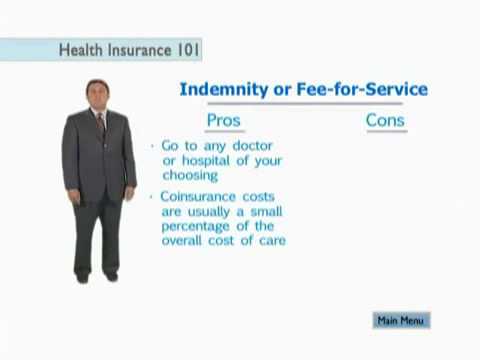

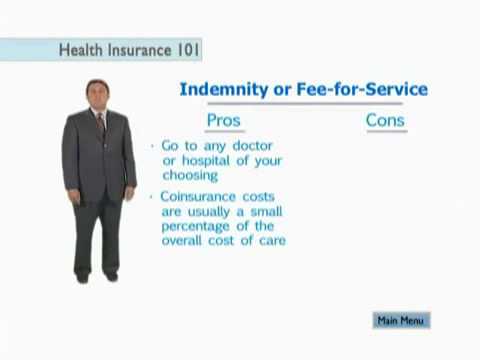

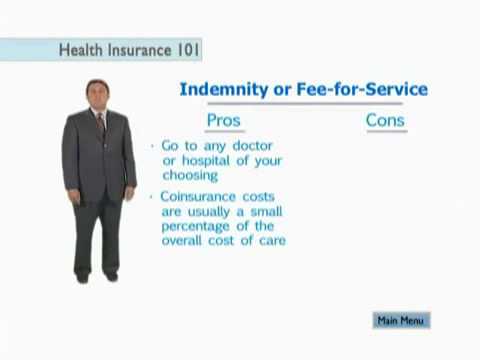

11:20Health Insurance 101: The Basics

Health Insurance 101: The Basics -

8:18

8:18What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

You can directly support Healthcare Triage on Patreon: http://vid.io/xqXr If you can afford to pay a little every month, it really helps us to continue producing great content. In this episode of Healthcare Triage, Dr. Aaron Carroll gets some surprised questions from "friend of Obama" John Green who is still waiting for his big government giveaway . Unfortunately, insurance still costs money, and it's still really complicated. Aaron explains how the insurance system we have today came to be, and why most of us get coverage through our jobs. He talks about why we need insurance, which basically boils down to the fact that health care is really, really, really expansive. More importantly, he explains why you need to know what premiums, networks, deductibles, co-pays, and co-insurance are, and how they have to be considered in the true cost of insurance. Also, ground unicorn horn. Make sure you subscribe above so you don't miss any upcoming episodes! Read more on Aaron's blog: http://theincidentaleconomist.com/ John Green -- Executive Producer Stan Muller -- Director, Producer Aaron Carroll -- Writer Mark Olsen - Graphics http://www.twitter.com/aaronecarroll http://www.twitter.com/crashcoursestan http://www.twitter.com/realjohngreen http://www.twitter.com/olsenvideo -

4:33

4:33मेडीक्लेम स्वास्थ्य बीमा में ध्यान रखें Remember in Health Insurance or Mediclaim Hindi हिन्दी

मेडीक्लेम स्वास्थ्य बीमा में ध्यान रखें Remember in Health Insurance or Mediclaim Hindi हिन्दीमेडीक्लेम स्वास्थ्य बीमा में ध्यान रखें Remember in Health Insurance or Mediclaim Hindi हिन्दी

5 Things to remember while taking Health Insurance or Mediclaim. Agents or Insurance Companies are not providing proper information and you will face difficulty at the time of claim. Insurance Companies will try to make all type of accuses at the time of claim. So better to have a check before buy it. -

3:52

3:52Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance PlanObamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

This video discusses a huge problem that has been seen nationwide with the new Obamacare health plan (and it isn't the Obamacare website). It is the fact that so many new enrollments seem to just be picking the cheapest monthly premium package instead of looking at all of the variables. Most importantly, the deductible that goes with that package. This video gives some specific examples that what some Americans are paying per month and also what the corresponding deductible is. Keep in mind, the most important thing to do when picking your health insurance plan is to find out the TOTAL cost of owning that obamacare plan, not just the monthly premium. For more on this and other retirement frequently asked questions, check out our site with new FREE retirement material for you to download every month. http://www.retirethinktank.com -

3:26

3:26Best individual health insurance policy in india

Best individual health insurance policy in indiaBest individual health insurance policy in india

Neelam | Ludhiana Q: I request u to suggest me a beneficial health policy. My DOB is 14 5 68 - I want a individual policy My annual income is about 6 lakh I also want a plan for my parents above 65 age. Please suggest me through mail. Ans: For you – there are many policies in the market. You could just go online and buy any of the policies. Companies like Bharti AXA, Religare, L&T;, Max Bupa – all have good plans. A cover of 3 lac should cost you anywhere between – Rs.3,700 to Rs.5,000 annually. Your age is 45 currently so companies will issue you the policy online without any medical check up. Most of the companies make the medical check compulsory on or after the age of 46. For your parents, you can look at plans designed for senior citizens Apollo Munich Optima Senior United India Senior Citizen Oriental India Senior Citizen Take an individual policy for your parents – one policy for each of them. The premium for one person of age 65 should be around Rs.10,000 to Rs.14,000 depending on the company. -

2:07

2:07Health Insurance Coverage 101 - the Basics Explained in Two Minutes

Health Insurance Coverage 101 - the Basics Explained in Two MinutesHealth Insurance Coverage 101 - the Basics Explained in Two Minutes

http://onphr.ma/1mpAUZJ Health Insurance Coverage 101 - the Basics Explained in Two Minutes We know insurance jargon can be confusing and consumers may have a hard time cutting through the clutter. In order to make informed decisions about health coverage and ensure patients have access to needed services and treatments, knowing the language of insurance is critical. That’s why we created a back-to-basics video walking through some basic insurance terms.

-

Health Insurance Explained – The YouToons Have It Covered

This cartoon explains health insurance using fun, easy-to-understand scenarios. It breaks down important insurance concepts, such as premiums, deductibles and provider networks. The video explains how individuals purchase and obtain medical care and prescription drugs when enrolled in various types of health insurance, including HMOs and PPOs. This is the third YouToons video written and produced by the Kaiser Family Foundation. The video is narrated by former U.S. Senate Majority Leader Bill Frist, a nationally-recognized surgeon and Foundation trustee. Also available in Spanish: http://youtu.be/mDPhCo11z0E To download the video, please visit: http://www.kff.org/youtoons-health-insurance-explained This year's open enrollment period begins on Sunday, November 1, 2015, and ends Sunday,...

published: 11 Nov 2014 -

How Health Insurance Works

When I consider purchasing an individual health insurance plan for myself or my family, do I have any financial obligations beyond the monthly premium and annual deductible? Answers: It depends on the plan, but some plans have the following cost-sharing elements that you should be aware of. Co-Payments: Some plans include a co-payment, which is typically a specific flat fee you pay for each medical service, such as $30 for an office visit. After the co-payment is made, the insurance company typically pays the remainder of the covered medical charges. Deductibles: Some plans include a deductible, which typically refers to the amount of money you must pay each year before your health insurance plan starts to pay for covered medical expenses. Coinsurance: Some plans include coin...

published: 09 Jun 2011 -

Understanding Your Health Insurance Costs | Consumer Reports

Baffled by premiums, deductibles and out-of-pocket maximums? Here is an overview of health insurance that will help clear things up and give you a better sense of how your money is spent.

published: 22 Dec 2014 -

Policy Bazaar: Ideal Health Insurance

In this episode of 'policy Bazaar', we talk about the ideal health insurance policy, the need for multiple plans, when you must start saving and its other benefits etc. Follow us: YouTube: https://www.youtube.com/channel/UCYPvAwZP8pZhSMW8qs7cVCw?sub_confirmation=1 Twitter: https://twitter.com/IndiaToday Facebook: https://www.facebook.com/IndiaToday

published: 06 Dec 2015 -

-

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

You can directly support Healthcare Triage on Patreon: http://vid.io/xqXr If you can afford to pay a little every month, it really helps us to continue producing great content. In this episode of Healthcare Triage, Dr. Aaron Carroll gets some surprised questions from "friend of Obama" John Green who is still waiting for his big government giveaway . Unfortunately, insurance still costs money, and it's still really complicated. Aaron explains how the insurance system we have today came to be, and why most of us get coverage through our jobs. He talks about why we need insurance, which basically boils down to the fact that health care is really, really, really expansive. More importantly, he explains why you need to know what premiums, networks, deductibles, co-pays, and co-insurance are, an...

published: 03 Nov 2013 -

मेडीक्लेम स्वास्थ्य बीमा में ध्यान रखें Remember in Health Insurance or Mediclaim Hindi हिन्दी

5 Things to remember while taking Health Insurance or Mediclaim. Agents or Insurance Companies are not providing proper information and you will face difficulty at the time of claim. Insurance Companies will try to make all type of accuses at the time of claim. So better to have a check before buy it.

published: 04 Sep 2014 -

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

This video discusses a huge problem that has been seen nationwide with the new Obamacare health plan (and it isn't the Obamacare website). It is the fact that so many new enrollments seem to just be picking the cheapest monthly premium package instead of looking at all of the variables. Most importantly, the deductible that goes with that package. This video gives some specific examples that what some Americans are paying per month and also what the corresponding deductible is. Keep in mind, the most important thing to do when picking your health insurance plan is to find out the TOTAL cost of owning that obamacare plan, not just the monthly premium. For more on this and other retirement frequently asked questions, check out our site with new FREE retirement material for you to down...

published: 06 Jan 2014 -

Best individual health insurance policy in india

Neelam | Ludhiana Q: I request u to suggest me a beneficial health policy. My DOB is 14 5 68 - I want a individual policy My annual income is about 6 lakh I also want a plan for my parents above 65 age. Please suggest me through mail. Ans: For you – there are many policies in the market. You could just go online and buy any of the policies. Companies like Bharti AXA, Religare, L&T;, Max Bupa – all have good plans. A cover of 3 lac should cost you anywhere between – Rs.3,700 to Rs.5,000 annually. Your age is 45 currently so companies will issue you the policy online without any medical check up. Most of the companies make the medical check compulsory on or after the age of 46. For your parents, you can look at plans designed for senior citizens Apollo Munich Optima Senior United India Sen...

published: 08 Apr 2016 -

Health Insurance Coverage 101 - the Basics Explained in Two Minutes

http://onphr.ma/1mpAUZJ Health Insurance Coverage 101 - the Basics Explained in Two Minutes We know insurance jargon can be confusing and consumers may have a hard time cutting through the clutter. In order to make informed decisions about health coverage and ensure patients have access to needed services and treatments, knowing the language of insurance is critical. That’s why we created a back-to-basics video walking through some basic insurance terms.

published: 23 Sep 2014

Health Insurance Explained – The YouToons Have It Covered

- Order: Reorder

- Duration: 5:25

- Updated: 11 Nov 2014

- views: 137714

- published: 11 Nov 2014

- views: 137714

How Health Insurance Works

- Order: Reorder

- Duration: 6:31

- Updated: 09 Jun 2011

- views: 172347

- published: 09 Jun 2011

- views: 172347

Understanding Your Health Insurance Costs | Consumer Reports

- Order: Reorder

- Duration: 4:55

- Updated: 22 Dec 2014

- views: 30943

- published: 22 Dec 2014

- views: 30943

Policy Bazaar: Ideal Health Insurance

- Order: Reorder

- Duration: 19:39

- Updated: 06 Dec 2015

- views: 637

- published: 06 Dec 2015

- views: 637

Health Insurance 101: The Basics

- Order: Reorder

- Duration: 11:20

- Updated: 02 Jul 2013

- views: 36392

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

- Order: Reorder

- Duration: 8:18

- Updated: 03 Nov 2013

- views: 83817

- published: 03 Nov 2013

- views: 83817

मेडीक्लेम स्वास्थ्य बीमा में ध्यान रखें Remember in Health Insurance or Mediclaim Hindi हिन्दी

- Order: Reorder

- Duration: 4:33

- Updated: 04 Sep 2014

- views: 2060

- published: 04 Sep 2014

- views: 2060

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

- Order: Reorder

- Duration: 3:52

- Updated: 06 Jan 2014

- views: 23059

- published: 06 Jan 2014

- views: 23059

Best individual health insurance policy in india

- Order: Reorder

- Duration: 3:26

- Updated: 08 Apr 2016

- views: 515

- published: 08 Apr 2016

- views: 515

Health Insurance Coverage 101 - the Basics Explained in Two Minutes

- Order: Reorder

- Duration: 2:07

- Updated: 23 Sep 2014

- views: 46455

- published: 23 Sep 2014

- views: 46455

-

major health insurance companies

American Family Insurance,CareSource,Bankers Life and Casualty,Conseco,Kaiser Permanente

published: 15 Oct 2016 -

Latest Health Insurance News,Health Insurance Services,Latest Personal Insurance News

Life insurance is a very good financial planning tool. It is necessary for everybody, irrespective of the nature of work. In case of the death of an earning family member, there can be a case of huge financial crunch on rest of the family. So it is highly advised to insure your life, so that your loved ones do not suffer financially on top of being emotionally hurt. More How many life insurance companies will I get quotes from? We currently feature over a dozen life insurance companies all of which offer quoting to qualified applicants and online applications. Can I get quotes for term life, universal life, and whole life insurance? Yes, Of the carriers featured many offer term, whole, and universal life insurance products. Some only offer term life insurance while others offer an instan...

published: 15 Oct 2016 -

health insurance in new york

health insurance in new york

published: 15 Oct 2016 -

Check out the European Health Insurance card app

Travelling in Europe? Check out the European Health Insurance card app

published: 15 Oct 2016 -

How to Shop for Health Insurance

Open enrollment for the federal health insurance marketplace begins November 1, 2015. The Pennsylvania Insurance Department is here to help you navigate the shopping process and choose a plan that’s right for you. For more information on how to purchase health insurance, visit the Pennsylvania Insurance Department website →

published: 15 Oct 2016 -

-

small business health insurance

http://healthpluswork.blogspot.com/ small business health insurance supplemental health insurance health insurance for small business small group health insurance small business group health insurance cheap affordable health insurance

published: 15 Oct 2016 -

Health Insurance for small business

http://healthpluswork.blogspot.com/ small business health insurance supplemental health insurance health insurance for small business small group health insurance small business group health insurance cheap affordable health insurance

published: 15 Oct 2016 -

small group health insurance

http://healthpluswork.blogspot.com/ small business health insurance supplemental health insurance health insurance for small business small group health insurance small business group health insurance cheap affordable health insurance

published: 15 Oct 2016 -

small business group health insurance

http://healthpluswork.blogspot.com/ small business health insurance supplemental health insurance health insurance for small business small group health insurance small business group health insurance cheap affordable health insurance

published: 15 Oct 2016

major health insurance companies

- Order: Reorder

- Duration: 0:23

- Updated: 15 Oct 2016

- views: 1

- published: 15 Oct 2016

- views: 1

Latest Health Insurance News,Health Insurance Services,Latest Personal Insurance News

- Order: Reorder

- Duration: 0:16

- Updated: 15 Oct 2016

- views: 1

- published: 15 Oct 2016

- views: 1

health insurance in new york

- Order: Reorder

- Duration: 0:55

- Updated: 15 Oct 2016

- views: 2

- published: 15 Oct 2016

- views: 2

Check out the European Health Insurance card app

- Order: Reorder

- Duration: 0:25

- Updated: 15 Oct 2016

- views: 0

- published: 15 Oct 2016

- views: 0

How to Shop for Health Insurance

- Order: Reorder

- Duration: 4:59

- Updated: 15 Oct 2016

- views: 0

- published: 15 Oct 2016

- views: 0

Health Insurance

- Order: Reorder

- Duration: 0:55

- Updated: 15 Oct 2016

- views: 0

small business health insurance

- Order: Reorder

- Duration: 0:32

- Updated: 15 Oct 2016

- views: 0

- published: 15 Oct 2016

- views: 0

Health Insurance for small business

- Order: Reorder

- Duration: 0:32

- Updated: 15 Oct 2016

- views: 0

- published: 15 Oct 2016

- views: 0

small group health insurance

- Order: Reorder

- Duration: 0:32

- Updated: 15 Oct 2016

- views: 1

- published: 15 Oct 2016

- views: 1

small business group health insurance

- Order: Reorder

- Duration: 0:30

- Updated: 15 Oct 2016

- views: 1

- published: 15 Oct 2016

- views: 1

-

Know the benefits of health insurance Business Videos - India Today

Know the benefits of health insurance Business Videos - India Today

published: 21 Sep 2012 -

Reinventing the Health Insurance Business

In a 2012 article in The New York Times, Zeke Emanuel predicted the extinction of the American health insurance industry by 2020, as changes render traditional payer business models obsolete. In this presentation, Mark Bertolini, CEO of Aetna, describes how his company is actively reinventing itself against this backdrop to diversify its core business and transform the way they engage with customers. The session also explores the role that health-related information technology is playing in helping Aetna realize its new strategy. This presentation, and the audience Q&A; that follows, took place at the 2013 Healthcare Innovation Summit sponsored by the Stanford GSB's Program in Healthcare Innovation.

published: 29 Apr 2013 -

Health Insurance Basics - PASA Webinar

This information session provides a basic understanding of the Pennsylvania health care industry as we head into 2016, with the start of open enrollment for health insurance under the Affordable Care Act. Gain a better understanding of basic health insurance concepts and considerations. Types of coverage that are now offered include Individual, Group, Medicare, Medicaid. Plan considerations, such as premiums, copays, coinsurance, deductibles, and out of pocket maximums, are also discussed. Presenter, Erin Hart is the Director of Health Benefit Services with American HealthCare Group and oversees Health & Wellness programs for the firm. Erin created one of their key programs – Farm to Table – in 2006. Farm to Table Pittsburgh unites the food producers of Western Pennsylvania with l...

published: 13 Nov 2015 -

Getting beyond employer-sponsored health insurance: Some fitful starts

Six years after the passage of the Affordable Care Act, the oft-predicted decline of employer-based health insurance shows few signs of arriving in the near future. Nevertheless, many businesses and workers remain apprehensive about future cost and regulatory burdens, and they continue to explore new ways to expand employee choice, increase health care value, and improve health outcomes. To borrow and update two sports quotes: “The future is [not yet] now” (George Allen), but if you do look back, “something might be gaining on you” (Satchel Paige). Join AEI as an expert panel examines the potential and limits for insurance coverage innovations such as private exchanges, defined contribution payments, and corporate purchaser alliances. Join the conversation on social media with @AEI on Tw...

published: 31 Mar 2016 -

Health Insurance: Understanding Deductibles and Coinsurance

An educational video about health insurance deductibles and coinsurance. What a deductible is, what coinsurance is, and how they work. And the differences in health insurance plan types when it comes to deductibles and coinsurance. If you want to know about the nuts and bolts of health insurance plans, you've come to the right place. David Hoxworth is "The Insurance Coach", an independent life and health insurance broker in Arizona. 480.276.7456 david.hoxworth@gmail.com

published: 27 May 2013 -

118: Health Insurance for the Self-Employed with Michelle Katz

http://howtoquitworking.com/health-insurance-self-employed Healthcare is complicated and confusing. Not only that, Obamacare has changed it in a big way. Since healthcare for the self-employed is an important consideration for anyone starting a business, I asked Michelle Katz, author of the upcoming book, Healthcare Made Easy, to join us to talk about insurance implications of becoming self-employed.

published: 09 Oct 2014 -

Minimalist Candid Health Conversation || Diet + Health Insurance + Fasting

In this episode of Thriving Minimalist .Com, Brittany, Dorothea and Conor have a candid chat about health. The topics we discuss are diet, health insurance, cancer, stress, and fasting, among others. We hope you enjoy this relaxed, open video. Check out Brittany and Dorothea on their channels -- look below! Check out Dot: https://www.youtube.com/user/therawwanderlust Checkk out Britt: https://www.youtube.com/user/sophiefire13 ____________ COACHING: http://www.ThrivingMinimalist.com THERAPY: http://www.ConorMcMillen.com FACEBOOK: @conor mcmillen INSTAGRAM: @handymanbananas ___________ thrifty cost saving how to save money minimalism minimalist frugal living simple living

published: 18 Sep 2015 -

Future of Fintech: Fireside Chat with Mario Schlosser (Oscar Health)

published: 17 Jun 2016 -

Pehredaar: health insurance

This week we would focus on health insurance sector. Why did the companies increase the policy premium multiple times, what are the loopholes in the claim and redressal mechanism and why the consumer has to roam here and there for his claim from insurance companies; these issues will be discussed with Insurance Information Bureau, General Insurance Council and two health insurance activists.

published: 09 Apr 2016 -

Health Insurance for Full Time RVers - ACA for Younger Non-Medicare Travelers

Join Cherie of Technomadia.com and Nina of WheelingIt.Us for a chat about healthcare on the road. We’ll cover health insurance considerations for RVers, finding healthcare on the road and touch some on self care options too. Our focus will be options for folks like us – not yet eligible for Medicare. Additional resources: Technomadia's articles: Healthcare: http://www.technomadia.com/healtchare Domicile: http://www.technomadia.com/domicile WheelingIt's healthcare series: http://www.wheelingit.us/category/health-care-2/ RVer Health Insurance: http://www.rverhealthinsurance.com Captured during our monthly live video cast. For more of our chats and to sign up to join one live: http://www.technomadia.com/video .

published: 19 Nov 2014

Know the benefits of health insurance Business Videos - India Today

- Order: Reorder

- Duration: 21:25

- Updated: 21 Sep 2012

- views: 8078

- published: 21 Sep 2012

- views: 8078

Reinventing the Health Insurance Business

- Order: Reorder

- Duration: 53:20

- Updated: 29 Apr 2013

- views: 12836

- published: 29 Apr 2013

- views: 12836

Health Insurance Basics - PASA Webinar

- Order: Reorder

- Duration: 45:26

- Updated: 13 Nov 2015

- views: 168

- published: 13 Nov 2015

- views: 168

Getting beyond employer-sponsored health insurance: Some fitful starts

- Order: Reorder

- Duration: 110:25

- Updated: 31 Mar 2016

- views: 910

- published: 31 Mar 2016

- views: 910

Health Insurance: Understanding Deductibles and Coinsurance

- Order: Reorder

- Duration: 22:15

- Updated: 27 May 2013

- views: 22567

- published: 27 May 2013

- views: 22567

118: Health Insurance for the Self-Employed with Michelle Katz

- Order: Reorder

- Duration: 33:30

- Updated: 09 Oct 2014

- views: 1690

- published: 09 Oct 2014

- views: 1690

Minimalist Candid Health Conversation || Diet + Health Insurance + Fasting

- Order: Reorder

- Duration: 22:12

- Updated: 18 Sep 2015

- views: 10811

- published: 18 Sep 2015

- views: 10811

Future of Fintech: Fireside Chat with Mario Schlosser (Oscar Health)

- Order: Reorder

- Duration: 44:48

- Updated: 17 Jun 2016

- views: 165

- published: 17 Jun 2016

- views: 165

Pehredaar: health insurance

- Order: Reorder

- Duration: 21:42

- Updated: 09 Apr 2016

- views: 219

- published: 09 Apr 2016

- views: 219

Health Insurance for Full Time RVers - ACA for Younger Non-Medicare Travelers

- Order: Reorder

- Duration: 50:43

- Updated: 19 Nov 2014

- views: 14025

- published: 19 Nov 2014

- views: 14025

- Playlist

- Chat

- Playlist

- Chat

Health Insurance Explained – The YouToons Have It Covered

- Report rights infringement

- published: 11 Nov 2014

- views: 137714

How Health Insurance Works

- Report rights infringement

- published: 09 Jun 2011

- views: 172347

Understanding Your Health Insurance Costs | Consumer Reports

- Report rights infringement

- published: 22 Dec 2014

- views: 30943

Policy Bazaar: Ideal Health Insurance

- Report rights infringement

- published: 06 Dec 2015

- views: 637

Health Insurance 101: The Basics

- Report rights infringement

- published: 02 Jul 2013

- views: 36392

What is Health Insurance, and Why Do You Need It?: Health Care Triage #2

- Report rights infringement

- published: 03 Nov 2013

- views: 83817

मेडीक्लेम स्वास्थ्य बीमा में ध्यान रखें Remember in Health Insurance or Mediclaim Hindi हिन्दी

- Report rights infringement

- published: 04 Sep 2014

- views: 2060

Obamacare: The BIGGEST Mistake You Can Make When Choosing a Health Insurance Plan

- Report rights infringement

- published: 06 Jan 2014

- views: 23059

Best individual health insurance policy in india

- Report rights infringement

- published: 08 Apr 2016

- views: 515

Health Insurance Coverage 101 - the Basics Explained in Two Minutes

- Report rights infringement

- published: 23 Sep 2014

- views: 46455

- Playlist

- Chat

major health insurance companies

- Report rights infringement

- published: 15 Oct 2016

- views: 1

Latest Health Insurance News,Health Insurance Services,Latest Personal Insurance News

- Report rights infringement

- published: 15 Oct 2016

- views: 1

health insurance in new york

- Report rights infringement

- published: 15 Oct 2016

- views: 2

Check out the European Health Insurance card app

- Report rights infringement

- published: 15 Oct 2016

- views: 0

How to Shop for Health Insurance

- Report rights infringement

- published: 15 Oct 2016

- views: 0

small business health insurance

- Report rights infringement

- published: 15 Oct 2016

- views: 0

Health Insurance for small business

- Report rights infringement

- published: 15 Oct 2016

- views: 0

small group health insurance

- Report rights infringement

- published: 15 Oct 2016

- views: 1

small business group health insurance

- Report rights infringement

- published: 15 Oct 2016

- views: 1

- Playlist

- Chat

Know the benefits of health insurance Business Videos - India Today

- Report rights infringement

- published: 21 Sep 2012

- views: 8078

Reinventing the Health Insurance Business

- Report rights infringement

- published: 29 Apr 2013

- views: 12836

Health Insurance Basics - PASA Webinar

- Report rights infringement

- published: 13 Nov 2015

- views: 168

Getting beyond employer-sponsored health insurance: Some fitful starts

- Report rights infringement

- published: 31 Mar 2016

- views: 910

Health Insurance: Understanding Deductibles and Coinsurance

- Report rights infringement

- published: 27 May 2013

- views: 22567

118: Health Insurance for the Self-Employed with Michelle Katz

- Report rights infringement

- published: 09 Oct 2014

- views: 1690

Minimalist Candid Health Conversation || Diet + Health Insurance + Fasting

- Report rights infringement

- published: 18 Sep 2015

- views: 10811

Future of Fintech: Fireside Chat with Mario Schlosser (Oscar Health)

- Report rights infringement

- published: 17 Jun 2016

- views: 165

Pehredaar: health insurance

- Report rights infringement

- published: 09 Apr 2016

- views: 219

Health Insurance for Full Time RVers - ACA for Younger Non-Medicare Travelers

- Report rights infringement

- published: 19 Nov 2014

- views: 14025

Don’t Drink the Kool-Aid, Clinton Is The Real Spoiler Warns Jill Stein

Edit WorldNews.com 17 Oct 2016Rise of Prince Mohammed bin Salman rattles Saudi Arabia

Edit The Times of India 17 Oct 2016Move over ISS, China inches closer to operationalise its space station

Edit Newstrack India 17 Oct 2016How Big Pharma's Money Is Affecting Our Health And Our Wallets

Edit WorldNews.com 17 Oct 2016Conflicting Reports Of Car Bomb Explosion in Southern Damascus

Edit WorldNews.com 17 Oct 2016The Delayed Gratification of Obamacare

Edit The Atlantic 17 Oct 2016Where to find a cheap flu shot in N.J.

Edit NJ dot com 17 Oct 2016Insurance Department Announces 2017 Affordable Care Act Rates; Moves to Join Lawsuit Asking Federal Government to Make Required Payments to Insurers (Pennsylvania Insurance Department)

Edit Public Technologies 17 Oct 2016Insurance Department Announces 2017 Affordable Care Act Rates; Moves to Join Lawsuit Asking Federal Government to Make Required Payments to Insurers (State of Pennsylvania)

Edit Public Technologies 17 Oct 2016One Million Reasons Obamacare Made Things Worse

Edit The American Spectator 17 Oct 2016Frustration Runs Deep For Customers Forced To Change Marketplace Plans Routinely

Edit Springfield News-Sun 17 Oct 2016HEALTH-CARE NARRATIVE Catherine Rampell column: Reports of Obamacare's demise are greatly exaggerated

Edit Richmond Times Dispatch 17 Oct 2016ANNOUNCEMENT OF PREMIUM INCOME (Ping An Insurance (Group) Co of China Ltd)

Edit Public Technologies 17 Oct 2016How to Maximize Your Health Benefits During Annual Enrollment (AON plc)

Edit Public Technologies 17 Oct 2016Medicaid Programs Expanding Payment Reforms (Healthcare Financial Management Association)

Edit Public Technologies 17 Oct 2016Carlos Migoya talks about his hopes for healthcare price transparency

Edit The Miami Herald 17 Oct 2016Remedies for Our Ailing Health Care System (US Chamber of Commerce)

Edit Public Technologies 17 Oct 2016CareSource expanded to 22 more West Virginia counties

Edit The Miami Herald 17 Oct 2016- 1

- 2

- 3

- 4

- 5

- Next page »